|

|

|

|

|

UHY LLP Michigan Practice

VOLUME 8: ISSUE 3

|

|

ARCHIVE

| |

Missed an issue? New subscriber? Visit our

news archive.

| |

|

|

SAVE THE DATE

UHY LLP's Annual Manufacturing Outlook "Autonomous Vehicle Technologies" will be held on Thursday, October 20 from 7:30AM-11:30AM at the Detroit Athletic Club.

CPE credit available.

Pre-registration for this year's complimentary program is required. Breakfast will be provided. Space is limited. Multiple registrations are welcome. To RSVP contact Jessica Labut. Formal invitation announcing keynote, speakers and topics will soon follow.

We hope to see you in October!

Back to top |

|

|

Many manufacturing executives know they should be doing more to protect their organizations from the growing threat of cyberattacks. However, a lack of practical easy-to-understand guidance has many manufacturing executives frozen in their tracks trying to figure out their next move.

Technology is invading every manufacturing organization regardless of whether or not it has been invited in. The list of technologies is impressive and growing: 3D printing, Internet of Things, robotics, cloud, sensors, virtual reality, etc.

Connectivity to the outside world is growing. Gone are the days where manufacturers could completely control their own destiny based on securing what exists within your four walls.

You wouldn't open the physical doors to your shop floor for anyone to come in and take a look around. However, many manufacturers are doing just that by leaving their virtual doors wide open.

Wondering where to begin? Start with these five pragmatic steps that anyone can take.

- Identify your "crown jewels". Many companies have never gone through the exercise of clearly defining the assets you are most concerned about protecting - i.e., intellectual property (IP), strategic plans, personally identifiable information (PII). Involve a team of leaders from across the company in this discussion and have the conversation in a group setting. Leaders will learn from one another as each has a different perspective (e.g., Human Resources vs. Operations). Once these "Crown Jewels" are identified, document them, label them and make sure everyone at all levels of the company knows to protect them.

- Recognize the enemy. A key step in protecting your "Crown Jewels" is to understand who would benefit from stealing them from you. Who would want your employee data? Something as simple as a copy of a W-2 could provide enough information to steal someone's identity or file a bogus tax return on their behalf. Who would want your intellectual property? How could competitors benefit from access to your engineering schematics, new product R&D efforts and pricing strategies? Who would want access to your CEO's email? The answers to these questions will help establish a profile of the types of threats you need to protect against.

- Establish ground rules for handling sensitive data. Sometimes the simplest solution is the best. Protect yourself from the most common scams by modifying processes to create a second set of eyes on key transactions. For example, ensure the treasury department cannot perform wire transfers without obtaining multiple approvals. Maybe include someone from outside of treasury in the review process to get another perspective? Or require a two hour hold before initiating the transfer? And the HR team must clearly understand the value of the data they possess. To protect employee personally identifiable information (PII), require that all external emails are encrypted? Require all documents to be password protected? Require that no data can be stored on external storage devices? Implementing simple ground rules may take time but may benefit you in the long run.

- Train your employees. Your employees are your first and best line of defense. Some companies magically expect their employees to know about cyberthreats and what to do about them. It is true that new breaches are announced seemingly on a daily if not hourly basis, however, many employees don't understand anything more about the breach than something bad happened. It is critical for employees to understand the details of what happened and how it happened. Don't think it can happen to you? Type your company's name plus "HR generalist" into LinkedIn and you will get a list of people with the keys to some of the company's most sensitive information (i.e., salaries, social security numbers, performance reviews). These employees are likely targets for spearphishing where an attacker will specifically target them and trick them into divulging sensitive information or clicking on a malicious link. Educate employees on possible threats.

- Do something! Your employees need to know that this is an important issue and requires their attention. It's easy to include cybersecurity as a bullet on an agenda and think that conveys the significance of the topic. It doesn't. Find something you can do to protect yourself which will serve as an example to others. For example, start using a Password Manager like LastPass or KeePass. Most people are trying to manage an overwhelming number of passwords so they cope by writing them down, tracking them in an unprotected Excel spreadsheet, or reusing the same passwords over and over again. A password manager solves this problem. Another idea would be to enable multi-factor authentication on the websites you personally use. The most common application is two-factor authentication where you receive a numerical code via text message on your phone (something you have - the first factor) when you enter your password into a site (something you know - the second factor). Visit www. twofactorauth. org to see websites and services that have enabled two-factor authentication.

Executing on these five simple steps will start you and your company down a path of improved protection from cyber risks.

For cybersecurity planning assitance, please contact your professional at UHY Advisors in Detroit 313 964 1040, Farmington Hills 248 355 0280 or Sterling Heights 586 254 8141, or visit us on the web at www.uhy-us.com.

David Hartley, Principal

St. Louis, MO

|

NA AUTOMOTIVE PRODUCTION FORECAST QUARTERLY SUMMARY

Summary includes economic outlook, light vehicle sales outlook, current production drivers, production capacity and long-term trend, model launches and investments.

|

CURRENT STATE OF THE MANUFACTURING INDUSTRY

According to a new Standard & Poor's report there are two key indicators that will tell you what kind of shape the manufacturing industry is in. The first is the Institute for Supply Management's manufacturing purchasing manager's index and the second is the Federal Reserve's Capacity Utilization Index for motor vehicles and parts. A reading above 50 percent for the ISM index indicates that manufacturing is expanding in the US, and below 50 means that it is contracting. History shows that each time since 1983 that the index fell below 43 percent "speculative grade" automotive companies began to panic. Similarly any time the Fed's utilization rate dropped below 72 percent during that period, it caused stress to automotive companies. Let's take a look at where we stand as of June 2016.

|

|

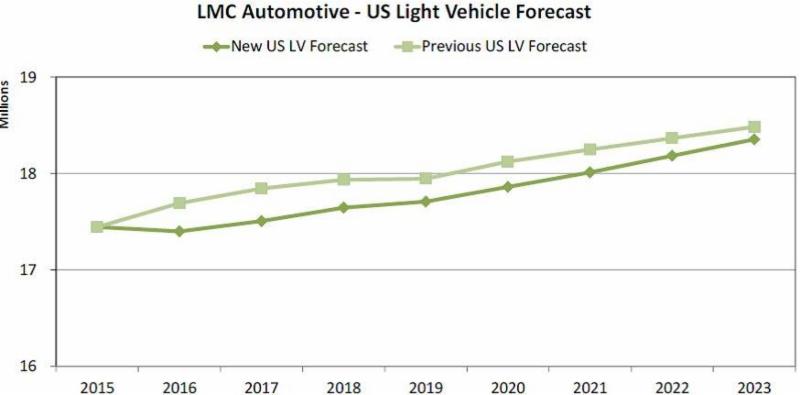

AUTO SALES FORECAST LOWERED FOR NEXT DECADE

LMC Automotive has revised the forecast for auto sales in the US for the entire forecast horizon based on the recent plateauing of year-on-year sales growth, combined with growing economic and political risk in the US and globally, potentially impacting trade, the US economy and consumer confidence. The full press release is below: Issued July 2016LMC Automotive cuts forecast for US auto sales: Revision projects first contraction in light vehicles sales since 2009 recession, but overall volume level remains strongLMC Automotive has revised the forecast for auto sales in the US for the entire forecast horizon (2016-2023) based on the recent plateauing of year-on-year sales growth, combined with growing economic and political risk in the US and globally, potentially impacting trade, the US economy and consumer confidence. The forecast reduction averages nearly 250,000 units each year from 2016-2023, with a larger reduction in 2016 and 2017. Specific to 2016, the US forecast was cut by 300,000 units to 17.4 million units from 17.7 million units, a -1.7% reduction. This represents a 0.3% contraction or about 40,000 units lower than the record level of 17.44 million units in 2015. Nearly all of this reduction was made to retail sales, bringing the forecast for retail light vehicle sales down to 14.0 million units from 14.3 million units previously.  Our latest forecast now reflects the reality that the growth track that the US market has been on since 2009 has stalled and appears to be levelling off, but it does not necessarily signal that further contractions or an automotive recession is imminent," said Jeff Schuster, Senior Vice President Forecasting at LMC Automotive. "Volume and growth risks in the second half of 2016 are running higher, as monthly US market results will be compared to a very strong second half of 2015 and as the global economy grapples with the impact of the Brexit result and the unknown of the upcoming US election". While the strong recovery and growth since the recession of 2009 may be coming to an end, LMC Automotive continues to expect the US automotive market to remain solid over the forecast horizon, with volume forecasts holding at the mid-17 million unit level before slowly climbing past 18 million units by 2022. Underpinning our automotive outlook is the expectation that the US economy will continue to expand, averaging at least 2% GDP growth throughout the forecast period, something which is certainly achievable. Our latest forecast now reflects the reality that the growth track that the US market has been on since 2009 has stalled and appears to be levelling off, but it does not necessarily signal that further contractions or an automotive recession is imminent," said Jeff Schuster, Senior Vice President Forecasting at LMC Automotive. "Volume and growth risks in the second half of 2016 are running higher, as monthly US market results will be compared to a very strong second half of 2015 and as the global economy grapples with the impact of the Brexit result and the unknown of the upcoming US election". While the strong recovery and growth since the recession of 2009 may be coming to an end, LMC Automotive continues to expect the US automotive market to remain solid over the forecast horizon, with volume forecasts holding at the mid-17 million unit level before slowly climbing past 18 million units by 2022. Underpinning our automotive outlook is the expectation that the US economy will continue to expand, averaging at least 2% GDP growth throughout the forecast period, something which is certainly achievable.

|

|

ARE YOU PREPARED TO SELL YOUR BUSINESS?

Many business owners spend most of their lives intricately planning every detail of their business, from sales calls to processing and manufacturing to post-sale support, all the way to the finance and accounting function. Despite all of the operational and financial planning, most business owners are left completely unprepared for the most important sale of their life - the sale of their business. Although many factors of an owner's business may be outside of their control, there are several steps that a business owner can take to help ensure a successful exit.

- Create a management team. Any buyer needs to clearly understand the roles filled by each member of the management team. The owner should be able to plainly convey to a buyer who is responsible for the key functional areas of finance and accounting, sales and marketing, manufacturing, information technology, and overall management of the company. The critical question any buyer asks is "Can the company survive if the owner is no longer active in the business?" If the answer is yes, then the owner has cleared one of the first major hurdles in buyer scrutiny. If not, then the business owner should assess the team and fill the appropriate gaps. Often times, owners are concerned that if key management team members learn about a proposed sale, those individuals may pursue other opportunities. While guarantees can never be made that some executives will not leave the business, transaction bonuses or stay bonuses are excellent tools to mitigate this risk. The bottom line is that a business that "runs itself" without intense owner input helps to maximize value.

- Prepare for a sale. During any sale process, it is the responsibility of the business owners and their advisors to gather the necessary documentation required for the acquirer to complete due diligence. Examples of these items include various functional areas including legal (e.g., stock records, shareholder agreements, loan agreements), financial (audited financial statements, internal monthly financial statements, fixed asset listings, tax returns), and operational (customer / supply contracts, royalty agreements, insurance policies, employee benefit plans, and collective bargaining agreements). Importantly, a certain level of "reverse due diligence" must be performed on this documentation prior to supplying to the acquirer, and any inconsistencies, inaccuracies, or undue delay in producing requested data may lead to the acquirer putting the deal on-hold, reducing the purchase price, or even ultimately walking away from the deal.

- Understand your company's position in the business cycle. Apart from industry-specific growth and individual company attributes such as customer concentration, gross margins, and top-line growth, the overall business cycle plays a key role in determining the enterprise value of a business. Most buyers will want to see that management has been operating a company at a relatively higher level of earnings for a year or two before the sale, as acquirers tend to discredit "hockey stick" projections. In addition, the business owner should be able to make the case that this elevated level of sales and earnings should be expected to continue for the foreseeable future, which can be done by tying top-line projections to the company's order book or linking sales projections to forecasted volumes, as is common in the automotive industry.

- Understand structure and tax impact. Are all offers created equally? Absolutely not! In addition to focusing on the gross consideration (i.e., purchase price), business owners and their advisors must consider items such as the type of acquisition (stock vs. asset), form of consideration (cash, seller's note, earn-out, etc.), working capital adjustments, escrows, caps and baskets, indemnification provisions, and representations and warranties. If improperly structured, an apparently great cash offer could subject the business owner to significant and unexpected post-closing tax and legal liabilities.

- Maintain your focus. Many business owners who go through the process of selling their company feel as though it is a second job due to the amount of time and effort involved. Because of this, often times, the management team loses focus and financial and other operational metrics slip. Nothing is more damaging to a sale process than a company's failure to meet projected performance. The importance of hiring a qualified investment banker cannot be understated as it is their responsibility to carry the load of moving the transaction forward.

Each transaction is unique and presents its own distinct set of circumstances, however, good companies can become highly sought-after opportunities by both private equity and strategic buyers by following these guidelines. Contact a member of UHY Advisors' Corporate Finance practice in Detroit at 313 964 1040.

Aaron Witalec, Managing Director

(Detroit, MI)

|

|

INDUSTRY INSIGHT

UHY LLP recognizes that manufacturing companies require their auditor, tax specialists and business advisors to add value to financial reporting activities. That is why we combine the strength of business and financial expertise with a hands-on, "shop floor" approach to solving complex business decisions in aerospace and defense, distribution, automotive suppliers, industrial manufacturing and consumer products.

Our professionals are leaders in the industry and take the steps necessary to ensure our client's future success by identifying and addressing new trends, accounting requirements and regulations.

Back to top

|

|

|

|

Our firm provides the information in this newsletter as tax information and general business or economic information or analysis for educational purposes, and none of the information contained herein is intended to serve as a solicitation of any service or product. This information does not constitute the provision of legal advice, tax advice, accounting services, investment advice, or professional consulting of any kind. The information provided herein should not be used as a substitute for consultation with professional tax, accounting, legal, or other competent advisors. Before making any decision or taking any action, you should consult a professional advisor who has been provided with all pertinent facts relevant to your particular situation. Tax articles in this newsletter are not intended to be used, and cannot be used by any taxpayer, for the purpose of avoiding accuracy-related penalties that may be imposed on the taxpayer. The information is provided "as is," with no assurance or guarantee of completeness, accuracy, or timeliness of the information, and without warranty of any kind, express or implied, including but not limited to warranties of performance, merchantability, and fitness for a particular purpose.

UHY LLP is a licensed independent CPA firm that performs attest services in an alternative practice structure with UHY Advisors, Inc. and its subsidiary entities. UHY Advisors, Inc. provides tax and business consulting services through wholly owned subsidiary entities that operate under the name of "UHY Advisors." UHY Advisors, Inc. and its subsidiary entities are not licensed CPA firms. UHY LLP and UHY Advisors, Inc. are U.S. members of Urbach Hacker Young International Limited, a UK company, and form part of the international UHY network of legally independent accounting and consulting firms. "UHY" is the brand name for the UHY international network. Any services described herein are provided by UHY LLP and/or UHY Advisors (as the case may be) and not by UHY or any other member firm of UHY. Neither UHY nor any member of UHY has any liability for services provided by other members.

©2013 UHY LLP. All rights reserved. [0613]

|

|

|

|

|

|