|

Elections Over. Bumpy Road Ahead? Weekly Update - November 12, 2012

|

|

|

In This Issue

|

|

|

|

|

|

The Markets:

The big question last week was: What next? Markets slid as investors reacted to fears about post-election economic policy and renewed turbulence in Europe. Stocks logged their worst week since June, with the S&P losing 2.64%, the Dow sliding 2.12% and the Nasdaq falling 3.16%. [1] The world tuned in on Tuesday to watch the end of a hotly contested U.S. national election. For those who missed it, President Obama won a second term in office. In Congress, Democrats won a majority in the Senate while Republicans maintained control of the House. Markets started the selloff first-thing on Wednesday as traders responded to concerns about the global economy, driving the S&P 500 down by 2.4%.[2] Bonds experienced a dramatic swing as well, as worried investors were driven towards the perceived safety of government securities.

Now that the election is over, analysts and media pundits are turning their attention to the issue that's been hanging over us for months: the fiscal cliff. The fiscal cliff will likely dominate headlines until an agreement is reached, meaning that we can expect markets to remain volatile. A split Congress will make it difficult for Democrats and Republicans to reach a compromise. Deep divisions between the parties remain, and the debate may continue through the New Year; though we really hope it doesn't.

President Obama jumped right into the debate last Friday and staked out the Democratic negotiating position by announcing that any agreement must include tax increases on the wealthy. Since this is a major sticking point for Republicans, it is unlikely that a compromise will be reached soon.[3] If Republicans do not give ground on the issue, Democrats may allow the Bush Tax Cuts to expire in order to gain bargaining power for their own 'middle-income tax relief' plan in the New Year.

A more desirable scenario would bring Republicans to the negotiating table for a bi-partisan plan to gradually phase in austerity measures instead of going over the cliff - similar to the 2010 Simpson-Bowles plan. This would set the stage for meaningful tax and budget reform over the next few years and reassure deficit-watchers that the U.S. is managing its debt. The crux of the matter is that while the U.S. needs to get its deficit spending under control (lest we end up like Europe), our still-fragile economy cannot withstand large-scale tax increases and government spending cutbacks.

In short, now that election season is over, lawmakers are faced with major challenges, and we fear that they are more interested in partisan bickering than hammering out a compromise. On the bright side, we see the potential for markets to respond positively when an agreement is finally made. If economic reports remain upbeat, we could see further upside in the near future. As always, we encourage you to remain patient and focused on your long-term financial strategy.

ECONOMIC CALENDAR:

Monday: Veterans Day, Stock Markets Open, Bond Markets & Banks Closed

Tuesday: Treasury Budget

Wednesday: Producer Price Index, Retail Sales, Business Inventories, FOMC Minutes

Thursday: Consumer Price Index, Jobless Claims, Empire State Mfg. Survey, Philadelphia Fed Survey, EIA Petroleum Status Report

Friday: Treasury International Capital, Industrial Production

|

|

|

|

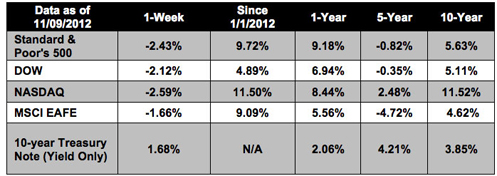

Performance

Notes: All index returns exclude reinvested dividends, and the 5-year and 10-year returns are annualized. Sources: Yahoo! Finance, MSCI Barra. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. N/A means not available. |

|

Headlines

China's economy may be turning the corner. The head of China's central economic planning agency claimed that China would meet its 7.5% GDP growth target in 2013. Data on Saturday showed that China's exports jumped significantly, surpassing expectations and lending credence to the claim. [4]

U.S. Q3 growth higher than previously thought. According to analysts, U.S. third-quarter growth estimates may be revised upwards due to economic data that was not originally included. Recent reports of higher wholesale business inventories and an increase in U.S. exports may indicate that the economy is doing better than expected.[5]

Oil rises above $86 per barrel. Higher projected U.S. economic growth led to a spike in oil prices as producers prepare for higher demand for petroleum products. Gasoline futures also rose on fears of distribution problems and tight supplies in Hurricane Sandy-affected areas.[6]

Greece is running out of cash. Greek's downward spiral continues as its cash reserves are depleted and its coalition government struggles for survival. Although Greece has missed every key austerity milestone, it will likely receive further bailout funds since it is in the interest of other Eurozone nations to keep the country running (for now).[7]

|

|

|

|

"If you cannot do great things, do small things in a great way."

- Napoleon Hill

|

|

|

Pumpkin Spice Whoopies   Cake mix and canned pumpkin make these little cakes, which have a light marshmallow filling. Recipe from Recipe.com Ingredients:

1 cup canned pumpkin

1/3 cup butter, softened

1 package 2-layer-size spice cake mix

2 eggs

1/2 cup milk

1 Marshmallow-Spice filling (see recipe below)

Directions:

1. Preheat oven to 375 degrees F. Line a cookie sheet with parchment paper or foil (grease foil, if using).

2. In a large mixing bowl, beat pumpkin and butter with an electric mixer on medium speed until smooth. Add cake mix, eggs, and milk; beat on low speed until combined, and then on medium speed for 1 minute.

3. By the heaping tablespoon, drop mounds of batter 3 inches apart on cookie sheet; keep remaining batter chilled. Bake 15 minutes or until set and lightly browned around edges.

4. Carefully remove from parchment or foil; cool on wire rack. Repeat with remaining batter, lining cooled cookie sheets each time with new parchment or foil. If desired, place cookies in a covered storage container with waxed paper between layers to prevent sticking.

5. Store cookies at room temperature for 24 hours. Prepare Marshmallow-Spice Filling up to 2 hours before serving. Spread about 2-1/2 tablespoons filling on flat side of one cookie; top with a second cookie. Repeat. Serve immediately or cover and chill up to 2 hours. Makes 15 whoopies.

Marshmallow-Spice Filling:

Up to 2 hours before serving, beat together 1/2 cup softened butter and one 8-ounce package softened cream cheese until smooth. Add 2 cups sifted powdered sugar, 1/2 of a 7-ounce jar marshmallow cream, 1 teaspoon vanilla, and 1/2 teaspoon each ground cinnamon and nutmeg. Beat until well combined.

|

|

|

Don't Rush When Playing Through

For many of us, a wave from the group ahead shifts our game into fast-forward. Why do we rush? Is it because we want to hit fast and get out of the way? Or do we feel we have something to prove, as if being in a faster group means we're better players?

Let go of such concerns. Remember, it was their decision to let you through (assuming you weren't hitting into them from every tee). Move quickly between shots, by all means, but maintain your normal preshot routine and you'll get out of their way in fewer strokes. As for how well you play, there's little connection between skill and speed - just watch the pros on television.

|

|

|

Try Seat-ercising The next time you must spend a lot of time sitting, try this simple exercise to burn calories and build strength.

Seated leg raise: While seated, straighten one or both legs for five or more seconds. Repeat for 15 reps. If you want to increase the difficulty, hook a purse or bag over your ankle while doing the repetitions.

|

Switch to Cold Water

Almost 90% of the energy used to wash clothes is spent on heating the water, according to the U.S. Department of Energy. Save money and energy. Wash your clothes in warm or cold water instead of hot, using a detergent formulated for cold-water use. Turning the dial from hot to warm will cut your energy use by 50% per load, and save you up to $63 a year, according to the Alliance to Save Energy.

|

|

Share the Wealth of Knowledge!

Please share this market update with family, friends, or colleagues. If you would like us to add them to our list, simply click on the "Forward email" link below. We love being introduced!

|

|

Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values.

Diversification does not guarantee profit nor is it guaranteed to protect assets

The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general.

The Dow Jones Industrial Average is a price-weighted average of 30 significant stocks traded on the New York Stock Exchange and the NASDAQ. The DJIA was invented by Charles Dow back in 1896.

The MSCI EAFE Index was created by Morgan Stanley Capital International (MSCI) that serves as a benchmark of the performance in major international equity markets as represented by 21 major MSCI indexes from Europe, Australia and Southeast Asia.

The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

The Housing Market Index (HMI) is a weighted average of separate diffusion indices based on a monthly survey of NAHB members designed to take the pulse of the single-family housing market. Each resulting index is then seasonally adjusted and weighted to produce the HMI.

The Pending Home Sales Index, a leading indicator of housing activity, measures housing contract activity, and is based on signed real estate contracts for existing single-family homes, condos and co-ops. The PHSI looks at the monthly relationship between existing-home sale contracts and transaction closings over the last four years. The results are weighted to produce the index.

The Chicago Board Options Exchange Market Volatility Index (VIX) is a weighted measure of the implied S&P 500 volatility. VIX is quoted in percentage points and translates, roughly, to the expected movement in the S&P 500 index over the upcoming 30-day period, which is then annualized.

The BLS Consumer Price Indexes (CPI) produces monthly data on changes in the prices paid by urban consumers for a representative basket of goods and services. Survey responses are seasonally adjusted and weighted to produce a composite index.

The Conference Board Leading Economic Index (LEI) is a composite economic index formed by averages of several individual leading economic indicators, which are weighted to produce the complete index.

Google Finance is the source for any reference to the performance of an index between two specific periods.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Past performance does not guarantee future results.

You cannot invest directly in an index.

Consult your financial professional before making any investment decision.

Fixed income investments are subject to various risks including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications and other factors.

These are the views of Platinum Advisor Marketing Strategies, LLC, and not necessarily those of the named representative or named Broker dealer, and should not be construed as investment advice. Neither the named representative nor the named Broker dealer gives tax or legal advice. All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. Please consult your financial advisor for further information.

By clicking on these links, you will leave our server as they are located on another server. We have not independently verified the information available through this link. The link is provided to you as a matter of interest. Please click on the links below to leave and proceed to the selected site.

|

Robert G. Miller, CFP® , RFC, LUTCF

The Miller Financial Group

7700 West Camino Real

Suite 400

Boca Raton,

FL

33433

561-353-3700

rob@tmfg.com

http://www.tmfg.com

|

|

|