|

Upbeat Spending a Welcome Diversion

Weekly Update - November 26, 2012

|

|

|

In This Issue

|

|

|

|

|

|

The Markets:

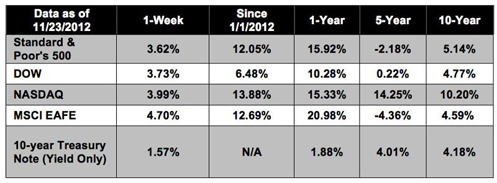

Equities ended the abbreviated week on a bullish note - with the S&P 500 having its second best week of the year - boosted by positive retail sales estimates and upbeat economic reports out of Europe. For the week, the S&P 500 gained 3.62%, the Dow gained 3.73%, and the Nasdaq gained 3.99%, erasing some of the losses we saw in previous weeks.[1]

Although the holiday shopping season is just beginning, early information suggests retailers can expect a good showing this year. A recent consumer survey by Deloitte suggested that shoppers would spend an average of $286 over the holiday weekend, which is a 28% increase over a similar survey last year. Additionally, the National Retail Federation forecasts holiday sales to grow 4.1% over last year. This is good news for retailers, who expect to make between 40-50% of their profits during the holiday shopping season.[2]

Hoping to goose the start of the shopping season, some retailers began offering Black Friday deals on Thanksgiving Day. Interestingly, the promotional push may have stolen sales from Black Friday itself. However, if Thursday's numbers are added to Black Friday, stores still saw a total increase in sales of almost 1% over 2011, and store visits increased 3.5%, indicating that consumers are feeling confident and want to spend money.[3]

The fiscal cliff is still very much on everyone's minds, and despite reassuring jawboning by lawmakers, we don't know how likely it is that we will see a resolution by Christmas. Federal Reserve Chairman Ben Bernanke fanned the flames during a speech last week by commenting that if a resolution is not reached, the U.S. economy will slide into recession. If that were allowed to happen, he does not believe that the Fed has the tools needed to help and that the economy would be on its own.[4] While this isn't a happy thought, it's clear that Bernanke is using his bully pulpit to push lawmakers into action. His message is clear: "Make it happen, or you're on your own."

Monday of this week is widely known as "Cyber Monday," the largest online shopping day of the year. As workers return to their desks after the long holiday weekend, many are still in shopping mode, and retailers offer online specials to lure them away from brick and mortar stores. It will be interesting to see if Cyber Monday numbers are as encouraging as Black Friday's. Also this week, analysts will be turning their attention to the state of economic reports being released, including GDP, employment data, and consumer confidence.

ECONOMIC CALENDAR: Monday: Dallas Fed Mfg Survey Tuesday: Durable Goods Orders, Ben Bernanke Speaks at 8:30 AM ET, S&P Case-Shiller HPI, Consumer Confidence Wednesday: New Home Sales, EIA Petroleum Status Report, Beige Book Thursday: GDP, Jobless Claims, Pending Home Sales Index Friday: Personal Income and Outlays, Chicago PMI

|

|

|

|

Performance

Notes: All index returns exclude reinvested dividends, and the 5-year and 10-year returns are annualized. Sources: Yahoo! Finance, MSCI Barra. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. N/A means not available. |

|

|

Headlines

iPad and iPhone dominate Black Friday online shopping. IBM found that 24% of online shoppers used mobile devices, compared to 14.3% in 2011. The iPad was used by 88.3% of tablet shoppers.[5] Greece closer to aid deal. After several days of bargaining and politicking, Europe's leaders are moving closer to a new bailout deal for Greece. The IMF has agreed to relax its debt-cutting targets for Greece, meaning the country may not be forced to adopt additional austerity measures.[6] Chinese manufacturing numbers are up. After seven consecutive months of slowing, an important manufacturing index is up as factory orders pick up. Since manufacturing forms a large part of the Chinese economy, this could indicate that the world's second-largest economy might be recovering from its slump.[7] Oil prices surge on Israel tensions. Oil prices rose above $88 a barrel, on increased tensions in the Middle East. A brewing fight between Israeli forces and Gaza separatists is causing supply worries, pushing up the price.[8]

|

|

|

|

"Set your goals high, and don't stop till you get there."

- Bo Jackson

|

|

|

Leftover Turkey Pot Pie   From allrecipes.com From allrecipes.comIngredients:

1/4 cup butter

1/2 cup chopped onion

1/2 cup chopped mushrooms

1 tablespoon minced garlic

1/3 cup all purpose flour

1/2 teaspoon dried sage

1/4 teaspoon dried thyme

1 1/2 cups prepared turkey gravy

1/2 cup water

1/2 cup milk

1 (14 ounce) package frozen mixed vegetables, thawed and drained

3 cups cooked turkey, cubed salt and ground black pepper to taste (optional)

1 pastry for a 10-inch double crust pie

Directions:

1) Preheat oven to 425 degrees F (220 degrees C).

2) Melt the butter in a large saucepan over medium heat. Stir in the onions, mushrooms, and garlic; cook until tender, but not browned, about 5 minutes. Stir in the flour, sage, and thyme until blended. Pour in the gravy, water, and milk, stirring to blend. Bring to a boil over medium-high heat; cook 1 to 2 minutes. Stir in the turkey and vegetables, and cook until vegetables are tender, about 5 minutes.

3) Line a 10 inch pie plate with the bottom crust. Pour in the turkey mixture. Cover with the top crust. Seal and crimp the edges. Pierce top crust in a few places with a fork. Cover the edges of the pie with strips of aluminum foil.

4) Bake in preheated oven for 25 minutes. Remove foil strips, and bake until crust is golden, about 20 minutes more. Remove from oven, and rest 10 minutes before serving.

|

|

|

|

In a golf swing, the rhythm describes the total time it takes to complete the swing among its three main parts: backswing, downswing, and forwardswing. If you treat the golf swing like a simple pendulum and divide it into equal beats or counts, the backswing should take two beats, and the combined downswing and forwardswing two beats. For example, you should be able to count "one-two" to the top of your backswing, and "three-four" to impact and finish. This 2:1:1 ratio is the golf swing rhythm. Like tempo, it's critical that you have the same rhythm for every club and every swing.

|

Get a Flu Shot!

It's the beginning of flu season and the CDC recommends annual flu vaccines for anyone without special health considerations. Studies show that getting the vaccine before the flu starts circulating in your area is the best way to avoid catching it. If you're over 65, you may want to consider getting the "high octane" vaccine to give your immune system an extra boost.

|

Switch to Cloth Napkins  Living a greener lifestyle can start with something as simple as switching from paper napkins and towels to reusable cloth napkins and cloth kitchen towels. This is a great simple switch for someone who is beginning to think about the impact of his or her household on natural resources. This simple, affordable step can drastically reduce your use of disposable products and can save you money at the same time.

|

|

Share the Wealth of Knowledge!

Please share this market update with family, friends, or colleagues. If you would like us to add them to our list, simply click on the "Forward email" link below. We love being introduced! Please share this market update with family, friends, or colleagues. If you would like us to add them to our list, simply click on the "Forward email" link below. We love being introduced!

|

|

|

Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values.

Diversification does not guarantee profit nor is it guaranteed to protect assets.

The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general.

The Dow Jones Industrial Average is a price-weighted average of 30 significant stocks traded on the New York Stock Exchange and the NASDAQ. The DJIA was invented by Charles Dow back in 1896.

The MSCI EAFE Index was created by Morgan Stanley Capital International (MSCI) that serves as a benchmark of the performance in major international equity markets as represented by 21 major MSCI indexes from Europe, Australia and Southeast Asia.

The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

The Housing Market Index (HMI) is a weighted average of separate diffusion indices based on a monthly survey of NAHB members designed to take the pulse of the single-family housing market. Each resulting index is then seasonally adjusted and weighted to produce the HMI.

The Pending Home Sales Index, a leading indicator of housing activity, measures housing contract activity, and is based on signed real estate contracts for existing single-family homes, condos and co-ops. The PHSI looks at the monthly relationship between existing-home sale contracts and transaction closings over the last four years. The results are weighted to produce the index.

The Chicago Board Options Exchange Market Volatility Index (VIX) is a weighted measure of the implied S&P 500 volatility. VIX is quoted in percentage points and translates, roughly, to the expected movement in the S&P 500 index over the upcoming 30-day period, which is then annualized.

The BLS Consumer Price Indexes (CPI) produces monthly data on changes in the prices paid by urban consumers for a representative basket of goods and services. Survey responses are seasonally adjusted and weighted to produce a composite index.

The Conference Board Leading Economic Index (LEI) is a composite economic index formed by averages of several individual leading economic indicators, which are weighted to produce the complete index.

Google Finance is the source for any reference to the performance of an index between two specific periods.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Past performance does not guarantee future results.

You cannot invest directly in an index.

Consult your financial professional before making any investment decision.

Fixed income investments are subject to various risks including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications and other factors.

These are the views of Platinum Advisor Marketing Strategies, LLC, and not necessarily those of the named representative or named Broker dealer, and should not be construed as investment advice. Neither the named representative nor the named Broker dealer gives tax or legal advice. All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy.

Please consult your financial advisor for further information. By clicking on these links, you will leave our server as they are located on another server. We have not independently verified the information available through this link. The link is provided to you as a matter of interest. Please click on the links below to leave and proceed to the selected site.

|

|

|