|

Southern Points

Safely guiding you through today's changing mortgage environment

Winter, 2014

|

|

|

|

Positive Words from Clients and Borrowers!

| |

"Thank you for your help. My group loves working with your team, because you always get the job done!"

- Client

If you've received great service, we'd love to hear from you! Please email lfierman@rubinlublin.com with your comments.

|

| Need Training? |

Do you have any new staff that need training on mortgage default laws in Georgia, Tennessee, Mississippi, or Alabama? Want to update existing staff or provide more in depth information to managers? We are happy to prepare materials and deliver learning sessions on site for you! Just email lfierman@rubinlublin.com to discuss your needs.

|

| Giving Back | |

We feel it's important to stay active in our community, as well as yours! Here's some of the charitable efforts we've been involved in this quarter:

- American Cancer Society

- Georgia SPCA

|

|

|

| |

Greetings!

Welcome to winter 2014 and the "new reality". Whatever happened to global warming, huh? But more importantly, whatever happened to record default volumes and mortgage servicing as we once knew it. The "new reality" for servicers and their mortgage default attorneys is now in full effect. For your reading pleasure, we have some timely articles on the CFPB regulations that have now gone live, reverse mortgages and Chapter 12 in bankruptcy, the SCRA and title issues related to document execution. To top it all off, we have a special feature this quarter on "Severe Weather Preparedness - Atlanta Style". Here's to spring coming as fast as possible! Enjoy.

Best Regards,

Glen D. Rubin

Managing Partner

Rubin Lublin, LLC

|

|

|

|

The CFPB's 120 Day Rule & Prohibition Against Dual Tracking

Written By: Patricia McKenzie, Associate

|

The Dodd-Frank Wall Street Reform and Consumer Protection Act created the Consumer Protection Financial Bureau (CFPB). The CFPB has the authority to create and enforce regulations for such institutions as HUD, the National Credit Union Administration, the FDIC and the Federal Reserve. In addition to the authority to regulate those institutions and agencies it was given the authority to supervise mortgage servicers.

On January 10, 2014 CFPB Rule X was put into effect. Two important provisions of Rule X are 1024.41(f) (1) the "120 day rule" and the rule which prohibits "dual tracking" -referral for foreclosure when the borrower has submitted and completed a proposal for loss mitigation.

The 120 day rule provides that "A servicer shall not make the first notice of filing required by applicable law for any judicial or non-judicial foreclosure process unless a borrower's mortgage is more than 120 days delinquent." The first notice in non-judicial states is considered to be the date of first publication of the notice of sale. The delinquency date is to be determined by examining the date the last installment was made and the date when the next installment was due, but not made. Upon such occurrence, a breach letter may then be sent to the borrower.

Prohibition of Dual Tracking of Foreclosure and Loss Mitigation: If a borrower has initiated and completed an application for the loss mitigation process, the servicer is obligated to review the proposal and make a decision as to the feasibility of the proposal. If the request for loss mitigation is denied, the borrower must receive a Denial Notice which states the reason for denial. The servicer is prohibited from referring the loan for foreclosure until there is a final determination as to whether loss mitigation is to be denied.

To continue reading, click here.

|

Chapter 12: Not Your Average Bankruptcy Case

Written By: Danielle Hudson, Associate

|

Many Rubin Lublin clients have an extensive understanding of the workings of bankruptcy filings under Chapters 7 and 13, and often create specialized departments to handle the more complex Chapter 11 filings. But the rare Chapter 12 case can cause some confusion amongst creditors, and even many practitioners less familiar with the chapter's code provisions. In recent years, Rubin Lublin has seen a rise in Chapter 12 filings, especially considering the large agricultural demographic of the southern states we serve.

Chapter 12 was added to the Bankruptcy Code by the Family Farmer Bankruptcy Act of 1986. Congress created Chapter 12 relief for family farmers or fishermen with regular, annual income. Chapter 12 provides tailored code provisions that offer the streamlined approach of a Chapter 13, unlike the more complex and costly Chapter 11 option better suited for large corporate entities, with added benefits for qualifying individuals beyond what Chapter 13 offers for regular wage earners. This chapter provides relief to both individuals (and their spouse, if applicable) like a Chapter 13, as well as to a corporation or partnership previously included under the Chapter 11 umbrella.

Like its Chapter 13 counterpart, a Chapter 12 plan runs for three (3) or five (5) years and proposes to cure delinquent debts during this period. The Chapter 12 plan may also restructure debts, particularly secured debts. Unlike a Chapter 13 where modified secured debts are paid within the plan period, a modified secured debt under Chapter 12 can be paid out over a period longer than the Chapter 12 plan period. Further, many clients and unsuspecting practitioners fail to realize that the Chapter 12 debtor is also capable of modifying most secured debts - even debts secured by the debtor's personal residence. This is starkly different than the anti-modification provisions found in both Chapters 11 and 13 that prevent modification of debts secured by the debtor's personal residence.

To continue reading, click here.

|

Litigation Corner:

The Importance of Proper Document Execution

Written By: Tenise Cook, Partner

|

Alabama has the least stringent execution standards of the four states we handle. All that is required by statute is attestation by one witness. See Ala. Code § 35-4-20. A notary acknowledgment can satisfy the witness attestation requirement pursuant (see Ala. Code §35-4-22) and must be taken by an officer as prescribed by Ala. Code § 35-4-23, which includes a notary public. While the law provides that no notary is required, most title underwriters require a notary acknowledgment and thus, this is the most common form on modern deeds.

Alabama has a "Savings Statute" which provides that a recorded deed, which is not properly executed, "operates to provide notice of the contents of such conveyance or instrument without any acknowledgment or probate thereof as required by law." See Ala. Code §35-4-63.

Spouses have an interest in the marital homestead, and thus, are required to execute mortgages on the marital home even when not on title to the property. See Ala. Code § 6-10-3, which holds that a mortgage is not valid without the voluntary signature and assent of the husband or wife.

To continue reading, click here.

|

|

SCRA Protection and Its Reach

Written By: Saba Legesse, Associate

|

The Service members Civil Relief Act (SCRA) is a growing area of concern for the mortgage default industry. The statute is very broad and much of it can be left to interpretation. Often times, borrowers can be afforded more relief than what was intended by the legislature in its enactment of the statute and the counter, not enough relief which could yield highly unfavorable outcomes for everyone involved. Determinations regarding the availability of these protections have often been delegated to the firms representing the servicers. While these determinations are mostly straightforward, there have been cases where the availability of the protection falls into a "grey area" that the firm is left to interpret.

One of the most recent areas of concern the firm has dealt with is the issue of spousal rights or lack thereof as it pertains to the SCRA. We know that the statute was enacted to provide protections for service members and their families in the event that their military service impedes their ability to meet their financial obligations incurred before entry into active military service but to what extent are their families protected? Consider this hypothetical: A husband was active military for over 20 years and is now discharged. He is not a party on the loan nor has he ever been in title to the subject property. His wife, who is our borrower and current title holder, believes she is covered under the SCRA. Assuming that the loan originated before his military service, can the privileges and immunities granted to him be extended to his spouse? The answer is possibly.

To continue reading, click here.

|

|

The Buyer's Select Program and What It Means to Lenders

Written By: Michael Baringer, Associate

|

Due to a recent change by HUD, there may be an increase in title-related HUD re-conveyance requests when compared to previous years.

It used to be that HUD published a list of designated closing agents. In order to close on a HUD property the buyer had to use one of those listed agents. For good or ill, it was easier for foreclosure firms to predict what title conditions would be acceptable to the designated agents based on past experience. And because of the limited number agents, firms often dealt with the same individuals and could develop a rapport which facilitated resolving concerns.

But there has been a change. The Buyer's Select Program was recently instituted by HUD, and it applies in all states in which the firm currently handles foreclosures on behalf of clients: Alabama, Georgia, Mississippi, and Tennessee. This program allows buyers to choose their own closing agent. If the agent is an attorney, they must be licensed to practice in the state. However, the program does not require the closing agent to be an attorney, thus the closer can be a title company or escrow agent so long as they are licensed to do business in the state and meet the state's regulatory requirements.

One side effect of this is an increase in the number of possible opinions regarding what constitutes clear and marketable title. It makes predicting what will be acceptable much more difficult. This problem can be exacerbated if the person objecting to title is not an attorney or not intimately familiar with local laws and standards when forming their opinion.

For instance, we sometimes hear someone suggest that title must be perfect, and so any errors, particularly an error in the legal description, must automatically mean that title is not clear and marketable. This is simply not accurate; it is unlikely that any title is completely free of irregularities. If you think you found a title that is free of all errors, you probably have not looked closely enough. Because of this, there are statues, case law, and in some states, established title standards which help determine whether there is clear and marketable title, despite an irregularity.

Many title decisions require a judgment call and depend on one's interpretation of statutes and case law. It is a balancing act, as virtually every file could be stopped for one reason or another; however, such an extremely conservative approach would not best serve our clients' interests. Our firm carefully evaluates issues to resolve matters that we believe need to be addressed, yet not obstruct every file because of a minor imperfection.

Time will tell how much of an impact the Buyer Select Program will have, but regardless, our firm stands ready to work with whoever the closing agent is in resolving their concerns and preserving the conveyance to HUD.

|

Reverse Mortgages in Bankruptcy

Written By: Natalie Brown Associate

| |

The reverse mortgage is a loan available to homeowners 62 and older with significant equity in their homes. It has grown to be an attractive option for the elderly population as a means to supplement retirement income. Home Equity Conversion Mortgages (HECMS) are reverse mortgages that are insured by the U.S. Federal Government and is only available through an FHA approved lender as opposed to a proprietary reverse mortgage through a private lender. In both, loan proceeds are usually paid out in the form of monthly payments made to the borrower, a line of credit, a lump sum payment or some combination. There is no set date for maturity. The borrower may become in default for not maintaining the property or failure to pay property taxes and insurance but generally, unless the home is no longer occupied by the mortgagor, is sold or until the last surviving mortgagor dies, the loan will not come due for repayment. So, what happens when someone with a reverse mortgage files for bankruptcy?

To continue reading, click here.

|

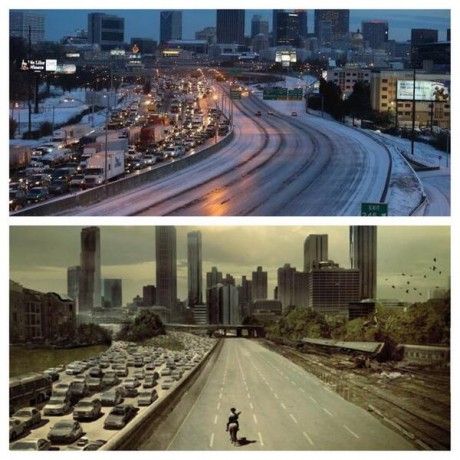

Atlanta Snowpocalypse Coverage

|

The mass exodus from Atlanta the night the snow fell, compared to an iconic Walking Dead image, also from Atlanta.

Abandoned cars on I-75.

Retired Atlanta Braves player Chipper Jones rescued former teammate Freddie Freeman.

To read their Twitter posts on the rescue click here.

|

|

|

Lauren Fierman

Marketing Director

770.246.3353

|

|

|

|

|