|

|

|

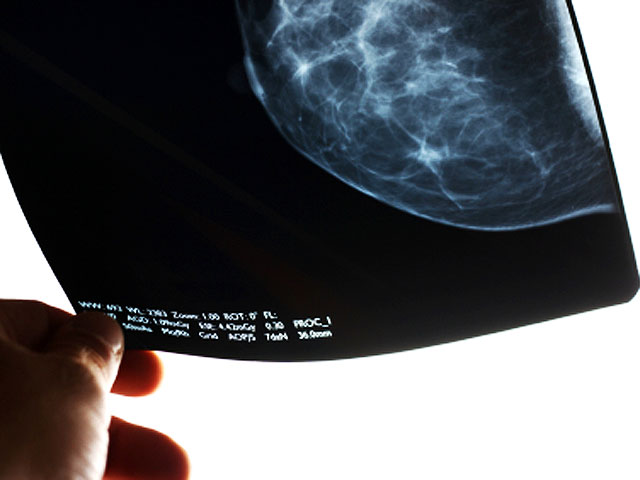

HEALTH:

| |  A False Positive Mammogram is a Real Risk Factor for Breast Cancer: Experts recommend women with histories of a false positive result be vigilant about regular mammograms. CNN, Dec, 2. A False Positive Mammogram is a Real Risk Factor for Breast Cancer: Experts recommend women with histories of a false positive result be vigilant about regular mammograms. CNN, Dec, 2.

|

|

MONEY:

| |

Couples Fight More About Finances as Retirement Draws Closer: Many couples fight about money - and those disagreements may increase and intensify as you get older, particularly when it comes to saving and planning for retirement. CNBC, Dec. 3. Couples Fight More About Finances as Retirement Draws Closer: Many couples fight about money - and those disagreements may increase and intensify as you get older, particularly when it comes to saving and planning for retirement. CNBC, Dec. 3.

Return Your Retirement Plan to Solid Footing: In the midst of retirement and feel like your plan has gone off the rails? Here's how to get back on track. Kiplinger's Retirement Report, Dec. 2015.

Are You Required to Take an IRA Minimum Distribution? Decoding RMDs: What goes up, must come down. And what goes in, must come out. And that's certainly the case with your IRA. USA Today, Dec. 3. Are You Required to Take an IRA Minimum Distribution? Decoding RMDs: What goes up, must come down. And what goes in, must come out. And that's certainly the case with your IRA. USA Today, Dec. 3.

How Much Income Will I Need in Retirement? My wife and I are 55 and contribute roughly 20% of our income to our 401(k)s. So does that mean we'll need only 80% of our current income to live in retirement? CNNMoney/Real Deal Retirement, Dec. 2.

Don't Have a 401(k) Plan at Work? A myRA Might Be Right For You: About 55 million American workers don't have access to retirement plans at their workplaces, and some who do may not like their choices. In either case, there are alternatives. USA Today, Dec. 2. Don't Have a 401(k) Plan at Work? A myRA Might Be Right For You: About 55 million American workers don't have access to retirement plans at their workplaces, and some who do may not like their choices. In either case, there are alternatives. USA Today, Dec. 2.

6 Money Strategies for the Sandwich Generation: When you're caught between the financial pressures of parents and children, you have to plan ahead. US News and World Report, Dec. 2.

10 Ways to Repair Your Retirement Finances: Try these last-minute strategies to boost your retirement income. US News and World Report, Nov. 30.

Is an HSA Missing From Your Retirement Savings Strategy? A health savings account is only for medical expenses right? Not according to some experts. US News and World Report, Nov. 30. Is an HSA Missing From Your Retirement Savings Strategy? A health savings account is only for medical expenses right? Not according to some experts. US News and World Report, Nov. 30.

Ways to Retire with More Money: This information is provided to help you avoid possible financial shortfalls that you may have already considered, but perhaps haven't fully looked into before/during retirement. MarketWatch, Nov. 30. |

|

TECHNOLOGY:

| |

How Technology Will Transform Retirement: Get ready for a new array  of devices and services that will make it easier to work, stay healthy, live at home and remain connected to friends and family. WSJ, Nov. 29. of devices and services that will make it easier to work, stay healthy, live at home and remain connected to friends and family. WSJ, Nov. 29.

|

|

The articles linked in this e-news feed service may not be published without consent from the publication or outlet from which they came. Also note that some articles to certain publications, including The New York Times, may require a subscription to their website to read them.

|

|

|