|

The Wrap - Appraisals bounce back after holiday weekend but still down

July 17, 2015

Excerpts:

While the appraisal volume did bounce back from the holiday week last week, it fell short of a complete recovery and supports the view that the overall trend is slightly downward.

a la mode captures 50% of the appraiser market - more than 6 million appraisals per year since 2007, making it the most comprehensive record of national appraisal.

Most recent data:

6/28/15 -10.06%

7/5/15 7.47%

My comment: this is the second edition of a new weekly report using data provided by a la mode to Housing Wire. It comes out on Friday. I assume the data is from Mercury Network, which was recently sold to Serent Capital, a private investment group.

Click here to get the full stats and more information

http://www.housingwire.com/articles/34511-the-wrap-appraisals-bounce-back-after-holiday-weekend-but-still-down

For more info on the sale of Mercury Network, go to

http://help.alamode.com/docs/1025.htm

------------------------------

Fannie and Freddie are Back, Bigger and Badder Than Ever

From the New York Times

Excerpt:

In the 2008 crisis, when it looked as if Fannie and Freddie might go bankrupt, Henry M. Paulson Jr., then the Treasury secretary, argued that their fall would cause economic catastrophe. Foreign investors, stuck with their securities, would panic, and the mortgage market would shut down. So Fannie and Freddie were put into something called conservatorship, and are now government controlled, supported by a line of credit from the Treasury.

My comment: Who will develop appraisal forms and find the "bad" appraisers? No UAD? No 1004MC? Sounds great!!!

http://www.nytimes.com/2015/07/20/opinion/fannie-and-freddie-are-back-bigger-and-badder-than-ever.html?_r=0

------------------------

Rethinking Appraisals in a Modernized Housing Finance System

Presentation to Collateral Risk Network, June 29, 2015

Edward J. DeMarco, Senior Fellow in Residence

Milken Institute - Center for Financial Markets

Excerpt:

Before proceeding, I should define what I mean by a future housing finance structure. I am thinking ahead to what the secondary mortgage market could look like in a post Fannie Mae and Freddie Mac conservatorship world. Think about it as a world not dominated by these two government sponsored enterprises (GSEs) and in which we have moved away from having taxpayers being the primary insurers of mortgage credit risk. Those two changes alone should challenge a lot of assumptions about whether the current appraisal system makes sense in the future.

One other note, I will focus my remarks on the conforming, conventional market served the past few decades by Fannie Mae and Freddie Mac. While much of what I have to say is applicable to other market segments, including the FHA market, for ease of presentation I intend to focus on this particular segment.

My comment: Sorry, I didn't read the full report... so I have no comments. I tried to read it, but kept losing track and taking breaks to check facebook ;> Some discussion on linkedin.

http://www.milkeninstitute.org/publications/view/721

------------------------------------------

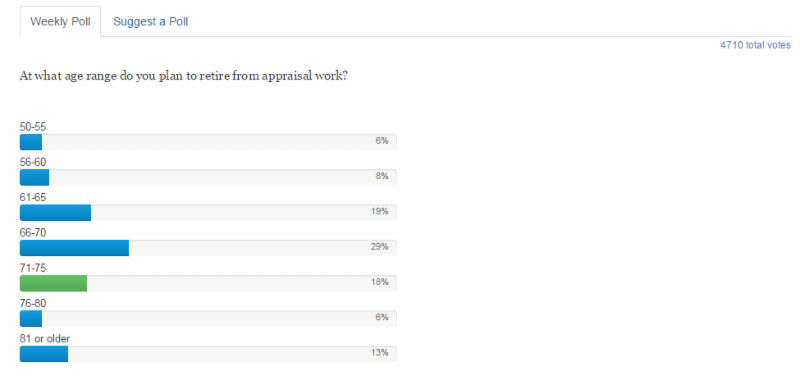

At what age range do you plan to retire from appraisal work?

Another interesting www.appraisalport.com poll. This week's current poll is "As a follow up, if you are a licensed or certified appraiser, what is your current age range?" Click the link above to vote, then click on Poll button on the right. It stops at over 70 - too low!!

My comments: Interesting results!! They left off "never";> Appraisers often just "fade away" as they get older. I am 72 and have cut back quite a bit on appraising. No more 7 days a week, 10-12 hours a day for me!! Only taking appraisals in my small city for the past two years, since I started getting $3,000 per month Social Security. No lender work. Estate work - often have multiple appraisals with different dates - death of first spouse, death of second spouse, beneficiaries fighting over how to divide up the properties... Just got one today for 4 properties I had previously appraised in 2002. Backed up for 3 months. I will always be an appraiser as I love it, but I will give up fee appraising eventually as I really hate writing up those darn reports!! Also, the fixed costs are fairly high, even before you do one appraisal - E&O, MLS, software, CE, license, etc. I can appraise without a license, but getting work can be hard. There is a local real estate agent who is my main competition for estate work.

Want to quit the lender rat race? My paid Appraisal Today has lots and lots of tips and will help you decide what non-lender work you want to do. Plus, how to get the work. Go to www.appraisaltoday.com to sign up.

------------------------------------

HOW TO USE THE NUMBERS BELOW. Appraisals are ordered after the loan application. These numbers tell you the future for the next few weeks. For more information on how they are compiled, go to

Note: I publish a graph of this data every month in my printed newsletter, Appraisal Today. For more information or get a FREE sample issue go to http://www.appraisaltoday.com/products.htmor send an email to info@appraisaltoday.com . Or call 800-839-0227, MTW 8AM to noon, Pacific time.

Mortgage applications increased 0.1 percent from one week earlier,

according to data from the Mortgage Bankers Association's (MBA) Weekly Mortgage Applications Survey for the week ending July 17, 2015. July 22, 2015

The Market Composite Index, a measure of mortgage loan application volume, increased 0.1 percent on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index increased 0.4 percent compared with the previous week. The Refinance Index decreased 1 percent from the previous week. The seasonally adjusted Purchase Index increased 1 percent from one week earlier. The unadjusted Purchase Index increased 1 percent compared with the previous week and was 18 percent higher than the same week one year ago.

The refinance share of mortgage activity decreased to 50.3 percent of total applications from 50.8 percent the previous week. The adjustable-rate mortgage (ARM) share of activity decreased to 7.3 percent of total applications.

The FHA share of total applications increased to 14.0 percent from 13.8 percent the week prior. The VA share of total applications increased to 11.3 percent from 10.8 percent the week prior. The USDA share of total applications remained unchanged from 0.9 percent the week prior.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) remained unchanged at 4.23 percent, with points decreasing to 0.34 from 0.39 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans. The effective rate decreased from last week.

The average contract interest rate for 30-year fixed-rate mortgages with jumbo loan balances (greater than $417,000) decreased to 4.16 percent from 4.20 percent, with points increasing to 0.33 from 0.28 (including the origination fee) for 80 percent LTV loans. The effective rate decreased from last week.

The average contract interest rate for 30-year fixed-rate mortgages backed by the FHA decreased to 4.00 percent from 4.02 percent, with points decreasing to 0.17 from 0.26 (including the origination fee) for 80 percent LTV loans. The effective rate decreased from last week.

The average contract interest rate for 15-year fixed-rate mortgages remained unchanged at 3.43 percent, with points increasing to 0.34 from 0.33 (including the origination fee) for 80 percent LTV loans. The effective rate increased from last week.

The average contract interest rate for 5/1 ARMs decreased to 3.08 percent from 3.13 percent, with points decreasing to 0.41 from 0.42 (including the origination fee) for 80 percent LTV loans. The effective rate decreased from last week.

The survey covers over 75 percent of all U.S. retail residential mortgage applications, and has been conducted weekly since 1990. Respondents include mortgage bankers, commercial banks and thrifts. Base period and value for all indexes is March 16, 1990=100.

|