|

|

|

E-file 1094-C and 1095-C

by June 30

|

1094-C and 1095-C

E-File your 1094-C and 1095-C forms with the IRS by June 30, 2016.

Instruction for filing via Greenshades are found in the Avionté Knowledgebase. If you need assistance please create a Support Center ticket. a printable copy.

|

|

|

|

|

Only 35 Business Days until

Client Connection!

August 2 - 4

Minneapolis

Marriott City Center

|

|

|

Avionté Roadshow - Next Up Cincinnati and Philly

|

Coming to a town near you!

Don't miss this opportunity for face-to-face training! We will be in Cincinnati on June 21 and Philadelphia June 23.

Roadshow Schedule

Click the link for more details

and registration

Who should attend the Roadshow: Anyone within your organization who uses Avionté and wants to learn more! We encourage you to send as many team members as you can spare. Space is limited, so register early!

What to expect: Click HERE for a tentative roadshow agenda. Sessions will begin around 9 am and wrap up around 4 pm. Lunch will be provided.

*Agenda is subject to change

Registration is free, but required. For more details and to register, please click the link for the roadshow you are interested in attending.

|

|

New Pricing and New Schedule!

Do you have new hires or employees that need a refresher? If so, then Avionté Bootcamp is for you! The sessions will cover basic Avionté functionality, getting employees better prepared for day to day responsibilities.

Bootcamp weeks usually begin the 2nd Tuesday of each month. Click the Register link for exact dates.

Contact your Client Manager for details.

|

Front Office, Part 1

Tuesday, 11:00 AM - 3:00 PM (CDT)

Includes:

Overview, Start Page & Basic Search

Calendar & Tasks

Customer

Contacts

Orders

|

|

Front Office, Part 2

Wednesday, 11:00 AM - 3:00 PM (CDT)

Includes:

Applicant/Employee

Candidate Management

Assignment

Intro to Reports & Advanced Search

Mass Mail & Favorites

|

Back Office

Thursday, 10:00 AM - 4:00 PM (CDT)

This Back Office Training session will cover basic Avionté functionality specific to back office users.

|

Admin Tools

Friday, 9:00 AM - 1:00 PM (CDT)

This Avionté Admin Tools Training will cover Avionté functionality specific to admin users.

|

Portals

Friday, 1:30 PM - 3:30 PM (CDT)

This Avionté Portals Training will cover functionality around the various portals offered by Avionté.

|

|

|

|

|

Sales CRM Tools

This webinar will discuss key components of Avionté designed specifically for your sales team and best practices that help ensure your team's success. This includes tracking leads, accessing information on the go, and using Avionté to its fullest potential.

Click Register to view the schedule.

Free

|

| |

|

|

|

Interview Setup

|

This session will cover recommended setup and use of Config Choice Properties in Employee > Extra and Employee > Interview to improve the applicant process and search capabilities as well as the setup of questions in the Applicant portal.

Click Register to view the schedule.

Free

|

| |

|

|

|  |

|

|

Back Office Corrections

Mistakes? We all make them once in awhile. This session will discuss best practices when making corrections within Avionté.

Click Register to view the schedule.

Free

|

| |

|

|

|  |

|

Standard Report of the Week

|

Requesting a Standard Report or AQ

If you don't find a discussed report in Avionté, first check Admin Tools, is the report available but not turned on? If the report or AQ isn't found in Admin Tools you will need to request its deployment.

Note:

The newer reports require compliance with Avionté's upgrade policy - your software must be within the last 2 full versions, that is version 14.2 or more recent. If you are not in compliance, the reports cannot be deployed.

Create a Support Center Ticket

- Login to the Avionté Support Center.

- Select Submit a Ticket.

- Choose: I'd like to request a new modification in Avionté.

- Add the Subject, i.e. Deploy Standard AQ (or Report).

- Select the Ticket Type: Reports > Modification. When the ticket type is selected additional fields become available.

- Answer the additional questions, making sure to include the name of the AQ or Report.

- Click Submit to send your request.

- Your ticket will be updated with the status of your request.

|

Follow our Standard Reports and Standard AQs

If you would like to stay up-to-date with all standard reporting changes, follow our Standard Reports and Standard Advanced Queries articles in the Avionté Knowledge Base! You will get an email when the manuals are updated with new reports, new parameters, and fields that will allow you to get the most out your standard reporting.

Recently Added Reports: Comprehensive Assignment AQ, Comprehensive Customer AQ, Comprehensive Employee AQ, Comprehensive Order AQ, Recruiter Metrics Report, Bureau of Labor Statistics Multiple Worksite AQ, Bureau of Labor_Current Employment Statistics AQ, Federal EEO Reporting, EVerify Case AQ, Prove IT AQ, Payroll Contribution AQ, Workers Comp Claim Detail AQ, and Turnover AQ

|

Employee Direct Deposit AQ

The Employee Direct Deposit AQ details employee direct deposit information

Parameters

Branch (Employee), Employee Name, Show Inactive (True, False)

Results Fields

Branch, Employee ID, First Name, Middle Name, Last Name, Status, On Assignment, Bank Name, Routing Number, Account Number, Amount Value, Amount Type, Bank Account Type, Sequence, Last Check Date, Is Active

Mapping:

Employee > Payroll > Direct Deposit

Who should use this report?

Back Office

Why is this report so awesome?

This report is a good summary of employees' direct deposit information, including bank names, routing, and account numbers.

|

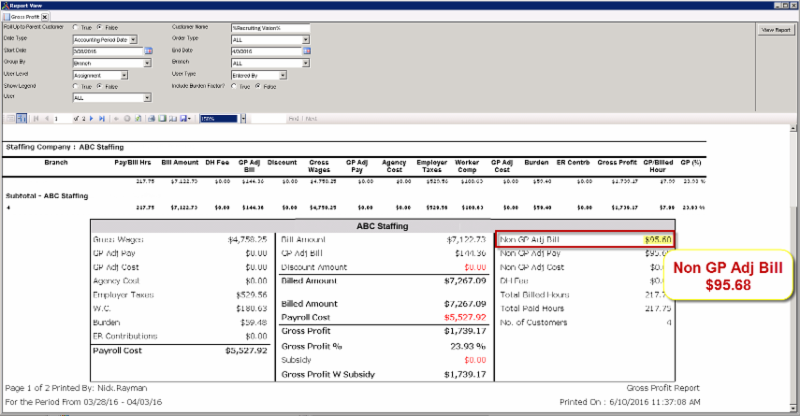

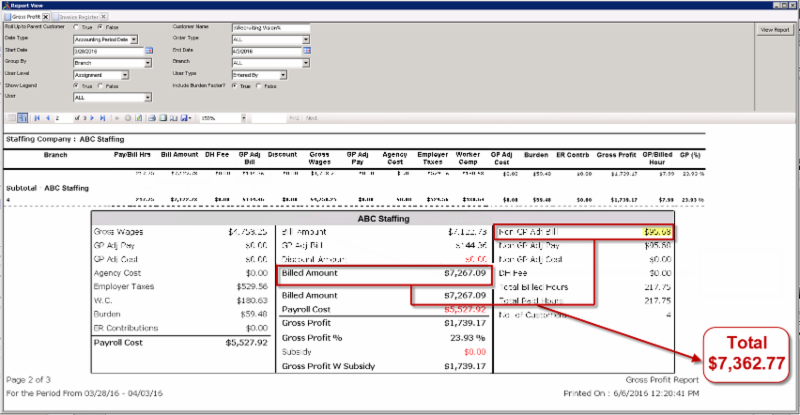

Transaction Properties and the Gross Profit Report

Does the billed amount on your Gross Profit report match the billed amount on other reports? If not, why not? This example compares the Gross Profit to the Invoice Register, and will shed some light on the calculation method.

In this case we are using four invoices from Accounting Period 3/28/2016-4/3/2016. The invoices include a mix of ACA Admin Fee and Reimbursement Transaction Types.

ACA Admin Fee (blue) Total = $144.36 ACA Admin Fee (blue) Total = $144.36

Reimbursement (yellow) Total = $95.68

Total Adjustments = $240.04

When the Invoice Register is run, these four invoices equal a Bill Amn't of $7,362.77.

Using the same four invoices, the Gross Profit Bill Amount equals $7,122.73

Why do the amounts differ by $240.04? The Gross Profit report breaks down data into different categories, columns, and totals based on the setup of the Transaction Types used. In this example, both ACA Admin Fee and Reimbursement Transaction Types are in play.

Transaction Type properties are set in Admin Tools> Transaction Type> Property tab. These settings determine which of the Gross Profit columns will include the transaction.

ACA Admin Fee Transaction: IsAdjustment = 1 (yes) and GP Calculation = True

Reimbursement Transaction: IsAdjustment = 1 and GP Calculation = False

Select True for the Show Legend Parameter. The legend lets you compare the Transaction Type properties to the Gross Profit report rules.

The three rules of most importance in this example are:

- Bill Amount sums the bill amount for transaction types where IsAdjustment = 0. Simply put this means that it sums the totals for the transaction types that are NOT adjustments as set up in Admin Tools.

- GP Adj. Bill sums the bill amount for the transaction types where IsAdjustment = 1 and GP Calculation = True. Note: The GP Adj Bill rules match the ACA Admin Fee properties.

- Non GP Adj. Bill sums the bill amount for the transaction types where IsAdjustment = 1 and GP Calculation = False. Note: The Non GP Adj Bill rules match the Reimbursement properties.

In the Gross Profit report the ACA Admin Fees ($144.36) are found under the GP Adj Bill column. When added to the Bill Amount ($7,122.73) the total Billed Amount is $7,267.09.

The Reimbursement amount ($95.68) is listed under Non GP Adj Bill.

When added, the Billed Amount and the Non GP Adj Bill equal $7,362.77. Ultimately, these reports provide the same total and all dollars are accounted for.

Billed Amount ($7,267.09) + Non GP Adj Bill ($95.68) = $7,362.77

Each of our Standard Reports has its own attributes. Choose the report which shows data in the breakout that works best for you. Standard Reports and the fields they include are listed in the Knowledgebase.

|

Video Preview of version 14.2

|

Webinar Resources

|

|

|

|

|

|

|