|

How is the Economy Really Doing?

Weekly Update - May 6, 2013

|

|

|

In This Issue

|

|

|

|

|

|

The Markets:

U.S. markets closed out last week with a bang, after a better-than-expected jobs report eased concerns about a stalled economic recovery. The S&P 500 and Dow both surged to new highs on the news, with the S&P 500 closing out the week above 1,600 and the Dow briefly topping 15,000. For the week, the S&P 500 gained 2.03%, the Dow gained 1.78%, and the Nasdaq gained 3.03%.[1]

Friday's Employment Situation report showed that the economy added a solid 165,000 jobs in April, dropping the headline unemployment rate to 7.5%. Even better, the report showed revised numbers for February and March, indicating that economic activity was stronger than originally estimated.[2] On the downside, when we dig deeper into the jobs report, we see threats to consumer spending as the average weekly hours worked dropped to 34.4 while wages increased just 0.2%. Furthermore, what economists believe to be the widest measure of unemployment, the U-6, rose slightly to 13.9%, its lowest point since December 2008.[3] The U-6 includes frustrated workers who have given up looking for a job, plus people who are working part-time because they can't find full-time work. All factors considered, the jobs picture looks lukewarm.

We realize this information could raise some questions, so briefly, let's take stock of how the recovery is progressing:

Hiring and unemployment are both growing at a measured pace. On the employment front, the economy has been adding an average of 196,000 jobs per month in 2013; this is far better than the 179,000 monthly average in 2011 and 2012, but still not as good as we would like. At the current rate of growth, the U.S. won't reach pre-recession hiring levels for at least another year. The unemployment rate has improved drastically from its 10% peak in 2009; however, at 7.5%, the current rate is still recession level, and the Fed doesn't expect to hit 6% until 2015 at the soonest.[4]

The economy is improving slowly. The economic recovery from the recession is the slowest since WWII. The economy grew 2.12% in 2012 and 2.5% in Q1 2013; in a normal economic cycle, these growth numbers would be perfectly respectable, but we need higher growth during recovery periods to generate enough jobs to bring down unemployment. Economists had hoped to see stronger growth this year (even as high as 3-4%), but the combined effect of the new payroll tax and across-the-board sequestration cuts is dragging down economic performance.[5]

Economic fundamentals and stock market performance are looking better. Despite worries about higher payroll taxes, consumers spent at the strongest pace in two years during Q1 2013. This is good news since consumer spending accounts for 70% of economic growth. The housing market is booming, fueled by record-low mortgage rates and higher housing prices. New-home sales were up 18.5% in March (from the prior year), and homebuilders were working on more than 1 million new homes in March for the first time in five years. Markets are also performing well above expectations: For the year, the Dow has gained over 14% and the S&P 500 has increased by more than 13%, showing that investors are ready to pile onto any good news.[6]

All told, the U.S. economy is doing pretty well. We could wish for a faster recovery, but we have to work with the hand we're dealt. While we may see a slower second quarter, economists still expect healthy economic growth in 2013.

ECONOMIC CALENDAR:

Wednesday: EIA Petroleum Status Report

Thursday: Jobless Claims

Friday: Ben Bernanke Speaks 9:30 AM ET, Treasury Budget

|

|

|

|

Performance

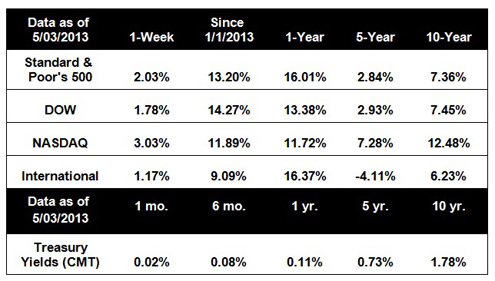

Notes: All index returns exclude reinvested dividends, and the 5-year and 10-year returns are annualized. Sources: Yahoo! Finance and Treasury.gov. International performance is represented by the MSCI EAFE Index. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Notes: All index returns exclude reinvested dividends, and the 5-year and 10-year returns are annualized. Sources: Yahoo! Finance and Treasury.gov. International performance is represented by the MSCI EAFE Index. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly.

|

|

Headlines:

States miss tax targets. Nearly half of U.S. states missed their monthly tax withholding targets in April as investors and companies sold off investments or made other moves to avoid steep tax bills. While this could cause a short-term cash crunch, state revenues are already above pre-recession levels.[7]

European markets reach five-year highs. European investors jumped onto the U.S. jobs bandwagon and sent European shares skyrocketing, erasing losses from earlier in the week. With the EU's prognosis still unknown, investors are looking for good news wherever they can find it.[8]

Gold ends rally, closes mostly flat. Although gold has recovered from its recent decline, the jobs report mostly erased its gains for the week. Bullion had been supported by recent rallies in copper and other commodities, but the economic good news dented its rally. Often treated as a haven investment during turbulent times, gold can be a volatile commodity.[9]

Factory orders drop. New orders of factory goods dropped by 4% in March, the largest drop in seven months. A Commerce Department report showed that highly volatile aircraft sales were largely responsible for the decline. However, non-aircraft orders increased during the same period, indicating that businesses may be investing again.[10]

|

|

|

|

"Success does not consist in never making blunders but in never making the same one a second time." - Josh Billings

|

Mixed Berry Shake

Indulge with a sweet, simple berry shake. Recipe from RealSimple.com.

Ingredients:

1 quart vanilla ice cream

6 ounces unsweetened frozen berries (such as strawberries, blackberries, and blueberries)

2 cups whole milk

Directions:

In a blender, combine half of the ice cream, berries, and milk. Keep blending until smooth, stopping occasionally to stir with a spoon. Pour into glasses. Repeat with the remaining ingredients.

|

|

|

Align the Clubface

One of the most common mistakes golfers make is improper alignment. Some think they should align their feet at the target; others try to get their shoulders parallel to it.

The correct way to align your shots is to start by first assessing your target from behind the ball. This will give you a perspective of the entire hole and help you aim where you want the ball to go. Secondly, before you make your actual stance, set the clubface behind the golf ball and align it directly at the target. Do this before, not after, you get into your stance. Tip from Golf Tips Mag.

|

|

|

|

Keep Moving!

It is never too late to start an exercise routine. Exercise is fun if it's an activity you enjoy doing. Activities like running, walking, skipping, dancing, and swimming are fun and get your heart rate up.

Exercise promotes a sense of well-being by releasing endorphins, improving circulation, and building strength. Even something as simple as rocking in a modern rocking chair, can aid in improving mood and strengthening legs. Always check with your doctor before taking on a new routine.

|

|

Seal Sneaky Leaks

Seal electrical outlets in the exterior walls of your house to save on your heating and cooling bills. According to the EPA, foam insulating gaskets (which cost less than $1 each) act as a barrier so conditioned air stays in, rather than leaking out.

Just unscrew the outlet cover, install the gasket, and replace the cover.

|

|

|

Share the Wealth of Knowledge!

Please share this market update with family, friends, or colleagues. If you would like us to add them to our list, simply click on the "Forward to a Friend" link below. We love being introduced! Please share this market update with family, friends, or colleagues. If you would like us to add them to our list, simply click on the "Forward to a Friend" link below. We love being introduced!

|

|

|

Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values.

Diversification does not guarantee profit nor is it guaranteed to protect assets.

The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general.

The Dow Jones Industrial Average is a price-weighted average of 30 significant stocks traded on the New York Stock Exchange and the NASDAQ. The DJIA was invented by Charles Dow back in 1896.

The Nasdaq Composite is an index of the common stocks and similar securities listed on the NASDAQ stock market and is considered a broad indicator of the performance of stocks of technology companies and growth companies.

The MSCI EAFE Index was created by Morgan Stanley Capital International (MSCI) that serves as a benchmark of the performance in major international equity markets as represented by 21 major MSCI indexes from Europe, Australia and Southeast Asia.

The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

Google Finance is the source for any reference to the performance of an index between two specific periods.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Past performance does not guarantee future results.

You cannot invest directly in an index.

Consult your financial professional before making any investment decision.

Fixed income investments are subject to various risks including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications and other factors.

These are the views of Platinum Advisor Marketing Strategies, LLC, and not necessarily those of the named representative, Broker dealer or Investment Advisor, and should not be construed as investment advice. Neither the named representative nor the named Broker dealer or Investment Advisor gives tax or legal advice. All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. Please consult your financial advisor for further information.

By clicking on these links, you will leave our server, as they are located on another server. We have not independently verified the information available through this link. The link is provided to you as a matter of interest. Please click on the links below to leave and proceed to the selected site.

|

Robert G. Miller, CFP® , RFC, LUTCF

The Miller Financial Group

7700 West Camino Real

Suite 400

Boca Raton,

FL

33433

561-353-3700

rob@tmfg.com

http://www.tmfg.com

|

|

|