|

New Highs Despite Mixed Economic Data

Weekly Update - April 15, 2013 (IRS Filing Deadline)

|

|

|

In This Issue

|

|

|

|

|

|

The Markets:

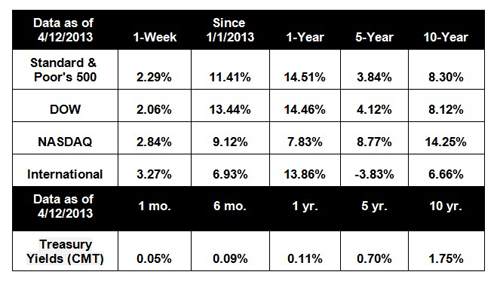

Despite some disappointing economic data, markets moved higher again last week. Both the Dow and S&P 500 posted new highs on Thursday, boosted by an upbeat jobs report. While U.S. investors still seem to lack some conviction, money is pouring in from Asia and Europe, as foreign investors seek growth.[1] For the week, the S&P 500 rose 2.29%, the Dow gained 2.06%, and the Nasdaq grew 2.84%.[2]

Retail sales contracted in March for the second time in three months, and consumer confidence tumbled in April in a double-whammy that sent equities into a spiral early last week. Retail sales fell 0.4% in March, and a gauge of consumer sentiment fell in April to the lowest level since July 2012.[3] These numbers are concerning because consumer spending is 70% of GDP and may signal that tax hikes and increases in gasoline prices have stolen some momentum from first-quarter GDP growth. While retail spending can be volatile, consumers cut back across a wide range of categories, indicating that there's not one dominant area driving the decline. One retail category, furniture, saw an increase last month, showing that the housing recovery is still driving a measure of spending.[4] Prior economic reports have glowingly stated that Americans were shrugging off new payroll taxes and continuing to spend. However, data now suggests that consumer spending was much weaker in Q1 than originally forecast.

On a more positive note, the number of Americans filing unemployment claims fell more than expected last week, easing fears of a deteriorating job market. After the previous week's unexpectedly bad jobs report, we were relieved to see that jobless claims were back in line with expectations, indicating that the March numbers were a seasonal aberration, rather than an underlying weakness in the economic recovery.[5]

Looking at the week ahead, investors will be watching earnings reports closely to size up the recent soft patch and see what business leaders expect in the coming months. Next week will be light on economic data, but about a third of Dow Industrial companies and 70 S&P 500 companies will be reporting their first quarter earnings.[6]

We will not be surprised to see a measure of volatility in the weeks to come as markets pore over earnings reports and additional first-quarter economic reports. Markets will also be watching the saber rattling in North Korea; thus far, America and its allies appear to be watchful but unconcerned about the totalitarian nation's threats, but that could change should North Korea make active moves toward the border.

Always remember to stay focused on your long-term financial strategy; short term ups and downs, while sometimes stressful, are a normal part of healthy markets.

NOTE: Don't forget that Monday, April 15, is the final deadline to make qualified contributions for the 2012 tax year. Feel free to call our office if you need assistance with this.

ECONOMIC CALENDAR:

Monday: Empire State Mfg. Survey, Treasury International Capital, Housing Market Index

Tuesday: Consumer Price Index, Housing Starts, Industrial Production

Wednesday: EIA Petroleum Status Report, Beige Book

Thursday: Jobless Claims, Philadelphia Fed Survey

|

|

|

Performance

Notes: All index returns exclude reinvested dividends, and the 5-year and 10-year returns are annualized. Sources: Yahoo! Finance and Treasury.gov. International performance is represented by the MSCI EAFE Index. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Notes: All index returns exclude reinvested dividends, and the 5-year and 10-year returns are annualized. Sources: Yahoo! Finance and Treasury.gov. International performance is represented by the MSCI EAFE Index. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. |

|

Headlines:

Mortgage money loosening up. In a sign that banks are losing their lending jitters in the face of the housing recovery, mortgage loans are loosening, making it easier for Americans to qualify for loans. Lenders are increasingly offering loans to borrowers with "average" credit and smaller down payments, instead of just those with strong credit and a large down payment.[7]

Business inventories rose less than expected in February. Business restocked their warehouses at a slower rate than economists had forecasted, which could affect first quarter GDP. Economists had forecast growth of 0.4% in February, but inventories grew by just 0.1%.[8]

Fed officials downplay inflation risk to recovery. In a clear signal that the Fed intends to continue its aggressive bond-buying program, two Federal Reserve presidents stated that runaway inflation is unlikely to be a problem in the near or medium term. The officials defended the Fed's actions and reiterated that inflation is being monitored carefully.[9]

Are Bitcoins the latest craze? Bitcoins, an entirely digital currency developed outside the control of any government, have enjoyed recent popularity with the price jumping to $200 per Bitcoin, before dropping to $105. While Bitcoins are popular among those who worry about the safety of government-backed currencies, they are highly speculative and volatile. Some analysts also believe that their anonymity also makes them vulnerable to attack and online theft.[10]

|

|

|

|

"Courage is the commitment to begin without any guarantee of success."

- Johann Wolfgang von Goethe

|

|

|

Orange Thyme Halibut

Wild halibut is light and packed with healthy fats and vitamins.

Recipe from RealSimple.com.

Ingredients:

4 6-ounce pieces skinless halibut fillet

12 sprigs of fresh thyme

1 small orange, thinly sliced

2 tablespoons of olive oil

1 10-ounce package spinach, thick stems removed (about 16 cups)

2 cups of fresh basil leaves

kosher salt and black pepper

parchment paper

Directions:

1. Heat oven to 400° F. Place the fish on one side of four 12 to 15-inch lengths of parchment.

2. Season the fish with ½ teaspoon salt and ¼ teaspoon pepper. Top with thyme and orange slices.

3. Fold the parchment over the fish; make small overlapping folds along the edges to seal. Transfer to 2 baking sheets and bake for 12 minutes.

4. Meanwhile, heat the oil in a large skillet over medium-high heat. Add the spinach, basil, and ¼ teaspoon each salt and pepper. Cook, tossing, until just wilted, 2 to 3 minutes.

5. Carefully cut the packets open and serve with the spinach.

|

|

|

|

Manage Your Weight for Better Chipping

When chipping, keep yourself stable at setup, impact, and finish to help ensure crisp, consistent contact with the golf ball. To improve your chipping, keep your weight at the 60/40 during your stroke. This means keeping 60% of your weight on your left side and 40% on your right side from start to finish.

To maximize the effect of the 60/40 position, start with a proper setup. Play the ball in the middle to middle-back of your stance, with hands slightly in front of the golf ball. The key to better chipping is to minimize excessive weight shifting (remember that this isn't a full swing) and swinging a bit steeper than you might ordinarily do. Keep these things in mind and you'll dial in better chips in no time.

|

|

|

|

When exercising, don't over do it. While regular exercise brings a host of benefits to your body and mind, some people end up overtaxing their bodies with a strenuous workout. Take things slowly by building up a workout regimen over time and by always listening to your body.

|

Reduce Energy Usage With Blackout Curtains

Blackout curtains can be used all year round to insulate your windows. This can have a significant effect on your energy bills each month as a third of home heating and cooling-related energy loss happens through our windows. According to some manufacturers, they can reduce thermal loss by up to 25%. They have the added benefit of helping to reduce noise as well.

|

|

Share the Wealth of Knowledge!

Please share this market update with family, friends, or colleagues. If you would like us to add them to our list, simply click on the "Forward email" link below. We love being introduced!

|

|

|

Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values.

Diversification does not guarantee profit nor is it guaranteed to protect assets.

The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general.

The Dow Jones Industrial Average is a price-weighted average of 30 significant stocks traded on the New York Stock Exchange and the NASDAQ. The DJIA was invented by Charles Dow back in 1896.

The MSCI EAFE Index was created by Morgan Stanley Capital International (MSCI) that serves as a benchmark of the performance in major international equity markets as represented by 21 major MSCI indexes from Europe, Australia and Southeast Asia.

The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

Google Finance is the source for any reference to the performance of an index between two specific periods.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Past performance does not guarantee future results.

You cannot invest directly in an index.

Consult your financial professional before making any investment decision.

Fixed income investments are subject to various risks including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications and other factors.

These are the views of Platinum Advisor Marketing Strategies, LLC, and not necessarily those of the named representative or named Broker dealer, and should not be construed as investment advice. Neither the named representative nor the named Broker dealer gives tax or legal advice. All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. Please consult your financial advisor for further information.

By clicking on these links, you will leave our server as they are located on another server. We have not independently verified the information available through this link. The link is provided to you as a matter of interest. Please click on the links below to leave and proceed to the selected site.

|

|

|