|

Markets Red Hot or Overheated?

|

|

Weekly Update - November 25, 2013

|

|

|

|

|

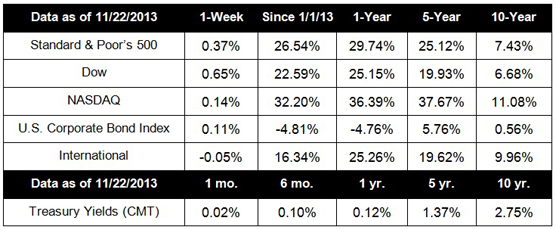

Stocks climbed again as the S&P 500 and Dow notched their seventh straight week of gains on positive economic data. The S&P 500 and Dow both hit new record closes, and the Dow posted its longest winning streak in nearly three years.[1] For the week, the S&P 500 gained 0.37%, the Dow rose 0.65%, and the Nasdaq swelled 0.14%.[2]

|

|

|

Optimistic economic data was behind a lot of the market movement last week. Initial jobless claims fell to their lowest level since the government shutdown; though seasonal factors may have affected the data, the four-week moving average (a less volatile measure) supports the trend.[3] This trend is not unexpected as retailers often pick up seasonal employees before the holiday shopping season. October retail sales were moderately good after a weak September, as consumers felt good enough to spend more on electronics, appliances, and eating out.[4] This is a very optimistic sign heading into the all-important holiday shopping season. On the other hand, factory activity slowed, dropping to its lowest rate since May as manufacturers lost some optimism about the future.[5]

Minutes from the October FOMC meeting were released and it's clear that there's a lot of debate among Fed officials about when to begin tapering. The one thing that participants seem to agree on is that the tapering of quantitative easing should not be automatic.[6] With the level of disagreement between major players so high, it's hard to believe that a tapering decision will come at the December 17-18 meeting, but the decision will ultimately depend on what the economic tea leaves show.

Markets have picked up a head of steam and the rally has continued for nearly two months, hitting new highs along the way. Whenever market rallies continue, especially without the support of solid fundamentals, many investors start to expect a pullback. Though we don't like to put too much confidence in technical stock market indicators, the Chicago Board Options Exchange Volatility Index (VIX), a popular measure of volatility in the S&P 500, has been steadily falling, which has often presaged a market decline.[7] On the other hand, buyers are still buying on every dip, and there's no sign yet that holders are selling out their positions to take profits. While we're delighted that markets have been performing so well in 2013, we always take measures to prepare our clients for potential declines, and we continue hunting for opportunities amid the volatility. As always, we'll keep you informed.

Looking ahead at the shortened holiday week, analysts will be focusing on the economic data released before the Thanksgiving holiday. They will also be closely monitoring any early retail data that might give a hint as to sector performance this quarter.

ECONOMIC CALENDAR:

Monday: Pending Home Sales Index, Dallas Fed Mfg. Survey

Tuesday: Housing Starts, S&P Case-Shiller HPI, Consumer Confidence

Wednesday: Durable Goods Orders, Jobless Claims, Chicago PMI, Consumer Sentiment, EIA Petroleum Status Report

Thursday: U.S. Thanksgiving Holiday. All Markets Closed

|

|

|

Notes: All index returns exclude reinvested dividends, and the 5-year and 10-year returns are annualized. Sources: Yahoo! Finance and Treasury.gov . International performance is represented by the MSCI EAFE Index. Corporate bond performance is represented by the DJCBP. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Notes: All index returns exclude reinvested dividends, and the 5-year and 10-year returns are annualized. Sources: Yahoo! Finance and Treasury.gov . International performance is represented by the MSCI EAFE Index. Corporate bond performance is represented by the DJCBP. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly.

HEADLINES:

Western negotiators reach initial nuclear deal with Iran. Western powers reached a deal to limit the advancement of Iran's nuclear program in exchange for offering limited repeal of punishing economic sanctions. While this initial step is designed to last just six months, leaving time to negotiate a more comprehensive agreement, it's one of the most positive developments in diplomatic relations with Iran in recent history.[8]

Obamacare rolls out two new extensions. Given the technical difficulties and widespread confusion surrounding the Affordable Care Act, the Obama administration has announced two significant deadline extensions for enrollment. The first gives consumers eight extra days - until Dec. 23 - to enroll in plans that kick in Jan. 1, 2014, and gives them until Dec. 31 to actually begin paying their premiums. The other changes the enrollment period in 2014 for plans beginning in 2015.[9]

Senate committee backs Yellen for Fed. Prospective Federal Reserve chair Janet Yellen took a big step towards confirmation when the Senate Banking Committee backed her nomination for the top seat. If she is confirmed by the full Senate, as is widely expected, she will become the first woman to lead the U.S. central bank and is expected to largely continue current Fed policies.[10]

Stimulus fears tarnish gold. Strong economic data caused a sharp drop in gold's value as investors ditched bullion for other investments. Typically, gold moves against economic trends, and positive economic news is usually bad for gold prices.[11]

|

|

"I've learned that people will forget what you said, people will forget what you did, but people will never forget how you made them feel."

- Maya Angelou

|

Beef, Eggplant, and Pepperoncini Kebabs

|

| These easy kebabs are perfect for a midweek dinner. Recipe from RealSimple.com. |

Ingredients:

2 tablespoons olive oil, plus more for the grill

1 pound strip or sirloin steak, cut into 1-inch pieces

1 medium eggplant, cut into 1-inch pieces

16 pepperoncini peppers (from an 11.5-ounce jar)

Kosher salt and black pepper

Directions:

1. Heat grill to medium-high. Once it is hot, clean the grill grate with a wire brush. Just before grilling, oil the grill grate.

2. Soak 8 skewers in water for at least 15 minutes.

3. Toss the steak, eggplant, pepperoncini, oil, ½ teaspoon salt, and ¼ teaspoon black pepper in a medium bowl. Thread onto the skewers and grill, turning occasionally, until the steak is cooked through, 8 to 10 minutes for medium-rare.

|

Get a Free Tax Transcript

|

|

A free transcript of a tax return can be attained from the IRS if you need it for your records. While it isn't a duplicate of a tax return, it includes several line items that were on the initially filed tax return and can be used when applying for financial aid or a home loan.

|

Have a problem with hooking? Keep the left wrist position consistent throughout your swing. This consistency will keep the ball from going left or right in the air. Changing the position mid-swing is a bad habit that can knock off your accuracy.

|

|

Squash: Acorn, Butternut, Spaghetti

|

Eat squash, any squash - It's all healthy. Carotenoids are found in these yummy vegetables and are changed to vitamin A, which is key to good vision and a healthy immune system. Other benefits include fiber, iron, niacin, potassium, and vitamin C. As if that wasn't enough, these healthy veggies may guard against heart disease and cancer.

|

|

Simple Fix = Lower Energy Bill

|

|

Block inside air from escaping outside by sealing electrical outlets on the outside wall. These seals are available from most hardware stores or home improvement retailers. They are simple to install: Just remove the outlet cover, mount the gasket inside, and replace the cover. Done!

|

|

Share the Wealth of Knowledge!

Please share this market update with family, friends, or colleagues. If you would like us to add them to our list, simply click on the "Forward email" link below. We love being introduced!

|

|

|

Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values.

Diversification does not guarantee profit nor is it guaranteed to protect assets

The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general.

The Dow Jones Industrial Average is a price-weighted average of 30 significant stocks traded on the New York Stock Exchange and the NASDAQ. The DJIA was invented by Charles Dow back in 1896.

The Nasdaq Composite is an index of the common stocks and similar securities listed on the NASDAQ stock market and is considered a broad indicator of the performance of stocks of technology companies and growth companies.

The MSCI EAFE Index was created by Morgan Stanley Capital International (MSCI) that serves as a benchmark of the performance in major international equity markets as represented by 21 major MSCI indexes from Europe, Australia and Southeast Asia.

The Dow Jones Corporate Bond Index is a 96-bond index designed to represent the market performance, on a total-return basis, of investment-grade bonds issued by leading U.S. companies. Bonds are equally weighted by maturity cell, industry sector, and the overall index.

The S&P/Case-Shiller Home Price Indices are the leading measures of U.S. residential real estate prices, tracking changes in the value of residential real estate. The index is made up of measures of real estate prices in 20 cities and weighted to produce the index.

The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

The Chicago Board Options Exchange Market Volatility Index (VIX) is a weighted measure of the implied S&P 500 volatility. VIX is quoted in percentage points and translates, roughly, to the expected movement in the S&P 500 index over the upcoming 30-day period, which is then annualized.

Google Finance is the source for any reference to the performance of an index between two specific periods.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Past performance does not guarantee future results.

You cannot invest directly in an index.

Consult your financial professional before making any investment decision.

Fixed income investments are subject to various risks including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications and other factors.

These are the views of Platinum Advisor Marketing Strategies, LLC, and not necessarily those of the named representative, Broker dealer or Investment Advisor, and should not be construed as investment advice. Neither the named representative nor the named Broker dealer or Investment Advisor gives tax or legal advice. All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. Please consult your financial advisor for further information.

By clicking on these links, you will leave our server, as they are located on another server. We have not independently verified the information available through this link. The link is provided to you as a matter of interest. Please click on the links below to leave and proceed to the selected site. |

|

Robert G. Miller, CFP® , RFC, LUTCF

The Miller Financial Group

7700 West Camino Real

Suite 400

Boca Raton,

FL

33433

561-353-3700

rob@tmfg.com

http://www.tmfg.com

|

|

|

|

|

Copyright © 2013. All Rights Reserved.

|

|

|