Light Crude Oil Light Crude OilNearby Futures WSJ

January 25, 2016 (WSJ.com) by Bradley Olson

China Slowdown Stokes Fears of Peak Oil Demand

Exxon cuts China energy demand forecast to 2025

A bedrock belief among oil forecasters has been that China's voracious appetite for fossil fuels would stoke global energy demand for decades to come. That assumption now appears increasingly shaky.

A highly anticipated new energy-demand projection from Exxon Mobil Corp. XOM 2.14 % released Monday cuts the company's expectations for China. And a slew of data is emerging that points to the toll a weakened economy has taken on Chinese energy demand, which is among the most important factors in determining the price of crude oil.

Exxon cut its forecast for annual energy-demand growth in China by almost a 10th to 2.2% a year through 2025. Over a decade, the revision amounts to more than Brazil's current annual oil consumption. Exxon also predicts that China's thirst for energy will peak by 2030.

The company played down the change to its figures based on its previously held view that China's working population is reaching its apex, said Bill Colton, vice president of corporate strategic planning.

"Countries sometimes have to go through transitions," he said. "One thing about economics, it's never a straight line."

Oil prices fell 7.4% to $29.80 a barrel after Chinese data released Monday showed that diesel fuel use fell in 2015 from a year earlier.

A study issued last week by consultancy ESAI Energy said China's oil-demand growth rate between now and 2030 would be less than half that of the previous 15-year period.

"If demand won't come from China, who will step in to fill China's shoes?" said Erica Downs, a senior analyst for the Eurasia Group who focuses on the country's energy sector.

Some energy companies have already taken concrete steps to pivot from oil because China's economic transformation and global efforts to reduce carbon emissions make its future less certain.

Royal Dutch ShellPLC, Chevron Corp.and others have pursued multibillion-dollar projects that hinge on natural gas, which emits less carbon than oil and is cheaper or more lucrative to use in power generation. Some analysts believe gas will eventually overtake oil as the world's most dominant source of fuel.

Shell is in the finishing stages of acquiring global gas powerhouse BG GroupPLC for $50 billion, while Chevron and partners are spending more than $80 billion to build two massive plants in Australia that will liquefy natural gas so it can be shipped overseas to Asia and beyond.

But those steps may prove problematic if energy demand doesn't pick up in emerging economies.

Chinese energy consumption rose just 0.9% last year, according to government estimates, as gross domestic product increased 6.9%, the weakest annual rate in a quarter century. The unexpected short-term drop casts a shadow over the prospect of an oil-price rally this year. U.S. and global benchmark crude prices fell below $27 a barrel last week for the first time since 2003.

The current oil glut was initially spurred by technology breakthroughs that unlocked more fuel reserves from the ground. But the oversupply is being prolonged and deepened by weaker-than-expected demand.

That confluence of factors has made this oil downturn particularly difficult to resolve. If tepid Chinese energy consumption continues, it could raise profound questions about the stability of oil and gas producers around the world, analysts say.

Expectations of robust energy demand have always been about more than just China. India, Asian tiger countries and other emerging economies with vast populations eager to move into the middle class were supposed to follow China's lead economically and on the energy-demand front. Once-prominent fears that the world would soon run out of oil have been upended by plentiful supplies unleashed in recent years. Now emerging concerns about peak demand are starting to percolate.

From 2000 to 2010, China's rapid industrialization created soaring demand for oil to power an economy tied to manufacturing and exports. Over that decade, China accounted for more than 40% of the growth in global demand for crude oil.

The seemingly insatiable need caught the market by surprise, helping push oil prices to a record $147 a barrel in 2008. But since 2010, China's energy demand growth has slowed faster than its GDP. In 2012, for instance, China's GDP rose at nearly double the rate of energy-consumption growth. Last year, China's GDP grew six times faster than energy-demand growth, according to figures from China and the World Bank.

Some analysts believe the numbers reflect uncertainty around the accuracy of data coming out of China. Yet even accounting for the possibility that GDP data is inflated, the decoupling of economic and energy growth suggests that China's transformation simply may not require as much fossil fuels as many have predicted.

Just as energy companies underestimated Chinese demand in the first decade of this century, they may be overestimating it now, said Anthony Barone, senior vice president for deals and restructuring at Argo, a Chicago-based consulting firm.

"Their growth has slowed, and the belief that they are going to be the top country providing stable long-term demand for energy is looking optimistic," he said.

BPPLC's 2015 energy outlook forecast 3.9% energy demand growth for China through 2020, more than four times higher than last year's actual increase in the country's consumption.

The International Energy Agency's 2015 energy-growth forecast was nearly double the actual demand figure.

Predictions of a tremendous wave of energy growth from China, India and other fast-expanding countries are based on a very real trend. As those economies mature, hundreds of millions of people will enter the middle class and use more energy, driving cars or using air conditioning. That is why Exxon still believes that from 2014 to 2040, global energy demand will grow by 25%, according to the company's Energy Outlook, released Monday.

No doubt middle-class Chinese are using more gasoline and electricity to power their homes and cars, but so far it isn't enough to make up for stagnating industrial activity.

All forecasts that seek to predict the supply and demand of oil or other commodities decades into the future make use of history and emerging trends, as well as informed "guesswork," said Citigroup C 1.92 % commodities analyst Eric Lee.

"China isn't going to keep sucking up oil voraciously," he said. "No matter what, China will have its own unique development."

Top

|

|

Coffee CoffeeNearby Futures WSJ

January 14, 2016 (ICO.org) December 2015 Coffee Market Report

International Coffee Organization December 2015 Coffee Market Report

The coffee market fell again in December 2015, reaching its second lowest monthly average of the year. This decrease was entirely attributable to the drop in Robusta prices over the course of the month. Our first estimate of coffee production in crop year 2015/16 comes to 143.4 million bags, a slight 1.4% recovery compared to 2014/15, which has been revised lower to 141.4 million. Lower production in Brazil as estimated by Conab has been compensated by increases provisionally estimated in Vietnam, Colombia and Indonesia, among others.

The downward trend in the coffee market over the last 15 months continued in December, although the rate of decline slowed. The monthly average of the ICO composite settled on 114.63 US cents/lb, down by 0.3% compared to November. This is nearly 24% lower than its level in December 2014, albeit 7.6% higher than December 2013. Over the last six months, coffee prices have remained in a relatively narrow range between 110 and 130 cents, whereas the first six months of 2015 saw a much greater range of 115 to 155 cents.

The performance of the four group indicator prices was quite different, as the three Arabica groups saw minor increases of between 0.5 and 0.9%, while Robusta was down by 3%. The monthly average of the Robustas indicator came to 79.28 US cents/lb, which is its lowest level since June 2010. As a result, the arbitrage between Arabica and Robusta has increased to 53.75 cents, up 6.8% compared to November.

World coffee production in 2015/16 is provisionally estimated at around 143.4 million bags, representing a recovery of 1.4% compared to 2014/15, which has been revised down to 141.4 million bags. Total production of Arabica is relatively unchanged on 84.3 million bags compared to 84.4 million last year, as lower production of Brazilian Naturals is matched by increases in Colombian Milds and Other Milds. A significant increase of 3.7% is expected in Robustas, with both Vietnam and Indonesia provisionally estimated higher.

The Brazilian coffee agency Conab has updated its estimate of output in 2015/16 from 42.1 million bags to 43.2 million, which is still down from the revised 2014/15 figure of 45.6 million bags. This would be Brazil's smallest crop since 2009/10. The Robusta crop is the most affected, down by 14.2% to 11.2 million bags, while Arabica is down by 1.7% to 32 million bags.

Production in Vietnam has been revised down to 26.5 million bags for 2014/15, given the low exports recorded over the course of the year, although this would still imply a significant stock build up. Output in the current crop year is provisionally estimated to increase to 27.5 million bags. Output in Colombia continues to increase, with production in the first quarter of 2015/16 already 25.5% higher than the same period last year. Total production in 2015/16 is provisionally estimated at 13.5 million bags, although if the current trend continues this could be revised higher.

In Indonesia, an increase of 6.1% to 11 million bags is provisionally expected, while Ethiopia is estimated down 3.4% to 6.4 million bags. The Coffee Board of India has indicated in its post-monsoon forecast that it expects production to increase by 7% to 5.8 million bags, with a similar increase expected in Honduras to 5.8 million bags.

The Uganda Coffee Development Authority has reported that it is expecting a significant 27% increase in Ugandan coffee production in 2015/16 to 4.8 million bags due to increased planting. In Mexico, production is estimated at 3.9 million bags in 2015/16, while output in 2014/15 has been revised down to 3.6 million, and in Guatemala a slight increase is expected of 3.4% to 3.4 million bags. Finally, production in Peru is expected to start recovering in 2015/16 to 3.2 million bags, although export volumes so far this year are relatively similar to 2014/15.

|

|

Corn CornNearby Futures WSJ

Which Crop Price Could Gain the Most from La Nina?

January 14, 2016 (AgWeb.com) By Alison Rice

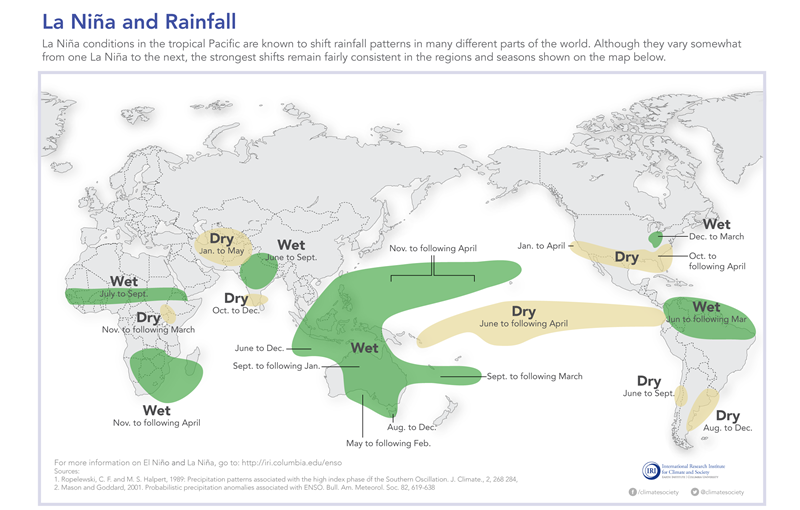

As the current El Nino weather pattern goes into the history books as one of the strongest in memory, grain analysts and growers alike are wondering what will follow.

One likely possibility: La Nina, which involves cooler than normal water temperatures in the Pacific compared to the warmer than normal oceans of El Nino. As a result, the weather patterns of La Nina and El Nino tend to be very different, with El Nino bringing wetter weather to the U.S. and La Nina resulting in the opposite with hotter, drier conditions.

Such growing conditions can affect crop production from the Corn Belt to Brazil and grain markets around the world.

"The most significant impact of La Nina on agricultural commodities is in the grain sector. Dry weather conditions in the U.S. can threaten the development of corn, soybeans and wheat crops, and dry conditions in Argentina and southern Brazil can impact corn and soybeans," according to a recent Commodity Compass report from three analysts at Societe Generale, including agriculture analyst Christopher Narayanan.

So what does this mean for the grain and soy complex? It depends on the commodity, but the most positive impact could be on corn prices, particularly July '16 corn futures and March '17 corn futures, with the biggest winner being U.S. farmers.

"When viewed in the context of our forecasts, the July 2016 corn contract in the heart of the growing season could see the greatest increase in price when combined with our fundamental research outlook," the Societe Generale analysts wrote. "In the event of a La Nina event occurring in the winter of 2016-2017, this would have the greatest impact on the Argentinean and Southern Braziliian corn crops due to an increased drought probability. The U.S. crop would be unlikely to be impacted at this stage as there is no crop in the ground (post-harvest and pre-planting). To capture any potential impact to the South American crop, a long position in the March 2016 corn contract, also currently trading at a discount to our forecasts, could see increased upside potential due to an increase in U.S. export demand."

Wheat prices could also see a boost. "Dry weather in the U.S. could affect the development of the U.S. winter wheat crop, which should support the September 2016 wheat contract in particular," the report said. "The risk with wheat in particular, due to the amount that is exported, is the dollar strength reducing export competiveness for U.S. grades and already high global stocks."

Unfortunately for soybean farmers, bean prices are less likely to benefit from a La Nina. "Similarly to corn, we would expect the July soybean contract to be the most sensitive, but considering the high level of global soybean stocks, it would have to be a very strong La Nina event to have a meaningful price impact," according to Societe Generale analysts

Top

|

|

Orange Juice Orange JuiceNearby Futures WSJ

January 12, 2016 (TheLedger.com) by Kevin Bouffard

Orange crop spared; grapefruit, tangerines tumble

WINTER HAVEN - Florida's orange crop escaped further reductions, but the state's grapefruit crop fell by another 6 percent while the projected tangerine harvest fell 18 percent.

Those were the grim results from the U.S. Department of Agriculture's latest citrus crop update released on Tuesday. The USDA kept the 2015-16 orange crop at 69 million boxes, down 29 percent from last season and the lowest orange harvest in 52 years. The crop appeared to stabilize after the USDA in the past two months cut 11 million boxes from the orange crop since its original Oct. 9 estimate. This season's grapefruit crop fell to 10.8 million boxes, down 700,000 boxes from last month's USDA estimate and 1.5 million boxes from October. If accurate, the 2015-16 grapefruit crop would represent a 16 percent decline from last year's crop and the lowest harvest in 84 years. The 2015-16 tangerine crop fell to 1.4 million boxes, a 350,000-box drop from October. This season's tangerine crop declined 38 percent from 2014-15 and would represent the lowest total in more than 80 years. Polk County historically ranks as Florida's leading tangerine producer. Polk leads the state with 80,488 grove acres and 9.9 million trees and ranked as the top orange produce in the 2014-15 season and third in grapefruit. The fatal bacterial disease citrus greening is the primary cause for the lower crop totals. Infected trees produce smaller fruit, which means more fruit to fill a box, and causes more fruit to drop before harvest. "A decline in grapefruit was not unexpected given the overall trend the industry has experienced due to citrus greening. However, the continuity reflected in today's orange forecast is encouraging," said Shannon Shepp, executive director of the Florida Department of Citrus, in a press statement. "The Florida citrus industry is made up of resilient, hardworking and innovative players who continue to produce the premium quality citrus consumers desire - even under less than ideal circumstances. Florida Agriculture Commissioner Adam Putnam, part of his family's citrus and cattle operation in Bartow, was less encouraged. "Today's USDA citrus crop forecast, even though unchanged, illustrates the dire state of Florida citrus. Without immediate and tangible support, citrus' place in Florida history might just become that - history," Putnam said in his press statement. Michael Sparks, chief executive at Lakeland-based Florida Citrus Mutual, the growers' representative, echoed Putnam. "Although there is no change to the size of the orange crop we are still in an extremely challenging time," Sparks said. "That's why it's important we continue to pursue important game-changing measures in both Tallahassee and Washington, D.C." Both mentioned measures before the Legislature that would make it easier to eliminate abandoned citrus groves, which harbor the disease. Citrus Mutual is also pursuing changes in federal tax law to give growers a bigger financial incentive to plant on abandoned properties. "I am dedicated to using every tool in the toolbox to save the industry, its more than $10.7 billion economic impact and the more than 64,000 jobs it supports," Putnam said. - Kevin Bouffard can be reached at kevin.bouffard@theledger.com or at 863-401-6980. Read more on Florida citrus on his Facebook page, Florida Citrus Witness, http://bit.ly/baxWuU.

Top

|

|

Wheat WheatNearby Futures WSJ

U.S. Farmers Plant Fewer Winter Wheat Acres

U.S. farmers planted fewer acres into winter wheat last fall as growers in top-producing states, including Kansas, cut back on the crop, a government report released Tuesday shows.

The National Agricultural Statistics Service estimated the nation's seeded area for this year's crop at 36.6 million acres, down 7 percent from a year ago. The agency did not indicate the reasons for the decline, but the industry group Kansas Wheat said Tuesday a combination of things likely factored into the decision by growers to seed fewer acres, including lower prices for the crop, which is planted in the fall and harvested in the spring and summer.

In Kansas, the nation's top wheat-producing state, winter wheat acres are down 8 percent to 8.5 million acres.

Marsha Boswell, spokeswoman for Kansas Wheat, said one reason for the fewer acres could be because of a rainy fall the state had. That delayed the soybean harvest because farmers couldn't get combines into those wet fields. Since many Kansas farmers double-crop their fields, the delayed harvest of soybeans meant some farmers couldn't get back into those fields in time to plant their 2016 winter wheat crop.

"We expected them to be down," Boswell said of the government's wheat planting estimate. "But I was a bit surprised they were as down as they were."

Also likely factoring into the planting numbers is the profitability of the various crops.

"Prices have been going downward, so that probably affected planted acres as well," Boswell said.

.

Other top wheat-producing states also had lower acreages. Texas planted just 5.3 million acres, down 12 percent. Oklahoma seeded 4.9 million acres, an 8 percent drop. Colorado and Montana are both down with 2.25 million wheat acres each.

The government's report shows that most of the winter wheat grown in the United States is hard red winter, the type commonly grown in Kansas.

The U.S. Agriculture Department said its estimate of 26.5 million acres nationwide for hard red winter is down 9 percent from a year ago, with the biggest declines in planted acreage in the Great Plains states. A record low acreage was seeded in Nebraska, the agency said.

Estimates for the other winter wheat types included 6.72 million acres of soft red winter wheat and 3.43 million acres of white winter wheat nationwide.

|

|

Dairy Products Dairy Products© Brian Gould, Agricultural and Applied Economics, UW Madison

MADISON, WI January 22, 2016 (REPORT 3)

|

|

Butter Highlights

© Brian Gould, Agricultural and Applied Economics, UW Madison

MADISON, WI January 22, 2016 (REPORT 3)

BUTTER HIGHLIGHTS:

Butter output is active in the country. Heavy cream volumes continue to clear into butter churns in all regions. Production is mostly focused on bulk butter. Some print butter is being made to meet immediate needs, however, a major part of the current production is moving into cold storage. In the Central region, demand from retailers is light, but steady from food service. In the West, some butter manufacturers note a decent domestic demand. At this point, the butter market undertone is unsettled. Some buyers/end users are skeptical about spot price volatility and are waiting for lower prices ahead of the spring holiday purchases. On the other hand, some buyers/end users are eager to get their retail butter needs met in advance of the spring holidays. This week, a cooperative export assistance program accepted requests for 1.543 million pounds of butter. At the CME Group, Grade AA butter price on Friday closed at $2.1700, down 8 cents from a week ago.

Top

|

|

Cheese Highlights

© Brian Gould, Agricultural and Applied Economics, UW Madison

MADISON, WI January 22, 2016 (REPORT 3)

CHEESE HIGHLIGHTS:

In the U.S., cheese production this week remains steady in the Northeast, but active in the Midwest and West. Readily available milk supplies are driving production volumes in the Midwest and West. In all regions cheese inventories are building, which is typical and expected in early Q1. Manufacturers in the West note small increases in cheese export activity and demand for barrels. The interest in barrels is welcome because supplies have been viewed as growing long. Cheese pricing in the EU weakened with concerns over continuing milk volumes and cheese export challenges resulting from global production volumes. At the CME Group, Barrels closed the week on Friday at $1.4300, down $0.0950 from last week's close and blocks closed at $1.4600, down $0.0350 from last week's close.

|

|

Polypropylene Copyright © 2015 The Plastics Exchange. LLC.

January 22, 2016 (Chicago, IL) The Plastics Exchange

The spot resin markets proved a bit challenging this past week, particularly the balance between sellers' desire to limit losses against buyers' sometimes unrealistic price expectations. Still, supplies were generally plentiful, order flow was heavy and a high volume of material changed hands. January Polyethylene con-tracts have yet to settle, but a $.03/lb decrease now seems likely. While offgrade Polypropylene is some-what available, prime material is scarce and producers will have some success enforcing a margin enhanc-ing price increase, targeting around half of the $.06/lb nominated for January. International resin markets are generally below North American levels, but are showing signs of firming. Extraordinary deals have been cut to continue the flow of PE to offshore destinations and avoid burdensome inventories from developing at the producer level.

The Propylene market was relatively quiet, few spot deals were done with just sporadic trader interest. PGP for January delivery sold down below $.285/lb, a penny-plus loss. It is very late in the month for PGP to be without settlement, but as the correlation to PP resin weakens, the price of PGP ultimately has less bearing. A week ago, contracts rolling flat at $.32/lb made sense, but current spot levels now suggest that a $.01/lb contract decrease would be fair. PGP prices are currently forecasted to decline slightly each month until the market reaches $.265/lb by the end of the year. Jan RGP was steady at $.19/lb, Feb is at a small discount.

Spot Polypropylene activity was a tad tenuous and transacted volumes ran about average. With energies and other resin markets eroding, Polypropylene processors are justifiably frustrated with the January price increase, which seems to be gravitating towards $.03/lb more than the change in PGP monomer. PP de-mand seems to be slowing and there are fears of imported finished goods competing with domestically produced goods. Resin availability is spotty- prime is tough to source, offgrade is a little easier and at a decent discount. Some resellers reeling with the rout in Polyethylene are willing to unload their Polypropyl-ene also just to lighten their overall inventories. There are also plenty of offers for imported Polypropylene resin permeating the market, some processors are giving it a shot.

|

|

The King Nut Report

January 27, 2016 (Solon, OH) King Nut

ALMONDS - The historic high Almond prices seen this past summer and fall have finally slowed demand. Financial uncertainties in the economies of major export markets are also contributing to demand decreases. Prices have fallen somewhat in the past several months.

In much the same way that the increasing Almond prices of the last several years may have been a continuous overreaction to high demand and lack of supply, we may be seeing the opposite happening now. Though the price of Almonds has fallen, many buyers in both the foreign and domestic markets remain reluctant to buy. That may be turning around now. The last several weeks have seen a strengthening in the market with prices ticking up from their low point a few weeks ago.

CASHEWS - The Cashew market remains strong. Prices have moved upward in the first few weeks of 2016, however prices are still within the ebb and flow range of the market over the past several years. Prices should remain firm with increased demand from foreign markets.

PEANUTS - The Peanut market has been relatively stable over the past several months. All indications are that the market will continue its stable course in the near term.

PECANS - Pricing for Pecans has been rising weekly and sometimes daily. Some sizes and grades are very hard to source as many of the shellers are reluctant to commit additional product to sale. There are no indications that the market will stabilize anytime soon. It is advisable to use other premium nuts this year or to book commodity quickly when shellers are willing to accept offers.

|

|

Hot Topics

January 14, 2016 (Businesswire.com) by Beth Braverman

Campbell's Culinary & Baking Institute Reveals 10 Influential Food Trends for 2016

Emerging Trends include Authentic Thai, Traditional Fats and Cooking with Fire

Campbell's Culinary & Baking Institute (CCBI), a global network of highly-trained chefs, bakers and culinary professionals at Campbell Soup Company (NYSE: CPB), released its third annual Culinary TrendScape - a report tracking the top 10 influential food themes for 2016.

The report is part of Campbell's culinary tracking system that identifies and categorizes the most impactful food trends and follows them on their journey as they evolve through six distinct stages. These range from the "Discovery" stage 1, like Cooking with Fire, where chefs are rediscovering the extreme flavors and textures that can come from cooking over an open flame, to the "Expanded" stage 6, like Caramel, which have universal appeal and international availability.

The top 10 trends to watch in 2016 are:

Cooking with Fire (Stage 1, Discovery) - A return to the simplest form of grilling, chefs are embracing wood-fired grills for cocktails, appetizers and even desserts, deliberately burning dishes, and incorporating specialty woods and charcoals to intensify flavor.

Authentic Thai (Stage 2, Introduction) - A step beyond traditional Thai. Homestyle dishes found throughout Thailand, like khao soy curry noodle soup, are hitting independent restaurants.

French Revival (Stage 2, Introduction) - Timeless dishes and traditional pastries are back in the comfort food limelight at a new wave of French bistros and cafes.

Inspired Ice Cream (Stage 3, Adoption) - The ice cream category is being reinvented one scoop at a time with bold new flavors like chorizo-caramel, hibiscus-beet and black pepper-butter pecan.

Traditional Fats (Stage 3, Adoption) - Fat is back. Rendered chicken fat, beef tallow, pork fat, nuts and seeds of all varieties and even avocados are in fashion despite their high fat content.

Veg 2.0 (Stage 3, Adoption) - The veggie revolution has expanded beyond kale to carrots wellington, beet tartare and zucchini pasta noodles.

Asian Noodle Soups (Stage 4, Mainstream) - Creative ramen and Vietnamese pho continue to rise in popularity.

Haute Dogs (Stage 5, Established) - New takes on the All-American classic include Vietnamese bahn mi flavored links, mac-n-cheese garnishes and croissant buns.

Simple & Real (Stage 5, Established) - The demand for wholesome food options with fewer and simpler ingredients is causing companies to become more transparent about how their food is made.

Caramel (Stage 6, Expanded) - Caramel is here to stay and has found a home in a wide range of categories from coffees to cocktails.

"Monitoring and understanding trends is our way of anticipating what our consumers and customers will desire as tastes shift year to year," said

Thomas Griffiths, CMC, Vice President, Campbell's Culinary & Baking Institute. "Some of the trends are inspiration for the foods we make, as they serve as a springboard that drives creative product development. The report paints a broad picture of how tastes are evolving, and how we are evolving our products along with them."

Trends are discovered and documented by Campbell chefs who attend culinary immersion tours and conferences, work in restaurants and network with highly-influential chefs. The chefs then track the development of these trends across different aspects of food culture, tagging them under two main categories - TrendPoints and TrendReach. - TrendPoints represent where the trends are seen in action such as the "Marketplace," like specialty shops and grocery stores, or in the "Media," like magazines and cookbooks.

- Chefs then categorize the TrendReach based on six distinct stages, such as the "Introduction" stage 2, where a culinary-minded audience like those who read food magazines might be aware of the trend, or the "Established" stage 5, which could be products found in supermarkets.

A copy of the Culinary TrendScape Report can be downloaded here.

About Campbell Soup Company Campbell (NYSE:CPB) is driven and inspired by our Purpose, "Real food that matters for life's moments." The company makes a range of high-quality soups and simple meals, beverages, snacks and packaged fresh foods. For generations, people have trusted Campbell to provide authentic, flavorful and readily available foods and beverages that connect them to each other, to warm memories, and to what's important today. Led by its iconic Campbell's brand, the company's portfolio includes Pepperidge Farm, Bolthouse Farms, Arnott's, V8, Swanson, Pace, Prego, Plum, Royal Dansk, Kjeldsens and Garden Fresh Gourmet. Founded in 1869, Campbell has a heritage of giving back and acting as a good steward of the planet's natural resources. The company is a member of the Standard & Poor's 500 and the Dow Jones Sustainability Indexes. For more information, visit www.campbellsoupcompany.com or follow company news on Twitter via @CampbellSoupCo.

|

|

|