The Army, NYPD and State Department can't get enough workers with this job skill. Neither can Fortune 500 companies, hospitals, local courts, and schools.

|

The summer home-selling season beckons, and it looks like a hot one. What should you do to prepare to sell your home? These tips could increase value by 10 times.

|

There is so much conflicting advice about what's healthy and what's not these days. What should actually be on a healthy shopping list?

|

Were you sad when you heard that Twinkies were gone? Well the brand has made a $2 billion comeback!

|

Refurb company offers laptops in the $100 range and desktops from $30 to $200.

|

Get a quick look at where you can stay during your vacation in Cuba. Airbnb is the first to offer accommodation.

|

11 ways to use every part of your fruits and veggies. Chef Steven Satterfield says, "Timing is one of the keys to cooking the whole plant."

|

Are you a fan of The Sound of Music? To critics and the intelligentsia alike at the time (1965), the film was the symbol of all that was wrong with American cinema. Here's how one Boomer learned to appreciate The Sound of Music.

|

Seven valuable things you can learn from your tax return. Before you stash your tax documents in a file drawer, review your return for ideas on how to save in 2015.

|

How to make money with Facebook. Facebook has not only revolutionized how we form and develop social connections, but also how businesses interact with and market to their customers.

|

|

|

|

Time for spring cleaning? Did you know that you can clear out the clutter in your "financial house?" This month's article from Commonwealth Financial Network gives you some hints for a credit review, emergency fund revamp, paperless options, and more.

At Chornyak & Associates, we are always trying to find new ways to serve our clients and potential clients. Be sure to read about the new features we've added to our web-site Home page. You can view it by clicking here. Health, nutrition, vacation news, technology, consumer trends, entertainment - this newsletter is sure to have something to interest everyone. I hope you enjoy this month's selections!

Let us know what's on your mind. You can call or e-mail us with any comments or questions at 614-888-2121 or 877-389-2121 toll free, or chornyak@chornyak.com. Sincerely,

Joe

|

|

Spring cleaning your financial house

|

|

Commonwealth Financial Network reminds us that although these financial to-dos may take some time, checking them off your list will free you up to enjoy the season and ultimately save you time throughout the year.

Spring is in the air, which for many means cleaning out the clutter. But don't forget about clearing the cobwebs from your "financial house," too! Even if you recently took a look at your finances as you prepared for tax season, there still may be some items that could use your attention.

Dust off your credit report and score

If you're planning to buy a home or make another big purchase, a good credit rating can be critical. Businesses also inspect your credit history when evaluating applications for insurance, employment, and even leases. With so much in the balance, it's important to review your credit report for accuracy at least annually. Plus, it's a good way to catch signs of identity theft.

You're entitled to one free annual report from each of the three major credit reporting agencies-Equifax, TransUnion, and Experian - which you can request at www.annualcreditreport.com. (Be wary of similar-sounding sites that charge you for these reports.)

Revamp your emergency fund

If you don't have one already, starting an emergency fund should be on your spring cleaning to-do list. The size of your fund depends on your particular situation and factors such as:

- Family size

- Current debt

- Insurance coverage

The standard is to set aside three months of expenses in case you or a family member encounters the unexpected, such as job loss. If you already have an emergency fund, you may want to increase your savings to six months of expenses. Remember, it's far better to have an emergency fund and never need it than to experience the reverse scenario.

Revisit credit cards

Review the terms and conditions of your credit cards to ensure that they're still in line with what you originally signed up for. In light of recent security breaches, it's more important than ever to check that the plastic in your wallet continues to meet your needs.

Click here to continue reading the article.

|

|

|

New features on our website

|

|

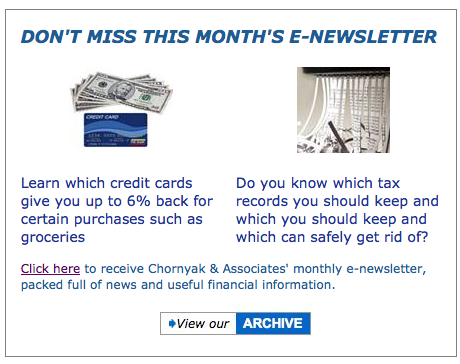

E-newsletter signup feature

We hope you enjoy receiving our curated edition of web news every month and would like you to pass on the opportunity to your friends and family.

You can do so by sending potential subscribers to our web site: www.chornyak.com.

When viewers scroll down the Home page, they'll find this new box:

By clicking on "Click here," they'll be taken to a simple form permitting them to sign up to get the Chornyak & Associates e-newsletter each month. By clicking on the ARCHIVE icon, web-site visitors will be connected to electronic versions of all e-newsletters since the beginning.

Financial Facts vs. Fiction featureThis helpful service provided by Commonwealth Financial Network, our a ffiliated broker/dealer, will provide new information each month to guide you in management of your financial affairs. That box looks like this:  We hope you'll benefit from these features and let us know your thoughts.

|

|

|

This guy has gamed the airline industry so he never has to pay for a flight again

|

|

Journalist Scott Keyes will be traveling to 13 countries and over 20,000 miles on his next trip, all for free.

Scott told Business Insider that he uses his massive collection of credit cards to gain points, frequent flyer miles, and plenty of other member perks all the time. He then turns around and uses those perks on vacations like his upcoming trip that will take him 20,000 miles on 21 flights - all for free.

This isn't luck. Keyes is somewhat of an expert on traveling for little to no cost, not unlike extreme couponers who put incredible amounts of time, energy, and thought into making sure they never pay a penny more than they have to when making purchases.

After jealous friends kept asking him how he does it, Keyes decided to write his e-books "How To Fly For Free" and " How To Find Cheap Flights." He even made an email list to send friends updates on any amazing travel deals he comes across on Twitter or his RSS feed.

He'll be traveling to Mexico, Nicaragua, Trinidad, St. Lucia, Grenada, Germany, Czech Republic, Ukraine, Bulgaria, Greece, Macedonia, Lithuania, and Finland over the course of two months.

The epic world trip spans 13 countries - Mexico, Nicaragua, Trinidad, St. Lucia, Grenada, Germany, Czech Republic, Ukraine, Bulgaria, Greece, Macedonia, Lithuania, and Finland - over the next two months. Total airfare is 136,500 frequent flyer miles plus a few small taxes, such as 'airport use' fees, that are all under $20 per flight.

Aside from those taxes, Keyes will be paying exactly $0 for his trip, including his hotel stays (he used credit card reward points that he had saved up for exactly this purpose).

He told Business Insider that it took around 10 to 15 hours to plan his itinerary, including finding flights that will use his miles, choosing between airlines, and avoiding "fuel surcharges" at all costs.

The 28-year-old author and reporter is an admitted wanderlust.

Keyes had been living and working for the past year in Oaxaca, Mexico, but now that he's returning to the US, he realized it was the perfect opportunity to spend some time traveling before jumping back into a full-time job.

"It's tough when you have a job and you have to ask your boss for time off," Keyes told Business Insider. "You only have a limited time off and then you spend a lot of that traveling. I figured while I'm in a position where I don't have a 9-to-5, I might as well take advantage."

This is not the first time Keyes has gone on an incredibly cheap getaway for next to nothing. He has flown to Milan for $130, gone to Galapagos for $45, and visited Norway and Belgium for around $350 instead of the typical $1,000.

"It's not necessarily easy or intuitive for beginners," he told Business Insider about finding bargain flights. "But the good news is that because if you do a little bit of leg work - learn how to get a few miles and how to use them well - you can start to travel really, really well."

Keyes has a few methods to procure his frequent flyer miles, including opening new credit cards that award miles or points, letting airlines know when there's a problem with his flight, and not being afraid to get bumped if a flight is full.

He also uses Award Wallet and a detailed spreadsheet to keep organized so he never misuses his credit cards or loses track of his points and miles. In fact, since he started accruing cards, Keyes insists his credit score has actually increased just by virtue of handling his credit responsibly.

And when it comes to finding cheap trips, Keyes has an RSS reader and Twitter list chock-full of blogs and websites like Airfarewatchdog and The Flight Deal that he skims to see if there are any "mistake fees" or cheap flights available.

The key, he said, is flexibility.

Continue reading this article by clicking here.

|

|

|

|

Market Update

|

|

Markets do well but...

April was a good month for stock markets, as major indices climbed throughout most of the period, despite a pullback toward month-end. For the month as a whole, the Dow Jones Industrial Average was up 0.45 percent, and the S&P 500 Index gained 0.96 percent. The Nasdaq also did well, returning 0.83 percent. But the respectable results for all three indices were actually down from mid-month gains of around 2 percent for the Dow and S&P 500 and almost 4 percent for the Nasdaq. These declines were primarily driven by concerns about China and the rising risks of a Greek exit from the eurozone.

The positive returns for April owed a great deal to better-than-expected corporate earnings. At the end of March, earnings expectations had been revised downward, with a decline of 4.7 percent predicted for the quarter; however, as of April 30, actual earnings for reporting companies had declined only 0.4 percent. Though a decline is not good, the results were better than expected and they bolstered market results.

Much of the decline in earnings was due to the energy sector, which had the largest year-over-year decrease in both earnings and sales among the sectors. Eight of ten sectors, however, actually reported increases in earnings growth due to upside surprises during the month, indicating that conditions are better than they appear for a broad range of companies. Technical factors also showed strength during the month, and all three indices remained well above worry levels, despite the market pullback at April's end.

Developed international markets performed more strongly than U.S. markets, with the MSCI EAFE Index up 4.08 percent, bringing the year-to-date results above U.S. levels. The decision by the European Central Bank to launch a stimulus program in March encouraged investors, who were further heartened when signs of growth also appeared in European economies.

The MSCI Emerging Markets Index was up by even more than the EAFE-7.51 percent-driven largely by the Chinese government's decision to implement stimulus measures, such as a reduction in required bank reserves, spurred by a slowing of China's economy.

The resumption in growth expectations, and the renewed willingness by investors to take risks, hurt the bond market. U.S. interest rates ticked up, with the 10-year U.S. Treasury rate increasing from 1.87 percent to 2.05 percent during April, driving down the Barclays Capital Aggregate Bond Index by 0.36 percent for the month. Longer-duration fixed income securities performed worst, but corporate high-yield bonds did well, as reflected by the Barclays Capital U.S. Corporate High Yield Index, which gained 1.21 percent.

..Spring slow to appear

Economic statistics continued to show weakness in April. The past winter-the coldest ever in the Northeast-certainly affected the economy, but other factors also slowed growth. The strong U.S. dollar hit exports and manufacturing, and a labor dispute at West Coast ports disrupted supply chains around the country. First-quarter 2015 gross domestic product (GDP) growth announced at April's end was only 0.2 percent, well below expectations, and job growth dropped to 126,000 for March, also well below expectations.

Another significant negative factor was a reduction in both business investment and government spending. Oil and gas drilling, in particular, dropped by almost one-quarter in response to lower oil prices, and state and local spending dropped. Both of these factors appear to be short term in nature-the reduction in drilling may run for one more quarter, and government spending typically rebounds in the second quarter-but the damage done was real.

Despite these very real headwinds and negative data points, longer-term trends remained positive. The weak monthly jobs report didn't change the fact that annual job creation is higher than at any point in the 2000s. Nor did it change the fact that job openings moved to new highs and initial jobless claims moved to new lows as a proportion of the labor force. Though some measures of consumer confidence were down, others were up, and retail spending and savings increased. Low oil prices reduced business investment, but they will eventually stimulate consumer spending, and even now are helping consumers save. Further, as oil prices stabilize, oil investment activity, as seen through active rig counts, will presumably recover as well.

Overall, the weakness again appears to be seasonal, with the economy poised for continued growth as the job market grows and businesses gain confidence. Just as we saw last year, even if winter weather and other short-term factors hurt results in one quarter, it doesn't necessarily mean that the economy has been derailed.

International uncertainty remains

Slower-than-expected growth notwithstanding, the improving U.S. economy has supported growth in the rest of the world, with even Europe starting to turn around. But, despite its nascent economic recovery, Europe remains a concern because of the Greek situation. The confrontation between the Syriza government and the Europeans has only gotten more divisive, and the chance of a Greek exit from the eurozone increased during April. A deal does remain probable, but the gap between the two sides is substantial and positions are hardening. The consequences of such an exit remain unpredictable, but even contemplating such an event adds significant risk to the global financial picture.

The second area of concern is China, where signs of a significant slowdown continue to appear. Although the Chinese government is deliberately attempting to slow growth-aiming to change from investment-driven to consumption-driven growth-there are signs that the government is worried about the extent of the slowdown. It has implemented stimulus measures to accelerate the growth rate, and further and more radical stimulus measures are rumored. This is not an immediate problem, but it remains a concern.

To continue reading, click here.

Authored by Brad McMillan, senior vice president, chief investment officer at Commonwealth Financial Network.

All information according to Bloomberg, unless stated otherwise.

|

|

|

|