|

|

|

HEALTH:

| |  Hearing Loss Costs Far More Than Ability to Hear: The effects can be physical and psychological, professional and social. Yet many sufferers don't realize it, or won't admit it. The New York Times, Sept. 28. Hearing Loss Costs Far More Than Ability to Hear: The effects can be physical and psychological, professional and social. Yet many sufferers don't realize it, or won't admit it. The New York Times, Sept. 28.

Added Calcium May Not Help Older Bones: Researchers find no evidence that boosting intake will prevent fractures, according to a new study. HealthDay, Sept. 29. Added Calcium May Not Help Older Bones: Researchers find no evidence that boosting intake will prevent fractures, according to a new study. HealthDay, Sept. 29.

|

|

MEDICINE:

| |

6 Ways to Save on Your Prescription Drugs: Prescription drug price inflation is expected to approach double-digits in 2016, more than 10 times the consumer price index for all goods and services. CNBC, Sept. 29.

|

|

MONEY:

| |

How to Draw Down Your Retirement Savings: Saving for retirement is challenging, no doubt. But if you want to know what's really tricky, consider spending that money in retirement. CNBC, Oct. 1. How to Draw Down Your Retirement Savings: Saving for retirement is challenging, no doubt. But if you want to know what's really tricky, consider spending that money in retirement. CNBC, Oct. 1.

New Ways to Ensure Steady Income During Retirement: Financial firms are launching products aimed at helping retirees transition from earning a paycheck to drawing on their savings. Kiplinger, Oct. 2015.

After-Tax 401(k) Rollover to Roth IRA OK'd: A recent IRS ruling makes it easier to do an after-tax 401(k) rollover to a Roth IRA. Bankrate.com, Oct. 1. After-Tax 401(k) Rollover to Roth IRA OK'd: A recent IRS ruling makes it easier to do an after-tax 401(k) rollover to a Roth IRA. Bankrate.com, Oct. 1.

MRD Requirements for Your Retirement Accounts: Know your minimum required distributions (MRD) requirements, or you could end up facing stiff penalties. The Motley Fool, Sept. 30.

Looking For An Easy Way To A More Secure Retirement? When it comes to investing, most people focus on returns, but if you really want to enhance your long-term financial security-especially in light of projections for subpar investment gains in the years ahead-you'd do better looking for ways to pay less in fees. Real Deal Retirement, Sept. 30.

The 4-Percent Rule: 3 Reasons to Rethink Your Retirement: This popular retirement planning guideline is still useful, but you should consider some minor changes. The Motley Fool, Sept 28. The 4-Percent Rule: 3 Reasons to Rethink Your Retirement: This popular retirement planning guideline is still useful, but you should consider some minor changes. The Motley Fool, Sept 28.

4 Ways To Rebound Your Retirement After A Market Correction: While we hold no sway over day-to-day market values, there are a few things that are in our control when it comes to retirement planning. Forbes, Sept. 29. |

|

RETIREMENT:

| |

4 Things You'll Wish You'd Thought About Before Retiring: If you fail to take these things into consideration before you retire, they could come back to haunt you in your golden years. The Motley Fool, Oct. 3.

9 Things That Can Make Retirement Really Stink: Why many middle-class Americans find retirement to be much tougher than anticipated, and what you can do to prepare for the most common pitfalls. MoneyTalkNews, Sept 29 9 Things That Can Make Retirement Really Stink: Why many middle-class Americans find retirement to be much tougher than anticipated, and what you can do to prepare for the most common pitfalls. MoneyTalkNews, Sept 29

Is More Money the Key to a Happy Retirement? With so many people approaching their retirement years with meager retirement savings, rather than aiming to fully retire and not work at all, it might be more realistic to aim for being happy. MoneyWatch, Sept. 28.

Find Your Best Retirement Spot: CNBC looked at several lists compiled by Bankrate, WalletHub and AARP to select a few cities that are the best options for those with specific needs. CNBC, Sept. 28. Find Your Best Retirement Spot: CNBC looked at several lists compiled by Bankrate, WalletHub and AARP to select a few cities that are the best options for those with specific needs. CNBC, Sept. 28.

Signs You Aren't Ready to Retire Yet: Some people are eager to escape an unpleasant work situation or want to spend less time at the office. But a desire for less stress and more leisure time doesn't necessarily mean you are ready to permanently retire. US News and World Report, Sept. 28.

|

|

WORK:

| |

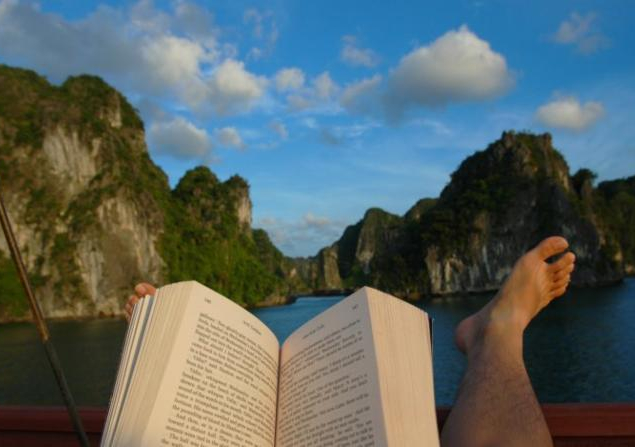

How to Retire Abroad and Make Money, Too: What would it be like to unretire and work  part-time in a place like Lake Atitlan, Guatemala or George Town in Malaysia's food capital? Here's some advice on the easiest way to pick up part-time work overseas. Next Avenue, Oct. 1. part-time in a place like Lake Atitlan, Guatemala or George Town in Malaysia's food capital? Here's some advice on the easiest way to pick up part-time work overseas. Next Avenue, Oct. 1.

|

|

The articles linked in this e-news feed service may not be published without consent from the publication or outlet from which they came. Also note that some articles to certain publications, including The New York Times, may require a subscription to their website to read them.

|

|

|