|

How Far We've Come

Weekly Update - October 15, 2012

|

|

|

In This Issue

|

|

|

|

|

|

The Markets:

Markets declined last week, retreating after initial third quarter earnings reports showed weakness and the World Bank cut its growth estimates in Asia. While the major indexes rallied a bit on Thursday and Friday, overall, investors decided that they didn't have much to get excited about. For the week, the S&P declined 2.21%, the Dow lost 2.07%, and the Nasdaq lost 2.94%.[1] While it can be hard to see the big picture when markets slide, it's important to keep short-term pull-backs in perspective. To help us do this, we can reflect on how far we've come since Tuesday's five year anniversary of the October 9, 2007 peak. In the last five years, markets have overcome a great deal: a catastrophic mortgage meltdown, a plunge that erased 50% of the market's value, and significant global uncertainty.[2] Since the darkest days of the "great recession" we've made enormous strides towards recovery, and currently, the S&P is within a few percentage points of its 2007 peak. Furthermore, we have reasons to be optimistic about the future. While we could hope for more robust growth, economic indicators are showing that the economy is gradually recovering. Unemployment is decreasing, manufacturing is increasing, and consumers are feeling more confident.[3]

We definitely have a long way to go before we can state with certainty that the global economy has recovered. And, as many analysts have stated, the next few months could be turbulent for equity markets. Factors such as the ongoing crisis in Europe, weak fundamentals in Asia, poor corporate earnings reports, the presidential election, and the fiscal cliff may create challenges that test your discipline to stay the course. [4]On the bright side though, the S&P 500 has gained 11.8% since June 1, indicating that investors are ready to respond to positive news and that there may still be some upside potential this year.[5] In September, the U.S. economy gained 114,000 jobs, driving the unemployment rate down to 7.8%.[6] The housing market is active, indicating that at least that corner of our economy is doing well.[7] Although we cannot predict the future, these factors are very encouraging. We've certainly come a long way.

ECONOMIC CALENDAR:

Monday:Retail Sales, Empire State Mfg. Survey, Business Inventories

Tuesday:Consumer Price Index, Treasury International Capital, Industrial Production, Housing Market Index

Wednesday:Housing Starts, EIA Petroleum Status Report

Thursday:Jobless Claims, Philadelphia Fed Survey

Friday:Existing Home Sales

|

|

|

|

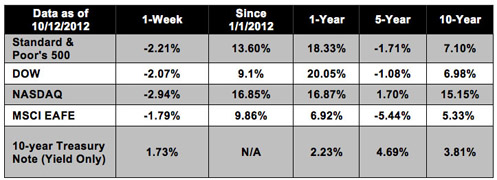

Performance

Notes: All index returns exclude reinvested dividends, and the 5-year and 10-year returns are annualized. Sources: Yahoo! Finance, MSCI Barra. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. |

|

Headlines

Eurozone seeking ways to cut Greek debt. Eurozone officials are seeking alternative ways to address Greece's woes as recession and reform delays have put their original debt targets out of reach. After lending over 25 billion euros, central banks are reluctant to offer lower interest rates or purchase additional Greek debt. [8]

China's weak imports signal recovery is slow. China's import growth recovered slightly in September but was still well below targets. Imports grew 2.4% in September, and exports, a major component of China's GDP, grew by a robust 9.9%, despite continued weakness in the U.S. and Europe. [9]

Mortgage lenders report record profits. In the latest sign that the housing market has turned the corner, the country's largest mortgage lenders, Wells Fargo and JPMorgan Chase, reported that a surge in lending has resulted in record profits last quarter. Lower interest rates are promoting refinancing as well as mortgages for new homes.[10]

U.S. producer prices rise in September. U.S. producer prices, a measure of inflation, rose 1.1% in September, following a 1.7% increase in August. The increase is due to rising energy costs. Though wholesales prices rose, core inflation remained steady, reducing concern about rising prices.[11]

|

|

|

|

"I am certain that after the dust of centuries has passed over our cities, we, too,

will be remembered not for victories or defeats in battle or in politics,

but for our contribution to the human spirit."

- John F. Kennedy

|

Roasted Brussels Sprouts with Pecans   Crunchy pecans add a sweet nuttiness to tender sproutsRecipe from RealSimple.com. Crunchy pecans add a sweet nuttiness to tender sproutsRecipe from RealSimple.com.

Ingredients:

2 pounds Brussels sprouts, trimmed and halved

1 cup pecans, roughly chopped

2 tablespoons olive oil

2 cloves garlic, finely chopped

kosher salt and black pepper

Directions:

1) Heat oven to 400° F.

2) On a large rimmed baking sheet, toss the Brussels sprouts, pecans, oil, garlic, 1/2 teaspoon salt, and 1/4 teaspoon pepper. Turn the Brussels sprouts cut-side down.

3) Roast until golden and tender, 20 to 25 minutes.

|

Steady Eyes For Sure Strokes

When your eyes wander during a putting stroke, the angle of the putter face will also wander. Train your eyes to remain steadily focused on the ball until the putter head is past the impact point.

|

|

|

Quick Drinking Fixes

If you're looking for a way to cut calories and increase your water intake, try some of these easy tips:

Keep a bottle of water on your desk. Many people mistake thirst for hunger, leading to excessive snacking. Instead of immediately reaching for a snack, drink some water first. Keeping a bottle of water around will also remind you to drink regularly.

Swap soda for water. Are you a soda addict? Even if you prefer diet sodas, they generally contain many additives and aren't that great for you. Try swapping sodas for plain water (with a squeeze of lemon if you need some flavor) or for carbonated water.

Skip the milky coffee drinks. If you like to indulge in flavored lattes or mochas regularly, you could be taking in over 300 calories in just one drink. If you can't do without your morning Joe, consider switching to simple coffee with a low-calorie sweetener.

|

|

|

Use Paper Wisely When possible, use an eReader or tablet instead of printing things out. Print on both sides of paper whenever possible to conserve. Keep a scrap paper pile of misprints to print on or take notes with. Try to reuse envelopes when possible to cut down on waste. Consider switching your coffee maker to a metal or plastic screen to cut down on paper filter waste.

|

|

Share the Wealth of Knowledge!  Please share this market update with family, friends, or colleagues. If you would like us to add them to our list, simply click on the "Forward email" link below. Please share this market update with family, friends, or colleagues. If you would like us to add them to our list, simply click on the "Forward email" link below.

We love being introduced! |

|

Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values.

Diversification does not guarantee profit nor is it guaranteed to protect assets

The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general.

The Dow Jones Industrial Average is a price-weighted average of 30 significant stocks traded on the New York Stock Exchange and the NASDAQ. The DJIA was invented by Charles Dow back in 1896.

The MSCI EAFE Index was created by Morgan Stanley Capital International (MSCI) that serves as a benchmark of the performance in major international equity markets as represented by 21 major MSCI indexes from Europe, Australia and Southeast Asia.

The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

The Housing Market Index (HMI) is a weighted average of separate diffusion indices based on a monthly survey of NAHB members designed to take the pulse of the single-family housing market. Each resulting index is then seasonally adjusted and weighted to produce the HMI.

The Pending Home Sales Index, a leading indicator of housing activity, measures housing contract activity, and is based on signed real estate contracts for existing single-family homes, condos and co-ops. The PHSI looks at the monthly relationship between existing-home sale contracts and transaction closings over the last four years. The results are weighted to produce the index.

The Chicago Board Options Exchange Market Volatility Index (VIX) is a weighted measure of the implied S&P 500 volatility. VIX is quoted in percentage points and translates, roughly, to the expected movement in the S&P 500 index over the upcoming 30-day period, which is then annualized.

The BLS Consumer Price Indexes (CPI) produces monthly data on changes in the prices paid by urban consumers for a representative basket of goods and services. Survey responses are seasonally adjusted and weighted to produce a composite index.

The Conference Board Leading Economic Index (LEI) is a composite economic index formed by averages of several individual leading economic indicators, which are weighted to produce the complete index.

Google Finance is the source for any reference to the performance of an index between two specific periods.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Past performance does not guarantee future results.

You cannot invest directly in an index.

Consult your financial professional before making any investment decision.

Fixed income investments are subject to various risks including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications and other factors.

These are the views of Platinum Advisor Marketing Strategies, LLC, and not necessarily those of the named representative or named Broker dealer, and should not be construed as investment advice. Neither the named representative nor the named Broker dealer gives tax or legal advice. All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. Please consult your financial advisor for further information.

By clicking on these links, you will leave our server as they are located on another server. We have not independently verified the information available through this link. The link is provided to you as a matter of interest. Please click on the links below to leave and proceed to the selected site.

[1] http://www.briefing.com/investor/markets/weekly-wrap/weekly-wrap-for-october-8-2012.htm

[2] http://www.bloomberg.com/apps/news?pid=newsarchive&sid=aVRYkOm8Te80

|

|

|