5 Things Investors Should Not Do Now

This week's observation comes from a clear, concise message found in last week's Wall Street Journal article by Jason Zwieg. We couldn't agree more with his assessment of the "5 things" so we've included them here along with a link to the full article below. In recent days stocks have slumped world-wide, oil prices have also skidded, and traders fear that slowing growth in China, the devaluation of the Chinese currency and the overhang of too much debt could stifle global economic recovery. Here are five things you should know about how not to react. #1 Don't fixate on the news#2 Don't panic #3 Don't be complacent #4 Don't get hung up on the talk of a "correction" #5 Don't think you--or anyone else--will know what will happen next At times like these we need to remind ourselves that market downturns are part of investing. The length of the current bull market, the lack of notable pullbacks, and the length of time without a correction may have increased investor sensitivity to pullbacks. Bear in mind that stocks are useful as long-term investments and despite the recent drop in the capital markets, there is no need to overhaul your investment strategy. 5 Things Investors Shouldn't Do Now

|

|

Strategic Discussions Lunch: September 24, 2015

|

Turning Duress into an Investment Strategy

Presenters Daryl L. Deke Principal & CEO New Market Wealth Management Erik Knutzen, CFA, CAIA Managing Director & Multi-Asset Class CIO Neuberger Berman Agustin "Gus" Araya, CFA Founding Partner Cordillera Investment Partners Join us on September 24th for lunch and a though-provoking discussion. Click here to learn more and to register.

|

|

Worry over China's economic slowdown coupled with still falling oil prices caused all the major US equity benchmarks to move into negative territory last week. The release of the minutes from the Fed's July meeting reveals that policy makers are still concerned about the low levels of inflation and this also contributed to last week's volatility.

|

|

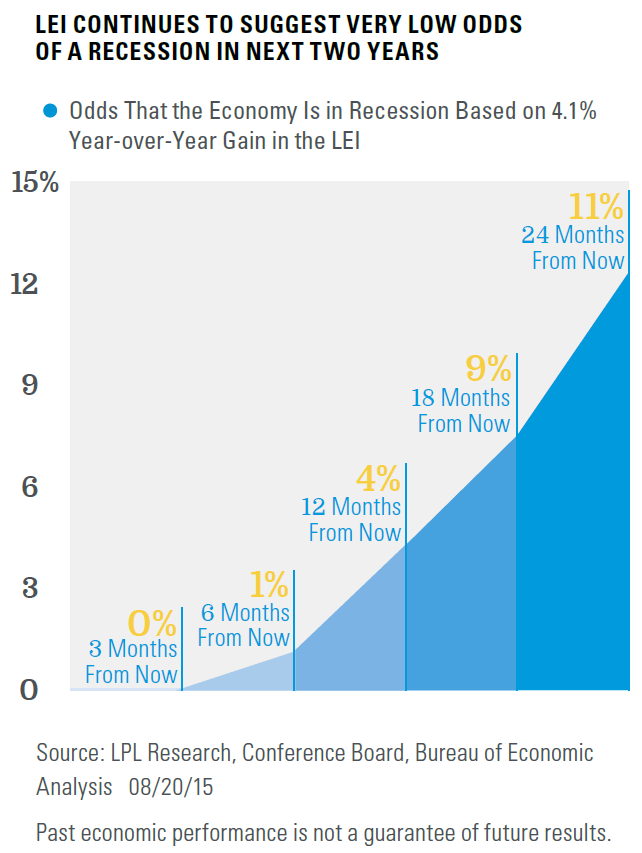

> Index of Leading Economic Indicators (LEI): The latest reading on the Conference Board's monthly LEI helps to provide some timely guidance regarding recent market volatility. The LEI is designed to predict the probable path of the economy 6 - 12 months in the future. The latest reading on the LEI, based on data from July 2015, revealed that the LEI had climbed 4.1% since July 2014. Sure enough, according to a Morningstar report, next week, based on already-released data, it is suspected the US Bureau of Economic Analysis will raise the GDP growth rate for the second quarter from 2.2% to a range of 3.0%-3.5% with the emphasis on the higher end of that range. Looking back at the last 55+ years, 3 months after each of the 333 months that the LEI was up 4.1% or more, the economy was in a recession just once. Six months after the LEI was up by 4.1% or more, the US economy has been in recession in just four months, or 1% of the time, and at 12 months post a 4.1% or better reading, the economy was in recession in just 14 of the 333 months, or 4% of the time. Based on this relationship, the odds of a recession within the next 18 months and 2 years are 9% and 11%, respectively

Another way to look at the LEI is its level relative to its prior peak. Sometime in the next several months, the level of the LEI will reach its prior peak (125.1), hit in March 2006. This may raise concern that the economic cycle is nearing an end. But in fact, during the last three economic recoveries (commencing in 1982, 1991 and 2001) the recovery continued, on average, for another 6 years after the LEI hit its prior peak.

Economic recoveries do not generally die of old age, but end due to excesses building up in one or more sectors of the economy. In the past, overbuilding in housing or commercial real estate, borrowing too much to pay for overbuilding and overspending, or even overconfidence by businesses and consumers have all led to overheating and recession. The current recovery has been relatively lackluster by historical standards, and the excesses that have triggered recessions in the past are not present. > Keeping News out of China in Perspective: While the news coming out of China (stock market correction, currency devaluation, slowing growth) has been negative and has certainly affected markets worldwide, it's important to keep the news in perspective.

Exports of all goods and services that the US ships to China amounted to just 0.9% of US GDP for all of 2014. US trade with Europe and Japan combined is roughly 4 times larger than US trade with China. US trade with both Canada and Mexico is greater than our trade with China.

Chinese stock market gains were simply unsustainable, as was the yuan's currency strength. The correction in Chinese stocks is likely to have a limited impact, if any, on the global economy. Only 9% of the Chinese public invests in equities compared to a much higher 55% in the United States. One interesting chart from Bloomberg shows margin credit (share of Shanghai stock exchange tradable market capitalization) and new shareholder accounts (millions) through May of this year.

|

New Market Wealth Management is dedicated to providing thoughtful research-based investment advice and forward thinking services. Combined, the Partners have over 70 years in the investment management business, providing advice to some of the wealthiest families and largest corporations, endowments and foundations in America.

|

695 Town Center Drive, Suite 540, Costa Mesa, CA 92626 (657) 900-1899

newmarketwealth.com

|

|

|

|

|