|

Fiscal Cliff Uncertainty

Weekly Update - December 10, 2012

|

|

|

In This Issue

|

|

|

|

|

|

The Markets:

Markets experienced another choppy week, disturbed by ongoing fiscal cliff debates and lackluster economic data. Equities finished the week mixed, with the S&P gaining 0.13%, the Dow gaining 0.99%, and the Nasdaq losing -1.1%.[1]

After another week of back and forth between Democrats and Republicans, no fiscal cliff resolution is in sight. Despite offers on the table from both parties, the debate remains stalled on the issue of higher taxes for the wealthy. Although both sides are exchanging accusations of brinkmanship, multiple polls suggest that Americans will blame Republicans should politicians fail to reach a deal.[2] It appears as though President Obama and Congressional Democrats are content to stall the clock in the hopes of pushing Republicans into grudging agreement with their plan to raise taxes on the wealthiest Americans (Those earning $250,000.00 or more per year).

Although we have been talking about the fiscal cliff with our clients for many months, the media is making up for its lateness to the issue with hysteria. In truth, the fiscal cliff deadline isn't December 31 st, it's actually much sooner.[3] According to the rules in the House of Representatives, the last day any bill can be submitted for consideration is December 18th since Congress will adjourn for the year on December 21st, and they need at least three days to deliberate. However, since President Obama may be leaving on December 17th for his annual family vacation to Hawaii, next Monday might be the last possible date for a fiscal cliff resolution.[4]

At this point, it seems unlikely that lawmakers will be able to hash out a compromise in the week we have left. While a lack of a resolution means we probably won't see a year-end market rally, regardless of whether a deal is reached or not, the economy won't suddenly stop on January 1st. It will take time for the full effects of tax increases and budget cuts to kick in, giving lawmakers further time to come to a resolution.

Looking ahead, we have the year's final Federal Reserve FOMC meeting this week; analysts don't expect interest rate targets to change. However, many will be closely watching the 4th quarter growth forecast, which Fed economists will announce before Bernanke speaks. Whatever the remaining weeks of the year have in store, we'll be monitoring the situation and will keep you up to date.

ECONOMIC CALENDAR: Tuesday: International Trade Wednesday: Import and Export Prices, EIA Petroleum Status Report, FOMC Meeting Announcement, FOMC Forecasts, Treasury Budget, Ben Bernanke Speaks 2:15 EST Thursday: Jobless Claims, Producer Price Index, Retail Sales, Bloomberg Consumer Comfort Index, Business Inventories Friday: Consumer Price Index, Industrial Production

|

|

|

|

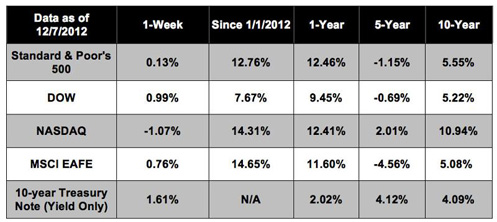

Performance

Notes: All index returns exclude reinvested dividends, and the 5-year and 10-year returns are annualized. Sources: Yahoo! Finance, MSCI Barra. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. N/A means not available.

|

|

|

Headlines

Manufacturers unable to fill job vacancies. Despite high unemployment rates, some manufacturers are unable to fill open jobs, forcing them to lower production rates or run fewer shifts. While this may affect manufacturing productivity, it's a good sign for job seekers.[5]

Greece buys back bonds to lower debt. In an important part of the country's efforts to lower debts to manageable levels, Greece used 10 billion euros of borrowed funds to buy back approximately 30 billion euros of Greek government bonds, cutting its national debt by a net of approximately 20 billion euros. The move is part of an aid package scheduled to be released later this month.[6]

November jobs report better than expected. Despite worries about Sandy's effect on employment, U.S. companies kept up their slow, steady hiring, adding 146,000 new jobs last month. Although the unemployment rate fell to 7.7%, this was largely due to job seekers dropping out of the search.[7]

German central bank cuts economic outlook. In a sign of deepening gloom in Europe, Germany's Bundesbank cut its growth outlook and warned of recession potential as the ongoing crisis continues to take its toll.[8]

|

|

|

"If you love life, it will love you back."

- Mark Twain |

|

|

Chewy Spice Cookies   These simple, delicious cookies are sure to please. Recipe from RealSimple.com. These simple, delicious cookies are sure to please. Recipe from RealSimple.com.Ingredients:

2 cups all-purpose flour, spooned and leveled

2 teaspoon ground ginger

1 1/2 teaspoons baking soda

1/2 teaspoon ground cinnamon

1/2 teaspoon kosher salt

1/4 teaspoon ground nutmeg

1/4 teaspoon ground black pepper

1/8 teaspoon ground cloves

3/4 cup vegetable shortening (preferably trans-fat-free)

2/3 cup packed light brown sugar

1 large egg

1/2 cup molasses

1 teaspoon pure vanilla extract

1/4 cup granulated sugar

Directions: - Heat oven to 350° F. In a medium bowl, whisk together the flour, ginger, baking soda, cinnamon, salt, nutmeg, pepper, and cloves.

- Using an electric mixer, beat the shortening and sugar on medium-high speed until fluffy, 2 to 3 minutes. Reduce speed to low and beat in the egg, molasses, and vanilla. Add the flour mixture, mixing just until combined (do not overmix).

- Place the granulated sugar on a plate. Roll heaping tablespoonfuls of the dough into balls; roll in the sugar to coat. Place on parchment-lined baking sheets, spacing them 2 inches apart. Using a glass, press the balls to a ⅜-inch thickness and sprinkle with more granulated sugar.

- Bake, rotating the sheets halfway through, until the edges are firm, 10 to 12 minutes.

- Cool slightly on the baking sheets, then transfer to racks to cool completely. Store the cookies in an airtight container at room temperature for up to 5 days.

|

|

|

Dealing with Side Hill Lies

The ball-below-your-feet on a side hill lie is the most difficult of all sloping lies. The biggest mistake made when faced with this type of shot is bending the knees too much to reach the ball. With the knees bent too far you will have the tendency to rise up as you swing through, causing you to top the ball. To correct this tendency, try these steps:

1. Keep your normal knee flex, but bend a little more from the waist.

2. Keep the back swing short - if you try to swing to your normal position there will be a tendency to rise up.

3. Take one more club (use an 8 if you normally hit a 9 from that distance)

4. Aim to the left as the ball will have a tendency to fade or go to the right (for right handed golfers).

|

|

|

|

Want to lose weight? Skip the expensive trainer or aerobics classes. Research shows that peer-led weight loss groups (such as Weight Watchers or weight loss contests among friends) lead to more consistent weight loss among participants than sessions with a professional trainer or counselor.

|

Drive 55 to Save $$$

With the holidays approaching, many of us will be traveling to visit friends and family. Leave your lead foot at home and save gas (and the ticket!) by lowering your highway speed. According to Consumer Reports, for every 10 mph over 55, aerodynamic drag reduces your fuel efficiency by around 5 miles per gallon.

|

|

Share the Wealth of Knowledge!

Please share this market update with family, friends, or colleagues. If you would like us to add them to our list, simply click on the "Forward email" link below. We love being introduced!

|

|

Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values.

Diversification does not guarantee profit nor is it guaranteed to protect assets

The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general.

The Dow Jones Industrial Average is a price-weighted average of 30 significant stocks traded on the New York Stock Exchange and the NASDAQ. The DJIA was invented by Charles Dow back in 1896.

The MSCI EAFE Index was created by Morgan Stanley Capital International (MSCI) that serves as a benchmark of the performance in major international equity markets as represented by 21 major MSCI indexes from Europe, Australia and Southeast Asia.

The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

The Housing Market Index (HMI) is a weighted average of separate diffusion indices based on a monthly survey of NAHB members designed to take the pulse of the single-family housing market. Each resulting index is then seasonally adjusted and weighted to produce the HMI.

The Pending Home Sales Index, a leading indicator of housing activity, measures housing contract activity, and is based on signed real estate contracts for existing single-family homes, condos and co-ops. The PHSI looks at the monthly relationship between existing-home sale contracts and transaction closings over the last four years. The results are weighted to produce the index.

The Chicago Board Options Exchange Market Volatility Index (VIX) is a weighted measure of the implied S&P 500 volatility. VIX is quoted in percentage points and translates, roughly, to the expected movement in the S&P 500 index over the upcoming 30-day period, which is then annualized.

The BLS Consumer Price Indexes (CPI) produces monthly data on changes in the prices paid by urban consumers for a representative basket of goods and services. Survey responses are seasonally adjusted and weighted to produce a composite index.

The Conference Board Leading Economic Index (LEI) is a composite economic index formed by averages of several individual leading economic indicators, which are weighted to produce the complete index.

Google Finance is the source for any reference to the performance of an index between two specific periods.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance. Past performance does not guarantee future results.

You cannot invest directly in an index. Consult your financial professional before making any investment decision.

Fixed income investments are subject to various risks including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications and other factors.

These are the views of Platinum Advisor Marketing Strategies, LLC, and not necessarily those of the named representative or named Broker dealer, and should not be construed as investment advice. Neither the named representative nor the named Broker dealer gives tax or legal advice. All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy.

Please consult your financial advisor for further information.

By clicking on these links, you will leave our server as they are located on another server. We have not independently verified the information available through this link. The link is provided to you as a matter of interest. Please click on the links below to leave and proceed to the selected site.

|

Robert G. Miller, CFP® , RFC, LUTCF

The Miller Financial Group

7700 West Camino Real

Suite 400

Boca Raton,

FL

33433

561-353-3700

rob@tmfg.com

http://www.tmfg.com

|

|

|