July 10, 2014 | Issue 247

|

|

Republic Properties Receives $255M

in Debt, Equity for Portals III in D.C.

|

| | Portals III is currently 78 percent leased. This newest round of financing includes a debt and equity facility that will extend capitalization for another five years with sufficient funds for future leasing cost needs. |

WASHINGTON, D.C. -- Republic Properties Corp. has received $255 million in debt and equity to refinance Portals III, the company's 509,935-square-foot office building in Washington, D.C. The Class A property is located at 1201 Maryland Ave. S.W. in the Southwest Riverfront submarket.

The 10-story building is situated in the master-planned Portals development, one of the largest, privately held developments in the area. Portals III is currently 78 percent leased.

Korean Exchange Bank provided a $160 million senior debt facility, while Samsung SRA made a $95 million equity investment. The debt and equity facility will extend the capitalization for another five years with sufficient funds for future leasing cost requirements.

David Webb and Jamie Butler led the team from CBRE'S Mid-Atlantic Debt and Structured Finance Group, which arranged the refinancing on behalf of Republic Properties Corp.

"Samsung SRA's key management staff approached us expressing an interest in investing in the Portals III building," says Steven Grigg, president of Republic Properties. "In a remarkably short time, we established a relationship which allowed us to replace and simplify the capital structure of the project to the mutual benefit of all involved. Even though the transaction is about a quarter of a billion dollars, it came down to a mixture of old-fashioned personal relationships that were built on mutual objectives being satisfied in the context of fundamentally sound real estate."

-- Nellie Day

Click here to read the full article.

|

|

IPA Brokers $74.7M Sale of Boca Raton Apartment Community

|

| | Mizner Court at Broken Sound in Boca Raton features a lakefront clubhouse and two lakefront resort-style pools. |

BOCA RATON, FLA. -- Institutional Property Advisors (IPA), a division of Marcus & Millichap serving institutional and major private investors, has arranged the $74.7 million sale of Mizner Court at Broken Sound, a 450-unit multifamily community located at 6503 N. Military Trail in Boca Raton. Still Hunter III of IPA represented the seller, CLP Mizner Court LLC, in the transaction. The buyer was Mizner Court Holdings LLC.

The apartment community's amenity package includes a recently remodeled lakefront clubhouse, two lakefront resort-style pools, two poolside spas, lakefront lounge areas, a fitness center, two lighted tennis courts, lakefront walking paths and a gated entrance with a guardhouse.

|

|

McCraney Breaks Ground on Spec Industrial Building in West Palm Beach

|

| | The new 100,000-square-foot industrial development will be part of the Vista Business Park in West Palm Beach. |

WEST PALM BEACH, FLA. -- McCraney Property Co. has broken ground on a Class A, 100,000-square-foot warehouse/distribution center in West Palm Beach. The property is located off Okeechobee Boulevard and Jog Road in McCraney's Vista Business Park. The project is the first new construction in the office park in the past five years.

City National Bank provided construction financing for the project, and Michael Falk & Co. LLC will lease the two-building property. The design team includes general contractor Edwards Construction Services Inc. and architect Jose Jaramillo of JJ Architectural Group. Upon completion, which is slated for December 2014, the property will feature 24-foot clear heights and available industrial space ranging from 10,000 to 100,000 square feet.

|

|

Bojangles' Opens its 600th Location

|

With one restaurant opening every six days or so, Bojangles' is outpacing the growth rate of its national competitors at a fast clip. The Charlotte-based chicken chain expects to open 55 to 60 locations throughout the Southeast this year, adding new restaurants in more than 25 market areas including Atlanta; Birmingham, Alabama; Orlando; Richmond, Virginia; and Nashville, Knoxville and Tri-Cities, Tenn.

This year's expansion is part of Bojangles' long term growth plan to have 1,000 units open by 2020.

|

|

Vista Capital Arranges $47M Loan

for Holiday Inn in Ocean City

|

| | The Holiday Inn Hotel & Suites features an oceanfront children's pool with a lazy river and water slides, a four-story atrium, three restaurants and approximately 1,000 square feet of meeting space. |

OCEAN CITY, MD. -- Vista Capital Co. has arranged $47 million in financing for a 210-room, 13-story Holiday Inn Hotel & Suites in Ocean City. The hotel features an oceanfront pool, an oceanfront children's pool with a lazy river and water slides, a four-story atrium, three restaurants and approximately 1,000 square feet of meeting space. Vista Capital arranged the non-recourse, fixed-rate loan through a European investment bank. The borrower is using the loan to refinance an existing loan from 2007.

|

Rock Creek Property Group Sells

Regal Center in Sterling for $18.2M

|

| | Regal Center's tenant roster includes Domino's Pizza, 7-Eleven, Firehouse Subs, BB&T and UFC Gym. |

STERLING, VA. -- Rock Creek Property Group has sold Regal Center, a 52,500-square-foot shopping center located at 20921-20955 Davenport Drive in Sterling. The Regal Center LLC/Bernstein Management Group purchased the asset for $18.2 million, or roughly $347 per square foot. Regal Center's tenant roster includes Domino's Pizza, 7-Eleven, Firehouse Subs, BB&T, UFC Gym, sweetFrog Yogurt, O'Faolains Irish Pub, Cheng's Oriental Restaurant, Old Virginia Tobacco Co. and The Good Shepherd Alliance.

|

The Shoptaw Group Refinances

Miller Station on Peachtree for $16M

|

| | Miller Station on Peachtree is a Class A, 192-unit apartment building in Atlanta's Chamblee submarket. |

ATLANTA -- The Shoptaw Group and its capital advisor Patterson Real Estate Advisory Group have closed a $16 million loan for Miller Station on Peachtree, a Class A, 192-unit apartment building in Atlanta's Chamblee submarket. Shoptaw purchased the asset, then known as Battery at Chamblee Station, in late 2012. Patterson Real Estate Advisory Group arranged the refinancing through MetLife.

|

CBRE Arranges Sale of Stratford Ridge

in Metro Atlanta

|

| | Stratford Ridge is a 446-unit apartment community in Marietta, approximately two miles from the site of the new Atlanta Braves stadium opening in 2017. |

MARIETTA, GA. -- CBRE has brokered the sale of Stratford Ridge, a 446-unit apartment community in Marietta, approximately two miles from the site of the new Atlanta Braves stadium opening in 2017. The property recently underwent capital improvements to its pool, clubhouse and fitness center. Brad Simmel of CBRE represented the seller, MESA Capital, in the transaction. Simmel worked closely with the new owner, Bridge Investment Group Partners, as well.

|

Banyan, Investra Investments Buy Holiday Inn Express in Bluffton

|

| | The Holiday Inn Express & Suites in Bluffton is located six miles from Hilton Head, 25 miles from Savannah and 90 miles from Charleston. |

BLUFFTON, S.C. -- Banyan Investment Group and Investra Investments have formed their second joint venture this year to purchase the 112-room Holiday Inn Express & Suites in Bluffton. The hotel features 1,250 square feet of meeting space, a business center and seasonal outdoor swimming pool. The hotel is located six miles from Hilton Head, 25 miles from Savannah and 90 miles from Charleston. The joint venture purchased the asset from Veritas Hospitality Group, a division of the Stafford Cos. Loxi Hospitality provided advisory services in the transaction.

|

|

Strong Job Growth in June Could Boost Office Occupancy in Near Term

|

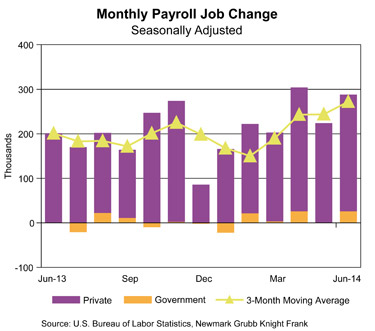

Private sector employees in June added 262,000 jobs and government agencies added 26,000 positions, for a net gain of 288,000 new jobs that will potentially have a substantial impact on commercial real estate, according to a Marcus & Millichap report. During June, the unemployment rate fell to 6.1 percent from 6.3 percent in May, reaching its lowest level since September 2008.

According to the commercial real estate services provider, these new jobs will create demand for rental housing, strengthening the 20 basis-point rise expected this year that will bring the national vacancy rate to 5.2 percent.

Marcus & Millichap predicts that growth in degreed professional and business service fields, as well as those in the financial services, will fill vacant office space and generate demand in the remaining quarters of this year.

An increase in office property operations will result in a 120 basis-point drop in U.S. vacancy to 14.8 percent this year.

Robert Bach, director of research for the Americas with Newmark Grubb Knight Frank, says the growth was "robust." He also believes the increase in jobs in the sectors most important to commercial real estate will support net operating incomes as space is filled and rents move higher. This will, in turn, he says, support investment activity.

During the second quarter of 2014, an average of 272,000 total positions were added monthly, surpassing the average monthly gain of 190,000 new jobs in the first quarter. The office-using sectors, comprising information, financial activities and professional and business services, added a combined 93,000 jobs in June, well above the previous six-month average of 51,900.

-- Scott Reid

Click here to read the full article.

|

|

InterFace Conference Group: Seniors Housing Southeast

When: August 20-21, 2014

Where: The Westin Buckhead

3391 Peachtree Road NE

Atlanta, GA 30326

|

InterFace Conference Group: California Commercial Real Estate Trends

When: September 22-23, 2014

Where: The Omni Los Angeles Hotel at California Plaza

251 South Olive Street

Los Angeles, CA 90012

|

InterFace Conference Group: Texas Commercial Real Estate Trends

When: October 1-2, 2014

Where: Intercontinental Dallas Hotel

15201 Dallas Parkway

Addison, TX 75001

|

Have an event that you would to share with our readers? Send an email with the details to Southeast Real Estate Business editor John Nelson at jnelson@francemediainc.com.

|

|

France Media Inc. 3500 Piedmont Rd., Atlanta, GA, 30305 Phone: 404-832-8262 Fax: 404-832-8260 E-mail Website |

|

|

|

|

|

Copyright © 2014 France Media, Inc. All Rights Reserved.

Copyright © 2014 France Publications, Inc., d/b/a France Media, Inc. All rights reserved. The opinions and statements made by authors, contributors and advertisers to Southeast Real Estate Business are not necessarily those of the editors and publishers. To unsubscribe, please click on the links at the bottom of this email.

|

|

|

|