| Cold Weather Freezes Economic Data |

Weekly Update - February 24, 2014

|

|

|

|

|

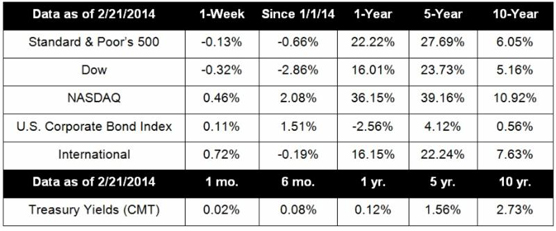

The major indices finished a choppy week on a mixed note as stocks sagged on chilly economic data. While the S&P 500 and Dow moved lower, the Nasdaq Composite posted its third weekly gain on upbeat news in the tech sector. For the week, the S&P 500 lost 0.1%, the Dow slid 0.3%, and the Nasdaq added 0.5%.[1]

|

|

The unrelenting winter weather that has inundated large swaths of the country is also having a chilling effect on the economy. Manufacturing fell drastically in January as the harsh weather curtailed production in some parts of the country. [2] The housing sector has also been affected, with existing home sales falling 5.1% in January, to the lowest level since July 2012.[3] Construction on new houses plummeted 16.0% in January as the weather disrupted groundbreaking activities.[4]

On the positive side, weekly unemployment claims fell last week as fewer Americans filed new claims for jobless benefits. This suggests that labor market conditions are improving, despite two straight months of weak hiring and unseasonably cold weather.[5]

The seasonal chill may also affect some corporate profits in the first quarter. While consensus estimates put first quarter profits at a 5.0% increase for S&P 500 companies, expectations have deteriorated dramatically; profits are now expected to be up an anemic 1.5% across the board.[6] That number could fall further as more companies reduce their earnings guidance due to weather disruptions.

So far, the stock market has been willing to look past these seasonal factors because investors hope to see a spring back when the weather warms up. However, what if the polar vortex is just exacerbating existing weakness? With so many seasonal factors affecting the data, it's hard to know how markets are going to react. We'll likely experience increased volatility as analysts struggle to see through the noisy data, but it's too soon to know for sure how the long-term trends will shake out.

What lessons are there for long-term investors this winter? Seasonal variations can play havoc with the best-laid plans. Savvy professionals watch and wait for the noise to subside so that we can look at the fundamentals underneath. As always, we're looking for good tactical investing opportunities in the volatility. If you ever have questions about seasonality or other cyclical market factors, please give us a call; we're always happy to be a resource for you.

ECONOMIC CALENDAR:

Monday: Dallas Fed Mfg. Survey

Tuesday: S&P Case-Shiller HPI, Consumer Confidence

Wednesday: J New Home Sales, EIA Petroleum Status Report

Thursday: Durable Goods Orders, Jobless Claims, Bloomberg Consumer Comfort Index, Janet Yellen Speaks at 10:00 AM ET

Friday: GDP, Chicago PMI, Consumer Sentiment, Pending Home Sales Index

|

|

|

Notes: All index returns exclude reinvested dividends, and the 5-year and 10-year returns are annualized. Sources: Yahoo! Finance and Treasury.gov. International performance is represented by the MSCI EAFE Index. Corporate bond performance is represented by the DJCBP. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly.

HEADLINES:

Japan's factory output rises. Japan's industrial output likely grew in January and inflation hovered near five-year highs, increasing hope that the economic recovery continues. Japan's factory output, which closely correlates with Gross Domestic Product (GDP), grew an estimated 3.0% last month.[7]

Milk prices may skyrocket in March. Dairy analysts estimate that milk prices could increase by as much as 60 cents in March, reaching their highest prices ever. Shortages in cheese supplies are pushing demand for milk to record levels; moreover, 2013 increases in feed costs caused farmers to cut back on herd growth, compounding shortage issues.[8]

China manufacturing output sinks to 7-month low. Activity in China's factories shrank again in February, reinforcing concerns of a slowdown in the economic giant and spooking Asian investors. While the Lunar New Year festival may have affected data, it could foretell lingering weakness in the Chinese economy.[9]

Facebook bets $19 billion on WhatsApp. The social media giant will buy the fast-growing mobile messaging startup for $19 billion in cash and stock in a landmark deal. Facebook executives hope that the move will put them closer to the growing mobile segment of social media users.[10]

|

|

"Keep your eyes on the stars, and your feet on the ground."

- Theodore Roosevelt

|

Gingersnap Cherry Cheesecake

|

Crush the ginger snaps in a food processor or with a rolling pin. Recipe from RealSimple.com

|

|

Ingredients:

3 cups ground gingersnap cookies

1/2 cup (1 stick) unsalted butter, melted

3 8-ounce bars cream cheese, at room temperature

1 1/4 cups sugar

2 large eggs

2 cups sour cream

2 teaspoons pure vanilla extract

1/2 cup cherry preserves

Directions: - Heat oven to 350° F. In a medium bowl, combine the ground gingersnaps and butter. Using a straight-sided dry measuring cup, press the mixture into the bottom and 2 inches up the side of a 9-inch springform pan.

- Using an electric mixer, beat the cream cheese and 1 cup of the sugar until smooth. Beat in the eggs, one at a time. Beat in ½ cup of the sour cream and 1 teaspoon of the vanilla.

- Pour the mixture into the crust and bake until just set, 40 to 45 minutes.

- Meanwhile, in a small bowl, combine the remaining 1 ½ cups of sour cream, ¼ cup of sugar, and 1 teaspoon of vanilla. Spread over the hot cheesecake and bake until set, 3 to 5 minutes more. Let cool in the pan, then refrigerate for at least 4 hours. Run a knife around the edge of the cheesecake before unmolding.

- Spread the preserves over the cheesecake before serving.

Chef's tip: Set an ovenproof dish of hot water underneath your cheesecake to increase humidity and prevent cracking. |

|

The Inside Scoop on Employee Tips

|

|

If you or a dependent changed a name last year, be sure to notify the Social Security Administration before you file your tax return with the IRS. This is important because the name on your tax return must match SSA records. If they don't, you're likely to get a letter from the IRS about the mismatch and it may delay a refund. If you have an employee, such as a housekeeper, assistant, or other worker, you may need to report any tips they receive to the IRS. According to the IRS, any cash tips over $20 must be reported to you so that you can file them with the IRS as taxable wages. Non-cash tips don't need to be reported.

For more information, speak with your tax advisor or see IRS Publication 761, "Withholding and Reporting."

|

Golf Balls Affected by Temperature

|

Did you know that golf balls are affected by the ambient temps? A warm golf ball has more resiliency, which results in more speed and rotation. When temperatures drop, golf balls get harder and require more speed to go the distance. Some golfers keep different balls on hand to adapt to the weather while others keep balls in an inside pocket to keep them warm and bouncy. Whatever you do, pay attention to the weather and adjust your play accordingly.

|

|

Dance to Better Health and More Fun

|

|

Foxtrot, Tango, Folk, or Line-dancing is great exercise. Dancing is invigorating and can provide a vigorous workout for both your mind and your body. With each step, turn, and dip you improve balance, muscle tone, and mental acuity. Getting out and enjoying a social hobby can also be great for emotional health. Check your local paper or free culture magazine for studios and social dances to get started.

|

Do you have piles of old holiday or greeting cards lying around? Consider donating those old cards to the St. Jude's Ranch for Children recycled greeting card program, a fundraiser that raises money for abused children and families. The children recycle and sell the used cards, learning entrepreneurship, a solid work ethic, and gaining a sense of accomplishment. For more information, visit www.stjudesranch.org.

|

|

Share the Wealth of Knowledge!

Please share this market update with family, friends, or colleagues. If you would like us to add them to our list, simply click on the "Forward email" link below. We love being introduced!

|

|

|

Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values.

Diversification does not guarantee profit nor is it guaranteed to protect assets.

The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general.

The Dow Jones Industrial Average is a price-weighted average of 30 significant stocks traded on the New York Stock Exchange and the NASDAQ. The DJIA was invented by Charles Dow back in 1896.

The Nasdaq Composite is an index of the common stocks and similar securities listed on the NASDAQ stock market and is considered a broad indicator of the performance of stocks of technology companies and growth companies.

The MSCI EAFE Index was created by Morgan Stanley Capital International (MSCI) that serves as a benchmark of the performance in major international equity markets as represented by 21 major MSCI indexes from Europe, Australia and Southeast Asia.

The Dow Jones Corporate Bond Index is a 96-bond index designed to represent the market performance, on a total-return basis, of investment-grade bonds issued by leading U.S. companies. Bonds are equally weighted by maturity cell, industry sector, and the overall index.

The S&P/Case-Shiller Home Price Indices are the leading measures of U.S. residential real estate prices, tracking changes in the value of residential real estate. The index is made up of measures of real estate prices in 20 cities and weighted to produce the index.

The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

Google Finance is the source for any reference to the performance of an index between two specific periods.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Past performance does not guarantee future results.

You cannot invest directly in an index.

Consult your financial professional before making any investment decision.

Fixed income investments are subject to various risks including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications and other factors.

These are the views of Platinum Advisor Marketing Strategies, LLC, and not necessarily those of the named representative, Broker dealer or Investment Advisor, and should not be construed as investment advice. Neither the named representative nor the named Broker dealer or Investment Advisor gives tax or legal advice. All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. Please consult your financial advisor for further information.

By clicking on these links, you will leave our server, as they are located on another server. We have not independently verified the information available through this link. The link is provided to you as a matter of interest. Please click on the links below to leave and proceed to the selected site.

|

|

|

|

|

|

Copyright © 2014. All Rights Reserved.

|

|

|