|

|

Dear Readers,

Silver is undeniably one of the most favoured investment vehicles for the top minds in the industry. From its ability to rise with a growing economy, to a precious metals hedge against inflation, silver is a metal with many talents. Right now, we're seeing history in the making for silver. 2012 will be a big year for silver and with it, my favourite way to play the precious metals boom: silver stocks.

This may all sound familiar to you. That's because during the last few years, every silver company we featured showed our readers gains of 100% plus.

So it's no wonder why our first report for 2012 involves a silver company that analysts are calling "one of the most important high grade silver projects on the planet." More on this story in a bit. Silver Set to Explode Just recently, Eric Sprott showed that the actual demand for silver, especially for investment, has been staggeringly underreported. Take a look:  His calculations show that more than 255 million ounces of silver demand was "missing" from figures for the decade-long stretch that ended in December 2009.

This figure doesn't include the demand from 2010, where the amount of trading in silver to ETFs and other investing vehicles was, according to Sprott, approaching 800 million ounces - a day!

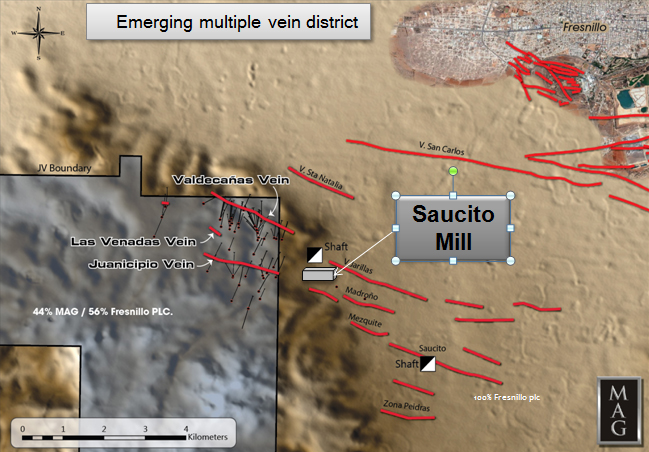

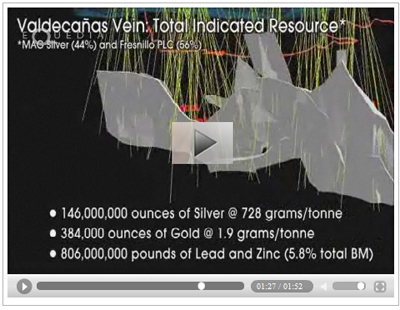

Some of the smartest minds in the industry are already calling for $50, $75, $100, and even $150 dollar silver. While these numbers seem far off, critics also said the same when silver hit $20 a few years back, before it skyrocketed to nearly $50. In the last ten years, the price of silver has had four major crashes, yet it still increased five-fold. Take a look:  Every time silver crashed, it found a way to climb higher - much higher. The net result? If you invested US$10,000 in silver at the start of 2004, it would now be worth $58,000 plus. While silver saw a 48% correction last year, it is now poised to explode with clear signs the latest correction is finished. Not only does silver generally bottom at this time of year, it's starting to break above its 65 week moving average. But that's not all. While institutional and retail demand for physical silver is on the rise (and over 255 million ounces short, according to Eric Sprott), industrial demand is also growing at a staggering pace. Silver's use in industrial applications increased 20.7% last year to 487 million ounces. That means as much as 50% of silver's total annual production is for industrial use...and that number is expected to rise another 36% by 2015. But here's the shocker: Unlike gold, silver is 98% consumable. Of all the silver ever mined - about 46 billion ounces - experts estimate that only 1 billion ounces are left above ground in bullion form (of the 5 billion ounces of gold ever mined, about 2 billion are available above ground in bullion form.) So where's the rest of the silver? It's being consumed at an astronomical rate... Most silver, used in electronics including the billions of cell phones and millions of TV's around the world, is not recoverable.Once a cell phone or TV goes to the landfill, you can't get the silver in them back. It's no wonder silver miners are struggling to keep up with the demand. The amount of silver coming out of the ground is going down every year. Few discoveries have been announced in the last decade and most silver produced now is coming from the last stages of existing mines. Not only that, but the quality of silver mined is the lowest it's ever been and like most metals, silver is rarely mined in veins now. It takes many tons of earth and rock to process even a single ounce. And that's what makes the next company I am about to introduce so special. One of the Highest Grade Silver Projects on the Planet Haywood Securities called this company's marquee project "one of the most important high grade silver projects globally." Canaccord Genuity views this company as "a likely acquisition target with a joint venture that hosts one of the richest and highest-grade silver deposits worldwide ...It's simply one of the most attractive undeveloped silver projects on the planet." BMO Capital Markets says the company's "current resource and exploration upside at their (flagship project) together with the company's other 100%-owned district-scale holdings in Mexico comprise an attractive asset for any silver producer, not just (the world's largest primary silver producer in the world.) " If you're looking for the next silver play and a potential takeover target, look no further than: MAG Silver Corp (TSX: MAG) (NYSE.A: MVG) We're not the only ones who think so. Experts at Raymond James and Canaccord Genuity both have strong buy ratings for MAG Silver Corp (TSX: MAG)(NYSE.A: MVG) (and all believe that MAG Silver may be the next potential takeover target - especially given the significant events that have occurred with MAG over the last few years.) Canaccord just upgraded MAG Silver Corp (TSX: MAG)(NYSE.A: MVG) with a target price of $16.00, while Raymond James has a price target of $14.50. Target prices from large institutions are often very conservative, factoring in every possible risk. With the price of silver looking to explode again, these target prices will undoubtedly be raised to reflect that. But there's another significant reason why these target prices may soon be raised much higher. MAG is about to announce something in the next few weeks that has the potential to make MAG Silver's NPV (Net Present Value) rise dramatically. Based on preliminary numbers by management, MAG's NPV could easily double from where it stands today - resulting in an even bigger discount to MAG Silver's current share price. More on this later. Simply One of the Most Attractive Undeveloped Silver Projects on the Planet: Juanicipio Joint Venture MAG Silver Corp's (TSX: MAG)(NYSE.A: MVG) flagship project is its Juanicipio Joint Venture with the world's largest primary silver producer, Fresnillo. It's located in the Juanicipio property, of which MAG owns 44% and Fresnillo the remainder 56%. Juanicipio is an exceptionally high grade epithermal vein system that has the potential to produce up to 16 million ounces of silver per year. It is considered to be one of the richest silver discoveries in recent history, hosting an astounding: Indicated resource of 6.2 million tonnes with an astounding average grade of 728 grams/t silver, 1.9 g/t gold, 1.9% lead, 3.9% zinc (containing 146 million ounces of silver) and Inferred resource of 7.1 million tonnes with an average grade of 373 g/t silver, 1.6 g/t gold, 1.5% lead, and 2.6% zinc (containing 85 million ounces of silver) That's not a typo. The Juanicipio Joint Venture contains an indicated resource of 146 million ounces with an average grade of 728 grams/t silver and 1.9 g/t gold and an inferred resource of 85 million ounces of silver with and average grade of 373 g/t silver and 1.6 g/t gold. I know I am repeating myself. But these numbers are so spectacular that when I speak with industry experts, they find it hard to believe. These type of numbers simply don't exist anymore. The vast majority of the Juanicipio resource is hosted within the principal vein, the Valdecanas, which spans over 1600 metres in length with average vein width between 4 and 6 metres. If you look at the map, Fresnillo has already developed its Jarillas shaft and the Saucito mill within 800 metres of the Valdecanas vein on the JV property.  | |

click to enlarge

|

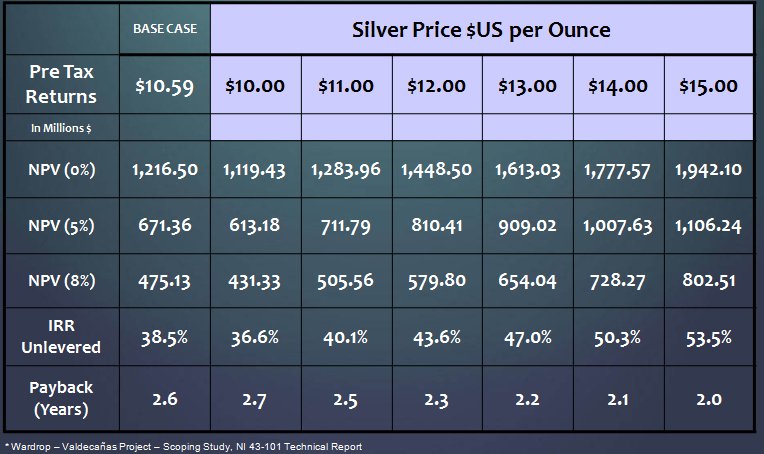

It's no wonder why analysts at Canaccord Genuity call Juanicipio, "simply one of the most attractive undeveloped silver projects on the planet." Crunching the Numbers A scoping study was done a few years back and the numbers are truly remarkable - especially considering the low silver price used in the calculations ($12 silver). Based on a scoping study done in 2009, the NPV (Net Present Value) of the Juanicipio project is estimated at US$ 967M using a 5% discount rate and a silver price of US$12.32 per ounce. That means MAG's share at 44% is estimated at US$425.5M. The payback period is 2.3 years with an estimated CAPEX of US$ 217.0M. Operating cost were estimated at US$ 42.28 per tonne milled, which means that the unit cost per ounce of accountable silver sits at only US$ 2.56. Considering silver is over US$33 /ounce today, that spells significant profits for MAG and anyone developing this project. If we were to use a higher silver price in our calculations, say US$15 /ounce, MAG's NPV would soar to over $1.1 billion. That means every dollar increase in the price of silver adds another $100 million plus to MAG's NPV. Just take a look:  | | click to enlarge |

This scoping study is based on a stand-alone mine development, with a 3.5 year development timeline to advance ramp down to the Valdecanas mineralization. While there are no current studies for alternative development scenarios, much of the CAPEX costs could be reduced significantly and development timeline significantly shortened if MAG were to use Fresnillo's current infrastructure. By drifting over from the Jarillas shaft less than 1km away, the development timeline could potentially be reduced to 18 months, instead of the 3.5 years estimated in the scoping study. Furthermore, even if mine development were to commence without the use of Fresnillo's nearby infrastructure, the payback period given today's current silver price could be less than a year. Try finding another silver project like this.  | | click to play |

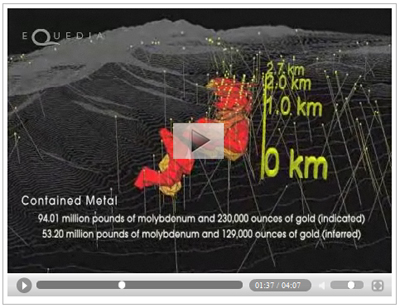

In addition to Juanicipio, MAG Silver Corp (TSX: MAG)(NYSE.A: MVG) also has a strong portfolio of promising high grade silver district projects in Mexico. One of these projects is their 100% owned Cinco de Mayo, which contains a high grade Moly-Gold project that alone would be a major company maker. Cinco de Mayo, Pozo Seco & Jose Manto Projects The Cinco de Mayo property comprises 22,000 hectares and is the most advanced of MAG's five Carbonate Replacement Deposit ("CRD") style targets. MAG Silver Corp (TSX: MAG)(NYSE.A: MVG) has already outlined a 147 million pound high grade molybdenum deposit at Pozo Seco within Cinco de Mayo. The deposit is entirely oxidized and possess a very high average molybdenum grade of 0.13%.  | | click to play |

Over the next few months, MAG is expected to release - for the first time - a new PEA (Preliminary Economic Assessment) that should show the potential for their Pozo Seco high grade Moly project. That means more news and more milestones to come for the company that already has one of the most attractive undeveloped silver projects in the world. In addition, MAG continually intercepts significant massive sulphides in its on-going exploration drilling at Cinco de Mayo, including a most recent hole of 386 grams per tonne (g/t) (12.4 ounces per tonne (opt)) silver with 14.0% zinc and 8.2% lead over 3.98 metres (298.88 to 302.86 metres downhole) including a high grade core of 1,170 g/t (34.0 opt) silver with 13.7% zinc and 19.1% lead over 0.86 metres. Of course, like any smart explorer, MAG Silver Corp (TSX: MAG)(NYSE.A: MVG) also has other significant and highly prospective projects in the Mexico Area. You can read more about them below. Combined with Juanicipio, MAG is on the way to a breakout year. Analysts from all over the nation are calling the Juanicipio project one of the richest and highest grade silver deposits in the world and simply one of the most attractive undeveloped silver projects on the planet. With such an amazingly high grade silver project, you may be asking yourself: "Why haven't I heard of MAG before and why isn't the company trading at much higher prices?" Why MAG Silver is Under the Radar In 2008, Fresnillo, which owns 56% of the Juanicipio project, tried a low-balled hostile takeover offer of MAG for US$4.54 per share without any success. During that time, MAG filed a formal request for arbitration on the grounds that Fresnillo attempted to acquire control of MAG on a hostile basis, in breach of standstill provisions contained in the shareholders agreement governing the Juanicipio joint venture. Two years later, in 2011, the arbitration ruling was issued. And MAG had not only won, but ended up with a much easier path to success. The arbitration ruling stipulated that any deal would need to be friendly, any offer would need to be cash. Fresnillo must move the project forward with MAG in a reasonable time frame - meaning Fresnillo cannot hold back on moving the project forward to suppress MAG's progress. As a matter of fact, exploration budgets have already increased this year. As a result of the ruling, MAG's share prices rocketed to over $14 last year, only to be pulled back with the rest of the market. But with silver prices expected to climb in 2012, an updated PEA out within the next few weeks, and nearly $11 million of exploration underway for both Juanicipio and Cinco de Mayo, this could be the breakout year for MAG Silver. It's Getting Crowded Silver is an asset whose consumption will exceed new production for many years. With just $50 billion of silver bullion above ground, the silver market is a very small market and gets crowded easily. The amount of silver stocks with strong assets are very limited and very few discoveries are being made worldwide. Over the next few years, we're going to see a lot of consolidation in the silver space - especially for companies with high grade projects. It's already happening... Just last week, we saw the takeover of Minefinders by Pan American Silver for $1.6 billion. So how does Minefinders' silver project compare to MAG's? According to Morningstar: Most of Minefinders' silver reserves and all of its current production come from its Dolores open-pit mine in northwest Mexico. Dolores is projected to produce more than 65,000 ounces of gold and 3.4 million ounces of silver in 2011 at cash costs of between $11 and $12 per silver-equivalent ounce (assuming a 41/1 gold to silver price ratio), but seems capable of supporting a much larger annual production rate given its sizable silver reserves. Dolores' low cash costs should also help Pan American better control its production cost inflation, as the firm's existing silver mines are projected to reach cash costs of more than $18 per silver-equivalent ounces in 2011. Based on the 2009 scoping study, MAG's unit cost per ounce of accountable silver (net of by product credit and TTM* costs) is expected to be US$1.77 - a big difference to the US$11-12 cost of Minefinders and an even bigger difference to Pan American's US$18. Clearly you can now see why analysts are calling Juanicipio one of the most important high grade silver projects on the planet. Silver prices are near $35/oz and are expected to climb much higher. You can do the math. Timing is Crucial There's no doubt that MAG has one of the most promising silver projects in the world. But that's not the only reason I am about to buy their shares right now. Within the next few weeks, MAG is about to hit a critical milestone that could send share prices much higher than where it is today... MAG is about to announce an updated PEA using much higher silver prices than the PEA done in 2009. The upcoming PEA on one of the world's highest grade silver deposits is going to be a critical milestone for MAG as it will truly show the real value of what the Juanicipio project has to offer. To give you an example of how big an impact an updated PEA can be, let's go back and look at Hathor - the company that hosted one of the world's richest uranium deposits. As you can remember, just a few weeks before Hathor announced their new PEA, not only did their share price soar, but takeover bids and rumours started to pour in with Cameco making the first unsuccessful bid. Once Hathor's new PEA was released, mining giant Rio Tinto made their move and bought Hathor at significantly higher prices. While in a different sector, the MAG story has many similarities. While Hathor had one of the richest uranium deposits in the world, MAG has one of the richest silver deposits in the world. Hathor received a failed low-balled takeover attempt by Cameco. MAG received a failed low-balled take-over attempt by Fresnillo. Once MAG's new PEA comes out in the next few weeks, you can be sure Fresnillo will be watching as other big shots in the silver space drool over MAG's asset. With the new PEA, the NPV for MAG would not only rise significantly based on higher silver prices, but it also means that Fresnillo would have to pay more for MAG if it wanted to buy MAG out. It's obvious that MAG is a likely acquisition target. Fresnillo has already boldly claimed that it has a goal of increasing its annual production to 65 million ounces of silver by 2018, up from a current production of around 42 million ounces. The Juanicipio project is expected to produce an average of 14 million ounces of silver annually. While 100% of Juanicipio would not likely get Fresnillo to its bold goals, it should certainly help the company along the way. It's apparent that Fresnillo would be the smartest and most economical suitor of the Juanicipio project. If Fresnillo were to use its existing infrastructure as I had already mentioned, not only would the CAPEX be significantly reduced, but the timeline would also be dramatically shortened (potentially down to 18 months from 3.5 years.) The reduced cost and shortened timeline makes a compelling and obvious reason why Fresnillo should make a move. Of course, the only thing that stands in the way is the recent past between MAG and Fresnillo. But at the end of the day, the courts have made their decision and any deal Fresnillo wants will not only have to be friendly, but have to be all cash. The only question is will Fresnillo come to a friendly agreement with MAG? If Fresnillo doesn't make a move soon, I wouldn't be surprised to see other suitors come to the table before MAG continues to increase its value via further exploration work on Juanicipio and its other properties. The big institutions feel the same way: "If Fresnillo does intend to eventually acquire MAG`s interest in Juanicipio, with an increased in exploration budget from last year, an updated PA for the Juanicipio project, and new value to be created at its Cinco De Mayo and Pozo Seco projects, the potential cost of acquiring MAG is likely only to increase over time. The challenge of structuring a friendly deal between the two companies is obvious, but despite the history, the argument supporting the potential friendly bid for MAG appears compelling. Even without a bid from Fresnillo, we believe the outlook for MAG has improved, which could potentially attract other suitors." - Canaccord, January 22, 2012 Fresnillo is the biggest player in the primary silver space and you can bet they wouldn't want any partners on their home turf - especially when MAG is sitting right in their backyard. MAG is already undervalued based on a 0.75x multiple to Canaccord's peak silver price estimate of NAVPS (net asset value per share, 7.5% US$35/oz Ag). With an updated PEA on Juanicipio, an upcoming PEA on Pezo Seco, drill results coming from their other high grade silver projects, and the possibility of a takeover, MAG will undoubtedly be the focus of anyone in the silver space. MAG's management is top notch and their share structure is rock solid. Management has been able to turn MAG from a penny stock to where it trades today - all without diluting shareholders. They have over US$27 million in the bank and less than 60 million shares outstanding when fully diluted. That is an amazing task considering the progress MAG has made. The real silver boom is about to begin. That is why I will be investing in "one of the most important high grade silver projects on the planet." That is why I will be investing in MAG Silver... MAG Silver Corp. Cdn Symbol: (TSX: MAG)

US Symbol: (NYSE.A: MVG)

We're biased towards MAG Silver because they are an advertiser and we will be buying shares. You can do the math. Our reputation is built upon the companies we feature. That is why we invest in every company we feature in our Equedia Reports, including MAG Silver. It's your money to invest and we don't share in your profits or your losses, so please take responsibility for doing your own due diligence. Remember, past performance is not indicative of future performance. Just because many of the companies in our previous Equedia Reports have done well, doesn't mean they all will.

Until next time, Ivan Lo Equedia Weekly

Questions?

Call Us Toll Free: 1-888-EQUEDIA (378-3342)

* Source "Wardrop - Valdecañas Project - Scoping Study, NI 43-101 Technical Report", |

MAG Silver Corporate Summary

MAG Silver Corp. is focused on district scale projects located within the Mexican Silver Belt, with numerous growing assets including a 44% interest in one of the world's highest grade silver deposits on the planet.  | | Property Locations and Work Activity |

Core Assets Location and Focus MAG holds a significant land package on the Fresnillo Silver Trend, which hosts the world's largest primary silver mine. Over 4.2 billion ounces of silver has been produced on this trend, representing more than 10% of the world's historical production.  | | click to enlarg |

Main Asset - 44% Interest in the Juanicipio Joint Venture - Indicated Resource of 6.2M tonnes grading 728 g/t Ag for 146M oz.

- Inferred Resource of 7.1M tonnes grading 373 g/t Ag for 85M oz.

- Updated PEA underway and tentatively scheduled for early Q1 2012 completion

Cinco de Mayo - Jose Manto Ag / Pb / Zn (100% Interest)

- New high grade Ag / Pb/ Zn sulphide intercepts in the Jose Manto - Cinco Ridge mineralized corridor)

- Resource estimation on Jose Manto by Q3 2012

Pozo Seco - Molybdenum / Gold Deposit (100%)

- Indicated resource 29.07 M tonnes grading 0.147% Molybdenum and 0.25 g/t Gold (94M lbs Mo / 230K oz. Au)

- Inferred resource 23.38M tonnes grading 0.103% Molybdenum and 0.17 g/t Gold (53M lbs Mo / 129K oz. Au)

| | click to enlarge |

|

MAG Silver Management and Directors

Dan MacInnis, President & CEO

Mr. MacInnis has over thirty years experience in worldwide mineral exploration - including Mexico. He has managed and directed multi-million dollar exploration programs for Noranda Exploration, Battle Mountain Gold/Hemlo Gold, and Sargold Resources. Mr. MacInnis has extensive global experience in property acquisitions and joint venture negotiations and operation. A significant number of mineral discoveries have been made under the guidance of Mr. MacInnis. Discoveries include gold and base metal deposits in the US, Canada and Mexico. Mr. MacInnis is a Registered Professional Geoscientist (P.Geo) and is a graduate of Saint Francis Xavier University with a BSc. in Geology.

Jonathan Rubenstein, Director

Chairman of the Board

Mr. Rubenstein was appointed to the board February 26, 2007. He is Vice President, Corporate Secretary and a Director of Andagan Resource Corp. In 2001, Mr. Rubenstein was one of the founders of Canico Resources Corp., where he served as a Director and as Vice President & Corporate Secretary as the company acquired, explored and developed its Onça Puma nickel deposit in Brazil. Mr. Rubenstein was instrumental in the negotiations for the 2005 acquisition of Canico by CVRD of Brazil for $941 million. As Vice President, Corporate Affairs for Sutton Resources, he also played a key role in negotiating the $525 million takeover of that company by Barrick Gold Corporation in 1999. He had practised law until 1993 and has been a mining executive since that time. He is also on the board of Cumberland Resources, Redcorp Ventures and Aurelian Resources.

Dr. Peter Megaw, Director

Dr. Peter Megaw, C.P.G., has a Ph.D. in geology from the University of Arizona and more than 27 years of relevant experience focussed on silver and gold exploration in Mexico. He is a certified Professional Geologist by the American Institute of Professional Geologists and an Arizona Registered geologist. Dr. Megaw has been instrumental in a number of mineral discoveries in Mexico including new ore bodies at existing mines, Excellon Resources' Platosa Mine, and MAG Silver's Juanicipio, Batopilas and Santa Eulalia Properties. Peter is the author of numerous scientific publications on ore deposits, and is a frequent speaker at academic and international exploration conferences.

R. Michael Jones, Director

Mr. Jones graduated from the University of Toronto in 1985 with a Bachelor of Applied Sciences Degree in Geological Engineering. He is a professional engineer licensed in Ontario, Canada. He has worked in the mining industry since 1985 and is currently the President of Platinum Group Metals Ltd. His experience includes exploration and mining development and production in public companies since 1985.

Eric H. Carlson, Director

Mr. Carlson has over 17 years of real estate investment, development, and management experience. Mr. Carlson has been President and Chief Executive Officer of Anthem Properties Corp. ("Anthem") since July 1994. Anthem is an investment group that specializes in the acquisition and management of Class B retail, multi-family residential and office properties in high growth markets in Canada and the United States. Mr. Carlson has also been President and a director of Kruger Capital Corp. since December 1992. Mr. Carlson is a Chartered Accountant and holds a Bachelor of Commerce degree from the University of British Columbia.

Richard M. Colterjohn, Director

Mr. Colterjohn is the founder, President and Chief Executive Officer of Centenario Copper Corporation, a development stage copper company active in Chile. Since 2002, he has also acted as Managing Partner at Glencoban Capital Management Inc., a private merchant banking firm. Between 2002 and 2007, he has also served as a director of three other Canadian public mining sector companies: Canico Resource Corp., Cumberland Resources Ltd. and Viceroy Exploration Ltd. Prior to April 2002, Mr. Colterjohn was Managing Director at UBS Bunting Warburg Inc., an investment dealer.

Derek C. White, Director

Chairman of the Audit Committee

Mr. White has over 20 years of financial experience in the mining and metals industry. He started his career in 1986 with Coopers & Lybrand LLC in Vancouver and Johannesburg. In 1992 he joined Impala Platinum Ltd. and held financial management positions in both mine operations in South Africa, and metals trading in London. He then joined Billiton International Metals BV in 1994, as part of the Gencor Ltd. acquisition team, and held executive financial positions in The Hague, London, and Toronto in Precious and Base metal operations, project and business development, and exploration including serving as Chief Financial officer for the Gencor International Gold Division and the Billiton Base Metals Division, formed after the acquisition by Billiton Plc of Rio Algom Ltd. In 2003, he served as the Chief Financial Officer of International Vision Direct Corp., an online contact lens retailer and winner of the 2003 Ernst &Young LLP - Pacific Region Entrepreneur of the Year Award. In 2004, Mr White, joined as the Chief Financial Officer of newly formed Quadra Mining Ltd., mid tier copper producer. Mr. White holds an undergraduate degree in Geological Engineering from the University of British Columbia and is a Chartered Accountant.

Frank R. Hallam, Director

Mr. Hallam was the original founder of New Millennium Metals Inc. He was previously an auditor with Coopers and Lybrand. Mr. Hallam has extensive experience at the senior management level with several publicly listed resource companies. He is a Chartered Accountant and has a degree in business administration from Simon Fraser University.

Larry Taddei, CFO

Mr. Taddei obtained his Chartered Accountant designation in 1990 and has held senior accounting and finance roles in the natural resource sector for the past 20 years. Most recently, he was the CFO of West Timmins Mining Inc. up until its business combination with Lake Shore Gold Corp., a transaction valued at over $420 million. Previous to this, he held the position of CFO with a Vancouver-based precious metals producer with operations in South America, where he was instrumental in the completion of both debt and equity financings and oversaw the transition of the Company from an explorer to a producer. Mr. Taddei also holds a Bachelor of Commerce degree from the University of British Columbia.

Gordon Neal, VP Corporate Development

Mr. Neal was the founder of Neal McInerney Investor Relations, which grew to be the second largest Investor Relations firm in Canada with international offices serving a Financial Post 500 and Forbes 100 client base. During his time as President of this firm he marketed more than $4 billion of debt and equity to institutional investors in Canada, the United States and Europe. Mr. Neal has been a consultant to TVX Gold, Glamis Gold, Santa Elina Gold and Hillsbourough Resources.

Michael Petrina, P.ENG, Vice President Operations

Mr. Petrina brings over 25 years of extensive experience in operations, engineering, mine development, financial modelling and acquisition analysis, and is a past technical advisor and engineering consultant for numerous mining companies. He is a Professional Engineer (P.ENG, Mining) registered in British Columbia and holds a MBA from the University of Athabasca. Mr. Petrina recently held the position of Vice President, Mining for Hawthorne Gold Corp. and has worked directly for or as a consultant for Candente Resource Corp., Adriana Resources Ltd., Adanac Molybdenum Corporation, Pan American Silver Corporation and Breakwater Resources Ltd.

|

|

Minera Juanicipio S. A. de C.V

The Juanicipio JV property is located in Mexico's Fresnillo Silver Belt, which also hosts the Zacatecas, Fresnillo and Sombrete-San Martin silver districts. Collectively, these districts have produced an estimated 4.0 billion ounces silver (40% of Mexico's historic silver production) since mining there began in the 1500's.

MAG owns 44% of the JV, while 56% is owned by Fresnillo PLC, the world's largest primary silver producer, and operator of the JV. All expenditures are shared pro rata (44%/56%), and the JV is, in part, governed by supermajority whereby annual budgets and capital expenditures in excess of US$500,000 must have 60% majority approval. The technical committee overseeing project development consists of five members, two from MAG and three from Fresnillo.

Resources

The JV hosts one of richest and highest-grade silver deposits worldwide. The deposit consists of a series of northwest to southeast trending vein structures, including the Valdecañas vein which is currently the largest in terms of tonnage and silver ounces contained, and the Juanicipio vein which was the original mineral discovery made at the

property by MAG in the late 1990s.

The JV's most recent mineral resource estimate was commissioned by MAG, and reported based on the drilling results completed on the property to September 8, 2010. The Juanicipio JV is now estimated to contain 110.8 million ounces of silver grading 662 g/t inthe Indicated category, and 93.3 million ounces of silver grading 376 g/t in the Inferred category. Besides silver, the deposit also contains substantial amounts of gold, silver and lead at meaningful grades.

Valdecañas Scoping Study Demonstrates Robust Economics

In May of 2009 Wardrop, A Tetra Tech Company, was retained by Minera Juanicipio S.A. (MAG Silver Corp 44% and Fresnillo plc 56%) to carry out a Scoping Level Study on the Valdecañas Vein Deposit.

The report was completed on the basis that the joint Mine/Mill project would be conducted on a "Stand Alone" basis, independent of any other regional mining operations or related infrastructure. It was also assumed that the most economical and efficient access to the mine would be via a ramp.

The study is authored by Wardrop, a Tetra Tech Company on behalf of the Joint Venture and is dated to the end of May 2009 and estimates are to an accuracy of + 35%. All costs are in $US and the Wardrop Base Case utilizes the Energy and Metals Consensus Forecasts (ECMF) quarterly reports in calculating Wardrop/ECMF prices.

Highlights - Valdecañas Stand-Alone Scoping Study - 4 Year Trailing Silver Price Scenario*

| Valdecañas Vein | 100% | MAG 44% | | NPV (5%) (@ US$12.32 oz./Ag) | US$967M | $US425.5M | | IRR (pretax) | 48.4% | | Payback | 2.2 years | | Pre Production / PP Capital | 3.5 years / US$65M | US$28.6M | | Mine Life / Mine Rate | 12.6 years / 2,350tpd | | Operating Costs | US$42.28 t / milled | | CAPEX (Includes pre production) | US$217M | $US95.5M | | Annual Production (Recovered Silver) | 14.0 Million ounces (ave.) | 6.2 M oz | | Unit cost per ounce of accountable silver (net of by product credit and TTM* costs) | US$1.77 |

"One of the highest quality silver deposits in the world"

Though the SRK audited resource estimate released (but not published) by Fresnillo varies substantially from MAG's, it is important to emphasize that the Scott Wilson RP Valdecañas resource estimate is NI-43-101 compliant and defines a truly world-class silver deposit. The average grade of our indicated resource is 879 grams silver per tonne, about twice the grade of Fresnillo's other producing mines in the district, making the Valdecañas Vein one of the highest grade undeveloped silver resources in the world.

There is also substantial exploration upside elsewhere on the property with the largely untested Juanicipio Vein, our original discovery. Highlights from the Juanicipio Vein include a high grade gold and silver intercept in Hole 20P which returned 4.95 grams per tonne (g/t) gold, 115 g/t (3.4 ounces per ton (opt)) silver, 1.19% lead and 2.89% zinc over a width of 1.20 metres (0.92 metres true width). The gold values demonstrated here are significantly higher than that of the historic Fresnillo district and is similar to the average gold grade and approaching the average width of the Saucito Vein which our partner Fresnillo has recently brought into production about 2.5 kilometres to the east.

It appears that the Juanicipio property is host to an emerging vein field potentially representing generations of additional productive life for this historical mining district.

Juanicipio Project Background

MAG's exploration team, headed by Dr. Peter Megaw of the consultant group Minera Cascabel / IMDEX, first identified the Juanicipio Property in the late 1990's. Prior to acquisition by MAG there was no silver, gold or base metal mineralization identified on the Juanicipio Property. It was the extensive advanced argillic alteration and silicification of the tertiary volcanic and volcaniclastic rocks, that implied mineralization at depth. Drilling by MAG Silver from 2003 to 2005 on this working geological model, intersected new high grade silver and gold veins within one of the oldest and most significant silver districts in the world.

This success quickly attracted the attention of Industrias Peñoles S.A. de C.V., the world's largest silver producer, to acquire an option to earn an interest in the property. Drilling by Peñoles in late 2005 subsequently discovered the Valdecañas Vein less than five kilometres from their main production headframe at Fresnillo.

MAG Silver's Juanicipio (almost 8,000 hectares) and Lagartos properties cover approximately 140,000 hectares in several large claim blocks along the "Fresnillo Trend" (350 km long), a regional structural corridor linking the famous Guanajuato, Zacatecas, Fresnillo and Sombrerete-San Martin silver districts. Combined, these four districts have produced over 4.0 billion ounces of silver (representing 40% of Mexico's historic silver production) and include Fresnillo, which produced 34 million ounces of silver in 2008.

Valdecañas Vein Description

Valdecañas lies 2.5 kilometres southwest from the San Carlos Vein, which is Fresnillo plc's principal production vein and 2.5 kilometres northwest from the El Saucito Vein, which is currently undergoing preproduction development with construction of a 600 metre shaft and a 2,200 metre decline. Also just completed is a 47-metre concrete headframe for the Jarillas/ Valdecañas shaft 1,100 metres east of the Juanicipio property boundary.

Geologically and mineralogically the Valdecañas Vein has affinities to Fresnillo plc's Santo Niño Vein, at one time the principal production vein at Fresnillo. The Santo Niño produced over 250 million ounces of silver from a four kilometre strike length.

Drilling to date clearly demonstrates that Valdecañas is an epithermal vein typical of the Fresnillo District. However, the Valdecañas and the Juanicipio (discovered by MAG in 2003) veins contain significantly higher gold grades (2-4 grams gold per tonne) than the average veins (0.5 grams gold per tonne) in the principal production parts of the district.

Mineralization observed in drill core consists of precious metal rich, banded or brecciated quartz-pyrargyrite-acanthite-polybasite-galena-sphalerite veins. The Valdecañas Vein has undergone multiple mineralizing events as evidenced by various stages of brecciation and quartz sealing, local rhythmic microcrystalline quartzpyrargyrite banding and open-space cox-comb textures and vuggy silica. The vein exhibits the characteristic metal zoning of the principal veins at Fresnillo, observed as a change from silver and gold rich zones at the top to increased base metals in the deeper intersections. Notably, the gold rich mineralization cuts across the silver rich zones, which in turn cut earlier base-metal dominant stages indicating complex multi-stage mineralization seen separately in other parts of the district.

Overall, the precious metals rich zone is 350 metres high, which is typical of major producing veins in the district although it lies slightly lower in elevation than the comparable precious metal zones being mined elsewhere in the district. Within ten to twenty metres of the vein, the wall rocks are progressively and pervasively silicified and cut by quartz veinlets carrying pyrite-sphalerite-galena sulphide minerals. Alteration in the volcanoclastic / sedimentary host rock farther away from the vein is characterized by weak pyritization, moderate clay alteration, and calcite veining.

Juanicipio Vein

The Juanicipio Vein, first intersected by MAG in 2003, is located about 1,100 metres south of Valdecañas and is one of the strongest indications of the existence of other significant vein sets on the property. Plans for the near term include drill testing and defining the Juanicipio Vein. Information from the Valdecañas drill program suggests that the Juanicipio Vein intersection occurs at the very top of the high grade silver/gold Bonanza Zone. The Juanicipio Vein is open at depth and along strike.

The return of the gold-dominant Hole 20P in January 2009 was further indication that the presence of separate gold and silver dominant veins on the Juanicipio property resulted from a long-lived, multi-stage mineralization event with each vein having unique metal contents and depth of emplacement.

Las Venadas Vein - New Mineralized Structure

The Venadas Structure lies approximately mid-way between the Valdecañas and Juanicipio Veins. Discovery of this new structure reinforces MAG's long-standing expectation that potential remains high for multiple vein discoveries within the Juanicipio Project area.

Joint Venture contractor and partner, Fresnillo plc ("Fresnillo"), reports that Drill Hole 43P has a structure intercept of 3.82 metres (true width) grading 491 grams per ton (g/t) silver (14.3 ounces per tonne (opt)) and 2.69 g/t gold, with negligible lead and zinc. Within the intercept is a higher grade zone reporting 1.52 metres (true width) grading 965 g/t silver (28.1 opt) and 6.39 g/t gold.

A further bore hole, Hole 44P, has cut 2.65 metres of visibly mineralized quartz structure deeper in the same section. Assays are pending for Hole 44P.

Collectively these three bore holes confirm the discovery of a new structure on the Juanicipio property. The significance of this new structure remains to be determined by further drilling. Initial indications are that the discovery of this third structure on the property is an important event in the evolution of the project.

The first hole into this south dipping structure was Hole 37P (in 2010) which cut a structure grading 490 g/t silver (14.3 opt), 0.94 g/t gold and negligible base metal values over an estimated 2.75 metre true width. Hole 43P, reported herein, intersected this new structure approximately and 100 metres deeper than the 37P intercept. Hole 44P was drilled on the same section as 43P to intersect the new structure 100 metres deeper than hole 43P and it intersected a quartz structure 2.65 metres wide containing visible acanthite (silver sulphide), pyrite, arsenopyrite and fluorite starting at 594.85 metres. The three holes mentioned are in the same section.

Exploration Results for the Juanicipio Vein

Drilling continues on the Juanicipio Vein, primarily in the area around the Inferred Resource mentioned above (see Longitudinal Section). The Juanicipio Vein lies 1.1 kilometers south of the Valdecañas Vein and was discovered in the first hole drilled in the Juanicipio Claim by MAG Silver in 2003. Overall, the Juanicipio Vein behaves more erratically in width and grade than the Valdecañas Vein, but the local extremely high grades maintain high exploration interest. The general textural and grade patterns of the Juanicipio Vein suggest that its Bonanza Zone lies deeper than that of the Valdecañas Vein, which is consistent with well documented vertical and lateral shifts in the centres of mineralization over time in the Fresnillo District.

The best of the recent holes is Hole 18R, which cut 1.56 metres (true thickness) reporting 4,223 g/t (123.2 opt) silver, 2.97 g/t gold, 3.00% lead and 5.57% zinc. Hole 18.5R, drilled 125 metres west of 18R cut a wider (3.55 metre true width thickness) segment of the vein, with significant but lower grades (see Table 3). More importantly, hole 18.5R cut several hanging wall veins, the first seen along the Juanicipio Vein; the most important of these is 0.55 metre wide and carries 453 g/t (13.2 opt) silver. Hole 17.5 R is currently in progress to determine if the mineralization cut in 18.5R continues to depth.

Table 3- Juanicipio Vein Drilling Results

Hole

Number | From

m | To

m | Gold (Au)

g/t | Silver (Ag)

g/t | Lead (Pb)

% | Zinc (Zn)

% | True Width

(metres) | | 18P | 627.60 | 628.2 | 1.47 | 4,100 | 2.02 | 4.07 | *0.60 | | 18R | 754.70 | 756.5 | 2.97 | 4,223 | 3.00 | 5.57 | 1.56 | | 18.5R HW | 880.90 | 882.5 | 0.28 | 453 | 0.19 | 0.92 | 0.55 | | 18.5R | 889.65 | 894.0 | 0.43 | 548 | 0.34 | 1.20 | 3.55 | | 18Q | 719.85 | 720.7 | 0.27 | 55 | 1.54 | 2.00 | *0.85 | | 19R | 921.60 | 922.2 | 2.09 | 731 | 10.50 | 7.66 | 0.52 |

Minera Juanicipio S.A. DE C.V.

This new company was established in December 2007 to own and operate the Juanicipio Joint Venture, MAG having a direct 44% interest and Fresnillo plc a direct 56% interest.

The Juanicipio Joint Venture owns the surface rights for Juanicipio and Valdecañas and is operated by Fresnillo plc. While all expenditures are shared pro rata (44/56), the joint venture is conducted by super-majority whereby all major decisions (any expenditures of $500,000 or more) must have 60% majority approval. The joint venture's technical committee consists of five members, two from MAG Silver and three from Fresnillo plc.

Highlights

- Owned 44% MAG / 56% Fresnillo plc

- One of the richest and highest grade silver projects in the world

- Main Asset - Valdecañas Vein

- New Resource (RPA) Estimate (100%)

Indicated 146Moz. Ag @ 728 g/t Ag

Inferred 85 Moz. Ag @373 g/t Ag - Emerging high grade ore shoot on Juanicipio Vein

- "Standalone" Updated PA Study underway (Q1 2012), incorporating higher grades, a larger resource, and higher silver prices

- 3rd Vein Identified / Las Venadas

- US8.5 million, 36,000 metres of drilling planned

|

Cinco De Mayo and Pozo Seco

The 100% owned Cinco de Mayo property comprises 22,000 hectares located approximately 190 kilometres north of the city of Chihuahua, in northern Chihuahua Sate, Mexico. Cinco de Mayo is the most advanced of MAG's five Carbonate Replacement Deposit ("CRD") style targets.

| |

click to enlarge

|

In late 2009 the Company announced the discovery of a new zone of high grade molybdenum and gold mineralization named "Pozo Seco" in the western part of the project area. Drilling to date clearly demonstrates grade, width and continuity within the Pozo Seco Prime discovery zone with contiguous holes outlining a very significant tabular body roughly measuring 1,800 metres long, averaging 250 metres wide and 55 metres thick. Successful, large, step outs through alluvial cover indicate that this body remains open in several directions.

In August 2010 MAG announced their first mineral resource estimate for the Pozo Seco Molybdenum (Moly)-Gold discovery. Results confirm that Pozo Seco is a significant high grade oxide molybdenum/gold deposit and metallurgical test work is underway looking at leach and floatation methods for recoveries.

Table 1 - Mineral Resource Estimate for the Pozo Seco Deposit

| Zone / Classification | Tonnage

(Tonnes

x 1000) | Molybdenum

(%) | Molybdenum

(pounds) | Gold

(g/t) | Gold

(ounces) | | INDICATED | | | | | | | FW1 | 2,719 | 0.116 | 6,943,000 | 0.27 | 24,000 | | MZ | 26,346 | 0.150 | 87,082,000 | 0.24 | 206,000 | | Total Indicated | 29,066 | 0.147 | 94,012,000 | 0.25 | 230,000 | | | | | | | | | INFERRED | | | | | | | FW1 | 4,357 | 0.086 | 8,220,000 | 0.22 | 31,000 | | FW3 | 1,312 | 0.109 | 3,155,000 | 0.19 | 8,000 | | FW4 | 38 | 0.057 | 48,000 | 0.02 | 0 | | HW1 | 819 | 0.065 | 1,177,000 | 0.08 | 2,000 | | HW2 | 1,234 | 0.070 | 1,911,000 | 0.14 | 5,000 | | MZ | 13,857 | 0.118 | 36,009,000 | 0.15 | 67,000 | | NWZ | 1,759 | 0.069 | 2,686,000 | 0.27 | 15,000 | | Total Inferred | 23,376 | 0.103 | 53,205,000 | 0.17 | 129,000 |

|

Notes:- CIM Definition Standards have been followed for classification of Mineral Resources.

- The cut-off grade of 0.022% Mo was estimated using a Mo price of US$17/lb and assumed operating costs and recoveries.

- Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability.

- Totals may not add correctly due to rounding.

The significance of this discovery is two-fold: 1) the very high-grade moly (approximately three times the average grade of most moly producers) encountered over bulk mineable widths just below surface suggests the possibility of a standalone moly operation; 2) perhaps more important is that the presence of high-grade molybdenum may indicate proximity to the intrusive centre of Cinco's silver-lead-zinc mineralization. A proximal moly zone characterizes the San Martin-Sabinas District in Zacatecas, the largest skarn-replacement deposit known in Mexico.

To date, the Company has drilled a cumulative over 128,000 metres on the property, in more than 270 holes, and outlined high grade silver/lead/zinc mineralization along approximately 2,000 metres of strike length of the Jose Manto, as well as the new moly-gold zone. Highlights of Cinco De Mayo:

Classic CRD Ag / Pb / Zn

- Latest drill results: Replacement style mineralization intersected over a 4.0+Km strike length

Jose Manto - Cinco Ridge

- High Grade Ag / Pb / Zn

- 220 - 400m below surface

- Open all directions

- Very large CRD system indicated

High Grade Oxide Moly / Gold Deposit

- Shallow / open pit configuration

- Open in several directions

- Nearby water, power, road

Cinco de Mayo Overview

Bridge Zone - Jose / Cinco Ridge Corridor

Latest seven drill holes connects Jose Manto and Cinco Ridge mineralization (Ag / Pb / Zn). Mineralized corridor is now over 4,000+ meters long indicating a very large CRD presence. Drilling to continue .

Pozo Seco

Metallurgy process in final stages. Once completed and with acceptable Mo recoveries will lead to a Preliminary Economic Assessment (PA) before end of 2012 Q1.

Jose Manto

Deposit remains open in several directions with large upside potential based on geophysics and drilling. Reassessment and a first resource estimate is underway and is expected by mid 2012 Q1.

|

Mojina Property

On March 30, 2010, the Company entered into an option agreement to acquire a 100% interest in the 5,500 hectare Mojina Silver-Lead-Gold (Zinc) property, subject to a 2.5% net smelter return royalty, half of which can be purchased at any time for US$1,250,000.

Located in north-central Chihuahua Mojina lies approximately 40 km due south of MAG's Cinco de Mayo property. The Mojina property includes the long-inactive Mojina Mine which produced an estimated 125,000 tonnes grading 8-10% Lead, 80-330 g/t (2.3 - 10 oz/t) Silver and 2-4 g/t Gold from thoroughly oxidized manto ores. MAG's reconnaissance dump sampling also revealed elevated Molybdenum, Tellurium, Indium and Gallium values.

The Mojina Property lies along the main strand of the Mexican Carbonate Replacement Deposit (CRD) Belt which includes the famous Santa Eulalia District (>50 million tonnes of production grading 330 g/t (11 oz/t) Silver; 8.2% Lead and 7.8% Zinc) and MAG's nearby Cinco de Mayo property. Mojina lies at the intersection of the strong group of NW-trending structures that define the Mexican CRD Belt and the nearly north-south structure that hosts the Pozo Seco Molybdenum-Gold zone at Cinco de Mayo.

Historic production at the Mojina Mine came from mantos 1 to 5 m thick lying along the upper and lower contacts of a 20 m thick felsite sill emplaced into a west-dipping limestone sequence. Exploited mineralization was thoroughly oxidized and probably originally contained zinc which was flushed out during oxidation. Alteration patterns in the felsite, manto geometry and intrusive outcrops along the western side of the range indicate a buried source just west of the main body of the range and initial exploration will focus in that area.

Mojina Highlights Past Production of: 125,000 tonnes grading 80 - 330 g/t (2.3 - 10 opt) silver, 2-4 g/t gold and 8-10% Lead from oxidized manto ores. Drilling currently in progress Similarties to Pozo Seco: - Same structural grain

- Same Regional Structure?

- Same Lithological Section

- Superb Infrastructure

- Easily explored from Cinco base camp

|

La Esperanza

On August 19, 2010 MAG Silver signed a binding letter of agreement with Canasil Resources Inc. to earn a 60% interest in the 18,954 hectare La Esperanza Silver Project.

To complete the earn-in of 60% interest in the La Esperanza project, MAG must complete CAD$5,000,000 exploration expenditures and CAD$500,000 cash payments to Canasil over a period of four years. The initial payment of CAD$50,000 upon signature and first year expenditure of CAD$750,000 are firm commitments, and will include a minimum of 1,500 metres of drilling.

Location

Canasil's La Esperanza project is located 100km SSE of Durango on the northern extension of the Fresnillo Silver Trend and has the potential for hosting a district scale epithermal high-grade silver mineralized system. The area is well served with power lines, water access and services, such as banks, medical services and labour, which are available in local municipalities. The project is also close to a number of prominent silver mines - San Martin mine operated by Grupo Mexico, the La Colorada mine of Pan American Silver and La Parrilla mine of First Majestic Resource Corp. The climate and topography are moderate and typical of the Eastern edge of the Sierra Madre Occidental volcanic province.

Geology

The La Esperanza property hosts a banded and cockade white to grey quartz breccia epithermal vein with silver, lead and zinc mineralization associated with argentiferours galena, silver sulfasalts and sphalerite. There has been a history of past mining activity at La Esperanza with direct shipments of reportedly high-grade ore to local smelters. There are a number of surface pits and dumps with ore left over from past mining operations around the vein and mine area. The mine was last active in 1970, and was reportedly mined on three levels, using a main access shaft down to a depth of approximately 90 metres.

District Scale Exploration Potential

The project claims cover multiple vein occurrences and alteration zones over a 5 km strike length on a prospective SE-NW trend. The main La Esperanza vein outcrops over a strike length of 300 metres and has been drill tested with 7 diamond drill holes to a shallow depth (200m). One of the better intersections by Canasil was 396 g/t silver (11.5 ounces per ton), 1.96% lead and 0.71% zinc over a true width of 10.30 metres.

Significant alteration zones are observed along strike extensions of the La Esperanza vein for over 4 km on a NW-SE trend. Additional vein outcrops and mineralized structures are also observed to the NW of the extended claim area approximately 15 km NW of the La Esperanza vein, indicating the potential for a large district scale epithermal system.

Phase 1 Diamond Drill Program

Past diamond drilling by Canasil included 9 diamond drill holes for a total of 1,432 metres. Seven drill holes intersected the main La Esperanza vein (LE) and a hanging wall vein (HW) over significant widths. The weighted average grade of mineralization intersected in the La Esperanza vein is 330 g/t (9.62 oz/ton) silver, 0.93% (18.60 lbs/ton) zinc and 1.57% (31.40 lbs/ton) lead over an average width of 4.21 metres.

Highlights

- 60% interest in 19k ha

- Fresnillo/La Colorado silver trend

- Multiple epithermal vein system

- 7 holes with a weighted average of 330 g/t Ag (9.6 opt) and 2.5% Pb + Zn/4.21 m

- Drilling currently in progress

|

Lagartos Property

With 135,000 hectares comprising the Lagartos property holdings, MAG is a dominant landholder in the Fresnillo Silver Trend, the world's premier silver producing district; looking to repeat success of Juanicipio in 'unearthing' mineral wealth beneath alluvial cover  Central to the MAG Silver story is the success in 2005 in discovering the Valdecañas Vein, on our Juanicipio Property, in the Fresnillo Silver Trend. This vein was encountered just 5 kilometres from the main headframe of our partner's (Industrias Peñoles) Fresnillo Mine, the world's largest primary silver producer. Key to the discovery was MAG's belief that hidden underneath the alluvium that covers virtually all of the Juancipio property, lay significant vein systems at depth. That proved correct, and the Valdecañas Vein today represents a substantial new mineral resource - still open and growing - and is considered within the industry one of the most important silver discoveries in recent memory. Following this success MAG moved quickly to secure, through acquisition and staking, two very large claim groups lying northwest and southeast of the Juanicipio Joint Venture. Both properties lay along the Fresnillo Silver Trend, a large regional structural zone hosting the Guanajuato, Zacatecas and Fresnillo epithermal silver-gold vein districts. All of the known deposits were found in outcrop between 350 and 500 years ago, but since over 60% of the trend is masked by alluvial soils, as was the Valdecañas Vein, MAG hopes it can repeat its Juanicipio success with discoveries at Lagartos. Lagartos SE has seen exploration focused on the eastern extension to the past producing Zacatecas silver district. Drilling in late 2009 appears to have discovered the continuation of the prolific Veta Grande Vein, the second most important production vein in the Zacatecas district. The holes were targeted along the direct projection of the vein, approximately 500 metres east of its last confirmed outcrop. This discovery shows that this important and historic vein is open along strike from areas of past production including an additional 4 kilometres of possible projection on MAG's wholly owned property. In a second discovery in the same vicinity, holes drilled in the Puerto Rico Vein, which runs parallel to the Veta Grande Vein, have encountered high-grade silver mineralization (see MAG press release dated January 19, 2010). Accompanying low base metal values indicate the vein was likely intersected at a high level. Future work will focus on exploring these significant results. The Veta Grande Vein was the second most important vein in this billion-ounce silver producing district, with significant ore-shoots distributed intermittently along the 12 kilometres of its trace across the north-central part of the district. The vein disappears under alluvium at both ends. MAG sought its continuation at the northwest end at La Luz before turning to the southeast extension (see MAG Press Release of June 5, 2009). There are no outcrops in the Veta Grande SE target area, so drilling was targeted on the south eastern projection of the principal Veta Grande Vein and a coincident linear colour anomaly. Alluvium was found to be less than 120 metre thick. The result of drilling indicates that the Veta Grande structure can be traced across the range-bounding fault with little lateral displacement. Vertical movement on the fault should have dropped the eastern part down, so any bonanza zone is expected to found at a deeper level than in the mined portion of the vein. Geophysical data are being examined to determine if anomalies potentially reflecting mineralization occur along the trace of this structure farther to the Southeast. The Puerto Rico Vein runs parallel to, and lies approximately 3 kilometres north of, the famous Veta Grande Vein. The Puerto Rico Vein has seen minor historic production and remains largely unexplored. Seven holes were drilled along approximately 1,000 metre of strike length of the vein, intersection the structure between 150 and 350 metre beneath the surface (see MAG press release dated January 19, 2010). The presence of high silver and gold grades with low base metals in three of the Puerto Rico vein intercepts indicates they are very high within the zoning pattern expected for Zacatecas District epithermal veins. The contrasting silver versus base metal-bearing intercepts in hole PR-03 indicates two separate mineralization events, intersected at different levels within the epithermal zoning pattern. This composite vein signature is typical of many of the larger veins in the Zacatecas District, including the Veta Grande and Mala Noche veins. Drilling began in Late 2011 - results pending.

|

Nuevo Mundo Property

Nuevo Mundo covers 110,811 hectares straddling the border of eastern Zacatecas State and western San Luis Polosi State, and is geologically located along the structural trend known to host Carbonate Replacement Deposits (CRDs) and all of our CRD projects (Sierra Ramirez, Guigui and Cinco de Mayo). It is also not far from Peñasquito and ties onto the eastern boundary of the Camino Rojo gold discovery of Canplats Resources. Reconnaissance work has been carried out and results are pending.

In June 2009 five short holes were drilled in isolated limestone exposures cut by strong gossan outcrops up to 8 metres wide and 200 metres long, reporting high mercury values. Three of the holes reported anomalous arsenic, mercury, antimony and zinc values. The majority of Nuevo Mundo is mantled by cover and work is on-going to develop targets in the more poorly exposed parts of this well located property.

|

Batopilas, Guigui, and La Lorena

Batopilas

Control of Batopilas Silver District an opportunity for MAG to apply modern geoscience and exploration technology to historic high-grade producer

The 100%-owned Batopilas project covers 4,800 hectares in the historic Batopilas Native Silver District in southwestern Chihuahua, which produced some 300 million ounces of silver between 1632 and 1912. Production was curtailed and the infrastructure destroyed during the Mexican Revolution (1912) and never recovered.

In 2005, MAG was successful in assembling the Batopilas land package, representing 94% of the Batopilas Native Silver District and the first-ever consolidation of the district's numerous mines and workings. Our goal was the reexamination of this native silver-rich area using a new district exploration model developed by MAG explorationists.

Work begun by MAG in 2006 is the first modern exploration program conducted in the district in over 93 years.

The Batopilas project is a unique opportunity for our exploration team to apply its accumulated knowledge of the Mexican Silver Belt - and its proven leadership in the application of modern geoscience - to identify new mineral wealth in the Batopilas district, and try to revive its silver production past.

Latest drilling encounters 61.2 metres of silver-lead-zinc mineralization; affirms new exploration model

Announced on May 5, 2008, Batopilas drilling encountered a broad zone of silver-lead-zinc mineralization in the Las Animas area. The zone starts immediately beneath the casing at 9.02 metres down hole and extends to 70.87 metres for a total core length of 61.2 metres grading 20.5 g/t silver, 0.66% lead and 0.84% zinc.

These returns are consistent with the new exploration model MAG is pursuing: another target type from the veins that provided the district's historical production. We are seeking previously unconsidered mineralization styles such as broader scale silver-lead-zinc mineralization in and around the intrusive dikes and their source stock, and this was the first intersection of this type.

As President and CEO Dan MacInnis said with the announcement, "We are extremely pleased with both the extent and the tenor of this new zone. It is a confirmation of our exploration model and takes us one step closer to understanding the true nature and potential of Batopilas. Tracing this mineralization to where we believe it is in proximity to both the intrusive centre and major structures cutting the prospective stratigraphy is very exciting and presents a high-priority target for MAG."

New exploration model also targets historic high-grade silver at depth

Also part of the new exploration model, MAG is targeting the historic high-grade native silver vein mineralization in specific stratigraphic units where vein openings should be widest. This structural and stratigraphic model is thought to indicate that surface silver occurrences (structures) persist to depth and that there are further indications that as they approach the lower contact of the middle sedimentary member and the lower volcanic unit there are improvements in scale and tenor of the veins.

This model suggests that an almost untouched northern half of the district lies untested under Cerro de las Animas.

Batopilas project background: Historical production, early MAG work

Almost 300 years of silver production from Batopilas was from ore shoots of very high-grade crystalline native silver hosted in calcite veins. The Batopilas veins are distinct from the other epithermal vein deposits of the region, which typically have a productive zone a few hundred metres high. The Batopilas silver veins were productive over a vertical interval of at least 700 metres and the bottom of the system has apparently never been reached.

In 2005, MAG generated the first modern detailed geological and structural map of the district and is combining it with modern geophysical and geochemical exploration techniques to locate new ore shoots quickly and effectively.

In April, 2006, MAG completed Phase One of its Batopilas drill program. A total of 12 holes were drilled totalling 3,025 metres. This work was successful in identifying a number of important exploration control vectors at Batopilas that included: a better understanding of the lithological controls on the native silver mineralization; the structural history and structural ore host controls; the vein and structural geochemistry as well as the lateral and vertical metal zoning characteristics of the vein mineralization.

2007: Drilling encounters high-grade silver; surface work discovers rich vein and numerous new mineralized structures

Exploration in 2007 included drilling and extensive aerial and surface work on the Batopilas Native Silver District. The program's results included encountering of high grade silver in: drilling in the Roncesvalles-Todos Santos area, drilling in the Las Animas area (Cobriza veins) and in a series of drill roads and trenches in the Las Animas Ridge area.

A seven-hole, 2,907 metre diamond drill program started in mid-February was completed in June 2007. Highlights of the program included Hole BA-15 at Todos Santos which intersected 1.0 metre of 3,070 g/t silver (89.5 opt), 3.6% lead and 0.63% zinc. This intercept is located on the east side of the Roncesvalles Fault Zone in the footwall of the Todos Santos-San Roberto vein system. The intercept is interpreted to be a parallel footwall vein of the historically highly productive "Todos-Santos Vein".

A highlight from the trench and road program included the discovery and exposure of the Cobriza North vein structure. This vein is exposed in a 4.0 metre high road-cut and is from 0.25 to 1.0 metres wide. Eleven samples totalling 281.54 kilograms (620 pounds) of bulk material was collected for analysis. Metallic screen analysis returned an average minimum grade for this bulk sample of 11,158 g/t silver (324.4 opt).

The 2,495 metre program of trench and road building at Las Animas Ridge also discovered at least two mineralized structures: the northern extension of the Cobriza, described above, and a silver sulphide-bearing structure 225 metres farther southeast. This work also uncovered entrances to several old 1850's era workings, as well as cutting numerous and previously undocumented silver, lead and zinc mineralized structures.

Numerous high grade returns from chip samples included 1.0 metre of 828 g/t silver (24.1 opt), which led to the discovery of the extension of the Cobriza Structure, and 1.0 metre of 851 g/t silver (24.8 opt) which revealed a previously unknown silver sulphide structure. Additionally, more than a dozen other geochemically anomalous structures containing silver values from 10 to 580 g/t (0.3 to 16.9 opt) await follow up work this year, as do the assay results of 337 soil samples, 28 of which returned values greater than 10.0 g/t silver and as high as 246 g/t (7.2 opt) silver.

Guigui

Guigui represents dominant landholding around world's largest CRD district; opportunity for MAG to play leading role in uncovering new mineral wealth in historically rich Santa Eulalia District

Carbonate Replacement Deposits (CRDs) represent 40% of Mexico's historical silver production and the Santa Eulalia Mining District the leading CRD producer with nearly 450 million ounces of silver and substantial amounts of lead and zinc mined from the period 1702-2001. Today, Grupo Mexico operates the San Antonio Mine in the East Camp of Santa Eulalia District.

Our 100%-owned Guigui property covers approximately 4500 hectares within the Santa Eulalia Mining District, 22 kilometres east of Chihuahua City, Chihuahua, and is a key project within MAG's CRD project portfolio. MAG controls all of the ground to the immediate south and between the east and west Camps of the Santa Eulalia making us a significant player in any future developments in this historically silver rich district.

Concealed intrusive source key to district mineralization

Mineralization in the district is very closely related in time and space to a series of felsite intrusions that apparently had a common stock source. Similar intrusions occupy the centre of substantial additional stock contact mineralization in districts such as San Martin, Zacatecas or Leadville, Colorado. The geologic model predicts that the principal intrusive centre related to district mineralization lies concealed under volcanic cover in the Guigui claims adjacent to the historic mining centre.

It is the search for this intrusive source that is the foundation of exploration in the Guigui project.

Initial drilling significant

A nine-hole drill program was conducted by MAG in 2005. Hole 05 returned a narrow intercept that assayed 3.5 ounces per tonne of silver and 5.6 % lead and 4.3 % zinc over 0.40 metres. Hole 6 returned with an 8.3 metre intercept of 4.2 ounces per tonne silver. It is significant that these intersections were within a 30 to 100 metre wide zone of manganoan-calcite (alteration) brecciation containing abundant veinlets and stringers of silver, lead and zinc minerals.

La LorenaLa Lorena is located 35 km north of the famous 1.3 billion ounce silver producing Guanajuato Silver Mining District within the Fresnillo Silver Trend and was identified from field work as a Juanicipio look-alike and staked in early 2008. Lorena displays similar surface alteration and trace element geochemistry is of the same magnitude that defined the active structures drilled at Juanicipio and Valdecañas. A past producing kaolin (clay) pit forms from the centre of the target and clearly marks the top of a hydrothermal system common to the genesis of the majority of the producing veins of the Fresnillo Silver Trend. Lorena is dominated by a large open pit where an estimated 150,000 tonnes of very pure kaolinite and alunite were produced prior to 1990. This alteration is developed along a strong NW structural system marked by pervasive silicification with silver-arsenic-mercury anomalies.

Six initial holes drilled from the northeast side of the principal structure, where MAG had obtained surface access for drilling. All cut narrow veinlets and silicified zones with anomalous gold (50-200 ppb); silver (3-10 ppm); lead (100-300 ppm) and zinc (100-450 ppm) values, but overall results indicate that the principal structure dips southwest and future drilling needs to be done from that side of the system.

|

|

Capital Structure and Major Shareholders

(as at January 25, 2012)

- Issued & Outstanding: 55,667,139

- Options: 4,123,618

- Fully Diluted: 59,790,757

- Working Capital ($CDN): $26,000,00

Major Shareholders

- Fresnillo plc 17.6%

- Equinox / Mason Hill 8.5%

- Sprott Asset 4.8%

- Oppenheimer 4.5%

- Van Eck Associates 4.0%

- Management 4.0%

- Franklin 3.0%

- Blackrock (US) 3.0%

- Top Gold / Pro Aurum 2.7%

- Goodman and Company 2.6%

- Totals 54.7%

|

|

Forward-Looking Statements

MAG Silver Corp is a Canadian issuer.

Daniel MacInnis P.Geo is a non-independent Qualified Person and has compiled this presentation from industry information and 43-101 reports and news releases with specific underlying Qualified Persons as set out in the Releases and reports. Industry Information has been compiled from publicly available sources and may not be complete, up to date or reliable.

This presentation contains forward-looking statements within the meaning of Canadian and U.S. securities laws. Such forward looking statements are subject to risks and uncertainties which could cause actual results to differ materially from estimated results. Such risks and uncertainties include, but are not limited to, the Company's ability to raise capital to fund development and exploration, changes in general economic conditions or financial markets, changes in metal prices, general cost increases, litigation, legislative, environmental and other judicial, regulatory, political and competitive developments in Mexico or Canada, technological and operational difficulties or inability to obtain permits encountered in connection with The Company's exploration activities, community and labor relations matters and changes in foreign exchange rates, all of which are described in more detail in the Company's filings with the Securities and Exchange Commission. There is no certainty that any forward looking statement will come to pass and investors should not place undue reliance upon forward-looking statements

This presentation uses the term "Indicated Resources". MAG advises investors that although this term is recognized and required by Canadian regulations (under National Instrument 43-101 Standards of Disclosure for Mineral Projects), the U.S. Securities and Exchange Commission does not recognize this term. Investors are cautioned not to assume that any part or all of mineral deposits in this category will ever be converted into reserves.

Cautionary Note to Investors Concerning Estimates of Inferred Resources: This presentation uses the term "Inferred Resources". MAG advises investors that although this term is recognized and required by Canadian regulations (under National Instrument 43-101 Standards of Disclosure for Mineral Projects), the U.S. Securities and Exchange Commission does not recognize this term. Investors are cautioned not to assume that any part or all of the mineral deposits in this category will ever be converted into reserves. In addition, "Inferred Resources" have a great amount of uncertainty as to their existence, and economic and legal feasibility. It cannot be assumed that all or any part of an Inferred Mineral Resource will ever be upgraded to a higher category. Under Canadian rules, estimates of Inferred Mineral Resources may not form the basis of feasibility or pre-feasibility studies, or economic studies except for Preliminary Assessment as defined under Canadian National Instrument 43-101. Investors are cautioned not to assume that part or all of an Inferred Resource exists, or is economically or legally mineable. The Company may access safe harbor rules. Please see complete information on SEDAR and at the SEC on EDGAR.

This presentation is for information purposes only and is not a solicitation. Please contact the Company for complete information and consult a registered investment representative / advisor prior to making any investment decision.

Note to U.S. Investors: Investors are urged to consider closely the disclosure in MAG Silver's Form 40F, File no. 001-33574, available at their office: Suite 770-800 West Pender, Vancouver BC, Canada, V6C 2V6 or from the SEC: 1(800) SEC-0330. The Company may access safe harbor rules.

Investors are urged to consider closely the disclosures in MAG Silver's annual and quarterly reports and other public filings, accessible through the Internet at www.sedar.com and www.sec.gov/edgar/searchedgar/companysearch.html

Neither the TSX Venture Exchange nor the New York Stock Exchange Alternex has reviewed or accepted responsibility for the accuracy or adequacy of this presentation.

|

|

|

|

|

January 20, 2012 MAG Silver Plans Increased Exploration at Juanicipio and Cinco de Mayo December 19, 2011 MAG Silver Announces Additional Silver And Gold In Updated Juanicipio Resource Estimation By Roscoe Postle And Associates November 28, 2011 MAG Silver Announces Seven New Silver / Lead/ Zinc Sulphide Intercepts at Cinco De Mayo November 10, 2011 MAG Silver Announces Updated Juanicipio Resource Estimate Prepared on Behalf of the Minera Juanicipio Joint Venture September 1, 2011 MAG Silver Confirms New Structure in Drilling at Juanicipio April 7, 2011 Abzu Gold Acquires Rights to the U&N Concession in the Ashanti Region of Ghana July 19, 2011 MAG Silver Provides Update on Juanicipio Joint Venture May 12, 2011 MAG Provides Update on Favourable ICC Arbitration Decision and Corrects Inaccuracies Disseminated by Fresnillo May 05, 2011 MAG Reports on Favourable ICC Arbitration Decision

March 25, 2011

Mag Silver Announces Silver-Zinc-Lead Sulphide Veins Near Skarn At Cinco De Mayo

February 28, 2011

MAG Silver Announces High-Grade Juanicipio Vein Intercept

December 01, 2010

MAG Silver Announces Juanicipio Resource Estimation And Exploration Update November 10, 2010 Cinco De Mayo: Management Discussion and Analysis ("MD&A") excerpt, with full Assay Table and Illustrative Map August 04, 2010 MAG Silver Announces First Resource Estimate For Pozo Seco

July 15, 2010

MAG Silver Announces Commencement of Prefeasibility Study on Juanicipio Property June 16, 2010 Pozo Seco - Assay Highlights

June 04, 2010

April 19, 2010

MAG Silver Drills Thickest Molybdenum-Gold Intercept to Date at Cinco De Mayo

March 26, 2010

MAG Silver Extends Molybdenum-Gold Zone At Cinco De Mayo

January 19, 2010

MAG Silver Discovers Veta Grande Vein Extension & Cuts High-Grade Silver In Puerto Rico Vein At Lagartos, Zacatecas, Mexico

January 08, 2010

MAG Silver Extends Molybdenum-Gold Zone At Cinco De Mayo

November 10, 2009 MAG Silver Expands High-Grade Molybdenum And Adds Significant Gold At Cinco De Mayo

September 23, 2009

MAG Silver Discovers High Grade Molybdenum With Gold At Cinco De Mayo |

|

|

|

|

Disclaimer and Disclosure

Disclaimer and Disclosure Equedia.com & Equedia Network Corporation bears no liability for losses and/or damages arising from the use of this newsletter or any third party content provided herein. Equedia.com is an online financial newsletter owned by Equedia Network Corporation. We are focused on researching small-cap and large-cap public companies. Our past performance does not guarantee future results. Information in this report has been obtained from sources considered to be reliable, but we do not guarantee that it is accurate or complete. This material is not an offer to sell or a solicitation of an offer to buy any securities or commodities.

Furthermore, to keep our reports and newsletters FREE, from time to time we may publish paid advertisements from third parties and sponsored companies. We are also compensated to perform research on specific companies and often act as consultants to many of the companies mentioned in this letter and on our website at equedia.com. We also make direct investments into many of these companies and own shares and/or options in them. Therefore, information should not be construed as unbiased. Each contract varies in duration, services performed and compensation received.