|

Appraiser gets $1,000 fee and a $100 "tip" to inflate value - twice

Sorry, no appraiser names was included. Darn!!

Excerpt:

According to Acting U.S. Attorney Horn, the charges and other information presented in court: In November 2004, Fricks contacted a senior vice president at Cornerstone Community Bank and stated that he needed an $850,000 loan to purchase property in Ringgold, Georgia. Fricks did not reveal that he had already signed a contract to purchase the property for only $425,000. Fricks had done business with that senior vice president for many years before this, both at Cornerstone and at the bank where the employee had worked before joining Cornerstone. And Fricks had allowed the bank employee free use of his condominium at a beach in Florida, five to ten times.

The senior vice president violated Cornerstone's policies and procedures by not obtaining a copy of the sales contract between Fricks and the seller of the property to verify the contract price. The senior vice president also allowed Fricks to select an appraiser to appraise the property. Fricks paid the appraiser $1,000 to inflate the appraised value of the property so that Cornerstone would approve the $850,000 loan Fricks was seeking. In addition, Fricks gave the appraiser $100 in cash as a "tip." The appraiser provided Fricks with a fraudulently inflated appraisal report, which stated that the market value of the property was $1,010,000.

Link to FBI press release

http://www.fbi.gov/atlanta/press-releases/2015/tennessee-man-pleads-guilty-to-conspiracy-to-defraud-cornerstone-community-bank-in-dalton-georgia

Excerpt:

Approximately two years later, in October 2006, Fricks contacted the same senior vice president at Cornerstone and stated that he wanted to borrow more money against the property.

Fricks paid the same appraiser $1,000 to re-appraise the property and once again directed the appraiser to fraudulently inflate its appraised value. Fricks also gave the appraiser another $100 tip.

The appraiser provided Fricks with a new appraisal report, which fraudulently stated that the market value of the property was $1,433,000.

Fricks caused the new appraisal report to be sent to Cornerstone, knowing that it was fraudulent. The new appraisal was more than 40 percent higher than the previous appraisal conducted by the same appraiser just two years earlier. As a result of this new appraisal, Cornerstone released the additional collateral pledged by Fricks when the loan was originated in 2004, consisting of five real properties and the guaranty of Fricks Properties, a company owned by Fricks.

Link to local newspaper article

http://www.northwestgeorgianews.com/catwalkchatt/news/local/feds-tennessee-man-pleads-guilty-to-conspiracy-after-overinflating-value/article_2e7f55ec-064b-11e5-9f06-873f009b13ec.html

---------------------------------

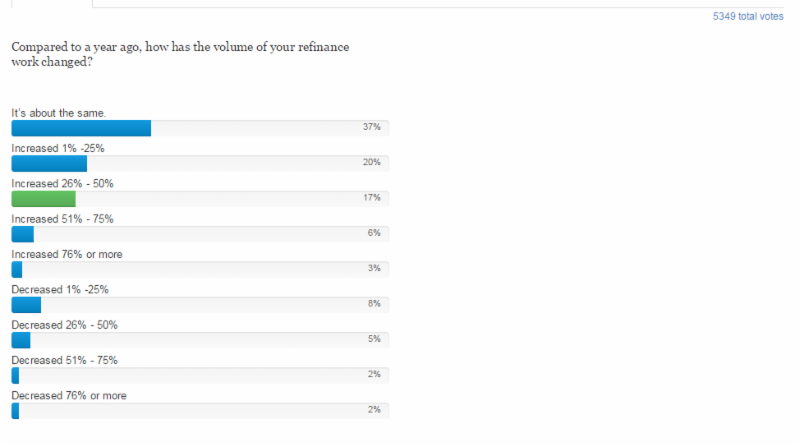

Compared to a year ago, how has the volume of your refinance work changed?

Appraisalport poll www.appraisalport.com

My comment: I wish it would have asked about all appraisals. But, I was surprised at the range of answers. But, only 15% had a decline in refi appraisals. Guess they weren't working for any AMCs.

----------------------------

Appraisalport polls on comp photos

By Steve Costello, www.appraisalport.com

This month I want to discuss three recent polls dealing with comp photos. In the first poll, we asked "With the availability of MLS photos, do you still feel it is necessary to drive by and photograph every comp?" We had a total of 3819 responses and the top two answers were very close. The winner, with 40 percent of the vote, was "Sometimes, it depends on the complexity of the specific assignment." Coming in a close second was "Yes, I always want to see any property I use in a report" with 38 percent of the vote. The final answer of "No, I would rather just use MLS photos" only scored about half the votes as the first two answers, finishing with 22 percent. This makes sense because I think most appraisers want to look at a comp before they include it in a report, especially if they aren't already familiar with the property. I can also see where some appraisers are very familiar with the properties in their area, use many of the same comps over and over again, and don't feel a need to drive by and photograph them every time they use them.

In the next poll, we asked "In your opinion, with MLS, Google, and other photo sources available to clients, the main reason original comp photos are required from the appraiser is:" This poll had 3986 responses and had a pretty clear winner. A full 63 percent of the appraisers chose the answer "To make sure the appraiser actually drives by the comps." So it looks like most appraisers don't think their clients care as much about the actual photo compared to just making sure the appraiser actually visited the comp. The answer we expected to be very popular, "To provide the client with up-to-date photos of the comps - ensuring they exist in the stated condition," only received 22 percent of the vote. A third response of "So the clients won't have to take the time to look up the photos from one of the sources noted above" didn't do well, only pulling in 3 percent of the vote. Not a surprise - we didn't really expect many appraisers to choose that answer. Finally, 13 percent of appraisers went with "Other reason" as the best choice for this question. We really don't know if there were one or many "other reasons" or what they are.

Finally, we asked "Would you be in favor of eliminating the requirement to include an original photo of every comp as long as a recent MLS photo of the property could be included with your report?" This question was very popular with 4770 total votes. It also produced a landslide vote with 79 percent of the appraisers selecting the answer "Yes." Only 15 percent answered "No" and would not want to use an MLS photo instead of an original if it were available. A final 6 percent were "Not sure" how they felt about this issue. So, from this poll it is clear that appraisers feel that an original photo is not a necessity to produce a quality appraisal as long as a good representative photo is available from another source like an MLS.

My comment: As we all know, a photo taken at the time of listing from the MLS is often better than one taken later and USPAP does not require comp photos. Fannie Mae certification require that the appraiser inspect the exterior of the comp, not take a photo. What about re-using a comp photo? Why the requirement of an "original" photo? To be sure appraisers drive by the comps.

WHAT DO YOU THINK? POST YOUR COMMENTS, AND READ OTHER COMMENTS, AT WWW.APPRAISALTODAYBLOG.COM

Link to Appraisalport Blog with this story and others

http://blog.appraisalport.com/blog/

-----------------------------------------

HOW TO USE THE NUMBERS BELOW. Appraisals are ordered after the loan application. These numbers tell you the future for the next few weeks. For more information on how they are compiled, go to www.mbaa.org

Note: I publish a graph of this data every month in my printed newsletter, Appraisal Today. For more information or get a FREE sample issue go to http://www.appraisaltoday.com/products.htm or send an email to info@appraisaltoday.com . Or call 800-839-0227, MTW 8AM to noon, Pacific time.

Mortgage applications decreased 7.6 percent from one week earlier,

According to data from the Mortgage Bankers Association's (MBA) Weekly Mortgage Applications Survey for the week ending May 29, 2015. This week's results include an adjustment to account for the Memorial Day holiday.

The Market Composite Index, a measure of mortgage loan application volume, decreased 7.6 percent on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index decreased 17 percent compared with the previous week. The Refinance Index decreased 12 percent from the previous week. The seasonally adjusted Purchase Index decreased 3 percent from one week earlier. The unadjusted Purchase Index decreased 14 percent compared with the previous week and was 14 percent higher than the same week one year ago.

The refinance share of mortgage activity decreased to 49 percent of total applications, its lowest level since May 2014, from 51 percent the previous week. The adjustable-rate mortgage (ARM) share of activity decreased to 6.1 percent of total applications.

The FHA share of total applications increased to 14.9 percent from 14.5 percent the week prior. The VA share of total applications increased to 12.0 percent from 11.7 percent the week prior. The USDA share of total applications increased to 1.0 percent from 0.8 percent the week prior.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) decreased to 4.02 percent from 4.07 percent, with points decreasing to 0.33 from 0.35 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans. The effective rate decreased from last week.

The average contract interest rate for 30-year fixed-rate mortgages with jumbo loan balances (greater than $417,000) decreased to 4.01 percent from 4.06 percent, with points increasing to 0.30 from 0.29 (including the origination fee) for 80 percent LTV loans. The effective rate decreased from last week.

The average contract interest rate for 30-year fixed-rate mortgages backed by the FHA decreased to 3.77 percent from 3.83 percent, with points increasing to 0.21 from 0.16 (including the origination fee) for 80 percent LTV loans. The effective rate decreased from last week.

The average contract interest rate for 15-year fixed-rate mortgages decreased to 3.27 percent from 3.29 percent, with points increasing to 0.33 from 0.24 (including the origination fee) for 80 percent LTV loans. The effective rate increased from last week.

The average contract interest rate for 5/1 ARMs decreased to 2.97 percent from 3.04 percent, with points increasing to 0.50 from 0.48 (including the origination fee) for 80 percent LTV loans. The effective rate decreased from last week.

The survey covers over 75 percent of all U.S. retail residential mortgage applications, and has been conducted weekly since 1990. Respondents include mortgage bankers, commercial banks and thrifts. Base period and value for all indexes is March 16, 1990=100.

|