|

|

|

Aviv REIT Acquires Seniors Housing Facilities, Land For $94M

| |

WEST YARMOUTH, WESTON AND BREWSTER, MASS. -- Aviv REIT Inc. (NYSE: AVIV) has acquired several seniors housing properties and land parcels in Massachusetts for $94.2 million.

The Chicago-based REIT acquired two assisted living facilities and one post-acute and long-term care skilled nursing facility for $82 million. Aviv also purchased two parcels of land and the entitlements for the construction of two new assisted living facilities and a 50-unit addition to an existing assisted living facility for $12.2 million.

The acquired properties include a 126-unit assisted living facility and a 72-unit skilled nursing facility located in West Yarmouth on Cape Cod; and a 93-unit assisted living facility located in Weston, a suburb of Boston. The new construction projects include two assisted living facilities in West Yarmouth and an assisted living facility in Brewster.

"This deal demonstrates our ability to opportunistically acquire high-quality seniors housing properties at attractive valuations, complementing our primary investment strategy of acquiring post-acute and long-term care skilled nursing facilities," says Craig Bernfield, chairman and CEO of Aviv.

The properties will be triple-net leased to existing Aviv operator Maplewood Senior Living, an operator of 12 facilities in three states that are triple-net leased from Aviv.

"We further diversified our high-quality portfolio, adding best-in-class private pay healthcare properties in desirable Northeast markets, and further enhanced our tenant diversification by materially growing our relationship with Maplewood," Bernfield continues.

The acquisition has an initial cash yield of 8 percent, which increases to 8.5 percent in year two, with consumer pride index (CPI)-based annual escalators thereafter; and an initial lease term of 10 years. The new construction projects have an initial cash yield of 9 percent upon completion, with CPI-based annual escalators and an initial lease term of 10 years.

The monthly revenues per occupied room at the properties are approximately $6,000 and the facilities are 91 percent occupied.

The total expected cost for the new construction projects is $69.7 million, inclusive of the $12.2 million paid for the land parcels and entitlements, with construction expected to take place from the end of 2014 to the end of 2016.

The new construction projects are already subject to a triple-net lease with Maplewood. The projects include:

- A 50-unit addition to the existing assisted living facility in West Yarmouth with a total estimated cost of $12.6 million and an initial cash yield of 9 percent. Construction is expected to begin in the second quarter of 2015 and is scheduled for completion during the third quarter of 2016.

- A 75-unit existing assisted living facility West Yarmouth with a total estimated cost of $19.8 million and an initial cash yield of 9 percent. Construction is expected to begin in the second quarter of 2015 and set for completion during the third quarter of 2016.

- A 131-unit existing assisted living facility in Brewster with a total estimated cost of $37.3 million and an initial cash yield of 9 percent. Construction is expected to begin in the fourth quarter of 2014 and is slated for completion during the second quarter of 2016.

Aviv is a real estate investment trust that specializes in owning post-acute and long-term care skilled nursing facilities and other healthcare properties. The company currently owns 312 properties that are triple-net leased to 39 operators in 29 states.

Aviv's stock price closed Monday at $27.90 per share, up from $25.95 per share this time last year.

-- Danielle Everson

|

|

|

Suffolk Construction To Build Addition

to Lahey Hospital & Medical Center

| |

| | The $60 million, 190,000-square-foot addition will feature a new emergency department, shell space and mechanical areas. |

BURLINGTON, MASS. -- Lahey Hospital & Medical Center has selected Suffolk Construction to perform pre-construction and construction management services for the first phase of the Stilts Infill Master Plan for Lahey Hospital & Medical Center in Burlington. Situated on the academic medical center's campus, the $60 million project will consist of a 190,000-square-foot addition featuring a new emergency department, shell space and mechanical areas to infill the existing Stilts structure and tie together Lahey's clinical facility. Construction is slated to begin this fall with completion slated for 2017. Suffolk has partnered with architect firm Freeman White on the project, which has been designed to achieve LEED Silver certification.

|

|

King Street Properties Launches

Two-Building Lab Project In Cambridge

| |

| King Street Properties received a $67 million loan for

200 Cambridge Park Drive in Cambridge, Mass. |

CAMBRIDGE, MASS. -- King Street Properties has purchased two laboratory buildings near the Alewife MBTA Station in Cambridge for a combined price of $54.5 million. Working on behalf of the buyer, HFF arranged $89 million in acquisition and repositioning financing through Cornerstone Real Estate Advisers. A $22 million floating-rate loan was secured for 87 Cambridge Park Drive, and a $67 million, floating-rate loan was secured for 200 Cambridge Park Drive. The buyer plans to renovate, reposition and re-lease the properties through Cushman & Wakefield. 87 Cambridge Park Drive is a vacant 62,492-square-foot office/laboratory, and 200 Cambridge Park Drive is a vacant six-story, 221,676-square-foot Class A office/laboratory facility that was most recently renovated in 2004. Greg LaBine led the HFF team representing the borrower in the transaction.

|

|

Phase II Construction Begins For Boyton Meadows In Groton, Massachusetts

| |

| | The second phase of Boyton Meadows will feature 15 townhouses, ranging from 2,000 to 2,500 square feet in Groton, Mass. |

GROTON, MASS. -- Senate Construction Corp. has begun construction on the second phase of development at Boyton Meadows, a mixed-use development in Groton. The second phase will include 15 townhouses, ranging from 2,000 to 2,500 square feet with additional walkout and basement space. The second phase is slated for completion in November. The first phase, which is located on Main Street, includes mixed-use first-floor office and retail space, which is occupied by a yoga studio, bakery and dental office. Maugel Architects has designed the mixed-use project to incorporate the colonial architecture of the community while including modern features. Mount Laurel Development LLC is developing the project, which is financed by Bank of New England.

|

|

|

|

HFF Brokers $101.5M Sale of Logan Towne Centre in Central Pennsylvania |

| The 715,819-square-foot Logan Towne Centre has sold

for $101.5 million in Altoona, Pa. |

ALTOONA, PA. -- HFF has brokered the sale of Logan Towne Centre, a 715,819-square-foot shopping center in Altoona. AVR-ALTOONA LP sold the property to a private investor for $101.5 million. Situated on 75 acres at 155 Falon Lane, the grocery-anchored shopping center is 98.4 percent leased to tenants, including Giant Eagle Supermarket, Kohl's, Best Buy, Staples, Bed Bath & Beyond, Michaels, Ross, Boscov's and Dick's Sporting Goods. Jim Koury and Claudia Steeb led the HFF investment sales team that represented the seller in the transaction.

|

|

Juniper Purchases Brookline Village For $35.5M In State College | | |

STATE COLLEGE, PA. -- Bloomfield, N.J.-based Juniper Communities has acquired Brookline Village in State College for $35.5 million. The five-building, 274-unit property offers a mix of residential units: 116 skilled nursing/rehabilitation, 38 memory care, 87 personal care and 33 independent living. The buyer plans to rename the property Juniper Village at Brookville. Juniper Communities is one of the largest seniors housing providers with a concentration of operations in Pennsylvania, New Jersey, Florida and Colorado. This acquisition will increase Juniper's size and resident capacity by 25 percent.

|

|

Capital One Bank Closes $24.2M Loan For Skilled Nursing Facility

NEW YORK CITY -- Capital One Specialty Healthcare Real Estate, part of Capital One Bank's Commercial Real Estate Group, has provided a $24.2 million HUD 232/223(a)(7) loan to refinance an assisted living facility in Queens' Flushing neighborhood. The 154-unit facility offers 280 beds and a full array of skilling nursing services and amenities, including rehabilitation therapy, hospice and palliative care, as well a beautician/barber and recreational activities. Joshua Rosen of Capital One's Chicago office originated the financing.

|

|

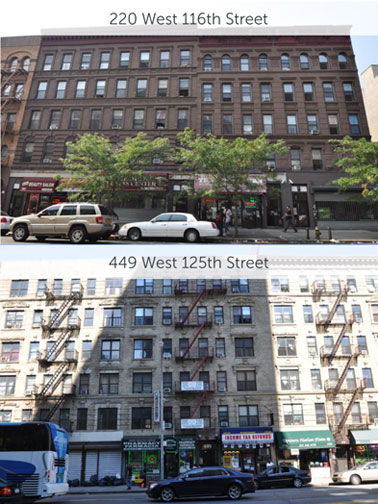

Ariel Property Brokers Two-Building Mixed-Use Portfolio Sale

| Treetop Development sold the two-property mixed-use portfolio

for $15.4 million in Harlem. |

NEW YORK CITY -- Ariel Property Advisors has brokered a two-building, mixed-use portfolio sale for $15.4 million. Located at 220 W. 116th St. and 449 W. 125th St. in Harlem, the properties offer a total of 59 units. The five-story, 46,080-square-foot building at 220 W. 116th St. features five retail units and 35 rent-stabilized apartments, including 33 three-bedroom units and two studios. The six-story, 16,382-square-foot property at 449 W. 125th St. features two retail units and 17 rent-stabilized apartments: one three-bedroom unit, seven two-bedroom units and six one-bedroom units. Shimon Shkury, Victor Sozio, Michael Tortorici and Jesse Deutch of Ariel Property Advisors represented the seller, Teaneck, N.J.-based Treetop Development LLC, and procured the buyer, a New York City real estate investment firm, in the transaction.

|

|

Eastern Consolidated Brokers $6.5M Long Island Warehouse Sale |

| |

GMS Seashore sold the 18,000-square-foot warehouse property

to 37-10 Crescent Street LLC for $6.5 million.

|

NEW YORK CITY -- Eastern Consolidated has arranged the sale of 37-10 Crescent Street, a warehouse property in Long Island City. GMS Seashore sold the 18,000-square-foot property to 37-10 Crescent Street LLC for $6.5 million. A limousine company, whose lease expires in May 2015, currently occupies the one-story building. The lease includes one five-year option and demolition clause that may be exercised with a six-month notice. The asset site totals 36,552 buildable square feet. Peter Carillo and Chad Ian Sinsheimer of Eastern Consolidated represented the seller in the transaction. Additionally, Carillo procured the buyer for the deal. The attorney for the seller was Farrel Fritz, and Seth Stein, Esq. was the attorney for the buyer.

|

|

NAI Friedland Brokers 80,000 SF Industrial Building Sale |

| |

750 South Fulton Storage LLC plans to renovate the property into a mini storage facility in Mount Vernon, N.Y.

|

MOUNT VERNON, N.Y. -- NAI Friedland has brokered the sale of an industrial building in Mount Vernon for nearly $3.9 million, or approximately $48.26 per square foot. 750 South Fulton Storage LLC purchased the multiuse, two- to three-story structure and plans to renovate the property into a mini-storage facility. The building's seller, Wampum LLC, previously used the building for various commercial uses, including retail, office and warehouse space. Andy Grossman of NAI Friedland represented both the buyer and seller in the transaction.

|

|

GFI Arranges $3.1M Multifamily Building Sale In The Bronx

|

| |

The 25,925-square-foot building offers 35 multifamily units

in the Bronx's Tremont Section of New York.

|

NEW YORK CITY -- GFI Realty Services has arranged the sale of 805 Fairmount Place, a five-story walk-up multifamily building in the Bronx's Tremont section. The property sold for $3.1 million or approximately $89,000 per unit. Built in 1931, the 25,925-square-foot building offers 35 apartment units and is in close proximity to the West Farms Square-East Tremont Avenue subway station. Yosef Katz and Yisroel Pershin of GFI represented the seller, Madison Realty, while Shulen Paneth and Eli Matyas, also of GFI, represented the buyer, a local investor, in the transaction.

|

|

Fantini & Gorga Arranges $2.3M Acquisition Financing For Retail Center |

| |

The 35,400-square-foot retail center is occupied by Wells IGA Food Market, Dairy Queen, a laundry mat and a family-style restaurant.

|

WELLS, MAINE -- Boston-based Fantini & Gorga has arranged $2.3 million in first mortgage acquisition financing for Wells Corner Shopping Center, located at 1517 Post Road in Wells. Developed in 1978, the 35,400-square-foot center is occupied by Wells IGA Food Market, Dairy Queen, a laundry mat and a family-style restaurant. Casimir Groblewski and Jason Cunnane of Fantini & Gorga arranged the fixed-rate, five-year loan, which was provided by a Massachusetts-based lending institution, on behalf of Wells Corner Shopping Center LLC, a Maine-based limited liability company.

|

|

Snapple Leases 51,734 SF Distribution Space In Bohemia, N.Y. |  | |

BOHEMIA, N.Y. -- Snapple, along with its parent company Dr. Pepper, has leased 51,734 square feet at 2004 Orville Drive North in Bohemia. Owned by Rechler Equity Partners, the one-story 106,515-square-foot building offers 24-foot clear ceiling heights and convenient access to Veterans Memorial Highway, the Long Island Expressway and Sunrise Highway. Snapple is moving its Long Island operations to the new facility. Ted Trias of Rechler Equity Partners represented the owner in the transaction, while Philip Heilpern of CBRE represented the tenant.

|

|

CBRE/NE, Cushman & Wakefield Broker 17,850 SF Charter School Lease

|

| Gate City Charter School plans to open in September with

140 students in Merrimack, N.H. |

MERRIMACK, N.H. -- Gate City Charter School, an elementary public charter school, has signed a lease for 17,850 square feet of space at Seven Henry Clay Drive in Merrimack. The school is slated to open in September for the 2014 school year with 140 students, with plans to grow to 180 students by 2016. Gate City Charter School will offer an arts-integrated curriculum for grades K-8. Mike Tamposi of CBRE/New England represented the landlord, Adamian Construction & Development, while Tom Farrelly and Sue Ann Johnson of Cushman & Wakefield represented the tenant in the transaction.

|

|

|

|

Certified Buyer Representative Course

| |

Overview: Sponsored by REBNY, the two-day course is for real estate professionals looking to obtain CBR certification or continuing education credits.

When: 9 a.m. to 5:30 p.m. August 12-13

Where: REBNY Mendik Education Center, 570 Lexington Ave. (Lower Level), NYC

|

InterFace Net Lease

| |

Overview: The agenda will cover investment, development and financing trends and discuss market conditions in the NNN and sale/leaseback space.

When: September 17

Where: New York Bar Association

(Cocktail reception on Sept. 16 at The Terrace Club)

|

Certified Negotiation Expert Course

| |

Overview: Sponsored by REBNY, the two-day course is for real estate professionals looking to obtain CNE certification or continuing education credits.

When: 9 a.m. to 5:30 p.m. September 29-30

Where: REBNY Mendik Education Center, 570 Lexington Ave. (Lower Level), NYC

|

2014 ULI Fall Meeting

| |

Overview: Urban Land Institute's fall meeting includes keynote speakers Jamie Dimon (JPMorgan Chase & Co.), Walter Isaacson (Aspen Institute), Jennifer Lawson (MakerBot) and Vincent Stanley (Patagonia).

When: October 21-23

Where: Javits Convention Center, NYC

|

|

|

Contact us

Matt Valley, Editorial Director Northeast Real Estate Business France Media, Inc. 404-832-8262 404-832-8260 northeast@francemediainc.com www.rebusinessonline.com |

|

|