|

|

|

Boxman Studios Builds Retail Venue From Shipping Containers For Assembly Row

| |

| The four shipping containers have been converted in SOMBLOX,

a dining and retail venue at Federal Realty's Assembly Row. |

SOMERVILLE, MASS. -- Boxman Studios, a global leader in shipping container modification, has created a one-of-a-kind dining and retail venue from shipping containers to anchor Federal Realty's Assembly Row neighborhood in Somerville. Located at the corner of Canal Street and Grand Union Boulevard, four modified 20-foot shipping containers create SOMBLOX. The container courtyard is slated to open in early August and is outfitted for three local businesses, including Somerville Brewing Company's American Fresh Taproom. The four containers create three distinct ADA-accessible spaces that include electrical and lighting. Two of the containers are designed for retail spaces with easy-to-open eight-foot hinged storefront windows and steel doors. The Taproom space is comprised of two containers that include kitchen equipment and plumbing.

|

|

|

|

Ranaan Katz Acquires Three Retail Properties For $87.7M In Massachusetts |

| |

Ranaan Katz added the 89,126-square-foot Kohl's location in Stoughton, Mass., to its RK Centers portfolio.

|

WORCESTER, WESTBOROUGH AND STOUGHTON, MASS. -- Ranaan Katz has added to its RK Centers portfolio with the acquisition of three retail properties in Massachusetts. In the first transaction, RKCenters purchased the 386,853-square-foot Worcester Crossing for $49 million from Madison Partners. Located along Route 146 in Worcester, the retail center is anchored by Walmart and Sam's Club. RK Centers also acquired the 185,279-square-foot Westborough Speedway Plaza from Regency Centers for $18.7 million. Anchored by Stop & Shop and Burlington Coat Factory, the center is located along Route 9 in Westborough. In the final transaction, the company purchased an 89,126-square-foot single-tenant triple-net leased Kohl's location in Stoughton. Stoughton Marketplace DST sold the property for $20 million.

|

|

HFF Arranges $51.5M Loan For New Jersey Multifamily Community |

| | Russo Development received a $51.5 million loan for Vermalla Lyndhurst, a 296-unit apartment community in Lyndhurst, N.J. |

LYNDHURST, N.J. -- HFF has arranged $51.5 million in financing for Vermalla Lyndhurst, a Class A multifamily community in Lyndhurst. Completed in early 2014, the property features 296 apartment units in one-, two- and three-bedroom floorplans ranging in size from 827 to 1,918 square feet. The units feature hardwood floors, quartz countertops, energy-efficient stainless steel appliances, in-residence washers and dryers and nine-foot ceilings. The community amenities include an 8,000-square-foot clubhouse, outdoor heated pool, fire pit, cyber café, fitness center, media lounge, billiards room and a 4,000-square-foot dog park. Thomas Didio and Michael Lachs of HFF secured the fixed-rate loan through a life insurance company for the borrower, Russo Development.

|

|

Chesapeake Lodging Trust Completes $60M Refinancing For Two Hotels | | |

NEW YORK CITY -- Chesapeake Lodging Trust has received $60 million in refinancing for the 122-room Holiday Inn New York City Midtown - 31st Street and the 185-room Hyatt Place New York Midtown South. The term loan was refinanced with a new 10-year, $90 million fixed-rate mortgage loan secured by the two previously mentioned hotels. Provided by Goldman Sachs Mortgage Co., the loan carries a fixed interest rate of 4.3 percent per annum. Additionally, the loan features two years interest only and a 30-year amortization schedule.

|

|

LEI Acquires 228-Unit Christina Mill Apartments In Newark, Delaware

| LEI plans to invest $1.5 million to upgrade the

228-unit Christina Mill Apartments in Newark, Del. |

NEWARK, DEL. -- Lowe Enterprises Investors (LEI) has purchased Christina Mill Apartments, a multifamily community located at 100 Christina Mill Dr. in Newark. Built in 1992, the 228-unit community consists of 25 separate apartment buildings on 18.5 acres. Some of the units have been recently renovated, and LEI plans to invest $1.5 million to upgrade the remaining 171 units, as well as the common areas, including the clubhouse, fitness center, leasing office and business center. The community features a mix of one- and two-bedroom units with washer/dryers in each unit. Community amenities include a swimming pool and sundeck, a lighted tennis court, an off-leash dog park, a shared community garden and a bike share program. John Gaghan led the LEI acquisition team, while Erin Miller of JLL represented the seller, Korman Residential, in the transaction. Berkadia secured property financing. Additionally, LEI retained Greystar as property manager for the multifamily community.

|

|

WP Realty Completes Sale Of Four Retail Properties In Metro Boston

BRYN MAWR, PA. -- Bryn Mawr-based WP Realty has completed the disposition of four retail centers in metro Boston. Philips Edison & Company purchased the portfolio for $52.8 million. The portfolio consists of the 71,210-square-foot Cushing Plaza in Cohasset, Mass.; the 104,923-square-foot Shaw's Plaza in Easton, Mass.; the 57,181-square-foot Shaw's Plaza in Hanover, Mass.; and the 45,882-square-foot Hannaford Bros.-anchored center in Waltham, Mass. The portfolio was 97 percent leased to variety of tenants, including Shaw's, Hannaford Bros., Walgreens, Rite Aid, Bank of America and Citizen's Bank.

|

|

Fantini & Gorga Arranges $27.5M Loan For Multifamily Property

|

| |

Situated on 68 acres, Cowesett Hills Apartments features

456 apartment units in Warwick, R.I.

|

| |

WARWICK, R.I. -- Fantini & Gorga has arranged $27.5 million in permanent first mortgage financing for the Cowesett Hills Apartment community in Warwick. The borrower was Cowesett Hills Apartments LLC, an affiliate of Rhode Island-based The Picerne Real Estate Group. Situated on 68 acres of land at 3595 Post Road, the community features 456 apartment units. John Gorga and Jason Cunnane of Fantini & Gorga secured the financing through a national insurance company.

|

|

Orion Student Housing Takes 114-Unit Orchard Trails In Orono, Maine | | |

ORONO, MAINE -- Orion Student Housing has acquired Orchard Trails in Orono. Located at Four Empire Dr., the 144-unit student housing complex is located near the University of Maine campus. Orchard Trails Housing LLC sold the property for an undisclosed price. Dan Greenstein of CBRE | The Boulus Company, in conjunction with Simon Butler and Biria St. John of CBRE's Boston and Ryan Reid of CBRE Dallas, arranged the transaction.

|

|

Meridian Capital Arranges $21.7M Multifamily Acquisition Loan

|

| |

Pantzer Properties has acquired 1601 Sansom Street,

a 13-story, 80-unit multifamily property in Philadelphia.

|

| |

PHILADELPHIA -- Meridian Capital Group has arranged a $21.7 million loan on behalf of Pantzer Properties for the acquisition of a multifamily property in Philadelphia. Located at 1601 Sansom St., the 13-story property features 80 units with 11,192 square feet of retail space. The units were previously leased and operated by Oakwood Corporate Housing as a short-term furnished corporate rental facility. The five-year loan, provided by a local balance sheet lender, features a competitive fixed-rate of 3.13 percent and interest-only payment for the first two years followed by a 30-year amortization schedule. Drew Anderman, Alan Blank and David Bollag of Meridian's New York City headquarters negotiated the transaction.

|

|

Besen & Associates Brokers $18.4M Manhattan Multifamily Portfolio Sale  |

| | A local private investor acquired the four-property multifamily portfolio in Manhattan's Inwood section for $18.4 million. |

NEW YORK CITY -- Besen & Associates has brokered the sale of a four-property multifamily portfolio located in Manhattan's Inwood section for $18.4 million or $145,000 per unit. Located at 150-152, 158-160 and 170 Vermilyea Ave., the 111,420-square-foot, 129-unit portfolio features five studio units, 35 one-bedroom, 69 two-bedroom and 20 three-bedroom apartments. Morris Arlos, Greg Corbin and Amit Doshi of Besen & Associates represented the seller and procured the buyer, a local private investor, in the transaction.

|

|

Tryko Acquires 96-Unit Liberty Village In Plainfield, New Jersey |

| | Liberty Village features 96 Section 8 Homeowners Assistance Program residences in Plainfield, N.J. |

| |

PLAINFIELD, N.J. -- Brick, N.J.-based Tryko Partners has acquired Liberty Village, an affordable apartment building located at 205 Liberty St. in Plainfield. The building features 96 Section 8 Homeowners Assistance Program residences, which range in size from one to four bedrooms. The buyer plans to renovate the property, including parking lots and sidewalks, adding a laundry facility and community rooms, as well as upgrading the electrical infrastructure throughout the property. Tryko secured financing for the acquisition through Community Preservation Corp. Terms of the transaction were not released.

|

|

|

|

Demand For U.S. Office Space Grows In Second Quarter | |

By Scott Reid

Demand for office space nationwide accelerated in the second quarter of 2014, according to research reports by several commercial real estate services firms that track data throughout the United States.

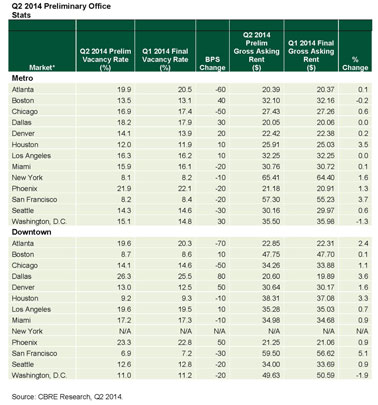

CBRE Group Inc. found that office vacancy rates declined in seven out of 13 major metro office markets during the second quarter of the year. The firm also reported that average asking rents increased during this period.

In its quarterly report, CBRE found that Atlanta led in vacancy declines, with a vacancy rate drop of 60 basis points (bps) during the quarter. Chicago posted a fall of 50 bps in its office vacancy rate, and Seattle's rate dropped 30 bps due to the expansion in its office stock of high-tech occupiers. Increases in vacancy occurred in Boston (40 bps), Dallas and Washington, D.C. (both 30 bps).

Vacancy rates in markets such as San Francisco and Houston are now near pre-recession levels. San Francisco saw a 3.7 percent increase in its average asking rents, and Houston experienced a 3.5 percent increase. Boston and Washington, D.C., saw decreases in average asking rents - 0.2 percent and 1.3 percent, respectively.

| |

Click on the image above to view a larger version.

|

Kevin Thorpe, chief economist of Cassidy Turley, says this growth was expected but his firm's findings pointed to stronger underlying trends.

"The office sector was due for a stronger quarter following the weather disruptions [of the first quarter], but what is telling is that we are now observing stronger demand trends for Class B and C space in many markets, indicating tenant demand is spreading beyond the highest quality product. Although high-quality space still dominates leasing activity, the Class B and C segment of the market accounted for 40 percent of the absorption this quarter, a major shift from the 25 percent averaged earlier in the recovery."

According to Cassidy Turley's report, U.S. office markets absorbed 15.1 million square feet of office space in the second quarter of 2014, up 41 percent from the previous quarter. The firm reported that vacancy rates nationwide fell 10 basis points (bps) from 15.2 percent in the first quarter to 15.1 percent in the second quarter.

Cassidy Turley also found that average asking rates in the U.S. rose 2.2 percent to $22.36 per square foot. As the second quarter closed, there was 73 million square feet of new office space under construction, up 34 percent compared to the second quarter of 2013.

The Q2 Cassidy Turley report differed from CBRE in its rankings, however, of the cities with the strongest demand for office space. It reported that the strongest market was New York, with 1.6 million square feet of net absorption, followed by San Jose, Calif., with 1.4 million square feet.

Investment management company JLL reported that overall leasing activity in the second quarter increased 6.2 percent from the first quarter of 2014. According to the company, there were 14 leases exceeding 300,000 square feet signed in the second quarter, compared to eight in the first quarter.

The office sector nationwide experienced 13.9 million square feet of positive net absorption in the second quarter, according to JLL, besting the first quarter by more than 5.5 million square feet, or 63 percent. JLL also found that in the 49 office markets it tracks, rents are increasing in 98 percent of those markets.

"Although development is picking up," says Cassidy Turley's Thorpe, "the office sector does not currently face the cyclical headwind of overbuilding, and absorption rates are solid enough in most markets.

"The majority of the country should expect that office rents will grow at an accelerating rate in the second half of the year driven by improving economic data, improving confidence and steady job creation."

|

|

|

|

Certified Buyer Representative Course

| |

Overview: Sponsored by REBNY, the two-day course is for real estate professionals looking to obtain CBR certification or continuing education credits.

When: August 12-13, 9 a.m. to 5:30 p.m.

Where: REBNY Mendik Education Center, 570 Lexington Ave. (Lower Level), NYC

|

InterFace Net Lease

| |

Overview: The agenda will cover investment, development and financing trends and discuss market conditions in the NNN and sale/leaseback space.

When: September 17

Where: New York Bar Association

(Cocktail reception on Sept. 16 at The Terrace Club)

|

Certified Negotiation Expert Course

| |

Overview: Sponsored by REBNY, the two-day course is for real estate professionals looking to obtain CNE certification or continuing education credits.

When: September 29-30, 9 a.m. to 5:30 p.m.

Where: REBNY Mendik Education Center, 570 Lexington Ave. (Lower Level), NYC

|

2014 ULI Fall Meeting

| |

Overview: Urban Land Institute's fall meeting includes keynote speakers: Jamie Dimon (JPMorgan Chase & Co.), Walter Isaacson (Aspen Institute), Jennifer Lawson (MakerBot) and Vincent Stanley (Patagonia).

When: October 21-23

Where: Javits Convention Center, NYC

|

|

|

Contact us

Matt Valley, Editorial Director Northeast Real Estate Business France Media, Inc. 404-832-8262 404-832-8260 northeast@francemediainc.com www.rebusinessonline.com |

|

|