|

|

|

Piece by Piece Update

March 2016

Please take note of the following news and calendar updates:

|

Around Atlanta, the Housing Recovery's Great Divide is in Black and White

(Courtesy of Washington Post): The communities in South DeKalb are almost entirely African American, and they reflect a housing disparity that emerges across the Atlanta metropolitan area and the nation. According to a new Washington Post analysis, the higher a Zip code's share of black residents in the Atlanta region, the worse its housing values have fared over the past turbulent housing cycle. Across metropolitan Atlanta, nearly 9 in 10 largely black Zip codes still have home values below that point 12 years ago. MORE

|

First-Time Home Buyers Face Challenges in Atlanta Market

(Courtesy of Atlanta Agent Magazine): The inventory of affordable homes in Metro Atlanta has fallen 11.5 percent over the last year according to a new Zillow analysis. Meanwhile, the supply of homes in the market's middle tier is down 11.9 percent, and luxury homes in the top-tier are up 1.3 percent. The declining supply is causing prices to rise in the lower price points, and Svenja Gudell, Zillow's chief economist, said that will only add to first-time buyer struggles. MORE FULL ZILLOW ANALYSIS

|

Expanding Homeownership for Underserved Households and Buyers in Distressed Markets

Much has changed in the affordable homeownership arena since the Great Recession including new mortgage products, regulatory requirements, underwriting tools and subsidy approaches. Freddie Mac is introducing a series of training events, beginning in Atlanta, to educate nonprofit housing program managers, local government officials and program administrators, loan officers, real estate professionals and housing developers about the new affordable home-buying landscape. The workshops will help participants identify barriers to homeownership, understand layered financing, access community lending products effectively, work with housing counselors, and showcase local initiatives. The first training is scheduled for June 7 at Emory Law School in Atlanta. Registration here or call 1-800-494-1283. Much has changed in the affordable homeownership arena since the Great Recession including new mortgage products, regulatory requirements, underwriting tools and subsidy approaches. Freddie Mac is introducing a series of training events, beginning in Atlanta, to educate nonprofit housing program managers, local government officials and program administrators, loan officers, real estate professionals and housing developers about the new affordable home-buying landscape. The workshops will help participants identify barriers to homeownership, understand layered financing, access community lending products effectively, work with housing counselors, and showcase local initiatives. The first training is scheduled for June 7 at Emory Law School in Atlanta. Registration here or call 1-800-494-1283.

|

Study Finds Declines in Low-Cost Rented Units in Large Southeaster Cities

Courtesy of Federal Reserve Bank of Atlanta): A growing number of US households spend over 50 percent of their income on rent, making them severely cost-burdened. This increase is due in part to the decrease in affordable rental units in urban areas. Dan Immergluck, Ann Carpenter, and Abram Lueders examined the landscape of low-cost rental housing units in Atlanta and seven other large southeastern cities in an analysis for the Federal Reserve Bank of Atlanta. They found that low-cost rental units(defined as those with rents of $750 or less per month) decreased in all eight cities in the last decade. Each of the eight cities studied, including Atlanta, is losing hundreds, and sometimes thousands, low-cost rental units annually. MORE | WABE Courtesy of Federal Reserve Bank of Atlanta): A growing number of US households spend over 50 percent of their income on rent, making them severely cost-burdened. This increase is due in part to the decrease in affordable rental units in urban areas. Dan Immergluck, Ann Carpenter, and Abram Lueders examined the landscape of low-cost rental housing units in Atlanta and seven other large southeastern cities in an analysis for the Federal Reserve Bank of Atlanta. They found that low-cost rental units(defined as those with rents of $750 or less per month) decreased in all eight cities in the last decade. Each of the eight cities studied, including Atlanta, is losing hundreds, and sometimes thousands, low-cost rental units annually. MORE | WABE

|

Atlanta City Council Passes Affordable Housing Ordinance

Last week, the Atlanta City Council passed a citywide Affordable Housing Ordinance requiring any multi-family residential property for lease that receives a grant, incentive, or subsidy in the City of Atlanta will be obligated to adhere to the housing set asides. That means that either 10% of the units at 60% Area Median Income (AMI) and below or 15% of the units at 80% AMI and below meet the provisions of the ordinance. WABE Story Last week, the Atlanta City Council passed a citywide Affordable Housing Ordinance requiring any multi-family residential property for lease that receives a grant, incentive, or subsidy in the City of Atlanta will be obligated to adhere to the housing set asides. That means that either 10% of the units at 60% Area Median Income (AMI) and below or 15% of the units at 80% AMI and below meet the provisions of the ordinance. WABE Story

|

New Analysis: With Right Implementation, IZ Can Produce Affordable Housing

(Courtesy of NHC): An analysis of research and empirical data on the viability of inclusionary housing programs finds that such programs can succeed at producing quality affordable housing and do not lead to significant declines in overall housing production or increases in market-rate prices. "Separating Fact from Fiction to Design Effective Programs," was recently released by the National Housing Conference. This analysis finds that inclusionary housing programs are most effective when they are mandatory instead of voluntary and that the programs work better when they include incentives that offset the cost to developers. MORE

|

Wall Street Veterans Bet on Low-Income Home Buyers

(Courtesy of NYT): Wall Street firms have beenbuying homes that were foreclosed on during the financial crisis and later resold to buyers under long-term installment contracts (also known as a contracts for deed). In these deals, a seller provides the buyer with a long-term, high-interest loan, with the promise of actually owning the home at the end of it. These contracts, a form of seller financing, have ballooned in recent years as low-income families unable to get traditional mortgages have turned to alternate ways to buy homes.The homes are often sold "as is," in need of costly repairs and renovations, and many of the transactions end in eviction when buyers fall behind on payments. The market is growing in part because so many would-be home buyers with damaged credit histories cannot get loans. Under many contracts, buyers can be evicted if they default on their loans. That is very different from traditional mortgages, under which the foreclosure process can be lengthy and costly. MORE

|

Terwilliger Foundation Hosts Southeastern Housing Roundtable in Atlanta with ANDP

On April 14, 50 key housing thought leaders representing national, southern regional, state, metro and local perspectives met at the Carter Center for an interactive roundtable discussion, facilitated by Nic Retsinas, director emeritus of the Joint Center for Housing Studies at Harvard. The dialogue focused on critical housing challenges facing the Southern region and potential policy solutions at the federal level. Ron Terwilliger, former HUD Secretary Henry Cisneros, former U.S. Senator Scott Brown (R-MA), former U.S. Congress Member Rick Lazio (R-NY), Fannie Mae Board Member Bart Harvey, Mayor Shirley Franklin, John Wieland, and Renee Glover were among the leaders participating. SaportaReport.com On April 14, 50 key housing thought leaders representing national, southern regional, state, metro and local perspectives met at the Carter Center for an interactive roundtable discussion, facilitated by Nic Retsinas, director emeritus of the Joint Center for Housing Studies at Harvard. The dialogue focused on critical housing challenges facing the Southern region and potential policy solutions at the federal level. Ron Terwilliger, former HUD Secretary Henry Cisneros, former U.S. Senator Scott Brown (R-MA), former U.S. Congress Member Rick Lazio (R-NY), Fannie Mae Board Member Bart Harvey, Mayor Shirley Franklin, John Wieland, and Renee Glover were among the leaders participating. SaportaReport.com

|

Former Homeowners are in the Rental Market Long-Term

(Courtesy of How Housing Matters): Around 19 million former homeowners are currently in the rental market, and many are unlikely to regain homeownership. An analysis by the Urban Institute has found that the majority of these are households who lost their homes because of the mortgage crisis and recession, rather than having chosen to rent due to retirement or a job-related move. Forty-five percent of these former homeowners now have credit scores of 650 or less, which is lower than typical mortgage qualification standards. The only group more likely to have low credit scores is renters who have never had a mortgage, but this group tends to be younger and have less of a credit history. MORE

|

HUD Allocates $174 million through New Housing Trust Fund

(Courtesy of NHC; Kaitlyn Snyder): For the first time ever, the U.S. Department of Housing and Urban Development (HUD) allocated nearly $174 million through the nation's Housing Trust Fund. The Housing Trust Fund is a new affordable housing production program that will complement existing federal, state and local efforts to increase and preserve the supply of decent, safe and sanitary affordable housing for extremely low- and very low-income households, including families experiencing homelessness. All states and territories received a minimum of $3,000,000 - a list of state allocations is included in the press release. The new funding can be used for real property acquisition, site improvements and development hard costs, related soft costs, demolition, financing costs, relocation assistance, operating cost assistance for rental housing (up to 30% of each grant) and reasonable administrative and planning costs. Georgia will receive $3.3 million for FY 2016. MORE

|

Fannie and Freddie Launch Principal Reduction Program

(Courtesy of Housing Wire): FHFA announced recently that it will be launching a principal reduction program for some borrowers whose loans are owned or guaranteed by Fannie Mae or Freddie Mac. But the program is not quite as widespread as was first reported. The FHFA said that it expects approximately 33,000 borrowers to eligible to participate in the principal reduction program due to very specific eligibility requirements. According to the FHFA, principal reductions will be available to owner-occupant borrowers who are 90 days or more delinquent as of March 1, 2016, meaning that borrowers will not able to "strategically default" in able to receive principal reduction. The program will only apply to borrowers whose mortgages have an outstanding unpaid principal balance of $250,000 or less, and whose mark-to-market loan-to-value ratios are more than 115%. MORE | View the FHFA Release

|

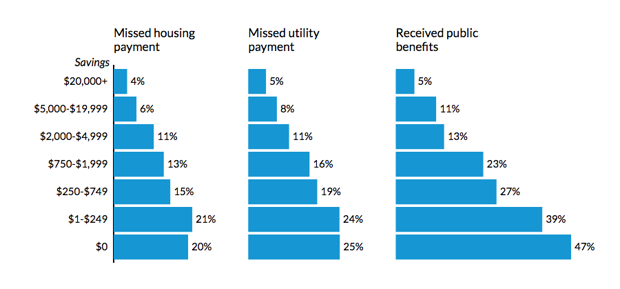

New Study: Minimal Savings Can Prevent Economic Hardship

(Courtesy of How Housing Matters): Having a small amount of savings can allow families to weather an income disruption without experiencing economic hardship, according to new research from the Urban Institute. "We were surprised to find that families with as little as $250 to $750 in savings are less likely to be evicted, miss a house or utility payment, or receive public benefits," says Caroline Ratcliffe, a senior fellow at the Urban Institute. Savings appear to be more important than household income in preventing hardship. MORE (Courtesy of How Housing Matters): Having a small amount of savings can allow families to weather an income disruption without experiencing economic hardship, according to new research from the Urban Institute. "We were surprised to find that families with as little as $250 to $750 in savings are less likely to be evicted, miss a house or utility payment, or receive public benefits," says Caroline Ratcliffe, a senior fellow at the Urban Institute. Savings appear to be more important than household income in preventing hardship. MORE

|

Hispanic Homeownership on the Rise

(Courtesy of Down Payment Resource): There's been much focus on millennials and their importance on the housing market, but when we look at where homeownership growth has been the strongest, it's among Hispanics, including Hispanic millennials. In fact, 2015 marked the fifth consecutive year that Hispanic homeownership has been on the rise, according to the recently released State of Hispanic Homeownership Report. Since 2000, Hispanics have accounted for 52 percent of the growth in U.S. homeownership. And, the Urban Institute predicts Hispanics will account for more than half of new homeowners by 2030. MORE

|

CALENDAR ITEMS

Share your calendar items with us! Please email Susan Adams at sadams@andpi.org with news of your upcoming events.

HomeSafe Georgia

HomeSafe Georgia representatives will be at the following events to discuss their federally funded mortgage assistance program that helps homeowners avoid foreclosure.

HomeSafe Georgia is a free, state government program to help homeowners who are unemployed, underemployed or face other types of financial hardships save their homes from foreclosure. There is no cost to apply and no fee if you are approved.

A homeowner who has experienced a financial hardship within the last 36 months i.e. hardship associated with loss of job, military service, death of a spouse, or medical hardship may be eligible for HomeSafe Georgia assistance. We encourage potential eligible homeowners to attend one of the events.

Churches, clubs and community organizations are encouraged to inform others about the above events and to help those without internet access to apply for these funds. For more information, please visit www.HomeSafeGeorgia.com.

- June 5, 2016; Real Estate Fair "Helping your dreams come true" from 1 - 5 PM at the Monarch Ballroom, 1960 Day Drive, Duluth.

May 28 - Committed to Communities will be holding a Neighborhood Open House & Community Artist Event / Fundraiser from 11 a.m. - 4 p.m., which includes an artist showcase featuring local performers. The event is aimed at promoting Capitol View as an affordable and thriving neighborhood for homeownership and community building. The May 28th event will include walking tours of open homes in Capitol View. If you are interested, please contact: Tawny Powell at Tawny@CommittedToCommunities.com

June 7: Coming Home Again is a new, comprehensive, one-day training event in support of local initiatives that expand home ownership opportunities for undeserved households and buyers in distressed markets. MORE

June 11 - Neighbors Together; NeighborWorks Week 2016, Atlanta Metropolitan State College. 9:30 to 3:30 PM. Atlanta Neighborhood Development Partnership (ANDP), along with a team of talented neighborhood leaders, is coordinating "Neighbors Together," a full-day of training and opportunity designed to empower neighborhood residents and reignite hope in communities slow to recover from the housing crisis. Neighbors Together is part of NeighborWorks America Week 2016. Nathaniel Smith, CEO of the Partnership for Southern Equity, will be our keynote speaker and will join national trainers with expertise in helping neighborhoods improve safety, build a stronger neighborhood brand, and foster inclusive communities where all are welcome. REGISTER

|

|

Sincerely,

Susan Adams

Piece by Piece Coordinator

|

|

|

|

|

|

|