|

The Bull Charges; For Now

Weekly Update - March 11, 2013

|

|

|

In This Issue

|

|

|

|

|

|

The Markets:

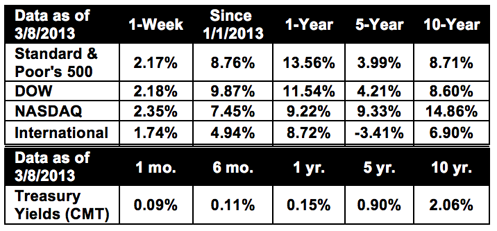

Markets made history last week as the Dow set an all-time high above 14,400 and the major indices all posted solid gains, buoyed by strong employment numbers and renewed confidence in the economy.[1] For the week, the S&P 500 gained 2.17%, the Dow gained 2.18%, and the Nasdaq gained 2.35%.[2]

The jobs report was the big market mover of the week. Employers added a greater-than-expected 236,000 workers to their payrolls in February and the jobless rate fell to a four-year low of 7.7%, providing the strongest signal yet that the economy is coming back. However, digging deeper into the jobs data, it's not all good news. Despite gradual improvement over the past few months, the labor force fell by 130,000 as people dropped out of the job search. Had labor force participation remained at its previous level, the unemployment rate would have held steady at 7.9%.[3] This simply means that the labor market is improving overall, but not everywhere at the same time. While economists were pleased with the news, they caution that the economy still has a long way to go.

On a more positive note, the average weekly hours worked increased from 34.4 in January to 34.5 in February, meaning that Americans are working more hours (and that businesses are seeing healthy demand). Hourly earnings also increased slightly last month. Even better, the overall increase in hours, earnings, and jobs caused aggregate wages to increase 0.7%, meaning that Americans are taking home more money every month. The gain is more than enough to offset January's payroll tax increase, which is excellent news for consumer spending.[4]

Despite the budgetary headwinds, the first quarter of 2013 is shaping up well. We still need to watch out for a second quarter slowdown similar to what happened in 2011 and 2012, but analysts think that this year might be different. While we are grappling with budgetary issues, the fiscal cliff is no longer ahead of us and housing is no longer a headwind to growth, but a tailwind.

This week's calendar is relatively light on data, but analysts will be watching consumer sentiment numbers as well as retail sales numbers to determine whether there's still additional upside. We're very pleased to see markets picking up, but we want our clients to be prepared for a potential short-term market pullback in the future as traders take profits.

ECONOMIC CALENDAR:

Tuesday: Treasury Budget

Wednesday: Retail Sales, Import and Export Prices, Business Inventories, EIA Petroleum Status Report

Thursday: Jobless Claims, Producer Price Index

Friday: Consumer Price Index, Empire State Mfg. Survey, Treasury International Capital, Industrial Production, Consumer Sentiment

|

|

|

|

Performance

Notes: All index returns exclude reinvested dividends, and the 5-year and 10-year returns are annualized. Sources: Yahoo! Finance and Treasury.gov. International performance is represented by the MSCI EAFE Index. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. |

|

Headlines

Fitch cuts Italy's debt rating after election. Fitch Ratings cut Italy's sovereign debt rating from AA- to BBB and issued a negative outlook about the country's economic future. The agency does not believe that Italy will be able to form a stable government capable of tackling economic issues, increasing its risk of default.[5]

Is U.S. net worth back? According to the Federal Reserve, the total net worth of American households and non-profits is nearly back to 2007 levels. A rebounding housing market and strong stock market helped bring total net worth of $66.1 trillion, as compared to $66.12 trillion in 2007.[6]

Wholesale inventories rose in January. The Commerce Department reported that wholesale inventories have risen at their fastest pace since December 2011 as construction companies, computer retailers, and car dealers stock up. Inventories are a key component of GDP and are a bellwether of business confidence.[7]

China's recovery is uneven. Chinese policymakers have tough decisions to make as new reports show that Chinese inflation was at a 10-month high in February while factory output and consumer spending were weaker than forecast. High inflation means that central bankers may need to raise interest rates; however, doing so risks the still-fragile economic recovery.[8]

|

|

|

|

"Genius without education is like silver in the mine."

- Benjamin Franklin

|

Lemon Chicken Caesar Salad   A quick, delicious recipe to greet spring!

Recipe from RealSimple.com. Ingredients:

2 tablespoons mayonnaise

2 tablespoons fresh lemon juice

2 tablespoons grated Parmesan, plus more, shaved, for serving

1 teaspoon Dijon mustard Kosher salt and black pepper

1/2 head romaine lettuce, torn into pieces (about 6 cups)

1 rotisserie chicken breast, sliced

1/2 cup croutons

Directions:

- In a medium bowl, whisk together the mayonnaise, lemon juice, Parmesan, mustard, and 1/4 teaspoon each salt and pepper.

- Add the lettuce and toss to coat. Top with the chicken, croutons, and additional shaved Parmesan, if desired.

|

|

|

Dealing with a Case of the Yips  Once fear gets a hold of your nervous system, it can seem like it will never end. Goodbye confidence. What can you do? Solve the problem by taking two actions:

- Spot the fear early. When spotted, step back, take a breath, and restart your routine. Once your body/mind learns you won't give in to your nerves, it actually gets the message.

- Put your mind on the present, not the future. Don't think about everything that can go wrong with your shot. Just focus on your movement.

Following this routine brings you into the "now." Use this to combat fear.

|

|

According to a study conducted by Purdue University's Center for the Human-Animal Bond, people who own pets - whether furry, feathered or finned - tend to make fewer visits to the doctor and have healthier hearts. Pets can help lower their owners' blood pressure during moments of stress.

|

Put Those Egg Cartons to Good Use Thanks to being biodegradable, egg cartons - the recycled paper version - break down very quickly in compost piles. They're also much loved by worms and other garden critters; simply soak the cartons in water, smash them, and put the resulting pulp in your compost pile.

|

|

Share the Wealth of Knowledge!

Please share this market update with family, friends, or colleagues. If you would like us to add them to our list, simply click on the "Forward email" link below. We love being introduced!

|

|

|

Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values.

Diversification does not guarantee profit nor is it guaranteed to protect assets.

The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general.

The Dow Jones Industrial Average is a price-weighted average of 30 significant stocks traded on the New York Stock Exchange and the NASDAQ. The DJIA was invented by Charles Dow back in 1896.

The MSCI EAFE Index was created by Morgan Stanley Capital International (MSCI) that serves as a benchmark of the performance in major international equity markets as represented by 21 major MSCI indexes from Europe, Australia and Southeast Asia.

The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

Google Finance is the source for any reference to the performance of an index between two specific periods.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Past performance does not guarantee future results.

You cannot invest directly in an index.

Consult your financial professional before making any investment decision.

Fixed income investments are subject to various risks including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications and other factors.

These are the views of Platinum Advisor Marketing Strategies, LLC, and not necessarily those of the named representative, Broker dealer or Investment Advisor, and should not be construed as investment advice. Neither the named representative nor the named Broker dealer or Investment Advisor gives tax or legal advice. All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. Please consult your financial advisor for further information.

By clicking on these links, you will leave our server, as they are located on another server. We have not independently verified the information available through this link. The link is provided to you as a matter of interest. Please click on the links below to leave and proceed to the selected site.

|

Robert G. Miller, CFP® , RFC, LUTCF

The Miller Financial Group

7700 West Camino Real

Suite 400

Boca Raton,

FL

33433

561-353-3700

rob@tmfg.com

http://www.tmfg.com

|

|

|