|

|

|

HEALTH:

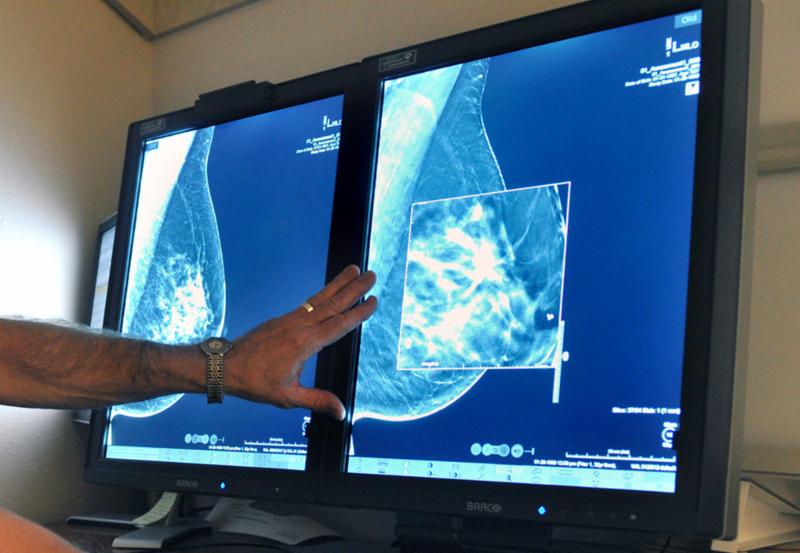

| |  American Cancer Society says Women Should Start Mammograms at 45: In a move that reflects changing attitudes about cancer screening, the ACS is now recommending fewer mammograms for women. USA Today, Oct. 20. American Cancer Society says Women Should Start Mammograms at 45: In a move that reflects changing attitudes about cancer screening, the ACS is now recommending fewer mammograms for women. USA Today, Oct. 20.

|

|

MEDICARE:

| |

5 Ways to Save on Medical Expenses in Retirement: The average  couple retiring in 2015 can expect to pay $245,000 in health care expenses during their retirement. Smart strategies can lower the cost. Kiplinger, Oct. 23. couple retiring in 2015 can expect to pay $245,000 in health care expenses during their retirement. Smart strategies can lower the cost. Kiplinger, Oct. 23.

Save Money During Medicare Open Enrollment: Open enrollment season for retirees is underway, and shopping around for a new Medicare plan for 2016 could save you money. CNBC, Oct. 22.

The Lowdown on the 52 Percent Medicare Premium Increase: You probably heard that there'll be no Social Security cost-of-living increase for beneficiaries in 2016. But what you may not know is that a ripple effect of this, for millions who'll be covered by Medicare next year, could be a 52 percent boost in their monthly Medicare Part B premiums. Next Avenue, Oct. 21. The Lowdown on the 52 Percent Medicare Premium Increase: You probably heard that there'll be no Social Security cost-of-living increase for beneficiaries in 2016. But what you may not know is that a ripple effect of this, for millions who'll be covered by Medicare next year, could be a 52 percent boost in their monthly Medicare Part B premiums. Next Avenue, Oct. 21.

Your Guide to Choosing a Medicare Drug Plan that's Right For You: Medicare Part D premiums will be 13 percent higher in 2016 than in 2015. However, there will be an enormous range of plan costs, with bare-bones plans costing little and others charging $100 monthly premiums. PBS Newshour, Oct. 21.

|

|

MONEY:

| |

With Rates So Low, Should You Pay Off Your Mortgage? With mortgage rates averaging less than 5% for the past five years - and 2015 set to become year No. 6 in that trend - there's never been a better time to carry a mortgage into retirement, right? MarketWatch, Oct. 23. With Rates So Low, Should You Pay Off Your Mortgage? With mortgage rates averaging less than 5% for the past five years - and 2015 set to become year No. 6 in that trend - there's never been a better time to carry a mortgage into retirement, right? MarketWatch, Oct. 23.

|

|

RETIREMENT:

| |

Are You Failing at Retirement Planning? You can only live your dream retirement if you have a road map for how to get there. Is your retirement plan up to snuff? The Motley Fool, Oct. 24. Are You Failing at Retirement Planning? You can only live your dream retirement if you have a road map for how to get there. Is your retirement plan up to snuff? The Motley Fool, Oct. 24.

Finding the best Places to Retire Abroad: Choosing to live overseas in retirement is certainly one of the best ways retirees can live the lifestyle they wish on a limited budget. MarketWatch, Oct. 21.

The 10 Best States for Early Retirement: Financial advice company SmartAsset named these the best states for those entering retirement early, based on factors including effective income tax rates on people ages 55 to 64, state and local sales taxes, property tax rates and health care costs. CNBC, Oct. 20. The 10 Best States for Early Retirement: Financial advice company SmartAsset named these the best states for those entering retirement early, based on factors including effective income tax rates on people ages 55 to 64, state and local sales taxes, property tax rates and health care costs. CNBC, Oct. 20.

5 Ill-Conceived Pieces of Retirement Advice: One size doesn't always fit all, especially when it comes to retirement advice. In fact, some of the most time-honored rules of thumb for managing your finances after the end of your primary working years may not make sense in your specific situation. Bankrate.com, Oct. 19.

|

|

SOCIAL SECURITY:

| |

Social Security's Viagra Benefit for Kids: If you're retired and are still raising young children, there's a little-known Social Security benefit dubbed the "Viagra benefit," that can put some extra money in your family coffers. The Huffington Post, Oct. 19. Social Security's Viagra Benefit for Kids: If you're retired and are still raising young children, there's a little-known Social Security benefit dubbed the "Viagra benefit," that can put some extra money in your family coffers. The Huffington Post, Oct. 19. |

|

INSURANCE:

| |

Long-Term Care Insurance Requires Long-Term Planning: Long-term care insurance really is long term: buying a policy commits you to pay premiums over decades. If you stop those payments, thousands of dollars you have already spent might as well have gone down the drain. Reuters, Oct. 22.

|

|

END OF LIFE:

| |

What Funeral Homes Won't Tell You: As if arranging for the death of a loved one wasn't painful enough. Now, a new national survey from the Funeral Consumers Alliance and the Consumer Federation of America reveals that funeral homes and cremation businesses do a miserable job disclosing their prices. Next Avenue, Oct. 21. What Funeral Homes Won't Tell You: As if arranging for the death of a loved one wasn't painful enough. Now, a new national survey from the Funeral Consumers Alliance and the Consumer Federation of America reveals that funeral homes and cremation businesses do a miserable job disclosing their prices. Next Avenue, Oct. 21.

5 Things To Do Immediately After a Loved One Dies: When a loved one passes away, there are many issues the survivors need to navigate during an already extremely difficult time. Credit.com, Oct. 24. |

|

The articles linked in this e-news feed service may not be published without consent from the publication or outlet from which they came. Also note that some articles to certain publications, including The New York Times, may require a subscription to their website to read them.

|

|

|