|

Why Are Bond Yields So Low?

|

|

Weekly Update - May 19, 2014

|

|

|

|

|

After several days of negative performance, stocks rallied in the last two days to close generally flat. For the week, the S&P 500 lost 0.03%, the Dow fell 0.55%, and the Nasdaq gained 0.46%.[1]

|

|

|

Economic data last week was generally ho-hum except for two reports. Weekly jobless claims plunged to their lowest level in seven years, giving investors hope that the labor market is moving into high gear. Keep in mind that this measure is highly volatile, and it's wise to wait and see if the trend continues.[2]

Another report showed an unexpected jump in April housing starts, which could indicate the beginning of resurgence in the housing market. Groundbreaking on new houses surged 13.2% in April as warmer weather and rentals buoyed demand for multi-unit buildings.[3]

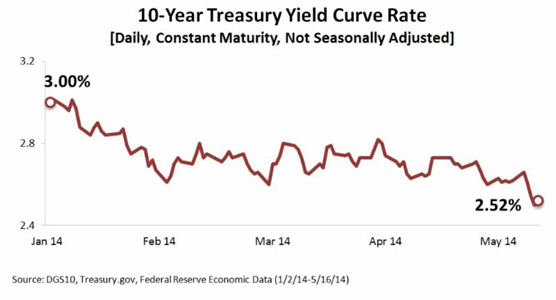

Investors who watch bond markets have probably noticed a puzzling downward trend in bond yields. Despite several new records for major stock indexes and an economy that might be reaching escape velocity, the yield on benchmark 10-Year Treasury bonds have been on a downward trend since the beginning of the year.

To give you a quick refresher, bond yields and bond prices are inversely related, meaning that as demand for bonds goes up, yields come down. Conversely, bond yields go up when demand falls. Typically, stronger economic performance leads to higher Treasury yields. Given recent stock market highs and better economic performance, we should see demand for Treasury bonds to go down as investors embrace risk and seek greater returns elsewhere. In fact, we're seeing the opposite.

There are a few factors that may be contributing to the demand for Treasuries:[4]

- Inflation is still muted. Higher inflation generally leads to higher interest rates and higher bond yields.

- The Fed doesn't appear to be in a hurry to raise interest rates, putting downward pressure on yields.

- The European Central Bank has pledged to lower interest rates to spur economic activity, driving up demand for U.S. bonds.

- U.S. debt is attractive to investors seeking high liquidity and lower default risk.

- Global jitters from the crisis in Ukraine are pushing investors into Treasury bonds.

What does this all mean for investors?

It's hard to know exactly where bond yields will go, but many analysts think that demand will remain high for the foreseeable future. Lower borrowing costs may spur business activity as companies are able to lower financing costs and prospective homebuyers can find mortgages at attractive rates. While the relationship between bond markets and stock markets is complex, lower bond yields might support higher stock prices as investors seek higher returns. On the other hand, frazzled investors may see plummeting Treasury yields as a sign that the economy is not picking up and turn bearish on equities.[5]

Looking ahead, this week is fairly light on economic data, but the housing market will be in the spotlight as analysts determine whether home sales data supports the upward trend in housing starts. Elsewhere, several important Fed economists, including Janet Yellen, will be speaking about the economy throughout the week, and the minutes from the most recent FOMC meeting will be released.[6]

ECONOMIC CALENDAR:

Wednesday: EIA Petroleum Status Report, Janet Yellen Speaks 11:30 AM ET, FOMC Minutes

Thursday: Jobless Claims, PMI Manufacturing Index Flash, Existing Home Sales

Friday: New Home Sales

|

|

|

Notes: All index returns exclude reinvested dividends, and the 5-year and 10-year returns are annualized. Sources: Yahoo! Finance and Treasury.gov. International performance is represented by the MSCI EAFE Index. Corporate bond performance is represented by the DJCBP. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly.

Consumer sentiment slips in May. An important gauge of consumer sentiment dropped below expectations as gloom over stagnant wage growth clouded consumer confidence.[7]

Economists raise Q2 GDP estimate. Fed economists believe that the economy is growing at a faster pace in the second quarter than originally thought. Analysts see the economy growing at an annualized rate of 3.3%, up from 3.0%.[8]

Retail sales edge up slightly in April. After two straight months of strong gains, retail sales hit the brakes last months, rising just 0.1%. Consumers reined in spending across multiple categories, but analysts still believe consumers are on track to spend more this quarter.[9]

Industrial production declines in April. Manufacturing fell 0.6% in April after two straight months of gains. Analysts are taking a wait-and-see approach to see if the general upward trend in activity continues next month.[10]

|

"Discover what you want most of all in this world,

and set yourself to work on it."

- John Homer Miller

|

|

These delicious cookies can be made in just one hour.

Ingredients:

Makes 24-32 cookies 1 14-ounce package sweetened shredded coconut 1 cup sliced almonds 3/4 cup sugar 1 teaspoon grated lemon zest 1/4 teaspoon kosher salt 4 large egg whites (whipped if you want crunchier macaroons) Directions:- Pre-heat your oven to 325°F.

- Combine coconut, almonds, sugar, lemon zest, and salt in a large bowl. Make a well in the middle and add in the egg whites, being careful not to over mix.

- Using a spoon, drop mounds (approx. 2TB each) onto parchment lined baking sheets, spaced about 1-2 inches apart.

- Bake 20-25 minutes, switching baking sheets between racks halfway through, until the edges brown.

- Store in an airtight environment at room temperature for up to one week.

Recipe adapted from Sara Quessenberry | RealSimple.com

|

|

Do You Qualify For a Health Insurance Exemption?

|

|

The Affordable Care Act requires individuals to have qualifying health insurance coverage for each month of the year, have an exemption, or report a shared responsibility payment on his or her federal tax return.

You may be exempt from health insurance coverage if you:

* Cannot afford coverage because the annual premium is more than 8% of your household premium;

* Have a gap in coverage of less than three consecutive months;

* Qualify for an exemption based on hardship or belonging to an explicitly exempted group.

For more information about the ACA or health insurance coverage requirements, contact a qualified financial advisor or visit IRS.gov/aca.

Tip courtesy of IRS.gov[11]

|

Get a Clue About Grip From Your Glove

|

|

A good grip is the foundation of a solid golf swing and the wear pattern on your glove can help you diagnose possible problems.

A worn-out palm can be caused by gripping the club with your palm instead of holding it below the heel pad of your fingers and hand.

Thumb tears can be caused by poor thumb placement and too much or too little grip pressure between your thumb and the club handle.

Index-finger wear can be caused by an overlapping grip where your dominant hand's pinky digs into the glove hands knuckle.

Tip courtesy of Jeff Ritter | Golf Tips Mag[12]

|

Recruit Activity & Workout Buddies

|

|

It's easy to allow lack of motivation and support to derail your activity plans. Surrounding yourself with family, friends, trainers, and workout partners can help keep you accountable and make activities much more fun.

Even if you can't find an obvious choice, keep your eyes open for a neighbor, colleague, friend, or fellow gym-goer that might be interested in partnering up.

|

May is National Bike Month

|

|

To celebrate national bike (as in bicycle) month, try leaving your car at home and making short trips by bike. By "burning fat not oil," you'll get some extra activity into your day and reduce carbon emissions by limiting car trips.

Make sure you have a mechanic look over your bike, always wear a helmet, and obey all traffic laws when on the road. If you're concerned about bike safety, consult a local cycling advocacy group for tips, maps, and organized rides.

|

|

Share the Wealth of Knowledge!

Please share this market update with family, friends, or colleagues. If you would like us to add them to our list, simply click on the "Forward email" link below. We love being introduced!

|

|

|

Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values.

Diversification does not guarantee profit nor is it guaranteed to protect assets.

The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general.

The Dow Jones Industrial Average is a price-weighted average of 30 significant stocks traded on the New York Stock Exchange and the NASDAQ. The DJIA was invented by Charles Dow back in 1896.

The Nasdaq Composite is an index of the common stocks and similar securities listed on the NASDAQ stock market and is considered a broad indicator of the performance of stocks of technology companies and growth companies.

The MSCI EAFE Index was created by Morgan Stanley Capital International (MSCI) that serves as a benchmark of the performance in major international equity markets as represented by 21 major MSCI indexes from Europe, Australia and Southeast Asia.

The Dow Jones Corporate Bond Index is a 96-bond index designed to represent the market performance, on a total-return basis, of investment-grade bonds issued by leading U.S. companies. Bonds are equally weighted by maturity cell, industry sector, and the overall index.

The S&P/Case-Shiller Home Price Indices are the leading measures of U.S. residential real estate prices, tracking changes in the value of residential real estate. The index is made up of measures of real estate prices in 20 cities and weighted to produce the index.

The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

Google Finance is the source for any reference to the performance of an index between two specific periods.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Past performance does not guarantee future results.

You cannot invest directly in an index.

Consult your financial professional before making any investment decision.

Fixed income investments are subject to various risks including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications and other factors.

These are the views of Platinum Advisor Marketing Strategies, LLC, and not necessarily those of the named representative, Broker dealer or Investment Advisor, and should not be construed as investment advice. Neither the named representative nor the named Broker dealer or Investment Advisor gives tax or legal advice. All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. Please consult your financial advisor for further information.

By clicking on these links, you will leave our server, as they are located on another server. We have not independently verified the information available through this link. The link is provided to you as a matter of interest. Please click on the links below to leave and proceed to the selected site.

|

|

|

|

|

|

Copyright © 2013. All Rights Reserved.

|

|

|