Light Crude Oil Light Crude OilNearby Futures WSJ

Record Gasoline Output to Curb Biggest U.S. Oil Glut in 85 Years

Refiners are poised to make gasoline at a record pace this year, keeping the biggest U.S. crude glut in more than 80 years from overflowing storage.

They're enjoying the best margins in two years as they finish seasonal maintenance of their plants before the summer driving season. They'll increase output to meet consumer demand and they've added more than 100,000 barrels a day of capacity since last summer, when they processed the most oil on record.

Booming crude production expanded inventories this year by 86 million barrels to 471 million, the highest level since 1930. Analysts from Bank of America Corp. to Goldman Sachs Group Inc. have said storage space may run out. What looks like an oversupply to banks is turning into an all-you-can-eat buffet for those making gasoline and diesel fuel."A lot of the excess crude we've been sitting on is going to get chewed up quickly," Sam Davis, an analyst for energy consulting company Wood Mackenzie Ltd., said in Houston April 2. "We're going to move from a stock build to a stock draw."

Goldman Sachs and Bank of America have said storage builds are increasing the risk of breaching storage capacity, sending prices tumbling. West Texas Intermediate oil, the U.S. benchmark, already has lost more than half its value since June as growing U.S. shale production led to a global oversupply. WTI for May delivery added $1.30 to $50.44 a barrel on the New York Mercantile Exchange at 10:02 a.m. local time.

Supply Growth

Inventories surged as U.S. output rose 71 percent over the past five years as drillers used techniques like horizontal drilling and hydraulic fracturing to tap previously inaccessible oil in shale rock layers. In Cushing, Oklahoma, the delivery point for WTI futures, supplies have more than tripled since early October to a record 58.9 million barrels.

Last July, refiners processed 16.5 million barrels of crude a day, the highest level in monthly Energy Department data going back to 1961. Refining margins in March have averaged $28.09 a barrel, the most since March 2013.

Refiners typically schedule maintenance shutdowns in the spring and fall, reducing oil demand during that time. U.S. refiners increased crude runs by an average 1.1 million barrels a day in April through July over the past five years. During that period, U.S. crude inventories have fallen an average of 24.7 million barrels from the end of May through September.

Pipeline Flows

Companies like Enterprise Products Partners LP and TransCanada Corp. have increased pipeline capacity from Cushing to the Gulf Coast to more than 1.5 million barrels a day from nothing at the beginning of 2012.

Shippers may use more of that space in April after differentials between crudes on the Gulf Coast and Cushing widened to the highest level since January 2014.

Light Louisiana Sweet averaged a $6.60 premium to WTI in March, according to data compiled by Bloomberg. Uncommitted shippers would have to pay between $5.11 and $6.58 a barrel to ship on pipelines from Cushing to St. James, Louisiana, where LLS is priced, according to regulatory filings.

Higher refinery runs and pipeline flows might not be enough to reduce inventories in Cushing, said Andy Lipow, president of Lipow Oil Associates LLC in Houston. WTI is in a contango market structure, with futures contracts for April 2016 selling for $10.84 a barrel more than April 2015 when that contract expired on March 20. That encourages traders to keep crude in Cushing to profit on the trade, Lipow said.

"There's an incentive to fill up Cushing and hold it there," he said.

More Processing

Kinder Morgan Inc. planned to run its 50,000-barrel-a-day Houston splitter at full rates by the end of March, company spokeswoman Melissa Ruiz said last month. Another unit of the same size is scheduled to come online later this summer. A splitter processes an ultra-light form of crude known as condensate that is plentiful in shale regions.

Delek US Holdings Inc. and Marathon Petroleum Corp. are expanding the capacity of refineries to run domestic crude. MDU Resources Inc. and Calumet Specialty Products Partners LP plan to start up a new 20,000-barrel-a-day refinery in North Dakota in the second quarter.

"There are a few incremental expansions that are going to help out and everyone else should be running full out, margins are saying to do that," said John Auers, executive vice president at Dallas-based energy consultant Turner Mason & Co. "That will help drain Cushing."

Top

|

|

Coffee CoffeeNearby Futures WSJ

February 2015 Report (ico.org) International Coffee Organization

Coffee Slumps to One-Year Low Despite Global Deficit Forecast for 2014/15

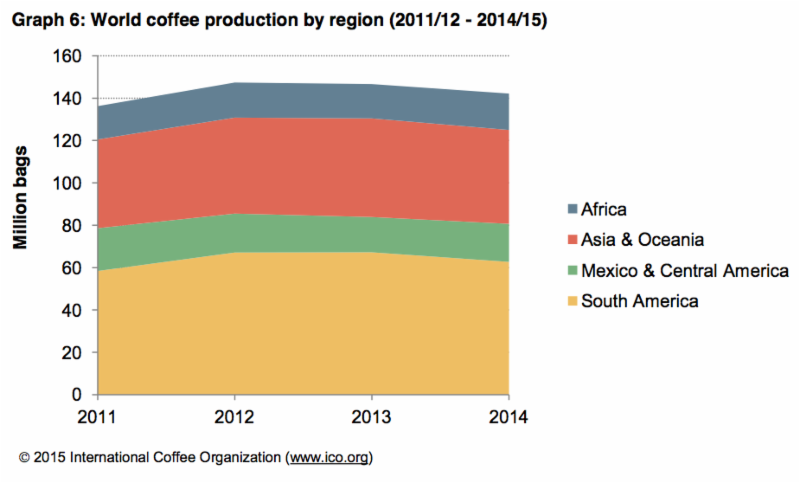

February saw the downward trend in the coffee market over the last few months continue. The ICO composite daily price dropped to a low of just under $1.30, more than 50 cents less than its most recent peak of 185.09 in October 2014. Despite this downward pressure on prices, world production is expected to come to 142 million bags in crop year 2014/15, 4.6 million less than 2013/14 and its lowest level in three years. This puts the coffee market into a deficit for the current year, although stocks in exporting countries have so far allowed exports to continue at a strong pace.

The coffee market fell sharply in February, as improved weather in Brazil contributed to heavy selling pressure. The daily price of the ICO composite dropped from a high of 148.25 cents/lb to a low of 128.75 cents, its lowest level since mid-February 2014. The monthly average settled on 141.10 cents, 4.8% lower than January, and the lowest monthly average in the last twelve months.

In terms of the group indicators, the heaviest decrease was observed in Brazilian Naturals, which fell by 7.1%; Colombian Milds and Other Milds dropped by 6.0% and 5.8% respectively. Robustas, on the other hand, recorded an increase compared to January of 0.4% to reach 98.36 cents. This can partly be attributed to reduced selling from Vietnam during the New Year holiday.

As a result, the arbitrage between Arabica and Robusta has narrowed significantly in the past month, reaching a low of 55 cents towards the end of the month. This is less than half its level of October 2014, and should present some resistance to further decreases in Arabica prices.

Total coffee exports came to 8.8 million bags in January 2015, essentially unchanged on the same month in 2014. This brings total exports for the first four months of the coffee year to 34.4 million bags, just 0.1% less than the same period in 2013/14. Brazil continues to record strong export performance, while higher levels also came out of Colombia and Vietnam.

Total production in crop year 2014/15 is now estimated at 142 million bags, 3.2% less than 2013/14. This is slightly higher than the previous estimate, due to increased production expected in Honduras (revised up to 5.4 million), and slight upward adjustments in Tanzania (to 1 million), Cameroon (475,000), Rwanda (280,000) and Burundi (250,000). Production in India, on the other hand, has been revised down slightly to 5.5 million bags, according to the post-monsoon estimate of the Coffee Board of India, and Mexico has also been adjusted slightly lower to 3.9 million bags. Output in Brazil, Vietnam, Colombia and Indonesia has been maintained at the same level.

As a result, world coffee production is likely to be some 4.6 million bags lower compared to 2013/14, with both Arabica and Robusta estimated lower, by 2.8% and 3.7% respectively. In terms of the regional distribution, production in South America is estimated 6.8% lower on 62.7 million bags, giving it a 44.1% share of the world total. Asia and Oceania is also lower by 4.8%, accounting for 31.2% of the world total. In Mexico and Central America, output is estimated at 18 million bags, which is 7.9% higher than 2013/14, suggesting that the impact of coffee leaf rust is lessening somewhat. However, it should be kept in mind that this is still over 2 million bags less than the region's production in 2011/12, before the outbreak, and the social and economic damage to many countries is ongoing. Finally, production in Africa is considered to be increasing by 5.2% to 17 million bags; if realised, this will be the first time Africa has reached 17 million since 1999/2000. This would also increase its share of the world total to 12%.

Finally, certified stocks on the London futures market have been significantly reconstituted over the last year, from a low of just 270,000 bags in April 2014 to 2.6 million in February 2015. This reflects the large level of exports from Vietnam and Brazil over the last 12 months, which have compensated for the lower availability from Indonesia. Certified stocks on the New York market, on the other hand, have been declining gradually over the same time period, from nearly 3 million bags to 2.6 million. |

|

Corn CornNearby Futures WSJ

USDA Reports to Support Corn Prices

March 31, 2015 (agweb.com) by Bloomberg

U.S. corn inventories on March 1 jumped more than forecast to the highest level since 1987, adding to prospects for ample supplies that have eroded prices the past 12 months, a government report showed.

Farms and warehouses held 7.745 billion bushels of corn to start this month, up 10.5 percent from 7.008 billion a year earlier, the U.S. Department of Agriculture said Tuesday in a report after surveying grain companies and farmers. The average estimate of 30 analysts in a Bloomberg survey was 7.609 billion.

Bigger global grain and oilseed supplies have helped drive world food costs to the lowest since 2010, with the Bloomberg Grains Subindex dropping more than 25 percent in the past year. A glut of corn, used in everything from animal feeds to alternative fuels, may signal lower costs for meat producers including Tyson Foods Inc. and for makers of sweeteners and ethanol such as Archer-Daniels-Midland Co.

Corn futures have tumbled about 20 percent in the past year on the Chicago Board of Trade, closing Monday at $3.945 a bushel after farmers produced two consecutive years of record crops. The United Nation's food index declined in February to the lowest since July 2010 amid bumper global harvests of wheat, corn and soybeans.

Corn supplies held by farmers on March 1 were 57 percent of the total, up from 55 percent a year ago, USDA data show. Total disappearance in the three months ended March 1 rose to 3.47 billion bushels from 3.44 billion a year earlier.

U.S. soybean inventories on March 1 were pegged at 1.334 billion bushels, up from 994 million a year earlier and below the 1.348 billion bushels expected by analysts.

U.S. inventories of all classes of wheat on March 1 rose to 1.124 billion bushels from 1.057 billion a year earlier, the department said. Analysts expected 1.141 billion, on average.

Top

|

|

Orange Juice Orange JuiceNearby Futures WSJ

March 12, 2015 (theLedger.com) by Kevin Bouffard

Citrus News Cautiously Optimistic; Greening Affecting Orange Juice's Taste, Expert Says

Mike Irey says big harvest declines might be in the past, but fallow land is a problem

LAKE ALFRED | Florida citrus growers have no place to go but up.

Florida orange juice, their biggest product, seems to be headed in the other direction.

Those were some of the messages nearly 400 citrus growers and industry officials heard at Thursday morning's Grower Day seminar at the Citrus Research and Education Center in Lake Alfred.

The three-hour seminar sought to give industry officials a layman's summary of 99 presentations from 475 scientists over five days in February at the International Research Conference on HLB, the scientific acronym for the fatal citrus greening disease.

The upward momentum came in research by Mike Irey, a plant pathologist and director of research and business development at Southern Garden Citrus Processing Corp. in Clewiston, the juice processing subsidiary of U.S. Sugar.

Irey developed a disease model for citrus greening that suggests Florida trees may have sustained the worst damages from the disease and that annual fruit production may have bottomed out at present levels.

"If I'm right, we should be past the major declines," in the annual citrus harvest, Irey told the growers.

But Irey also presented research from USDA and University of Florida scientists that shows the bacterial disease does impart barely perceptible "off flavors" to orange juice, which he described as "a bitter, metallic taste."

Scientists are working to identify the chemicals that impart the bitter flavors and ways to counteract them in the juice, Irey said.

Research also shows greening increases levels of limonoids, a chemical also associated with bitterness in OJ, he said. The disease also lowers sugar levels and increases acids in oranges.

So far, the change in juice quality has come gradually enough that OJ consumers would not notice, Irey said. Juice processors can eliminate off flavors through blending.

But Irey said consumers probably would detect a change in flavor if comparing a glass of Florida orange juice produced before 2005, when greening first surfaced in the state, and one produced from oranges today, when greening has infected virtually every citrus tree.

Greening is a bacterial disease that weakens citrus trees and eventually kills them. Since the 2012-13 season, infected trees still able to produce healthy fruit have experienced record high rates of pre-harvest fruit drop, a major factor in the plunging annual harvest numbers.

Irey's disease model projects a more positive future for Florida orange production than an economic model released by the Florida Department of Citrus a year ago. The Citrus Department model projected the Florida orange harvest would fall to 103.4 million boxes this season and down to 85.4 million boxes in 2023-24.

The USDA on Tuesday projected the 2014-15 orange harvest at 102 million boxes.

Irey said his research built a "purely biological" model that projects greening's progression based on the behavior of other plant diseases. Biologically, plant diseases do the most damage in the initial years, then the effects level off.

Irey cautiously projected the annual Florida orange harvest leveling off at 95 million to 100 million boxes.But that projection could change if one or more assumptions in the model changes, he said.

The model assumes Florida growers would plant 3.1 million new orange trees annually to replace trees lost to greening and other diseases, Irey said.

That would be double the rate of new orange tree plantings in recent seasons, according to USDA statistics, which show Florida growers planted 1.5 million to 1.6 million new orange trees in the three years ending 2013.

The model's other major assumption is that fruit production on a greening-infected tree levels off at a 40 percent loss, Irey said."The big declines are probably over, but that's completely dependent on that loss figure," he said.

PSYLLID CONTROL

Other scientists at the seminar discussed research related to controlling the Asian citrus psyllid, the insect that hosts the greening bacteria and is responsible for spreading the disease.

Harold Browning, an entomologist and chief operating officer at Citrus Research and Development Foundation Inc. in Lake Alfred, a UF affiliate leading the research effort against the disease, capped the seminar by suggesting the best immediate solution will not involve science but economic and social policies.

"There are no, and are likely not going to be, what we call silver bullets. It's going to be a total management system," he said.

The reason greening is so virulent now is that Florida has 133,947 acres of abandoned citrus groves, which serve as a breeding ground for psyllids and the bacteria, Browning said.

Growers have abandoned those groves because they can't afford the cost of fighting greening against diminished profits from smaller harvests.

Virtually all of the psyllids in Florida carry the greening bacteria because they have refuge in the abandoned groves and can spread the disease to neighboring groves owned by growers still committed to fighting the disease, he said.

Growers will not have the confidence to plant those 3.1 million new trees each year if they can't protect those trees from infection next door, Browning said.

Top

|

|

Wheat WheatNearby Futures WSJ

U.S. Wheat Priced out of Global Markets

March 26, 2015 (Bloomberg.com) Jeff Wilson

U.S. wheat exports fell to the lowest in 25 years, underscoring the blow to farmers who are struggling to compete with foreign growers as the strengthening dollar makes American goods more expensive.

Their troubles are compounded by a world awash in wheat after two consecutive record global harvests, leaving exporters to undercut each other's prices in a bid to unload supplies at a time when domestic production costs are already relatively high. American exports in the week ended March 19 fell to the lowest for this time of year since 1990, government data showed Thursday.

"The strong dollar will continue to squeeze U.S. exports, and most farmers are looking already looking at losses," Sterling Liddel, a vice president of Rabobank International's food and agribusiness research advisory in St. Louis, said in a telephone interview.

The European Union overtook the U.S. as the biggest wheat shipper in 2014. The gap is set to widen because Europe's record crop and sliding currency make it the world's most competitive supplier, according the U.S. Department of Agriculture. Farmers aren't the only commodity producers suffering from the dollar's rally, with American steelmakers getting undermined in their own backyards by cheaper imports.

The euro reached a 12-year low against the dollar this month amid a diverging outlook for global interest rates. The Bloomberg Commodity Index dropped 25 percent in the past 12 months. Most raw materials are priced in the U.S. currency.

U.S. wheat exports dropped 74 percent from a year earlier to 102,341 metric tons in the week ended March 19, Department of Agriculture data show. That was the third straight decline and lowest since the season started in June. Cumulative sales for delivery before May 31 are trailing last year by 24 percent.

"Without serious weather problems, wheat revenue will be below breakeven for the median U.S. farmer," Liddel said. "The drop in exports will be very challenging."

Global production jumped to a record in the past season after prices more than doubled in the decade through 2012. Swelling supplies are now driving futures lower, eroding farmers' income. The grain is the fourth-biggest U.S. crop, valued at $11.92 billion in 2014, USDA data show.

Wheat slumped 3.8 percent to $4.9925 a bushel in Chicago on Thursday, after the export data was released. Futures traded at $5.005 by 2:22 p.m. Singapore time on Friday, tumbling 30 percent in the past 12 months.

"Export sales were dismal," Shawn McCambridge, the senior grain analyst for Jefferies LLC in Chicago, said in a telephone interview. Wheat prices have "struggled with disappointing export demand the entire crop year, with few prospects for improvement unless quality or supply issues develop overseas," he said.

The U.S. shipped 31.497 million tons of wheat, flour and wheat products in the 12 months ended May 31, 2014, according to the USDA. The EU exported 31.925 million tons. For 2015, the USDA pegs U.S. sales at 25 million tons and the EU's at 31.5 million.

|

|

Dairy Products Dairy Products© Brian Gould, Agricultural and Applied Economics, UW Madison

MADISON, WI March 27, 2015 (REPORT 12)

Top

|

|

Butter Highlights

© Brian Gould, Agricultural and Applied Economics, UW Madison

MADISON, WI March 27, 2015 (REPORT 12)

BUTTER HIGHLIGHTS:

Group butter prices are steady to firmer. Demand is mixed for print butter as producers finish up holiday orders. Butter production is active. Producers in the West have begun shifting to bulk production to build inventories. Retail sales have been strong this year. Retail advertisements have increased. Cream supplies are tight among the regions as demand for other cream products have gone up. Export demand is light. Bulk butter prices range from 4 to 6 cents over in the Northeast, from 4 cents under to 6 cents over in the Central region and 5 cents under to market in the West. The NASS Cold Storage report noted U.S. butter stocks as of February 28, 2015 were 178.2 million pounds, an increase of 29.3 million pounds from a month ago, and an increase of 6.4 million pounds compared to a year ago. This week, a cooperative export assistance program accepted requests for 5.7 million pounds of butter. Friday at the CME Group, Grade AA butter closed at $1.7525, up $.0725 from a week ago.

Top

|

|

Cheese Highlights

© Brian Gould, Agricultural and Applied Economics, UW Madison

MADISON, WI March 27, 2015 (REPORT 12)

CHEESE HIGHLIGHTS:

Cheese markets this week moved within a trading range but evidenced no distinct trend. Cheese output continues to increase, following seasonal milk production, with many manufacturers electing cheese as the preferred use of milk volumes. Buyers are stepping up to acquire cheese at current price levels, especially cheddar. Some manufacturers are drawing on inventories to fill orders. Swiss demand also remains strong. Supplies of domestic foreign type cheese are readily available. NASS Cold Storage reports that U.S. stocks of cheese (total natural) at the end of February 2015 were 1.064 billion pounds,up 5% (54.0 million pounds) from February 2014. Friday in CME Group trading, barrels closed at $1.5450, up $.0250 from last Friday and 40# blocks closed at $1.5400, even with last Friday

Top

|

|

Polypropylene Copyright © 2014 The Plastics Exchange. LLC.

March 29, 2015 (Chicago, IL) The Plastics Exchange

The Propylene market saw limited activity, there were few transactions seen and prices were pressured. Suppliers were looking to unload spot PGP in the area of $.445/lb; buyers were hard to find as several PP resin reactors remain running at reduced rates, restricting demand for monomer. Earlier in the month, March PGP con- tracts settled down $.015/lb to $.49/lb - April is also looking lower and initial nominations surfaced down an- other cent to $.48/lb. The forward curve indicates further softness as prices are currently set to slide to $.43/lb by December, before recovering back into the $.50s/lb during 2016. RGP was indicated in $.35-.38/lb.

The spot Polypropylene market continued to be challenged by limited supply and relatively high prices. Four producers have Force Majeure conditions, restricting PP production; since resin producers cannot process all available PGP monomer costs have been sliding. Many resin contracts are still somewhat tied to monomer, so consequently, a very wide range of prices are seen in the PP market. Those processors well supplied by con- tracts scoff at the high spot prices floated by resellers, while processors that are short of material have little choice but to pay up. PGP contracts are poised to slip again in April, but resin producers will look to hold PP prices steady or even prop them a couple pennies higher, utilizing the tight supply/demand dynamics to in- crease margins a little bit more. Pinnacle Polymers is currently bringing their production back to more normal levels, some so spot relief might ensue.

|

|

The King Nut Report

March 30, 2015 (Solon, OH) King Nut

PEANUTS - Current spot prices for Peanuts have remained firm with limited blanching availability being the leading factor. Demand for Peanuts has been increasing steadily. Even through the price shocks of the 2011 and 2012 crop years, when pricing set a new 20 year high, utilization of Peanuts in most categories continued to increase. Total utilization to date for the 2015 crop year is also trending upwards.

ALMONDS - Forecasts are mixed for this year's Almond crop. The bloom is complete and the nutlets are growing. Warm weather in January and the lack of chilling hours the trees endured may affect the crop. Meanwhile, there has been no positive change in the drought situation. The snow pack in the mountains remains at extremely low levels and the state of California has advised there will be limited to no allocations of water for certain areas. Though it is still very early in the growing season and various factors could influence the results, it is doubtful that anything will happen that could significantly lower prices from current levels in the foreseeable future.

CASHEWS - 2014 was a record year for Cashew imports into the U.S. Demand and popularity remain very strong in the U.S., India and China. EU and Australian buyers are struggling with a weak currency, which has dampened demand. Continued Euro weakness may allow commodity prices to remain stable to soft while a turnaround against the USD may spike demand and prices. Regardless of the current effects of the EU and Australian economies, some grades of Cashews remain tough to source and consequently are selling at a premium to the overall market. Those tough to source grades include Whole 180, Whole 210, Splits, Butts and Pieces. Demand for Whole 240 also continues to grow as virtually all "BIG BOX" stores are heavily promoting this product.

PECANS - 2014 was a small crop year for U.S. Pecans at 265 million pounds. The previous year's carry-over of 171 million pounds plus Mexico's 2014 crop of 100 million pounds brings the total available supply to 536 million pounds against annual consumption of nearly 500 million pounds. Chinese demand remains strong for the larger nuts that produce larger halves, large pieces and extra-large pieces and that demand continues to put pressure on the market. Prices are firming and may continue to do so throughout 2015. Industry consensus is that any commodity needed through December should be booked as soon as possible.

Top

|

|

Hot Topics

December 3, 2014 (NRN.com) by Bret Thorn

Chefs predict top culinary trends for 2015

National Restaurant Association releases "What's Hot in 2015" forecast

Local sourcing of meat, seafood and produce is expected to remain a top culinary trend in 2015, but nose-to-tail cooking, bruschetta and kale salads are on the decline, according to an annual survey of chefs conducted by the National Restaurant Association.

For its "What's Hot in 2015" Culinary Forecast, released Wednesday, the NRA surveyed nearly 1,300 chefs, all members of the American Culinary Federation. They were given a list of 231 items and asked to rate them as a "hot trend," "yesterday's news" or a "perennial favorite."

The top four hot trends are the same as last year: locally sourced meats and seafood, locally grown produce, environmental sustainability, and healthful kids' menus. Last year's fifth place trend - gluten-free items - fell to 16th place, replaced by natural ingredients/minimally processed food, which made its debut on the top 20 list. Food waste reduction/management, at ninth place; housemade/artisan ice cream, at 18th place; and artisan cheeses, at 20th place also made their first appearances in the top 20.

Hudson Riehle, senior vice president of the NRA's research and knowledge group, said the growing trend of food waste reduction and management "mixes those eco-friendly practices with the social responsibility component [such as donating extra food to those in need] as well as the additional benefit of cost management."

Artisan butchery was not far behind artisan cheese, in the 23rd spot. Other top gainers were housemade condiments, at 40th place, and oven-baked items in kids' meals, at 53rd place, according to the NRA.

Riehle added that rising food costs were cited by 34 percent of operators as their top challenge, rising from just 18 percent last year, and in stark contrast to pre-recession surveys, when labor recruitment and retention was always cited as the biggest challenge. He also noted that wholesale food prices rose by 1.2 percent from September 2014 to October 2014, and have currently increased by 5.3 percent year over year, the highest growth rate in three years.

Besides underutilized fish, doughnuts, grass-fed beef and ethnic condiments, other trends that gained in popularity among chefs included grilled vegetables, brown/wild rice, free-range pork/poultry, specialty iced tea, alternative red meats, fresh beans/peas, root vegetables and gelato.

Trends declining in popularity, in addition to nose-to-tail, kale salads and bruschetta, were hybrid desserts, housemade soft drinks, gluten-free cuisine, ethnic-inspired kids dishes, Korean food, Greek yogurt and milkshakes.

Topics marked most frequently as "yesterday's news" were insects, foam/froth/air, gazpacho, bacon-flavored/covered chocolate and popovers.

Topping the list of perennial favorites were barbecue, Italian cuisine, fried chicken, French toast and frying.

The NRA also broke down the top trends by category, noting that microdistilled/artisan spirits were the top alcoholic trend, followed by locally produced beer, wine and spirits. Gourmet lemonade and specialty iced tea topped trends in the non-alcoholic beverage category.

In the appetizer category, vegetarian starters were the top trend, followed by house-cured meats.

Ethnic-inspired items remained the top breakfast trend, followed by traditional ethnic breakfast items.

Housemade/artisan ice cream was the top dessert trend, followed by bite-sized or miniature desserts.

Peruvian and Southeast Asian cuisines were singled out in the "ethnic flavors and cuisines" category, in fourth and fifth places, respectively. Topping the list was ethnic fusion cuisine, followed by authentic ethnic cuisine and regional ethnic cuisine.

Although gluten-free food has slipped down chefs' radars, 6 percent said it would be the hottest culinary trend 10 years from now, making it the fifth most popular answer. The most popular answer was environmental sustainability, followed by local sourcing, nutrition, and ethnic cuisines and flavors.

To see the full report, visit the NRA website.

Top

|

|

|