Light Crude Oil Light Crude OilNearby Futures WSJ

January 29, 2015 (WSJ.com) by Georgi Kantchev

Oil Markets Rebound as Record High Supply Drags on U.S. Futures

U.S. Stockpiles Hit 84-Year High

LONDON- Oil markets rose on Thursday rebounding after reports of record high oil supplies sent U.S. futures prices close to six-year lows.

U.S. data showing crude stockpiles at more than an 80-year high added to signs that the global oil glut that has pummeled prices since midsummer will likely persist well into this year. Oil prices are off close to 60% since a peak in June.

Brent, the global price benchmark, rose 0.7% to $48.74 a barrel on London's ICE Futures Exchange. In New York, March-dated WTI, the U.S. marker, was little changed at $44.46 a barrel,

Thursday's bounce back is largely technical with some investors taking profit after hitting a new low overnight, said Jameel Ahmad, chief market analyst at FXTM.

WTI settled at its lowest level since March 2009 on Wednesday after data from the U.S. Energy Department showed the country's oil stockpiles rose by a more-than-expected 8.9 million barrels in the week ended Jan. 23. The stockpiles are now near 407 million barrels, an 84-year high.

"What is really shocking is that U.S. production still continues to increase despite low crude oil prices," Phillip Futures analysts said. "Without a drop in U.S. crude production, it is going to be an uphill battle for oil bulls."

The surge in U.S. production has been driven by the booming shale oil industry taking advantage of technologies such as horizontal drilling and hydraulic fracturing to unlock new oil and gas reserves.

The rise in stockpiles is being driven by continued increases in U.S. oil output, which despite the fall in prices still grew at almost 15% over the year last week, according to Capital Economics, which expects stocks to continue to rise over the next few months, limiting price increases over the next year.

Some analysts, however, expect U.S. production to slow sooner than the market expects.

Norbert Rucker, head of commodity research at Julius Baer, said that as drilling in the U.S. shale oil industry has been "dropping like a stone" since December and there is usually a four-month lag between this affecting production growth, a flattening of U.S. output should be expected soon.

This would drive a rebound in prices but the "new normal" will be lower at about $65 a barrel, a lower level than in recent years, Mr. Rucker said, citing advances in technology that have deflated production costs.

"We also know now there is a lot more oil in the ground," he added.

Nymex reformulated gasoline blendstock for February-the benchmark gasoline contract-rose 0.4% to $1.3502 a gallon, while ICE gas oil for February changed hands at $475.25 a metric ton, down $3.25 from Wednesday's settlement.

-Eric Yep contributed to this article.

Top

|

|

Coffee CoffeeNearby Futures WSJ

December 30, 2014 (bloomberg.com) by Marvin G. Perez, Luzi Ann Javier and Gerson Freitas Jr.

Winner Becomes Loser as Rain Revives Brazil Coffee Supply

Coffee, the best-performing commodity of 2014, is ending the year in a bear market that shows few signs of ending.

Prices that doubled this year by October fell 12 percent in the past two months as rains aided parched trees in Brazil, the world's top grower. November was the wettest month of the year, after the worst dry spell in eight decades forced Starbucks Corp. (SBUX) and Folgers to charge more for their coffee.

Ecom Agroindustrial Corp. predicts the 2015 crop will be at least 25 percent bigger than the National Coffee Council's July forecast, and farmers are exporting more as Brazil's currency weakens against the dollar. While Brazil heads for its first three-year output drop since 1965, the easing drought renewed investor attention on a global surplus as production exceeds demand for a fifth straight season. Hedge funds have cut their bullish bets on prices by 35 percent since mid-October.

"We are a bit more bearish on coffee now," said Paul Christopher, the St. Louis-based chief international strategist at Wells Fargo Advisors, which oversees $1.4 trillion. Prices may drop 9 percent further by April to $1.50 a pound in New York, he said. "The November rainfall was pretty good, and we also have adequate global supplies."

Rally Ending

Arabica-coffee futures tumbled 12 percent this month, paring this year's advance to 49 percent. While that's twice the gain for cattle, the next-biggest increase among the 22 items tracked in the Bloomberg Commodity Index, only crude oil, gasoline and heating oil fell more in the past 10 weeks. The MSCI All-Country World Index of equities rose 2.7 percent this year, while the Bloomberg Dollar Spot Index surged 11 percent.

Coffee probably will slip to $1.582 before March 31, according to the average estimate in a Bloomberg survey of 17 analysts. Futures slid 0.2 percent to settle at $1.648 in New York today.

The crop that Brazilian farmers will harvest from May to October will reach 50 million bags, Pully, Switzerland-based Ecom, the second-largest trader, said Dec. 10. The forecast was matched the same day by Brazil-based Exportadora de Cafe Guaxupe Ltda. In July, the National Coffee Council, said output would drop below 40 million bags, the smallest since 2009. Each bag weighs 60 kilograms, or 132 pounds.

In Minas Gerais, the top producing state, farmer Josť Maria Pontes said the wet weather means he will boost production by 22 percent to 5,500 bags next year on his 234-hectare farm in Monte Santo de Minas. "As the rains came in November, I became more optimistic," he said.

Crop Risk

With the harvest still months away, there's still a risk to supply. Citigroup Inc. predicts coffee will average $2.15 in the first quarter as Brazilian output drops. Rabobank International forecast $1.95 in the first quarter before climbing to $2 in the second.

"The rains did help plantations recover in Brazil, but they didn't fix the problem," said Thiago Cazarini, president of Cazarini Trading Co., a broker in Varginha, Minas Gerais. "A lot of the fruit will not develop, and that could lead the market up."

At the same time, global demand has never been higher, with expanding sales in the U.S., Asia and Europe. Consumption will reach a record 147.6 million bags in the marketing season that began in October for most producers, up 3.7 percent from a year earlier, the USDA estimates. Volcafe Ltd., a coffee trader, estimates demand will exceed harvests by 9.9 million bags in season that began Oct. 1, compared with a surplus of 7.4 million a year earlier.

More Coffee

Global output has exceeded demand for five straight seasons, according to the U.S. Department of Agriculture. Supplies are getting a boost from harvests in Central America and Colombia, where output will rise this year to the highest since 2008, the USDA estimates.

High prices have sparked a surge in exports, boosting inventories of arabica beans at ports in consuming countries as of Sept. 30 by 2.3 million bags from a year earlier, the most since at least 2011, Volcafe estimated in a November report. As of November, farmers in Brazil sold 65 percent of the harvest for delivery next year, up from 55 percent a year earlier, forecaster Safras & Mercado said Dec. 11.

Rising Inventories

In the U.S., the largest consumer, stockpiles of unroasted raw beans reached a nine-year high in July and are heading for a fourth straight annual increase, which would be the longest since 1992, industry data show. Seattle-based Starbucks, the largest coffee-house owner, has secured about 65 percent of its coffee needs for 2015, according to Haley Drage, a spokeswoman.

"There's no concern for nearby supply in the U.S.," George Kniesel, a vice president for commodities at Massimo Zanetti Beverage Group, the maker of Chock Full O'Nuts and Hills Bros. coffee, said in a telephone interview from Suffolk, Virginia. "Roasters have very good coverage. You're able to buy coffee throughout next year today, if you want to."

|

|

Corn CornNearby Futures WSJ

USDA Reports to Support Corn Prices

© Alison Rice

By Darrel Good, Department of Agricultural and Consumer Economics, University of Illinois

Today (January 12, 2015), the National Agricultural Statistics Service (NASS) of the USDA released the final estimates of the size of the 2014 U.S. corn and soybean crops and estimates of the stocks of corn and soybeans in storage as of December 1, 2014. In addition, the World Agricultural Outlook Board of the USDA released new forecasts of 2014-15 marketing year U.S. and world supply, consumption, and ending stocks of these two crops (as well as for many other commodities). These estimates and forecasts may dominate corn and soybean price behavior into the spring of the year. Following is a brief discussion of the estimates and forecasts and their price implications.

The 2014 corn crop is estimated at 14.216 billion bushels, 191 million bushels less than the November forecast and 133 million bushels less than the average trade guess. The U.S. average yield is estimated at 171 bushels per acre, 2.4 bushels less than the November forecast. There were relatively large yield changes for a number of states, with large declines in Iowa, Kansas, Minnesota, South Dakota, Michigan, and Wisconsin. Somewhat surprisingly, the estimate of planted acreage in 2014 was reduced by only 288,000 acres and the estimate of harvested acreage was increased by 39,000 acres. The relatively small number of planted acres that were reported to FSA through mid-December had indicated that NASS might reduce the estimate of planted acres even more. FSA will release the final report of 2014 planted acres (which NASS has already seen) on January 15.

December 1 corn stocks were estimated at 11.203 billion bushels, 750 million larger than stocks of a year ago and 80 million bushels larger than the average trade guess. Based on Census Bureau estimates, corn exports during the first quarter of the 2014-15 marketing year totaled 408 million bushels, 58 million more than exported during the same quarter last year. Based on EIA estimates of ethanol production, total domestic processing uses of corn during the quarter totaled 1.617 billion bushels, up 71 million bushels from use of a year earlier. Implied feed and residual use of corn during the quarter totaled only 2.225 billion bushels, down 91 million bushels from the revised first quarter use of a year ago. For the year, the USDA projection of marketing year exports was unchanged at 1.75 billion bushels, with no significant changes in production estimates for the rest of the world. The projection of ethanol use of corn was increased by 25 million bushels, to 5.175 billion bushels, but the projection of feed and residual use was lowered by 100 million bushels, to 5.275 billion bushels. First quarter feed and residual use of corn represents 42 percent of the projected use for the year. That is well below the average of 46.9 percent in the previous two years, but above the 39.7 percent average of the six years prior to that.

Year-ending stocks of corn are projected at 1.877 billion bushels, 121 million less than last month's projection and 50 million bushels less than the average trade guess. Projected stocks represent only 13.8 percent of projected marketing year consumption. The 2014-15 marketing year average corn price is projected in a range of $3.35 to $3.95, $0.15 higher than the December projection.

Top

|

|

Orange Juice Orange JuiceNearby Futures WSJ

Florida Without Oranges

A disease is decimating the citrus industry, leading some to wonder what's next for parts of the Sunshine State.

Sam Wimborne/Reuters

PLANT CITY, Fla.-More than a century ago, Martha Sue Hawkins' ancestors homesteaded on this flat land in central Florida. Her grandfather planted the first orange groves in the 1900s, and then her father added more trees as Americans started getting used to the idea of orange juice on their breakfast tables.

By the time Martha Sue and her husband Richard Skinner took over the property, they had 2,600 trees stretching out across 15 acres in neat rows, and made a handy profit selling the oranges to processing plants each year, which would make the fruit into juice.

But in 2012, the Skinners pulled up every single tree. Their groves had been infected by the Asian citrus psyllid, a tiny bug that carries a bacteria which attacks a tree's vascular system, eventually killing it. The disease, which showed up in Florida in 2005, has created a phenomenon known as citrus greening that is decimating the orange and grapefruit industries in the state.

"Unless they find a cure for this disease, there will not be citrus in this state."

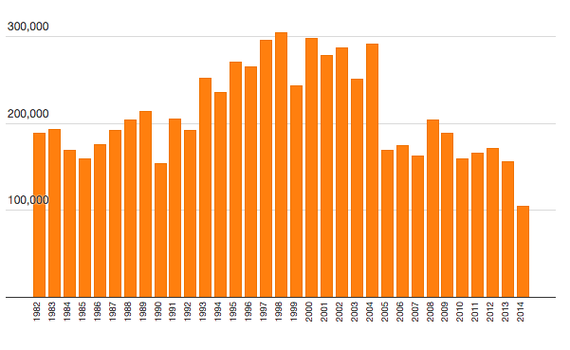

Florida may produce as few as 89 million boxes of oranges this year, forecasters say, down 63 percent from the 242 million boxes the state produced a decade ago. In a state where citrus is on the license plates and 75,000 people made their living from it just a few years ago, this could have a huge impact. It's not just growers like the Skinners who are feeling the pinch-citrus generates jobs for the companies that fertilize the trees, the people who pick them, the processing plants that make the juice, and the advertisers that figure out how to sell it.

One report, released in December by the University of Florida, estimated that citrus generates $10.68 billion annually in the state, contributing $326 million to state and local coffers. But because of citrus greening, the study estimated, the industry in the 2012-'13 season employed 18 percent fewer people than five years ago, and generated about $1 billion less each year since 2007. There are now 476,000 acres of citrus in the state, down from 750,000 in 2000.

Florida Citrus Production, Thousands of Boxes

USDA, National Agricultural Statistics Service/Datawrapper

With no cure in sight, some in Florida are starting to wonder if the industry could be completely gone in a matter of years-and what the state will do without it.

"We would be hard-pressed not to have citrus-it is critically important to the state, not only financially, but as a big part of our export business," said Dominic Calabro, the president of the government watchdog Florida TaxWatch.

It's not just greening that driving growers to give up on the industry. Freezes in the 1980s, hurricanes in the early 2000s, and a disease called canker made it increasingly difficult for small growers to stay afloat. Packing plants have been consolidating and shutting down for decades, and in coastal areas, developers have long been pulling up citrus groves and putting up homes and hotels.

In addition, calorie-counting Americans seem to be less interested in orange juice than they have been in decades. About 90 percent of the citrus harvested in Florida goes into juice, which is now competing on the shelves with different types of waters, sodas, and teas. In the 2003-'04 crop year, Americans consumed an average 5.49 gallons per person of citrus juice each year; in 2012-2013, they drank just 3.95 gallons, according to Florida Agricultural Statistics Services.

Grapefruit production is also shrinking as a younger generation doesn't seem to have a taste for it and an older generation is told to stay away if they're taking certain medications. The state produced 18 million boxes of grapefruit in 2013, half of what it produced a decade ago.

"There's been a tremendous contraction in fresh fruit production in Florida," said Thomas Spreen, a professor emeritus at the University of Florida's Food and Resource Economics Department. "There have been a series of events that knocked the industry down again and again."

It's hard to imagine Florida without citrus-it would be akin to Vermont without maple syrup, Iowa without corn, or Georgia without peaches, Spreen said.

"Citrus is very much a part of the fabric of Florida," he said. "It would be kind of like if Texas didn't have any cows anymore-Texas wouldn't blow up economically, but it would take something out of the culture of Texas."

Still, thousands of people throughout Florida, including the Skinners, are trying to imagine that very future. Other growers have pulled up their trees and moved on to strawberries or blueberries or pine trees, Richard Skinner told me, and indeed, the roads into Plant City are dotted with workers bent over strawberry fields.

If Skinner looks out the front window of the shack where he now sells peach and plum trees and other plants from a nursery, he can see his neighbor's property, where rows of pine trees now stand. The Skinners want to farm something because they get a property tax break from the state for running an agricultural operation-they're thinking of growing hay.

"I just knew that I was between a rock and a hard place," Skinner told me. "I had to make a decision, otherwise I had to pay the tax man a whole lot more money than I wanted to pay."

Eventually, Skinner told me, he hopes to grow olives, as other farmers in northern Florida have done. But so far there's no processing plant to handle them, though he thinks that may change soon.

Some growers have just given up and abandoned their groves without pulling up the trees, which can worsen citrus greening, since the psyllid will feast on trees that don't have pesticide, and then fly to nearby groves and infect those trees. There were 126,000 acres of abandoned groves in Florida in 2014, and 7,300 acres of forested areas that have abandoned citrus in their canopies, according to the USDA.

There are some measures that arrest or slow the spread of the disease, but they're costly. Growers are now treating their trees eight times a year or more to reduce the number of psyllids on them, they're also adding fertilizer and other nutrients to the trees' roots to help them fight the disease. A citrus grower now spends $2,250 an acre to grow trees-prior to greening, he would spend $850 an acre, according to Florida Citrus Mutual, an industry association.

"The smaller growers seem to be really thinking about the economics, a lot of them are deciding to throw in the towel and are selling their groves," said Dean Saunders, a real-estate broker who served in the state House of Representatives and comes from an agricultural family.

As many growers give up, the infrastructure to support citrus is shrinking, too. United Indian River Packers, Inc., one of Florida's oldest packinghouses, announced last year they were auctioning off their properties in order to focus on other businesses. A Naples store where customers could buy fresh produce before it was shipped elsewhere closed in May, the land sold to a builder.

"You kind of scratch your head and wonder-is there even going to be an industry?" Saunders said. "I don't believe that but I understand why people would ask the question."

In many coastal areas where tourism can replace citrus and the market for second homes is picking up, there are other jobs and types of industry. But in inland areas, the decline of citrus could be more of a challenge-and its complete disappearance could be devastating.

"If I planted a new tree today, it would get greening this week and it will be dead in five years for sure," said Scott Young, a fourth-generation farmer who owns 400 acres in Polk County, which is located between Tampa and Orlando. "It's kind of grim."

Young is looking to sell all but 150 of the acres his family owns. He'd initially thought he could find buyers to develop the land into homes, but Polk County was hit hard by the housing bust and is still suffering. Developments were abandoned and commercial spaces lost their tenants. He's now hoping he can sell to someone who will run cattle on the land, or plant blueberries, but he's doubtful anyone will want citrus.

"Unless they find a cure for this disease, there will not be citrus in this state," he said. "It's going to have a major impact to the state, as far as the interior of the state goes."

Indeed, landlocked Hendry County, which has Florida's highest unemployment rate at 9.7 percent, is one of the areas most dependent on citrus. In 1998, 13 percent of all the acreage in Hendry County contained citrus, now just 8 percent do, said Electa Waddell, a county spokeswoman.

"Agriculture is a chief industry in Hendry County and as citrus and other agriculture declines, it creates a ripple effect throughout the local economy," she wrote, in an email. As growers give up, other businesses are shuttering too. Duda Farms Fresh Foods, for example, closed its LaBelle citrus packinghouse in Hendry County, in 2008. A company spokesman said at the time that industry forecasts of further decline made it not worthwhile to run the packinghouse anymore.

Ron Reyes, the manager of Vision Ace Hardware in LaBelle, said that many local citrus companies have been making fewer charges on their accounts in the store, and nothing else has come to replace them. "Almost all businesses feel the pinch as citrus revenues decline-there is less cash in the local economy and growers buy less fuel, fewer pickups, computers-there are lots of ripple effects," said Gene McAvoy, who works at the Hendry County Cooperative Extension, an affiliate of the University of Florida that provides research on agriculture.

Other inland counties grappling with the decline in citrus include DeSoto and Hardee Counties. Hardee County manager Lex Albritton said that the county has seen an effect from declining incomes of residents who once worked in the citrus industry. "I've lost 3 percent of my tax base for each of the last two years," Albritton said. "I expect it to get worse."

Hendry County is trying to diversify its portfolio of businesses, said Gregg Gillman, the president of the Hendry County Economic Development Corporation. Leaders there are working to add a new cargo and logistics space with a 12,000 foot runway to an existing general aviation airport for use as an alternative to the busy port of Miami. The county also recently attracted a new biomass plant that will create 75 jobs, he said.

Eventually U.S. Sugar Corporation, headquartered in Hendry County, and landowners Hilliard Brothers hope to create a new development in the area with 18,000 residential units and 25 million square feet of industrial, retail, and office space, tied in part to the new airport. "In the last four years, there's been a very concerted effort to take on this diversification of the economy and create new opportunities for our people," Gilman said.

Still, many in Florida are sticking with citrus, hoping that scientists will find a cure for greening. The biggest growers are taking advantage of the little guys getting out of the business and buying more acres, doubling down on citrus. "We're fighting for it-the growers are fighting tooth and nail," said Mike Sparks, the CEO of Florida Citrus Mutual. "I know this is the most devastating challenge we've ever faced, but we're going to whip this disease, period."

Some growers are optimistic about a program announced as a part of the 2014 Farm Bill, which will provide up to 50 percent of the cost of tree removal and 65 percent of the cost of replanting trees, including labor, to replace trees affected by greening since October of 2011.

Others are hanging on because they don't know what else to do. They include Jay Clark, who has 400 acres of citrus. He took me around some groves near Wauchula, a small town in Hardee County, to show me the effects of greening.

Up and down the neat rows of trees, oranges were scattered on the ground, a sign that a tree is infected, since it releases fruit earlier than it is supposed to. Clark took a leaf in his hands and pointed out its yellow tint, another sign that the tree is infected. Other trees in his grove had barely any leaves. "As the growers say, you can throw a cat through some of these without hitting any limbs," he said. He picked a puny orange off one of the trees and handed it to me. It was slightly larger than a golfball. It was too small to even be squeezed for juice, he said.

Driving through the rural roads of Wauchula, Clark kept pointing out groves that no longer produce citrus. On one, grass had grown up through a field where only a few sickly-looking trees stood. Another was fenced in, but instead of neat rows of trees, only a few remained. Another field now has rows and rows of blueberries, although its owners grew citrus just a few years ago.

Clark runs cattle on another 5,000 acres of land, but says it doesn't make sense to turn his orange groves into grazing land. It takes three acres to run a cow on, and Clark can get $500 for a calf. But three acres will grow you a lot of oranges; an acre can produce about 600 boxes, which could fetch about $3,000. "There's no profit in it if you compare the two," he said.

Clark drove me by a grove where the owner had invested thousands of dollars trying to save his trees-they towered above most of the other groves, since they hadn't been torn down and replanted. But even those trees will soon grow sick, he warned, unless scientists can find some sort of silver bullet to cure greening, rather than just slow its progression.

Still, he's going to keep fertilizing his trees and hoping that scientists find a way to prevent the disease in new trees. He might even acquire a few more groves.

"When you've been in it all your life, you try not to give up. If there's any kind of ray of hope out there, somewhere, you keep on going," he said.

Top

|

|

Wheat WheatNearby Futures WSJ

Wheat Supplies Raised Due to Lower Feed Use

January 12, 2015

By Darrel Good, Department of Agricultural and Consumer Economics, University of Illinois

Feed and residual use for 2014/15 is lowered 30 million bushels reflecting disappearance for June-November as indicated by the December 1 stocks released in the Grain Stocks report. Seed use is lowered on the winter wheat planted area reported today in the Winter Wheat Seedings report. U.S. wheat supplies for 2014/15 are up slightly on increased beginning stocks. Projected ending stocks are raised 33 million bushels. The 2014/15 season-average farm price is projected 10 cents higher on both ends to $5.90 to $6.30.

Global wheat supplies for 2014/15 are raised 1.7 million tons with both increased production and beginning stocks. World wheat production remains record high and is raised 1.2 million tons led by a 1.1-million-ton increase for Ethiopia on improved weather conditions. EU is raised 0.1 million tons on updated government statistics. Global beginning stocks are up 0.5-million-tons almost exclusively on 2013/14 production revisions for EU.

Global wheat trade for 2014/15 is raised with exports up 1.2 million tons on larger supplies and stronger demand in several importing countries. Exports are raised 1.0 million tons for EU and 0.7 million tons for Ukraine. The EU increase stems from a fast shipment pace to date and expanded opportunities once Russia's export duties take effect. The Ukraine increase also stems from expanded opportunities resulting from Russian export duties. Exports are raised 0.5 million tons each for Canada and Iran, and 0.2 million tons each for India and Kazakhstan; these changes are all on a fast shipment pace to date. Partly offsetting is a 2-million-ton export decrease for Russia on announced export duties that will take effect February 1. EU and Iran imports are each raised 0.5 million tons. Uzbekistan and United Arab Emirates are raised 0.2 and 0.1 million tons, respectively. Partly offsetting are a 0.5-million-ton reduction for Ethiopia imports and a 0.2-million-reduction for China. The Ethiopia reduction reflects a larger crop; all other import changes are on pace to date.

Global wheat consumption for 2014/15 is up slightly mostly on increased feed use for Iran, Ethiopia, and Uzbekistan. A 0.2-million-ton increase for Ethiopia food use is offset by a 0.2-million-ton reduction for EU. Increased supplies are mostly offset by increased use with global ending stocks raised 1.1 million tons.

|

|

Dairy Products Dairy Products© Brian Gould, Agricultural and Applied Economics, UW Madison

MADISON, WI January 16, 2014 (REPORT 2)

Top

|

|

Butter Highlights

© Brian Gould, Agricultural and Applied Economics, UW Madison

MADISON, WI January 16, 2014 (REPORT 2)

BUTTER HIGHLIGHTS:

Butter production continues to be strong as cream supplies are readily available at profitable margins for churning. Export orders are improving, spurring additional volumes of 82% production. Domestic sales are mostly steady with some variance from region to region. Stocks are generally building. Bulk butter is actively exchanging hands with prices ranging from 4 cents under to 7 cents over the market, based on various time frames and averages used. Friday at the CME Group, Grade AA butter closed at $1.5500, up $0.0100 from a week ago. This week, a cooperative export assistance program accepted requests for 11.7 million pounds of butter. According to FAS, January-November U.S. butter exports total 150.6 million pounds, 16% below last year during the same time span.

Top

|

|

Cheese Highlights

© Brian Gould, Agricultural and Applied Economics, UW Madison

MADISON, WI January 16, 2014 (REPORT 2)

CHEESE HIGHLIGHTS:

Cheese supplies are building throughout much of the country this week. Milk flows into cheese plants continue to be strong, keeping production active. Some plants are balancing extra milk into cheese. This is occurring even as less spot milk is being shopped around, reflecting continued strong milk production. Reports indicate that food service orders are sluggish due to lower restaurant business following the holiday weeks. Demand for mozzarella is expected to increase in the near term as pizza sales will increase when colleges and universities begin their spring terms. Domestic foreign type cheese prices rebounded this week. Some wholesalers are looking to contract beyond Q2 i their current negotiations and are finding that deals can be made at lower prices. Friday in CME Group trading, barrels closed at $1.4500, down 9 1/2 cents from last Friday and 40# blocks closed at $1.4700, down 12 cents from last Friday.

Top

|

|

Polypropylene Copyright © 2014 The Plastics Exchange. LLC.

January 23, 2015 (Chicago, IL) The Plastics Exchange

The spot resin markets slowed a bit while prices slid further. A heavy flow of Polyethylene offers continued to pelt the secondary market; however, fresh Polypropylene offers were still spotty. Processors that required material after the year-end lull seemed to have had their fill through mid-month. Purchasing then dropped off this past week as buyers anticipated cheaper February contract prices, particularly PE, which could be coming around the bend. Houston prices are still eroding, as export offers drop to meet international levels and spur demand.

Spot Propylene saw better activity and prices began to recover a little. PGP for January delivery most recently transacted at $.48/lb, which was up $.02/lb for the week. Jan PGP contracts settled at $.495/lb, which was down $.12/lb. Given current spot levels, we would expect very little change, if any, for February contracts. The stability could be good for downstream resin demand. The back end of the forward market only gained about a cent, so the PGP curve steepened a tad, indicating a $.025/lb discount by Dec 2015. RGP is around $.35/lb, providing very healthy splitter margins, especially considering this price level.

The spot Polypropylene market remains challenging; prices are dropping but supplies are relatively light. Producers have not relied heavily on the export market to balance off inventories, instead they have kept operating rates reduced to closely match forecasted orders, and so a significant surplus of material has simply not developed. Spot PP prices have fallen about $.22/lb since they peaked in October. However, Polypropylene contract prices, which are still heavily tied to monomer, have decreased $.25-.27/lb since November - including the $.10-.12/lb decline in January. PGP monomer costs have recently stabilized, so unless something changes significantly, the bulk of the PP market's break has already been seen.

Spot resin trading came off its active pace, although prices continued to decline. Resellers have been focusing on back-to-back railcar sales rather than taking additional resin into inventory while they sell off their uncommitted warehoused resin. Contracts for both PE and PP are decreasing for the third month in a row. PP contracts are down about $.25/lb, supplies are tight and further downside is limited. If only $.04/lb comes out of PE contracts this month, they will have only fallen a total of $.11/lb; PE supplies are ample and spot prices are well discounted, so contracts could have Michael Greenberg more to go in February.

|

|

The King Nut Report

January 28, 2015 (Solon, OH) King Nut

PEANUTS - Pricing for Peanuts has been holding relatively stable for the past several months. Blanching time, and therefore the available supply of blanched Peanuts, remains somewhat constrained and is expected to continue to be so through at least the majority of 2015. At this time shellers do have a level of confidence in the future Peanut market and some are already accepting bookings for the fall crop.

ALMONDS - There was a slight softening in the Almond market but since then prices have firmed back up. There is limited forward contract activity while shellers are closely watching weather reports and forecasts of the spring bloom for indications of the future crop. Demand for Almonds remains strong and could support current price levels even if positive weather and bloom reports indicate increased supply of Almonds for 2015.

CASHEWS - The Cashew market firmed in fourth quarter but then softened somewhat in early January. Pressure from other commodities, most significantly Almonds, is keeping Cashew pricing from falling any further. Cashews have held position as the most attractively priced premium nut for over a year and some demand for Almonds has been transferring to Cashews. News from the spring Almond bloom will be important to the future Cashew market.

Top

|

|

Hot Topics

December 14, 2014 (www.usnews.com) by Susan Johnston

What Will Cost More in 2015

Prepare to pay higher prices for chocolate, coffee, shipping and airfare next year.

Bad news for chocoholics: More worldwide demand and a West African drought impacting cacao crops could raise the price on your favorite sweet treat next year. "Manufacturers have been warning us of a cocoa shortage," says DealNews.com spokesman Mark LoCastro. "Chocolate prices have been rising, particularly small artisanal chocolates that use more cacao for dark chocolate."

But he doesn't expect that to diminish our cravings. "I think people will always buy chocolate," LoCastro says. "It's such a delicacy for some and an addiction for others." Paying a few extra cents for a chocolate bar may not cause much sticker shock, but here's a look at other goods and services that will cost more in 2015.

1. Coffee and bourbon. The cost of two favorite beverages is likely to increase in the coming year due to supply and demand. Coffee prices were forecast to drop in 2014, but a severe drought in Brazil had the opposite effect, according to LoCastro. Starbucks raised prices last summer, as did several other coffee makers. Meanwhile, the rising popularity of bourbon has caused some distilleries to ration bottles and raise their prices. "Bourbon is just increasing in popularity, and because of the aging process, you can't just whip up another batch," LoCastro explains.

2. Food. Droughts in California are likely to drive up not only the cost of agricultural products like avocados, but also beef and pork products. "Producers with both beef and hogs have thinned their herds in response to drought conditions," says Michael Levin, associate professor of marketing at Otterbein University in Westerville, Ohio. "As the price of the hog has gone up, people have started to switch their consumption towards chicken, which relies on corn." (Corn may be also subject to higher prices). Olive oil imported from Italy and Spain is also expected to cost more next year due to drought, LoCastro adds.

3. Health care. Medical costs will rise 6.8 percent next year, compared to a projected 6.5 percent for 2014, according to the PricewaterhouseCoopers Health Research Institute. "Pharmaceutical expenses are going to continue to go up," says Chip Manning, director of the Babson Center for Global Commerce at Sewanee - University of the South. "There's still some administrative cost issues in compliance obligations [with the Affordable Care Act]." Increasing life expectancies are also expected to drive up overall health care costs. To cope with rising health insurance costs, many employers are now considering shifting a greater share of these costs to their employees or switching to high-deductible health plans.

4. Debt. The past few years have seen ultra-low interest rates (good news for homebuyers, not so good news for savers). However, that may change in 2015. "The Fed has eliminated quantitative easing [where a central bank purchases securities to lower interest rates and increase the supply of money], and is expected to let interest rates start to rise, so the cost of debt will go up," Levin says.

5. Shipping. The U.S. Postal Service has chosen not to raise postage rates this January, but UPS and FedEx have announced shipping price increases for 2015. "People are going to have to absorb a good bit of that for those products that must be shipped that way," Manning says. Of course, shipping costs have been gradually rising in recent years, with several price increases in stamps and retailers like Amazon raising their minimum threshold for free shipping from $25 to $35. Amazon also raised the cost of Amazon Prime (which includes free two-day shipping on most items) from $79 to $99 last spring.

6. Travel. Planning a trip in 2015? Consider budgeting a little more money for airfare and hotel stays. Despite lower fuel costs for airlines, carriers may raise prices (and certainly haven't been shy aboutadding new fees) because of increased demand. "There is an improving economy, and airlines are operating at full capacity, so there are fewer flight bargains to be found," LoCastro says. "Flight bargains happen when there are empty seats." A recent report by the Global Business Travel Association and Carlson Wagonlit Travel predicts a 2.4 percent increase on domestic hotel room rates, and 2.2 percent price growth on airfare globally (although some transatlantic flights may be cheaper due to increased capacity).

But it's not all bad news. "We've seen a nice downward trend in gas prices, which is important to a lot of us," Manning points out. A few other items, including cloud storage, smartphones, cranberries and butter may also be cheaper in 2015, LoCastro notes.

Top

|

|

|