|

Markets Lower but Economy Growing

Weekly Update - October 29, 2012

|

|

|

In This Issue

|

|

|

|

|

A NOTE ABOUT HURRICANE SANDY:

Sunday night, as Hurricane Sandy took aim at the heart of America's financial district, both the New York Stock Exchange and Nasdaq stock market said they would not open for trading Monday due to the storm. Depending on how much damage is inflicted on the Eastern seaboard, there is a possibility that trading might also be halted on Tuesday.[1] With Hurricane Sandy approaching, and likely bringing high winds and flooding, its potential economic impact is a point of concern.The historic storm is thought to be the largest to hit the U.S. and could cause major damage to cities in the northeast and mid-Atlantic. Please be assured that we will keep you informed about any developments with the potential to affect your investments.[2]

The Markets:

Markets got off to a slow start last week as disappointing earnings and a downgrade of Spanish debt combined to fuel bearish sentiment. Major indices closed near their seven-week low with the S&P trimming 1.48%, the Dow sliding 1.77%, and the Nasdaq losing 0.59%.[3]

Last week's earnings reports mostly continued the downbeat trend we've seen this year of top-line revenue misses and a weak earnings outlook. With earnings reports in from nearly half of S&P 500 companies, just 36.9% have reported revenue that beat forecasts, far below the 62% historical average, according to Thomson Reuters data. Earnings are faring slightly better, with 62.5% above expectations.[4] Moody's downgraded the debt of five Spanish regions last week, citing limited cash reserves and upcoming interest payments. This move will make it more likely that these regions will reach out to the national government for a lifeline, worsening Spain's already-precarious debt situation.[5] This move is an unfortunate reminder that the European debt situation is far from resolved. On the bright side, Friday's GDP reading showed that the U.S. economy grew at an accelerated rate in the third quarter. The Commerce Department's initial GDP estimate clocked in at 2% growth, beating economists' estimate of 1.9% and showing a substantial improvement over the second quarter's 1.4% increase. The uptick in growth was a result of a last-minute surge in consumer spending and an increase in government spending. Despite the tough economy, consumers went on a shopping spree, buying up automobiles and iPhone 5s, driving up consumer spending by 2% in Q3.[6]

ECONOMIC CALENDAR:

Monday: Personal Income and Outlays, Dallas Fed Mfg. Survey

Tuesday: S&P Case-Shiller HPI, Consumer Confidence

Wednesday: ADP Employment Report, Employment Cost Index

Thursday: Motor Vehicle Sales, Jobless Claims, Productivity and Costs, ISM Mfg. Index, Construction Spending

Friday: Employment Situation, Factory Orders

|

|

|

|

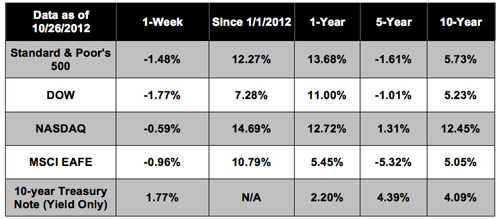

Performance

Notes: All index returns exclude reinvested dividends, and the 5-year and 10-year returns are annualized. Sources: Yahoo! Finance, MSCI Barra. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. N/A means not available. |

|

Headlines

Consumer sentiment reaches five-year high. Consumer sentiment rose to its highest level in five years in October, as Americans were more upbeat about their finances and economic prospects. Since consumer spending accounts for 70% of GDP, this level of optimism could bode well for fourth quarter GDP.[7]

Consumer prices rose in September. The Consumer Price Index, a measure of inflation, rose 0.6% in September, as gasoline prices surged. Although core inflation, which excludes volatile food and fuel prices, declined for the third month in a row, pain at the pump may cause consumers to cut back on spending.[8]

Home prices rise, but downward pressure may be ahead. According to a sales index compiled by Lender Processing Services, home prices rose 2.6% in August and are up 4.6% for the year. Much of the increase is due to tight supply conditions as sales of distressed homes drop. However, next year could see downward pressure on prices as banks seek to unload thousands of bank-owned homes.[9]

Layoffs increase as firms respond to earnings disappointments. An increasing number of firms, largely in the technology sector, are responding to poor third-quarter results by announcing layoffs. Although September layoffs were up 4.9% from August, they are still down significantly from a year ago. [10]

|

|

|

|

"Healthy citizens are the greatest asset any country can have."

-Winston Churchill

|

Pesto Chicken Pasta Salad   This simple dish dresses up pasta salad with pesto and mozzarella. Recipe from RealSimple.com. 3/4 pound rigatoni

4 boneless, skinless chicken thighs (3/4 pound)

1 tablespoon olive oil

kosher salt and black pepper

1/2 cup chopped pitted kalamata olives

1 cup halved bocconcini (mozzarella balls)

3/4 cup pesto

Directions:

1) Cook the pasta according to the package directions; drain, return to the pot, and let cool.

2) Heat oven to 400° F. Rub the chicken with the oil and season with ½ teaspoon salt and ¼ teaspoon pepper. Place on a rimmed baking sheet and roast until cooked through, 20 to 25 minutes; shred.

3) Toss the pasta, shredded chicken, olives, and bocconcini with the pesto and ¼ teaspoon each salt and pepper.

|

|

|

Practice Short Putts Until You Can't Miss

Next time you go out to practice, instead of focusing on your driving, practice two to three foot putts until you can't miss. Then, move back one additional foot and practice four foot putts until you can't miss. Then, move back another foot, and so on.

Most golf courses and driving ranges have putting greens that are free. Utilize these facilities to improve upon the most important stroke saving part of your game - putting. Everyone can improve in this area, and it will have the quickest impact on your score.

|

|

|

Pressure Points Hit the Spot Many health advocates promote the use of pressure points as a natural help with simple ailments.

Feeling queasy? Calm a nervous stomach with this quick acupressure trick: Use your index and middle fingers to massage the space between the tendons that run from the base of your palm to your wrist. Wristbands that apply pressure to this spot are available at drugstores and online and are great for people who suffer from motion sickness. Consult a medical journal or ask a doctor that specializes in neuromuscular therapy for more information.

|

Car Alternatives

If you're concerned about the environmental impact of your car, try a few of these tips:

* Consider buying a fuel-efficient car or a hybrid - you might still be in time for a tax break.

* Car pool with neighbors or coworkers when possible.

* Ride a bike when doing small errands.

* If you're able, walk to nearby stores and restaurants.

|

|

Share the Wealth of Knowledge!

Please share this market update with family, friends, or colleagues. If you would like us to add them to our list, simply click on the "Forward email" link below. We love being introduced!

|

|

Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values.

Diversification does not guarantee profit nor is it guaranteed to protect assets

The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general.

The Dow Jones Industrial Average is a price-weighted average of 30 significant stocks traded on the New York Stock Exchange and the NASDAQ. The DJIA was invented by Charles Dow back in 1896.

The MSCI EAFE Index was created by Morgan Stanley Capital International (MSCI) that serves as a benchmark of the performance in major international equity markets as represented by 21 major MSCI indexes from Europe, Australia and Southeast Asia.

The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S.

Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

The Housing Market Index (HMI) is a weighted average of separate diffusion indices based on a monthly survey of NAHB members designed to take the pulse of the single-family housing market. Each resulting index is then seasonally adjusted and weighted to produce the HMI.

The Pending Home Sales Index, a leading indicator of housing activity, measures housing contract activity, and is based on signed real estate contracts for existing single-family homes, condos and co-ops. The PHSI looks at the monthly relationship between existing-home sale contracts and transaction closings over the last four years. The results are weighted to produce the index.

The Chicago Board Options Exchange Market Volatility Index (VIX) is a weighted measure of the implied S&P 500 volatility. VIX is quoted in percentage points and translates, roughly, to the expected movement in the S&P 500 index over the upcoming 30-day period, which is then annualized.

The BLS Consumer Price Indexes (CPI) produces monthly data on changes in the prices paid by urban consumers for a representative basket of goods and services. Survey responses are seasonally adjusted and weighted to produce a composite index.

The Conference Board Leading Economic Index (LEI) is a composite economic index formed by averages of several individual leading economic indicators, which are weighted to produce the complete index.

Google Finance is the source for any reference to the performance of an index between two specific periods.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Past performance does not guarantee future results.

You cannot invest directly in an index.

Consult your financial professional before making any investment decision.

Fixed income investments are subject to various risks including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications and other factors.

These are the views of Platinum Advisor Marketing Strategies, LLC, and not necessarily those of the named representative or named Broker dealer, and should not be construed as investment advice. Neither the named representative nor the named Broker dealer gives tax or legal advice. All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. Please consult your financial advisor for further information.

By clicking on these links, you will leave our server as they are located on another server. We have not independently verified the information available through this link. The link is provided to you as a matter of interest. Please click on the links below to leave and proceed to the selected site.

|

|

|