|

Quarterly Edition: Winter Chill Causes Volatile First Quarter

|

Weekly Update - April 8, 2014

|

|

|

|

|

Equities closed out a lackluster quarter basically flat, as investors grappled with the effects of the chilly winter and widespread volatility. Though the major indices approached new highs in March, stocks gave in to selling pressure at the end of the quarter. For the quarter, the S&P 500 gained 1.84%, the Dow lost 0.35%, and the Nasdaq fell 0.10%.[1]

|

|

|

On the economic front, the quarter was a bit of a disappointment, though economists hope that a warmer spring will cause improvement in economic indicators. The final jobs report of the quarter showed that employers added 192,000 new jobs in March, though the unemployment rate remained unchanged. The good news is that milder weather and better job prospects are drawing the unemployed back to the job search. January and February job additions were revised upward, meaning the job market was not as weak as first thought.[2]

Though economists had hoped for more new jobs in March, the labor market reached a milestone last month when private-sector employment passed its previous all-time high of January 2008.[3] Though it's taken six years to get here, total employment is finally back where it was before the financial crisis. Unfortunately, the economy still has a way to go to regain its former vitality.

Retailers saw their sales slump last quarter as icy weather caused shoppers to stay home. Excluding automobiles, retail sales have been virtually flat since October, meaning retailer earnings probably took a hit. Major chains will release their March sales data next week and analysts will be looking to see if a warmer March sent more shoppers to the mall.[4]

The manufacturing sector also experienced a weather-driven slowdown in January, but factories shrugged off the cold winter in February with a surge in new orders, the largest increase since September.[5] A different survey showed that manufacturing growth accelerated in March.[6]

This January, the Fed welcomed its new chairwoman, Janet Yellen. So far, Yellen has held the party line, continuing to scale back quantitative easing and reducing monthly bond purchases to $55 billion at the March meeting. The Fed also shifted its stance on unemployment, dropping its 6.5% unemployment threshold in favor of more nuanced language.[7] Investors reacted badly to hints that the Fed might raise short-term rates before the end of 2015. In a speech last week, Yellen attempted to reassure investors by stating that the economy still needs "extraordinary support" and that she has a strong commitment to maintaining support until the economic recovery is self-sustaining.[8]

Global events also took their toll on markets last quarter, with a burgeoning crisis between Ukraine and Russia and emerging market issues contributing to a great deal of volatility in U.S. markets. Though the threat of violence in Ukraine appears to be over, markets are still nervous about the effects of economic sanctions against Russia may have on U.S. and European companies. Investors, who had sought higher returns in developing economies in previous years, fled signs of structural weakness, causing overbought emerging market equities to fall.[9] Many questions remain about the ability of developing economies to survive the end of cheap credit.

Looking ahead at the second quarter of 2014, analysts will be looking for more encouraging economic data that they hope with a warmer spring will cause growth to accelerate. Though this week is light on data, investors will be looking forward to getting a closer look at the minutes from the Federal Open Market Committee (FOMC) mid-March meeting to get more details about the Fed's thinking behind their shift in guidance. Earnings will soon start trickling in and investors will get a good look at how well firms were able to manage lackluster demand at the beginning of the year.

Though we can't make predictions about which way markets will go, we're still optimistic about economic growth and market performance in 2014. We believe that underlying economic fundamentals are still strong and that the seasonal effects of winter will give way to stronger performance this quarter. If you have any questions about how market events may affect your portfolio, please don't hesitate to reach out.

ECONOMIC CALENDAR:

Wednesday: EIA Petroleum Status Report, FOMC Minutes

Thursday: Jobless Claims, Import and Export Prices, Treasury Budget

Friday: PPI-FD, Consumer Sentiment

|

|

|

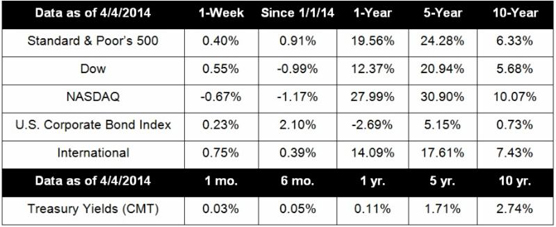

Notes: All index returns exclude reinvested dividends, and the 5-year and 10-year returns are annualized. Sources: Yahoo! Finance and Treasury.gov. International performance is represented by the MSCI EAFE Index. Corporate bond performance is represented by the DJCBP. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly.

HEADLINES:

Gas prices heading higher, but are still below 2010 levels. Gasoline is making its annual trek higher as demand increases ahead of the spring and summer driving season. Nationally, gas prices average $3.55, though areas like California are seeing prices spike over $4.01. Despite the price creep, gas prices are still at their lowest level since 2010.[10]

Mortgage applications fall on low refinance demand. Applications for mortgages fell for the third time in four weeks. A measure of refinancing activity has declined to the lowest level since April 2010, as rising interest rates curb activity.[11]

China targeting job growth with stimulus measures. The Chinese premier's version of the State of the Union Address highlighted China's need for growth to create jobs for its 7.2 million college grads and the millions of rural Chinese flooding cities looking for work.[12]

European central bank mulls quantitative easing. Though the ECB has long resisted calls to undertake the unconventional type of asset purchases the Federal Reserve has made, weak inflation and persistently low growth in the EU may force its hand. Setting negative deposit rates might force banks to extend more loans to consumers and asset purchases could bolster the economy.[13]

|

|

"I attribute my success to this: I never gave or took any excuse."

- Florence Nightingale

|

Olive Oil Cake With Oranges & Mascarpone

|

The combination of cornmeal and olive oil yields a moist, tender crumb.

|

|

Ingredients:

Serves 8

3/4 cup olive oil, plus more for the pan

1 1/2 cups all-purpose flour, spooned and leveled, plus more for the pan

3/4 cup finely ground cornmeal

1/2 teaspoon baking powder

1/2 teaspoon baking soda

1/2 teaspoon kosher salt

3/4 cup buttermilk

2 large eggs

1 3/4 cups sugar

2 blood oranges or navel oranges

1/2 teaspoon pure vanilla extract

mascarpone or sweetened whipped cream, for serving

Directions:

- Preheat oven to 350° and oil an 8x4 inch loaf pan, dusting with flour.

- Whisk flour, cornmeal, baking powder, baking soda, and salt in a large bowl. Whisk the olive oil, buttermilk, eggs, and 1 ½ cup of sugar in another bowl.

- Add the wet ingredients to the dry, mixing until just combined. Take care not to over mix.

- Pour the batter into the loaf pan and bake 50-55 min until golden and a toothpick comes out clean. Set it aside for 20 minutes to cool in the pan and then transfer to a wire rack.

- While the cake is in the oven, supreme the oranges by cutting away the peel and pitch and cutting along the sides of each segment, dropping them into a bowl. Toss the orange pieces with vanilla and the remaining ¼ cup of sugar. Let the fruit macerate for at least 30 minutes, but no longer than 2 hours, tossing occasionally.

- Slice and serve the cake at room temperature, topped with oranges and mascarpone.

Recipe adapted from Dawn Perry | RealSimple.com

|

|

Tax Rules for Children's Investment Income

|

|

Like adults, children with investment income must file tax returns. Generally, parents or guardians are responsible for filing tax returns on behalf of minor children. Here are some special tax rules you should know before filing:

- Interest, dividends, capital gains, or unearned income from a trust must all be reported.

- If your child's total investment income is more than $2,000, special "kiddie tax" rules kick in and any excess may be taxed at your income tax rate.

- If your child's income was less than $10,000 in 2013, you may be able to simply include the income on your own tax return instead of filing a separate return.

For more information, speak to your tax advisor or see IRS Publication 929, "Tax Rules for Children and Dependents."

Tip courtesy of IRS.gov[16]

|

|

Keep Weight Centered for Better Wedge Shots

|

Many amateurs have trouble with consistency on their wedge shots because they treat them like a full-swing drive, shifting their weight too much. Instead, keeping your weight centered, or even a little left, will flatten your trajectory and give the ball extra spin, making your shots easier to control. Practice hitting wedge shots while keeping your weight balanced throughout the shot and dialing in the swing length based on your distance from the hole.

Tip courtesy of Paige Mackenzie, LPGA | Golf Tips Mag[15]

|

|

Eat Red Fruit for Heart Health

|

|

New research shows that eating these red fruits can reduce your risk of heart disease by as much as 40%. A heart-healthy diet is one of the best ways to lower blood pressure, reduce cholesterol levels, and avoid other risk factors for heart disease.

- Tomatoes contain lycopene, an antioxidant that fights coronary disease risk.

- Apples, especially the peel, contain powerful antioxidants that have been shown to reduce the risk of heart disease.

- Cranberry juice can help prevent unhealthy plaque from forming in your arteries and can help raise healthy HDL cholesterol.

Tip courtesy of AARP[16]

|

|

Many of us leave all kinds of appliances plugged in, even when we haven't used them in days, or even weeks. Electronics that stay plugged when not in use still steadily draw small amounts of power. Studies show that "standby power" can account for 5 to 10 percent of your energy bill. Taking a minute to walk around the house and taking stock of what is not being used could save you some money and help you be even more eco-friendly. A power strip can reduce the hassle of unplugging multiple appliances each time.

Here is a short list of appliances that you should consider keeping unplugged: TV, DVD/Blu-Ray player, lamps, microwave, toaster, coffee maker, computers, etc.

Tip courtesy of DailyFinance [17]

|

|

Share the Wealth of Knowledge!

Please share this market update with family, friends, or colleagues. If you would like us to add them to our list, simply click on the "Forward email" link below. We love being introduced!

|

|

|

Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values.

Diversification does not guarantee profit nor is it guaranteed to protect assets.

The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general.

The Dow Jones Industrial Average is a price-weighted average of 30 significant stocks traded on the New York Stock Exchange and the NASDAQ. The DJIA was invented by Charles Dow back in 1896.

The Nasdaq Composite is an index of the common stocks and similar securities listed on the NASDAQ stock market and is considered a broad indicator of the performance of stocks of technology companies and growth companies.

The MSCI EAFE Index was created by Morgan Stanley Capital International (MSCI) that serves as a benchmark of the performance in major international equity markets as represented by 21 major MSCI indexes from Europe, Australia and Southeast Asia.

The Dow Jones Corporate Bond Index is a 96-bond index designed to represent the market performance, on a total-return basis, of investment-grade bonds issued by leading U.S. companies. Bonds are equally weighted by maturity cell, industry sector, and the overall index.

The S&P/Case-Shiller Home Price Indices are the leading measures of U.S. residential real estate prices, tracking changes in the value of residential real estate. The index is made up of measures of real estate prices in 20 cities and weighted to produce the index.

The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

Google Finance is the source for any reference to the performance of an index between two specific periods.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Past performance does not guarantee future results.

You cannot invest directly in an index.

Consult your financial professional before making any investment decision.

Fixed income investments are subject to various risks including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications and other factors.

These are the views of Platinum Advisor Marketing Strategies, LLC, and not necessarily those of the named representative, Broker dealer or Investment Advisor, and should not be construed as investment advice. Neither the named representative nor the named Broker dealer or Investment Advisor gives tax or legal advice. All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. Please consult your financial advisor for further information.

By clicking on these links, you will leave our server, as they are located on another server. We have not independently verified the information available through this link. The link is provided to you as a matter of interest. Please click on the links below to leave and proceed to the selected site.

[17] http://www.dailyfinance.com/2011/06/20/12-household-appliances-you-should-unplug-to-save-money/

|

|

|

|

|

|

Copyright © 2014. All Rights Reserved.

|

|

|