A Resolution We'll Help You Keep!

As life changes and years pass, insurance needs can change dramatically. Just as we do an annual physical check-up, it is important to consider life stage events each year... marriage, children, divorce and retirement can all impact your insurance needs.

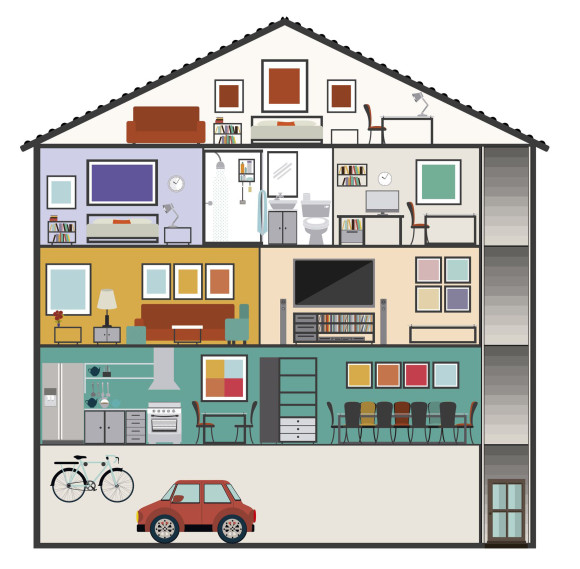

For most of us, our home is our most valuable asset; it is important to confirm that your homeowner's policy provides enough coverage for:

- The Structure of Your Home

- Your Personal Possessions

- Living Expenses if you must live elsewhere during repairs

- Your Liability to Others

The Structure of Your Home:

You will need enough insurance to cover the cost of rebuilding your home at current construction costs, not including your land. For a quick estimate of insured value, multiply the total square footage of your home by the local building cost per square foot. Other factors that determine rebuilding costs are exterior wall construction, style of house, number of bathrooms and other rooms, type of roof, additional structures and out-buildings, fireplaces, exterior trim, special features, custom kitchens and current improvements.

Standard Homeowners Policies provide for coverage from disasters such as fire, lightning, hail, explosions and theft, but they do NOT cover floods, earthquakes or damage caused by lack of maintenance.

Replacement Cost Polices pay for repair or replacement of damaged property with materials of similar quality.

Guaranteed or Extended Replacement Cost Coverage protects you against rebuilding costs exceeding policy limits due to an increased demand for building materials and construction professionals after a major natural disaster.

Ordinance or Law Endorsements can provide coverage if you are required to rebuild your home to meet higher standards imposed by newer Building Codes, etc.

Modified Replacement Cost Policies for older homes will pay for repair or replacement of older features such as plaster walls using standard materials and construction techniques in use today.

Your Personal Possessions:

Most policies provide coverage for 50-70% of the amount of insurance you have on the structure of your home. To determine if this is sufficient, conduct a home inventory. KnowYourStuff.org has a free app to simplify this process.

Actual Cash Value Policies factor in depreciation on your belongings, Replacement Cost Coverage will pay to replace your items with similar new ones.

Floaters & Endorsements provide additional coverage for expensive items such as jewelry, silverware, furs and computers.

Additional Living Expenses:

(ALE) pays the added costs of temporarily living away from your home if you cannot stay in it due to a fire or other insured disaster. It covers hotel bills, restaurant meals and other living expenses incurred while your home is being repaired or rebuilt.

Liability to Others:

Liability to Others:

This part of your policy protects against lawsuits for bodily injury or property damage caused by you, a family member or your pets to others. It will pay for both the cost of defending you in court and for any damages a judgement rules you must pay. If you own property and or have investments that are worth more than the limits in your policy, you may consider purchasing an Excess Liability or Umbrella Policy.

We're Here To Help!

Today, homeowner's policies provide a wider variety of coverages than just 5-10 years ago. This is why it is increasingly important to review your policy annually. Let us assist you in navigating these options to customize coverage that meets your specific needs.

Call us at 401-846-9629 to schedule your free policy review.

Read & download the full article here

Some content, International Risk Management Institute, Inc.

* * * * *