|

Weekly Update - January 28, 2014

|

|

|

|

|

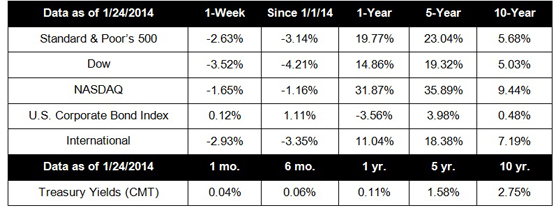

Markets slid considerably last week after investors were rattled by a confluence of events in emerging markets. For the week, the S&P 500 fell 2.63%, the Dow sank 3.52%, and the Nasdaq dropped 1.65%.[1] What were the international events that fueled the sell off?

|

|

|

Chinese manufacturing activity contracted in January for the first time in six months, according to one important survey. While there are probably some distortions in the numbers due to the Chinese New Year holiday, the data indicates that all may not be well with one of China's most critical sectors.[2]

Political unrest in Turkey and financial turmoil in Argentina also stoked investor fears about these countries' ability to maintain order.[3] Concerns about developing economies are being heightened by the Fed's tightening of its easy money policies, which could hurt emerging markets. Loose monetary policy has helped keep interest rates low around the world. Countries that have relied on low borrowing costs to spur economic activity could face a period of painful readjustment to the new reality.[4]

Investors seeking higher returns have also poured money into developing markets in recent years. The central bank's tapering process now has investors scrutinizing the weak fundamentals that underpin many developing countries' markets and wondering if their economies can stand on their own. If they pull their money out, developing economies could be hurt by damaged currencies, falling standards of living, and potential social unrest.

Fourth quarter earnings reports also drove some volatility last week. So far, results have been a mixed bag, with slightly more than half of the S&P 500 beating estimates. Of the 102 S&P 500 companies that have reported in, 63% have achieved earnings above expectations, as compared to 67% over the previous four quarters.

The takeaway: If any of last week's headlines rob you of sleep, try to remember that it's routine for economies and equity markets to cycle. While the selloff is troubling to some, it may also have created some opportunities to cherry pick investments with good upside potential at attractive prices. Investors buying the dip could spur another rally; disappointing data or a Fed surprise could cause the contraction to deepen. Whichever way markets move, we'll be keeping our eyes on the trend and working to position our clients for long-term success.

ECONOMIC CALENDAR:

Monday: New Home Sales, Dallas Fed Mfg. Survey

Tuesday: Durable Goods Orders, S&P Case-Shiller HPI, Consumer Confidence

Wednesday: EIA Petroleum Status Report, FOMC Meeting Announcement

Thursday: GDP, Jobless Claims, Pending Home Sales Index

Friday: Personal Income and Outlays, Employment Cost Index, Chicago PMI, Consumer Sentiment

|

|

|

Notes: All index returns exclude reinvested dividends, and the 5-year and 10-year returns are annualized. Sources: Yahoo! Finance and Treasury.gov . International performance is represented by the MSCI EAFE Index. Corporate bond performance is represented by the DJCBP. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Notes: All index returns exclude reinvested dividends, and the 5-year and 10-year returns are annualized. Sources: Yahoo! Finance and Treasury.gov . International performance is represented by the MSCI EAFE Index. Corporate bond performance is represented by the DJCBP. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly.

HEADLINES:

2013 existing home sales highest in 7 years. U.S. home resales rose in December after falling for the previous three months as low interest rates and continuing demand pushed up sales. Despite the loss of some momentum, 2013 was still an excellent year for the housing market.[5]

Weekly jobless claims creep up. While the number of Americans filing new unemployment claims inched upward last week, the overall trend suggests slow improvement in the labor market. The four-week moving average, a less volatile measure, fell 3,750 to 331,500 new claims.[6]

Oil prices climb on cold weather. U.S. oil rose on expectations that cold weather would cause demand for heating oil to surge. Frigid weather also caused natural gas prices to surge to a multi-year high.[7]

U.S. manufacturing growth slows in January. Falling new orders caused a slowdown in manufacturing growth for the first time in three months. Even so, the overall rate of growth remains robust.[8]

|

|

"You may only live once, but if you live right, once is enough."

- Unknown

|

Rustic Apple Tart

|

| Crisp and fresh from the oven, this dessert will be a family favorite. Recipe from MyRecipes.com |

|

Ingredients:

½ 15-ounce package refrigerated piecrust (1 crust, not the pie-plate version)

2 10-ounce packages frozen cinnamon apples, partially thawed

1 teaspoon grated lemon peel

1 egg, lightly beaten

2 tablespoons sugar

Directions:

1. Heat oven to 375° F. Lightly coat a baking sheet with vegetable cooking spray.

2. Unfold the piecrust and place on sheet. Place the cinnamon apples in the center of the crust and mix in the lemon peel. Fold the edges over the filling, making pleats as you go.

3. Brush the edges with the egg; sprinkle with the sugar.

4. Bake 20 minutes or until the crust is golden. With a spatula, transfer from baking sheet to a platter. Serve warm or at room temperature.

|

Medical Deduction Rules Change

|

|

Unreimbursed medical expenses that exceed 10% of a taxpayer's Adjusted Gross Income (AGI) can generally be deducted on federal taxes; however, an IRS temporary exemption is in place for taxpayers 65 years or older until December 31, 2016, which decreases the threshold from 10% to 7.5% of AGI. For more information, speak to a tax advisor or visit IRS.gov.

|

A good stretch before taking a practice swing can relieve muscle tension or joint stiffness. Hold the club along your shoulders and as you go back, pull with your right hand; when coming through, pull with the left hand. Repeat several times then reverse the action.

|

Relax and Enjoy your Flight

|

|

Before boarding a plane, you may want a quick drink to dismiss your nervousness or a cup of coffee to step up your energy, but both will dehydrate you. So grab a healthy protein bar, take a deep breath, relax, drink water, and stay hydrated while flying.

|

|

Household oven cleaners may contain caustic elements that are harmful to people and pets. However, a common item you have in your kitchen is also an effective oven-cleaning product-baking soda. Make a paste of ¼ baking soda and ¾ warm water and scrub away oven stains without scratching your oven.

|

|

Share the Wealth of Knowledge!

Please share this market update with family, friends, or colleagues. If you would like us to add them to our list, simply click on the "Forward email" link below. We love being introduced!

|

|

|

Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values.

Diversification does not guarantee profit nor is it guaranteed to protect assets.

International and emerging market investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors.

The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general.

The Dow Jones Industrial Average is a price-weighted average of 30 significant stocks traded on the New York Stock Exchange and the NASDAQ. The DJIA was invented by Charles Dow back in 1896.

The Nasdaq Composite is an index of the common stocks and similar securities listed on the NASDAQ stock market and is considered a broad indicator of the performance of stocks of technology companies and growth companies.

The MSCI EAFE Index was created by Morgan Stanley Capital International (MSCI) that serves as a benchmark of the performance in major international equity markets as represented by 21 major MSCI indexes from Europe, Australia and Southeast Asia.

The Dow Jones Corporate Bond Index is a 96-bond index designed to represent the market performance, on a total-return basis, of investment-grade bonds issued by leading U.S. companies. Bonds are equally weighted by maturity cell, industry sector, and the overall index.

The S&P/Case-Shiller Home Price Indices are the leading measures of U.S. residential real estate prices, tracking changes in the value of residential real estate. The index is made up of measures of real estate prices in 20 cities and weighted to produce the index.

The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

Google Finance is the source for any reference to the performance of an index between two specific periods.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Past performance does not guarantee future results.

You cannot invest directly in an index.

Consult your financial professional before making any investment decision.

Fixed income investments are subject to various risks including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications and other factors.

These are the views of Platinum Advisor Marketing Strategies, LLC, and not necessarily those of the named representative, Broker dealer or Investment Advisor, and should not be construed as investment advice. Neither the named representative nor the named Broker dealer or Investment Advisor gives tax or legal advice. All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. Please consult your financial advisor for further information.

By clicking on these links, you will leave our server, as they are located on another server. We have not independently verified the information available through this link. The link is provided to you as a matter of interest. Please click on the links below to leave and proceed to the selected site. [1] http://briefing.com/investor/markets/weekly-wrap/weekly-wrap-for-january-21-2014.htm

|

|

|

|

|

|

Copyright © 2013. All Rights Reserved.

|

|

|