|

Markets Rally For Sixth Week

|

|

Weekly Update - November 18, 2013

|

|

|

|

|

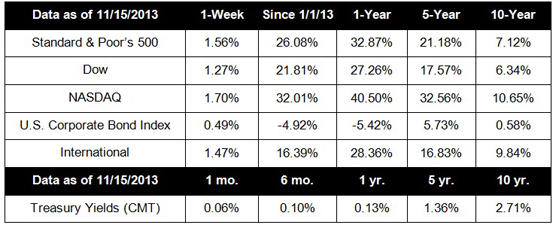

Stocks climbed again this week with the S&P 500 and Dow closing out a sixth straight week of gains despite some volatility. For the week, the S&P 500 gained 1.56%, the Dow rose 1.27%, and the Nasdaq climbed 1.70%.[1]

|

|

All eyes were on the Senate confirmation hearings for Federal Reserve chair nominee Janet Yellen last week. The hearing didn't generate any bombshells but confirmed Wall Street's belief that the Fed will not be in any hurry to taper its bond-buying programs. Yellen also made it clear that under her leadership, the Fed will take on greater supervision of banks. Dodd-Frank regulations specifically task the Fed with protecting the financial system from risks that could spill into the broader economy - something called macroprudential regulation.[2] Hopefully a Fed with sharper teeth can prevent a repeat of the financial crisis. Though current chairman Ben Bernanke spoke at a town hall meeting last week, he appears to be working on a graceful exit, as he made no specific comments about tapering or pending monetary policy decisions.[3]

The bulk of earnings season is behind us, with results from 92.6% of S&P 500 companies already known. Overall, we'd say that Q3 earnings have been reasonably good, particularly as compared to previous quarters. Out of the 463 companies that have reported results so far, 65.4% beat earnings expectations and 43.4% beat revenue expectations, which is better than the same group did in Q2. Estimates for total earnings growth suggest that S&P companies were able to eke out 4.9% earnings growth on 3.0% higher revenues.[4] As we've seen in previous quarters, companies are deriving a lot of their profits through cost-cutting measures and productivity increases, which will hopefully benefit them when demand turns around.

Looking ahead, investors will be focusing their attention on a raft of economic data due to be released. Wednesday is particularly important as the meeting minutes from the most recent FOMC meeting will be released, hopefully giving analysts some insight into when the Fed may begin tapering. While a December taper is still possible, most Fed analysts expect the Fed to delay until the New Year.

ECONOMIC CALENDAR:

Monday: Treasury International Capital, Housing Market Index

Tuesday: Employment Cost Index, Ben Bernanke Speaks 7:00 PM ET

Wednesday: Consumer Price Index, Retail Sales, Business Inventories, Existing Home Sales, EIA Petroleum Status Report, FOMC Minutes

Thursday: Jobless Claims, Producer Price Index, PMI Manufacturing Index Flash, Philadelphia Fed Survey

|

|

|

Notes: All index returns exclude reinvested dividends, and the 5-year and 10-year returns are annualized. Sources: Yahoo! Finance and Treasury.gov . International performance is represented by the MSCI EAFE Index. Corporate bond performance is represented by the DJCBP. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Notes: All index returns exclude reinvested dividends, and the 5-year and 10-year returns are annualized. Sources: Yahoo! Finance and Treasury.gov . International performance is represented by the MSCI EAFE Index. Corporate bond performance is represented by the DJCBP. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly.

HEADLINES:

U.S. manufacturing output rises for third straight month. Manufacturing activity rose in October, even as automobile production fell, suggesting a broadening of activity in the sector. This is a sign of possible factory momentum after a slump earlier in 2013.[5]

China unveils bold new reforms. China unwrapped its boldest set of economic and social reforms in nearly three decades, relaxing its one-child social policy and further loosening markets. The sweeping changes strengthened hopes that the country's leadership is committed to the reforms needed to bolster economic growth.[6]

Industrial production falls in October. Falling output at power plants and mines caused industrial production to unexpectedly decline even though manufacturing output increased. Experts attribute the slide to the temporary shutdown of oil and gas rigs in the Gulf of Mexico as Tropical Storm Karen approached.[7]

U.S. consumer debt rises the most since 2008. While Americans have been on a deleveraging spree in the past few years, an increase in credit balances and loans suggests that the cycle may be over. While this is a sign that Americans feel comfortable spending again, a return to high debt burdens could cause financial distress.[8]

|

|

"Common sense and a sense of humor are the same thing, moving at different speeds. A sense of humor is just common sense, dancing."

- William James

|

Warm Apricot-Cranberry Sauce

|

Cranberries aren't just for turkey! Try this sauce alongside beef, pork, or lamb.

Recipe from RealSimple.com.

|

Ingredients:

1 tablespoon unsalted butter

2 tablespoons finely grated ginger

16 ounces cranberries (fresh or frozen)

2/3 cup sugar

1 cup fresh orange juice

1/2 cup apricot preserves

Directions:

1. In a saucepan, over medium heat, melt the butter. Add the ginger and cook, stirring, for 2 minutes. Stir in the cranberries, sugar, orange juice, and preserves.

2. Cook, stirring occasionally, until the cranberries burst and the sauce thickens, about 20 minutes. Transfer to a bowl and serve warm.

|

|

Help For The Self-Employed And Small Business Owner

|

|

The IRS provides helpful information for small business and self-employed individuals on how to make quarterly payments, self-employment taxes, and additional important hints at the Small Business and Self-Employment Tax Center.

|

For a Good Drive, Think Setup

|

A good drive starts with a good setup. Weight on the back foot and a wide stance establishes a steady base. Take the club back slowly, saving the speed for the downswing.

|

Medical research suggests that snacking can defend against Alzheimer's disease, possibly reducing the risk by 70% to 80%. Some good brain snacks include avocados, pomegranate juice, freshly brewed tea (not bottled or powdered), and dark chocolate.

|

Decrease your household's energy usage by controlling the indoor temperature with window blinds. In winter, keep the indoors warm by opening the blinds, and in summer, close the blinds and help the cooling system do its job more efficiently. |

|

Share the Wealth of Knowledge!

Please share this market update with family, friends, or colleagues. If you would like us to add them to our list, simply click on the "Forward email" link below. We love being introduced!

|

|

|

Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values.

Diversification does not guarantee profit nor is it guaranteed to protect assets

The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general.

The Dow Jones Industrial Average is a price-weighted average of 30 significant stocks traded on the New York Stock Exchange and the NASDAQ. The DJIA was invented by Charles Dow back in 1896.

The Nasdaq Composite is an index of the common stocks and similar securities listed on the NASDAQ stock market and is considered a broad indicator of the performance of stocks of technology companies and growth companies.

The MSCI EAFE Index was created by Morgan Stanley Capital International (MSCI) that serves as a benchmark of the performance in major international equity markets as represented by 21 major MSCI indexes from Europe, Australia and Southeast Asia.

The Dow Jones Corporate Bond Index is a 96-bond index designed to represent the market performance, on a total-return basis, of investment-grade bonds issued by leading U.S. companies. Bonds are equally weighted by maturity cell, industry sector, and the overall index.

The S&P/Case-Shiller Home Price Indices are the leading measures of U.S. residential real estate prices, tracking changes in the value of residential real estate. The index is made up of measures of real estate prices in 20 cities and weighted to produce the index.

The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

Google Finance is the source for any reference to the performance of an index between two specific periods.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Past performance does not guarantee future results.

You cannot invest directly in an index.

Consult your financial professional before making any investment decision.

Fixed income investments are subject to various risks including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications and other factors.

These are the views of Platinum Advisor Marketing Strategies, LLC, and not necessarily those of the named representative, Broker dealer or Investment Advisor, and should not be construed as investment advice. Neither the named representative nor the named Broker dealer or Investment Advisor gives tax or legal advice. All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. Please consult your financial advisor for further information.

By clicking on these links, you will leave our server, as they are located on another server. We have not independently verified the information available through this link. The link is provided to you as a matter of interest. Please click on the links below to leave and proceed to the selected site.

|

|

Robert G. Miller, CFP® , RFC, LUTCF

The Miller Financial Group

7700 West Camino Real

Suite 400

Boca Raton,

FL

33433

561-353-3700

rob@tmfg.com

http://www.tmfg.com

|

|

|

|

|

Copyright © 2013. All Rights Reserved.

|

|

|