Investing in Classic Businesses

How to be more valuable to yourself and investors

A few years ago I wrote this piece about classic cars and how they reflect some business models. Today there is an entire cable network devoted to cars and dozens of additional shows on other networks that rebuild, customize, or trade in automobiles. Let's explore the three ways you can add value to your classic business.

Some of you will remember that Hyundai sent over a batch of really cheap cars in the 1980's. The Korean manufacturing giant (they build just about anything you can imagine) decided that Japan had too much of the automobile market and set about to use inexpensive Korean labor and factories to compete. They got the price right, but the cars were junk. The market had shifted from price-only to reliability at a good price. Hyundai's CEO challenged the auto division to completely retool with the goal to exceed the Japanese model - and succeeded.

Some of you will remember that Hyundai sent over a batch of really cheap cars in the 1980's. The Korean manufacturing giant (they build just about anything you can imagine) decided that Japan had too much of the automobile market and set about to use inexpensive Korean labor and factories to compete. They got the price right, but the cars were junk. The market had shifted from price-only to reliability at a good price. Hyundai's CEO challenged the auto division to completely retool with the goal to exceed the Japanese model - and succeeded.

Hyundai didn't just retool their factories; they tore them down and re-invented how cars are made.

Most small businesses need retooling of some sort. Rarely will an owner start over like Hyundai did. More often businesses will try to compete with the innovators - without actually innovating. Imagine updating a 1968 Triumph to compete with a modern production sports car. No amount of tinkering or re-engineering will change the fact that the chassis wasn't designed for the speeds and agility of today's engines and suspension systems. If you want a competitive sports car that you can add value to, then you have to start with a competitive sports car. Paint, body work, and tune-ups are easy to add.

What Are Business Investors Looking For?

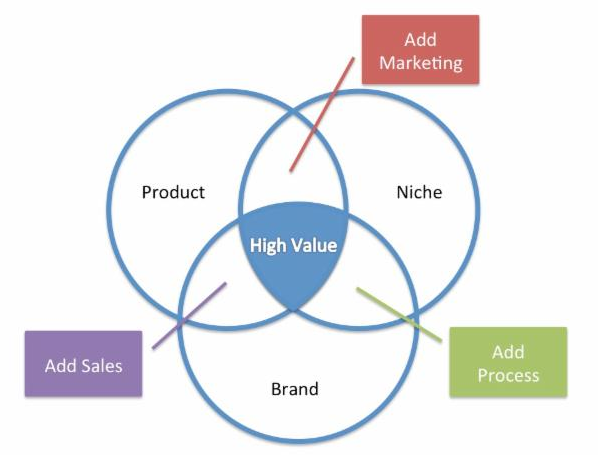

It's all very simple. Investors need you to have something of value to them to begin with. In the end, they want to create more value, but its easier to build from something than nothing. Here are the three things most consider good starting points:

Good Work

Not every company is as good as they think they are, and many are good at things they don't necessarily recognize or value themselves. A good investor will find the hidden excellence in a potential acquisition. It could be employees, infrastructure, inventory, or intellectual property. Does the company do good work or, are the elements that should produce good work present?

Market Niche

Sure, market domination is nice, but few companies are truly dominant in anything. However, it is not difficult to discover companies that have a foothold in a segment, an expertise in a valuable technology, or a great geographic location. Microsoft bought Youtube to compete with Google Hangouts for video conferencing share.

Brand Value

US Airways bought American Airlines. The new Brand will be called American Airlines and the look and feel of the merged business are clearly AA. US Air may be a tainted brand with some market baggage, but they had enough money to buy a bigger airline. Go figure. Brand may be the least valuable thing to an investor (watch Shark Tank), but if the investor's brand sucks, then what's wrong with buying a new one?

Companies with strengths in all three qualities will achieve greater returns and therefore have higher value to investors (not to mention the current owner). If you take away one strength, then what's left is the need to add value. A firm with strong Brand and Product will need to add Sales. This might mean added resources, additional training, or a change in approach. A weakness in overall Product will trigger a need for inputs into Process either through infrastructure, personnel, or methodology - or all three. Undefined Brands need better marketing or to be rolled into a brand that is already established.

Not every investor is skilled at filling in all the gaps. Some are just looking for acquisitions that need Marketing for instance. The best way to attract those buyers is to be exceptional at something else. Think about the kinds of folks that buy classic cars as an investment: The buyer that is good at bodywork will be more inclined to buy a car with bad paint but a great engine. When you are good at something, you will increase your value.

AV-Matters Blog is written by Tom Stimson, MBA, CTS, President of Stimson Group LLC, a Dallas-based management consulting firm specializing in strategy, process improvement, and market research for the Audiovisual and Communications Services Industries. Tom is a Past-President of InfoComm International and a current member of InfoComm's Adjunct Faculty. Email Tom at mailto:tom@trstimson.com