|

A Rally with Less Gusto

Weekly Update - February 11, 2013

|

|

|

In This Issue

|

|

|

|

|

|

The Markets:

Markets lost some exuberance last week as news out of Europe weighed on U.S. investors. Despite some selling pressure however, the rally rolled on as the S&P 500 edged to a five-year high. [1] Major indices ended the week mixed, with the S&P 500 gaining 0.31%, the Dow losing 0.12%, and the Nasdaq gaining 0.46%. [2] Friday showed very low volume as snowstorm Nemo pounded the Northeast and traders watched the clock, waiting for the final bell to ring so they could hustle home. Even so, a batch of encouraging economic data was enough to push the S&P 500 to its highest level since November 2007. Reports showed that international trade in China and Germany has improved, and that the U.S. trade deficit narrowed in December, indicating that global demand is improving.[3] To the contrary, the December wholesale inventory report released earlier in the week showed a 0.1% decrease, which was significantly worse than expectations. This carries negative implications for the upcoming revised fourth quarter GDP growth report as the Bureau of Economic Analysis had estimated inventory growth of 0.7% in their preliminary estimates.[4] Troubles in Europe drove most of the market action last week as downbeat European equities prompted selloffs in the U.S. Scandals have rocked European markets as regulators investigate several banks for trading irregularities[5] as well as one of Greece's leading statisticians, who has been charged with falsifying fiscal data.[6] According to European Central Bank President Mario Draghi, the Eurozone economy remained weak and contracted in the second and third quarters of 2012. Two quarters of negative growth meets the technical definition of a recession, and economists widely expect the malaise to continue into 2013. On the positive side, recent gains in European equities and a strong Euro show that investors have regained confidence in the Eurozone's ability to clean up its mess.[7] Looking ahead, analysts will have a few January and February economic reports to chew on this week, which economists widely expect will show that the U.S. economy started off 2013 at a modest pace. January retail sales figures come out on Wednesday, and the preliminary February reading on consumer sentiment will be released Friday.[8] Chinese markets will be closed all of this week in observance of the Chinese New Year, so attention will be focused on European and domestic headlines. While there is no way to know what will happen with the winter we've been enjoying, our primary hope is that the fundamentals will continue to show improvement in the worldwide economy. ECONOMIC CALENDAR: Tuesday: Treasury Budget Wednesday: Retail Sales, Import and Export Prices, Business Inventories, EIA Petroleum Status Report Thursday: Jobless Claims Friday: Empire State Mfg. Survey, Treasury International Capital, Industrial Production, Consumer Sentiment

|

|

|

|

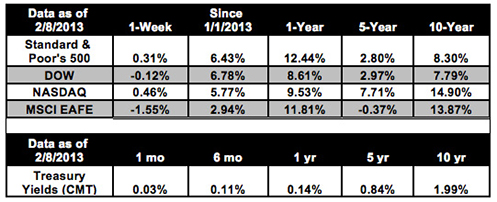

Performance

Notes: All index returns exclude reinvested dividends, and the 5-year and 10-year returns are annualized. Notes: All index returns exclude reinvested dividends, and the 5-year and 10-year returns are annualized.

Sources: Yahoo! Finance, Treasury.gov. Past performance is no guarantee of future results.

Indices are unmanaged and cannot be invested into directly. N/A means not available. |

|

Headlines

Winter storm sends fuel prices higher. The storm pounding the Northeast is also hitting consumers with a one-two punch of high home-heating costs on top of record-high gasoline prices. High prices are largely due to increased domestic and foreign demand for crude oil as well as potential supply disruptions due to the storm.[9] Housing market may be a bubble. Economists think that the housing market may be showing signs of a bubble. Historically, housing prices rise about three to four percent a year; however, last year, home prices grew eight percent, a similar rate to before the crash in 2007.[10] Political uncertainty dogs Spain and Italy. Selloffs hit European markets last week as investors show unhappiness with instability at the top of the two major European nations. Spanish President Mariano Rajoy is embroiled in a corruption scandal that threatens his tenure, and Italian Prime Minister Mario Monti may lose the February 24 election.[11] Americans tapping into home equity again. Despite the nearly 11 million borrowers who are underwater on their mortgages, home equity loans are on the rise again. As home prices rise - increasing equity, and consumers regain confidence in the economy, borrowers are again turning to lines of credit on their houses to fund purchases, fueling a 19% rise in home equity loan originations.[12] |

|

|

|

"When one door of happiness closes, another opens, but often we look so long at the closed door that we do not see the one that has been opened for us."

- Helen Keller

|

|

|

Baked Chicken With Veggies

Pair with a light salad for a perfect mid-week meal. Recipe from RealSimple.com.

Ingredients:

6 tablespoons olive oil

2 lemons, 1 thinly sliced, 1 juiced

4 cloves garlic, minced

1 teaspoon kosher salt

1/2 teaspoon freshly ground black pepper

3/4 pound trimmed green beans

8 small red potatoes, quartered

4 chicken breasts (bones left in, with skin, about 3 1/4 pounds)

Directions:

- Preheat oven to 450°F. Coat a large baking dish or cast-iron skillet with 1 tablespoon of the olive oil. Arrange the lemon slices in a single layer in the bottom of the dish or skillet.

- In a large bowl, combine the remaining oil, lemon juice, garlic, salt, and pepper; add the green beans and toss to coat. Using a slotted spoon or tongs, remove the green beans and arrange them on top of the lemon slices. Add the potatoes to the same olive-oil mixture and toss to coat. Using a slotted spoon or tongs, arrange the potatoes along the inside edge of the dish or skillet on top of the green beans.

- Place the chicken in the same bowl with the olive-oil mixture and coat thoroughly. Place the chicken, skin-side up, in the dish or skillet. Pour any of the remaining olive-oil mixture over the chicken.

- Roast for 50 minutes. Remove the chicken from the dish or skillet. Place the beans and potatoes back in oven for 10 minutes more or until the potatoes are tender. Place a chicken breast on each of 4 serving plates; divide the green beans and potatoes equally. Serve warm.

|

|

|

Set Your Alignment

Many shots that are hit to the right or left get blamed on the swing when they are actually a product of poor alignment. In order to hit the ball at a target, you must line up correctly.

Before hitting, stand behind your ball about 3 to 5 feet so it is between you and your intended target. Now pick an object on the ground no more than two feet in front of the ball (a golf tee, blade of grass, leaf, or anything else) that lies on the imaginary line that goes from your ball to your intended target.

Walk up and address the ball while pretending the object on the ground is your target. Align the lines on your club face so they are perpendicular to the object. Do not even look at your real target until you have established your address, and then be sure not to change your stance.

|

|

|

|

A Friend A Day Keeps the Doctor Away

Research shows that America's happiest people spend at least six hours a day with friends or family. A Harvard University study found that each happy friend in our network increases our happiness by nine percent.

|

|

Turn Your Car Off When Idling

If you see that a train, long stoplight, or traffic jam will block your vehicle for more than 30 seconds, turn off your engine to save gas and reduce carbon output. An idling vehicle burns more fuel than restarting your engine.

|

|

Share the Wealth of Knowledge!

Please share this market update with family, friends, or colleagues. If you would like us to add them to our list, simply click on the "Forward email" link below. We love being introduced!

|

|

|

Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values.

Diversification does not guarantee profit nor is it guaranteed to protect assets

The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general.

The Dow Jones Industrial Average is a price-weighted average of 30 significant stocks traded on the New York Stock Exchange and the NASDAQ. The DJIA was invented by Charles Dow back in 1896.

The MSCI EAFE Index was created by Morgan Stanley Capital International (MSCI) that serves as a benchmark of the performance in major international equity markets as represented by 21 major MSCI indexes from Europe, Australia and Southeast Asia.

The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

Google Finance is the source for any reference to the performance of an index between two specific periods.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Past performance does not guarantee future results.

You cannot invest directly in an index.

Consult your financial professional before making any investment decision.

Fixed income investments are subject to various risks including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications and other factors.

These are the views of Platinum Advisor Marketing Strategies, LLC, and not necessarily those of the named representative, Broker dealer or Investment Advisor, and should not be construed as investment advice. Neither the named representative nor the named Broker dealer or Investment Advisor gives tax or legal advice. All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. Please consult your financial advisor for further information.

By clicking on these links, you will leave our server, as they are located on another server. We have not independently verified the information available through this link. The link is provided to you as a matter of interest. Please click on the links below to leave and proceed to the selected site.

[1] http://www.spokesman.com/stories/2013/feb/09/sp-at-5-year-high-rally-rolls-on/

[2] http://www.briefing.com/investor/markets/weekly-wrap/weekly-wrap-for-february-4-2013.htm

[3] http://www.nbcnews.com/business/stocks-edge-higher-sp-500-highest-nov-2007-1B8307746

[4] http://www.briefing.com/investor/markets/weekly-wrap/weekly-wrap-for-february-4-2013.htm

[5] http://www.briefing.com/investor/markets/weekly-wrap/weekly-wrap-for-february-4-2013.htm

[6] http://uk.reuters.com/article/2013/02/08/uk-greece-statistics-idUKBRE9170SO20130208

[7] http://www.cnbc.com/id/100441862

[8] http://blogs.wsj.com/marketbeat/2013/02/08/next-weeks-tape-new-year-off-to-a-modest-start/

[9] http://www.cnbc.com/id/100446710

[10] http://www.cnbc.com/id/100435276

[11] http://www.cnbc.com/id/100446234

|

Robert G. Miller, CFP® , RFC, LUTCF

The Miller Financial Group

7700 West Camino Real

Suite 400

Boca Raton,

FL

33433

561-353-3700

rob@tmfg.com

http://www.tmfg.com

|

|

|