|

|

|

|

|

ARCHIVE

| |

Missed an issue? New subscriber? Visit our

news archive.

| |

|

|

|

|

NA AUTOMOTIVE PRODUCTION FORECAST MONTHLY COMMENTARY

The North American Automotive Production Forecast Monthly Commentary provides a rolling monthly update on the current state of the industry. Commentary includes a top-down briefing on the macroeconomic environment, the region's vehicle sales and the impact upon light vehicle production. It also includes the latest insights into North American vehicle exports, inventory developments, capacity utilization as well as news on new model programs, other plant specific developments and the current state of assembly trends in the industry.

Back to top |

PROFITABLITY: SEPARATING THE WHEAT FROM THE CHAFF

I remember hearing a statement that went something like: "In the world of breakfast food, the key to a wholesome, crunchy cereal is the proper separation of the wheat from the chaff and, to know which is which". In order to recognize and achieve profitability, let's assume that it's the same. There is wheat and there is chaff. The keys to generating and retaining profits are likewise, understanding which parts are the wholesome wheat and which parts are the chaff. In today's business economy, it's a forgone conclusion that successful companies must have an embedded knowledge of the true costs of the products or services provided and a factual grasp of which customers generate the profits that drive a company's economic engine. The troublesome questions often faced are what products, services or customers are the wheat and which are the chaff?

IDENTIFYING THE WHEAT

Wheat is a staple food and used as one of the core ingredients to produce a variety of products. It has limited value as a kernel of grain. It needs to be integrated into the end product to release its potential. Here's a recommended approach to identifying and integrating the "wheat" in your organization:

1. Develop and communicate a business management strategy based on urgency and sound cost management principles. Understand and address the activities, services, operational practices, and customers that drive costs and ultimately profitability. Incorporate planning tools such as balanced scorecard, strategy maps and performance management along with common sense. But how do you start? Begin by completing a comprehensive review of your business operations. Assess necessary actions such as:

- Strategic planning for your business including sales, marketing and production

- Financial strength and capability to finance future growth

- Adequacy and utilization of resources, including capital, direct and indirect labor, equipment, technology and facilities

- Efficiency and effectiveness of your key business processes (i.e., sales, accounting, engineering, operations, maintenance, etc.)

- Management leadership and personnel skills

- Costing capabilities, including availability and accuracy of data.

2. The last point listed above - costing capability - is probably one of the hardest items to accurately establish. You need to look at your revenues via a "value-added" approach using the formula VA = SR - (MC + OS), where VA is value added, SR is sales revenues, MC is material costs and OS is outside servicing costs. This value-added approach will begin to crack the hull of the wheat grain and allow you to look inside your business operations. You need to establish the true costs associated with your business operations; those costs directly associated with individual products and specific customers. You need to define cost drivers (i.e., machine hours, labor hours, square footage, etc.) that can be used to calculate overhead / unit numbers. You need to accurately allocate specific costs to designated cost centers or product lines. Where do indirect personnel spend their time? What resources are assigned to specific areas, processes or product lines? How much floor space is consumed for specific machines or product lines? Where are the utilities consumed?

As a recent example, we worked with a St. Louis metal fabricating company to implement a roadmap to analyze and improve profitability. Starting with a value-added approach, the company soon identified gross margin percentages that quickly indicated which products, cost centers and customers were the least profitable. Yes, there was overhead absorption by the "losers", but the company's ability to strategically plan and expand had been clouded. The old saying "what you can't see won't hurt you" is just not true. Try asking an electrician!

The company's core business is metal stamping. Available machine hours were 1,800 per machine per week. Actual measured machine hours per week averaged out at 1,152 per machine. That's a utilization rate of 64% (1,152/1,800 = 0.64). The company allocated costs to specific cost centers and utilized the cost driver of machine hours to determine manufacturing overhead rates. In this company, the manufacturing overhead rate, after allocation of specific costs, was determined for various production cells. Values ranged from $89/machine hour to $134/machine hour. It was valuable detail that was needed to make changes and improve operations.

The results of the profitability analysis and subsequent improvement action steps were dramatic. The company focused sales and marketing efforts on those products and processes that generated the highest true margins. Armed with accurate cost analysis data, they also negotiated with customers to address losing products. The 12 month results were impressive. They went from a $30,000 per month running loss to a $521,417 net profit.

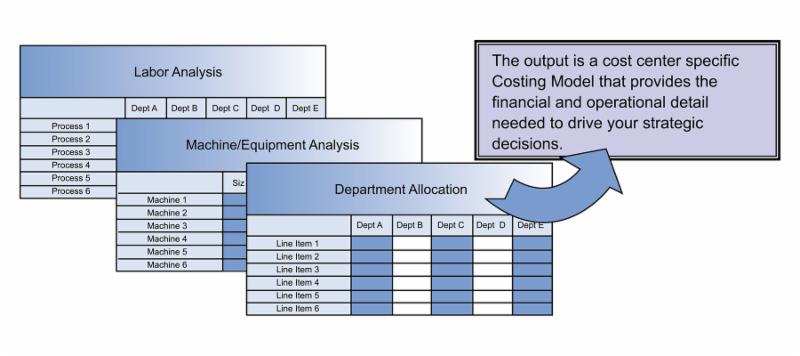

A viable costing methodology incorporates a detailed analysis of your business operations including labor, machine/equipment efficiencies, overhead, process capability and performance, and deliverable services.

3. The old adage "what gets measured gets improved" continues to be true. In order to achieve profitability, a disciplined performance management framework needs to be identified and established. Key results indicators (KRIs) provide the "dashboard" to inform management as to business health and goal achievement. KRIs must be measured, trended and acted upon by senior management. KRIs include measures such as customer satisfaction, net profit before tax, and profitability of service.

In order to sustain profitability, KPIs need to be identified and established for each business process. KPIs must be measured frequently (e.g. daily), trended and acted upon by department management. These indicators have a significant impact on the whole organization and provide an early warning indication of a pending process breakdown. KPIs include measures such as indirect/direct labor hours, machine rates/hour, errors and omissions, rework/labor hour, cost overruns, revenue per employee, overtime hours, etc. KPIs need to follow the 3-C rule; clear, concise and communicated.

IDENTIFYING THE CHAFF

The chaff; it's the hull that tightly encloses the grain. To obtain the wheat, you need to remove the chaff by threshing. The key to profitability is to understand what activities within your business have a grip on maximizing profits. These hulls need to be thrashed. What is the chaff within an organization? Data accuracy.

Every company must operate with accurate data. We call this "clean data". We have learned a valuable lesson working with a wide variety of companies. Although we are told that the data supplied to us for analysis is correct and guaranteed to be precise (i.e., our bill of material states that the part weighs 3.141 ounces), it just might not be accurate ( i.e., the part actually weighs 3.251 ounces per piece). That 0.11 ounce difference times 2,500 parts per day times five days per week times 50 weeks per year can make a significant difference. In this case, 4,296 pounds of material at an average cost of $1.43 per pound equates to an additional cost of $6,143. That's a lot of money to just give away to any one customer. Companies must generate data that accurately represent what is happening throughout the business operations.

"Dirty data" has been responsible for a multitude of disasters within many companies and can have a direct, rifle-shot impact on the bottom line results of a company. Back to the world of breakfast cereal, bad data is like spoiled milk. No matter how fresh the cereal is, bad milk becomes embedded throughout and taints the whole bowl. Dirty data is both wasteful and contagious. With dirty data flowing through a company, managers and employees are forced to create their own data management and analysis systems. Hence, the launch of multiple spreadsheets and individual databases throughout various departments and process areas.

Here are a couple of recent examples of how dirty data can impact a company:

1. An injection molding company. 22 molding machines providing 230 different products to 30 different customers. Following the 80/20 rule, a detailed review of the top individual product routers that are used to control production was completed. These routers specified cycle times, material use percentages, scrap rates, finished part weights, etc. The results? Every router was inaccurate in at least one item. Data was precise. Just not accurate. This data had been used as the premise to secure a large contract that necessitated a $2,800,000 expansion. Results were disastrous. The expansion building is now available for sale or lease.

2. A road contractor that specializes in preparing the road surface for repaving. Eight machines chewing up asphalt on a daily basis. Machines range in age from six to ten years old. Business has been going down over the past three years. Their data was inaccurate and, in most cases, nonexistent. The company was unable to track repairs, fuel consumption, efficiencies, etc. in order to make strategic decisions regarding machine replacement. The "guesstimated" costs of fuel/hour, repairs/hour, overhead/hour, etc. were all off base. After capturing true data, the company was able to efficiently and accurately quote machine rates for each individual unit. The results? The company sold four units, purchased one new unit and expanded their reach into a new market area.

WHERE TO FROM HERE

There are profit "pain points" within every organization. Often, managers don't have the means of knowing what they don't know. They lack the ability to accurately know what products or services customers are consuming verses generating profits, or where the company needs to target its resources to achieve greater profitability.

The impact of effectively separating the wheat from the chaff can be a powerful antidote to reduce costs and improve profitability in most organizations. The information needed is embedded in the company's knowledge base; it's just not fresh and crunchy!

For more on profitability, please contact a member of the firm's national manufacturing practice in Detroit 313 964 1040, Farmington Hills 248 354 1040 or Sterling Heights 586 254 1040, or visit us on the web at www.uhy-us.com. By Alan Lund, Consulting Principal

(Farmington Hills, MI)

Back to top

|

UHY VIDEO ARCHIVE

Back to top |

|

THE NEW REVENUE RECOGNITION STANDARD

What should manufacturing and distribution companies be doing right now to ensure compliance upon the effective date?

In its continued efforts to achieve convergence between US GAAP and international standards, on May 28, 2014, FASB issued Accounting Standards Update ("ASU") 2014-09 - Revenue from Contracts with Customers. This new ASU provides a single, comprehensive, principles-based revenue recognition model for all contracts with customers to improve comparability within industries and across capital markets. Codified into ASC Topic 606, the new standard supersedes the existing revenue recognition guidance in ASC Topic 605. For public entities, this ASU is effective for annual reporting periods beginning after December 15, 2016, which for calendar year entities represents fiscal 2017. For private entities, this ASU is effective for annual reporting periods beginning after December 15, 2017, which for calendar year companies represents fiscal 2018. Accordingly, since the effective date of this ASU is years away, companies can simply forget about it until the year it becomes effective, right? Not quite.

Although the effective date of the ASU is several years away, the information needed for disclosures in comparative financial statements for large accelerated filers on a calendar year will actually need to be gathered starting in Q1 2015. Also, this ASU could have a significant impact on the internal policies, procedures and operations of all companies, public and private that will take time to implement properly. Accordingly, we at UHY thought it would be a good time to start introducing this ASU to our clients and friends of the firm within the manufacturing and distribution (M&D) niche in order to provide valuable insight and points to consider at this stage to avoid pitfalls as the effective date draws near.

The purpose of this article is not to give a comprehensive analysis of how to comply with the new standard but rather to identify points that M&D companies should be considering currently to be in compliance upon the effective date. We will go through a high level synopsis of the new standard below but readers are encouraged to reach out to their UHY accounting professional for a more in depth analysis of the new standard.

THE FIVE STEPS

The new standard follows a five step approach for revenue recognition:

1. Identify the contracts with the customer

A contract is described in the standard as an agreement that creates enforceable rights and obligations between parties. It can be written, oral or even implied based on customary business practices. For the revenue standard to be applied, the following criteria need to be met:

a. The parties need to have a meeting of the minds and intend to perform their respective obligations

b. Each party's rights under the contract can be specifically identified

c. Payment terms are stated

d. The contract has commercial substance (i.e. there is risk to the entities and respective future cash flows under the contract)

e. Collection is probable

2. Identify the separate performance obligations in the contract

A performance obligation is a promise to transfer a distinct good or service to a customer under a contract. The concept of performance obligations is to identify the timing of the transfer of goods and services under a contract. Management is required to apply their judgment in ensuring that the performance obligations identified most accurately reflect the economic substance of the underlying transactions. The concept of a "distinct performance obligation" is important as these are effectively the units of account that determine the method and timing of revenue recognition.

3. Determine the transaction price

The transaction price is described as the amount of consideration that is expected to be received for meeting performance obligations. This amount can be fixed or variable depending on the economic substance of the transaction and significant management judgment will be required to accurately determine the variable consideration in the underlying contracts.

4. Allocate the transaction price to the separate performance obligations

The transaction price is allocated to the performance obligations in a contract in relation to their relative standalone selling prices. In cases where there are no standalone selling prices for the performance obligations, management is required to make estimates of these amounts using an acceptable method under the standard.

5. Recognize revenue as each performance obligation is satisfied

As the last step under the standard, an entity will recognize revenue as a good or service is transferred to the customer and the customer obtains control of that good or service.

Now that we covered the basics under the standard, let's look at some specific areas that (M&D) companies will have to take specific steps in order to ensure proper implementation of the standard.

CHANGES IN CONTRACTS

The new standard requires a number of changes in underlying contracts to be captured and the related accounting implications to be recognized as the changes take place. Changes such as a deterioration in the credit profile of a customer (collectability of the transaction price) will require the management to make a judgment on whether the underlying contract, its performance obligations and the respective timing of revenue recognition needs to be modified. Upon the discovery of such a change in the credit profile of a customer, an M&D company needs to be able to gather the required information, make the required adjustments to the terms of the contract and reflect and disclose that change in its financial statements. Other modifications to contracts such as change orders from customers will need to be captured and evaluated for whether they represent a new set of enforceable rights or obligations.

Management will need to apply significant judgment to contract modifications to determine their accounting implications. Modifications such as predetermined delivery schedules, production specifications and options within an order are all applicable modifications to contracts that an M&D company will have to be able to capture. Once a modification is approved by both parties, it needs to be reflected in the entity's accounting records under the new standard.

Being able to respond to changes such as change orders or a deterioration of the credit profile of a customer, timely and effectively, will require the company's ERP package to be configured to identify, capture and process new data points to be evaluated by management for their impact on revenue recognition. Such changes to the configuration of ERP packages take time, money and internal and external resources to implement. Accordingly, accounting and IT functions need to be in sync prior to the effective date of the new standard to be ready for the challenges that will be presented.

WARRANTIES

Historically, an M&D company would record a liability on its records to reflect the costs of performing any future repairs and replacements on the products sold within the warranty period. That warranty liability was a management estimate and would be evaluated periodically to ensure that it most accurately reflected the company's best estimate of future costs it expected to incur to fulfill its warranty obligations.

Under the new standard, an entity is required to account for the warranty as a separate performance obligation if the customer has the option to purchase the warranty separately or if the warranty provides "an additional service to the customer" other than assurance that the product performs to its specifications. In cases where the warranty may be considered to provide an additional service, management will have to evaluate the warranty period, service deliverables and the nature of the tasks to be performed to be able to properly identify all performance obligations and the standalone selling price of those obligations. This process will take significant effort and management may need to develop specific processes with involvement and input from operational and sales personnel to be incompliance with the new standard.

SALES INCENTIVES

Original equipment manufacturers (OEMs) and retailers frequently offer incentives to their end user customers in the form of cash rebates, rebate refund checks and credits for purchases of other goods and services for free or after heavy discounts. Under the new standard, any such incentives and credits will be treated as a reduction of the selling price and correspondingly of revenues to be recognized. Accordingly, manufacturers need to identify all such incentives in advance of the effective date of the new standard as such items will have a significant downward impact on the revenues to be recognized in future periods. Once again heavy collaboration between the accounting group and the operational and sales personnel will be required to properly capture all such incentives that will have revenue implications.

It is also important to note that any such impact on revenues may have a negative impact on the ability of the company to meet its debt covenants. Therefore, it is very important for companies that are in the process of negotiating new borrowing arrangements to keep in mind the upcoming changes and include language in the legal documents to reflect the proper accounting in the calculation of debt covenants. An alternative is to include language that specifically introduces a method of adjusting the covenants based on the impact of the new standard on metrics that drive covenant calculations.

TOOLING EQUIPMENT

For contracts that have a tooling component which do not transfer the title of the tooling to the end customer, under the old revenue recognition guidelines, there was no revenue recognition impact of these items. Under the new standard, tooling will in most cases be considered to transfer a good or a service to the customer and accordingly will have to be considered a separate performance obligation. An entity will have to first determine whether the tooling is a "distinct" performance obligation which will be determined by whether the tooling can be separately identified from the production of the related parts. This determination will have multiple decision points and will take a significant amount of judgment from management. Based on whether tooling is considered a distinct performance obligation or not, corresponding revenue recognition will either be a point in time or over time. Again the ultimate decision will require planning and discussions with operational and sales personnel and facts and circumstances of the transaction between the manufacturer and its customers.

DISCLOSURES

In addition to the above identified specific areas, the new standard will also require extensive interim and annual disclosures that will document the significant judgments and estimates required of management to determine the timing and amount of revenues to recognize. Under the historical guidance, disclosures about revenues were limited at best, with some industry specific requirements, but nothing that was all encompassing was required to be disclosed for the interim and year-end financial statements. The new disclosures have been designed to complement the new five step model for recognizing revenue and will standardize the information that users of the financial statement will have available to aid their decision making. The following specific disclosures are some of the items that will be required under the new standards:

- Revenues disaggregated by various company specific criteria

- Timing of the satisfaction of performance obligations and significant payment terms

- Remaining performance obligations and the timing of the expected recognition of the future revenues

- Significant judgments and changes in judgments including how the transaction price was determined and allocated to performance obligations

- Costs capitalized in obtaining or fulfilling contracts

- Practical expedients elected

In conclusion, as companies try to solidify their understanding of the new standard, it is important to reach out to their accounting firms to get guidance on the requirements to comply as the effective date draws near. What is more important is to get the decision makers from the accounting, operations and sales in a room with the accounting firm to talk about the common pitfalls and processes and procedures that should be initiated now for an effective adoption of the new standard.

For more information on revenue recognition, please contact a member of the firm's national manufacturing practice in Detroit 313 964 1040, Farmington Hills 248 354 1040 or Sterling Heights 586 254 1040, or visit us on the web at www.uhy-us.com.

By Mehmet Sengulen, Audit Principal

(New York, NY)

|

|

INDUSTRY INSIGHT INDUSTRY INSIGHT

UHY LLP recognizes that manufacturing companies require their auditor, tax specialists and business advisors to add value to financial reporting activities. That is why we combine the strength of business and financial expertise with a hands-on, "shop floor" approach to solving complex business decisions in these key segments:

- Aerospace & Defense

- Distribution

- Automotive Suppliers

- Industrial Manufacturing

- Consumer Products

Our professionals are leaders in the industry and take the steps necessary to ensure our client's future success by identifying and addressing new trends, accounting requirements and regulations.

Back to top

|

|

|

|

Our firm provides the information in this newsletter as tax information and general business or economic information or analysis for educational purposes, and none of the information contained herein is intended to serve as a solicitation of any service or product. This information does not constitute the provision of legal advice, tax advice, accounting services, investment advice, or professional consulting of any kind. The information provided herein should not be used as a substitute for consultation with professional tax, accounting, legal, or other competent advisors. Before making any decision or taking any action, you should consult a professional advisor who has been provided with all pertinent facts relevant to your particular situation. Tax articles in this newsletter are not intended to be used, and cannot be used by any taxpayer, for the purpose of avoiding accuracy-related penalties that may be imposed on the taxpayer. The information is provided "as is," with no assurance or guarantee of completeness, accuracy, or timeliness of the information, and without warranty of any kind, express or implied, including but not limited to warranties of performance, merchantability, and fitness for a particular purpose.

UHY LLP is a licensed independent CPA firm that performs attest services in an alternative practice structure with UHY Advisors, Inc. and its subsidiary entities. UHY Advisors, Inc. provides tax and business consulting services through wholly owned subsidiary entities that operate under the name of "UHY Advisors." UHY Advisors, Inc. and its subsidiary entities are not licensed CPA firms. UHY LLP and UHY Advisors, Inc. are U.S. members of Urbach Hacker Young International Limited, a UK company, and form part of the international UHY network of legally independent accounting and consulting firms. "UHY" is the brand name for the UHY international network. Any services described herein are provided by UHY LLP and/or UHY Advisors (as the case may be) and not by UHY or any other member firm of UHY. Neither UHY nor any member of UHY has any liability for services provided by other members.

©2013 UHY LLP. All rights reserved. [0613]

|

|

|

|

|

|