|

|

Cooper Carry, tvsdesign Wrap Up Design of Marriott Marquis in D.C.

|

| |

The new Marriott Marquis in Washington, D.C., is a $520 million property located next to the Walter E. Washington Convention Center.

|

WASHINGTON, D.C. -- Marriott International last month opened its 4,000th hotel -- the $520 million Marriott Marquis in Washington, D.C. The hotel, adjacent to the Walter E. Washington Convention Center, is one of five Marriott Marquis hotels in the United States. International architecture firms Cooper Carry and tvsdesign collaborated on the hotel, which was designed to achieve LEED Silver certification.

The 15-story, 1,175-room hotel is linked to the historic Samuel Gompers AFL-CIO headquarters, which features an upscale bar, fitness center and boutique guestrooms. The project team includes developers Quadrangle Development Corp. and Capstone Development.

|

|

Keurig Acquires 584,678 SF Production Facility in Metro Atlanta

|

| | Rendering of the 584,678-square-foot production facility in Lithia Springs, roughly 17 miles west of Atlanta. |

LITHIA SPRINGS, GA. -- Keurig Green Mountain Inc. has purchased a 584,678-square-foot production facility located at 7705 Staples Drive in Lithia Springs, roughly 17 miles west of Atlanta. Known for its single-serving coffee and tea brewing, Keurig will produce pods for its new Keurig Cold beverage platform at the property. Sean Boswell and Scott Plomgren of Colliers International represented the seller, CenterPoint Properties, in the transaction. The facility features 9,200 square feet of office space, 32-foot clear heights, 80 exterior docks, three drive-in doors, 196-space parking lot and 199 trailer positions.

|

|

Washington Property Co. to Build Progress Place in Silver Spring

|

| | The current Progress Place in Silver Spring, pictured above, sits on the site of Washington Property Co.'s new land acquisition. |

SILVER SPRING, MD. -- Washington Property Co. (WPC) and Montgomery County have signed an agreement to develop Progress Place, a homeless services center that will be located at 8110 Georgia Ave. in Silver Spring. The new facility is scheduled to break ground in a year, according to WPC. The first three floors of the facility will service the county's homeless community and the fourth floor will feature 21 personal living quarters for individuals transitioning into permanent housing.

Under the terms of the recently signed agreement, WPC will build Progress Place at no cost to the county and the county will operate the facility. WPC will obtain the deed to three contiguous land parcels totaling about 1.5 acres in exchange. The site of the current Progress Place sits in that parcel, which is adjacent to WPC's new Solaire-Silver Spring property at 1150 Ripley St.

|

|

Fairlead Commercial Real Estate

Acquires Office Portfolio in Jacksonville

|

| | The Class A 23-acre Gran Park at the Avenues business park is located in Jacksonville. |

JACKSONVILLE, FLA. -- Fairlead Commercial Real Estate has purchased three Class A office properties totaling 241,277 square feet in Jacksonville. The office buildings are located at 7406 and 7411 Fullerton St. and 10199 Southside Blvd. in the 23-acre Gran Park at the Avenues business park. Fairlead, along with its equity partner Bridge Investment Group Partners, purchased the assets for an undisclosed price. John Bell of Transwestern represented the seller, Flagler Development Group, in the transaction. Fairlead has hired Ross Carrier of Flagler Development to lease the properties.

|

Binswanger Brokers Sale

of Manufacturing Facility in Arkansas

|

| | Nordex USA invested $100 million to build the wind turbine production plant in Jonesboro, Ark., in 2008. |

JONESBORO, ARK. -- Binswanger has arranged the sale of a single-story 188,771-square-foot manufacturing and warehouse facility located at 3100 Nordex Drive in Jonesboro. The industrial facility is situated on a 195-acre parcel in the Craighead Technology Park, which is located three miles from the future Interstate 555. TrinityRail Maintenance Services Inc., an operating unit of TrinityRail Group LLC, purchased the asset from Nordex USA. Nordex invested $100 million to build the wind turbine production plant in 2008. Holmes Davis of Binswanger's Dallas office represented Nordex in the transaction.

|

Capital Advisors Secures $17.2M Loan

for Metro Raleigh Mixed-Use Property

|

| | The portion of Main Street Square acting as collateral for the loan includes 172 apartment units and 32,285 square feet of commercial space. |

HOLLY SPRINGS, N.C. -- Capital Advisors has arranged $17.2 million in refinancing for Main Street Square, a mixed-use development in Holly Springs, a suburb of Raleigh. The portion of the Class A property acting as collateral for the loan includes 172 apartment units and 32,285 square feet of commercial space. Main Street Square also includes 70,000 square feet of office and retail space, a 6,000-square-foot medical office building, 101 townhomes and 16 cottage homes.

Cooper Willis of Capital Advisors' Charlotte office arranged the 10-year loan with a fixed interest rate and 30-year amortization schedule through Morgan Stanley on behalf of the borrower, MSS Apartments LLC.

|

Franklin Street Brokers $6.4M Sale

of Tampa Apartment Community

|

| | Sunset Square Apartments, located across the street from USF, will be demolished to make way for a student housing community. |

TAMPA, FLA. -- Franklin Street has arranged the $6.4 million sale of Sunset Square Apartments, a two-story multifamily community in north Tampa. The asset is located across the street from the University of South Florida (USF) at 12708 Bruce B. Downs Blvd. Robert Goldfinger, Darron Kattan, Kevin Kelleher and Zach Ames of Franklin Street represented the buyer, Gainesville, Fla.-based Collier Cos., in the transaction. The Franklin Street team also represented the seller, Sunset Square Blackhawk Realty Advisors. Collier Cos. plans to demolish the 1960s-era apartment complex and develop a student housing community serving USF students.

|

Salazar Jackson Arranges $1.6M Sale

of Miami Apartments at Auction

|

| | The 22-unit apartment community located at 747 N.E. 83rd Terrace in Miami sold at auction for $1.6 million. |

MIAMI -- Salazar Jackson LLP has closed on the $1.6 million sale of a 22-unit apartment community located at 747 N.E. 83rd Terrace in Miami. Linda Worton Jackson of Salazar Jackson counseled the bankruptcy trustee, Maria Yip, in the transaction, which was conducted via a bankruptcy auction. 747 Property LLC won the bid for the apartment community. Sperry Van Ness Commercial Realty brokered the sale. U.S. Bankruptcy Judge A. Jay Cristol approved the sale at a June 18 hearing.

|

|

Demand for U.S. Office Space Grows

in Second Quarter

|

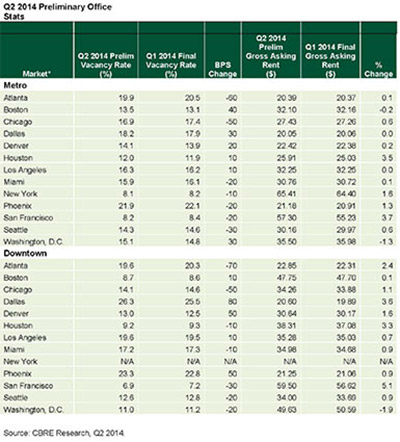

Demand for office space nationwide accelerated in the second quarter of 2014, according to research reports by several commercial real estate services firms that track data throughout the United States.

CBRE Group Inc. found that office vacancy rates declined in seven out of 13 major metro office markets during the second quarter of the year. The firm also reported that average asking rents increased during this period.

In its quarterly report, CBRE found that Atlanta led in vacancy declines, with a vacancy rate drop of 60 basis points (bps) during the quarter. Chicago posted a fall of 50 bps in its office vacancy rate, and Seattle's rate dropped 30 bps due to the expansion in its office stock of high-tech occupiers. Increases in bps occurred in Boston (40 bps), Dallas and Washington, D.C. (both 30 bps).

| | Click on the image above to view a larger version. |

Vacancy rates in markets such as San Francisco and Houston are now near pre-recession levels. San Francisco saw a 3.7 percent increase in its average asking rents, and Houston experienced a 3.5 percent increase. Boston and Washington, D.C., saw decreases in average asking rents -- 0.2 percent and 1.3 percent, respectively.

Kevin Thorpe, chief economist of Cassidy Turley, says this growth was expected but his firm's findings pointed to stronger underlying trends.

"The office sector was due for a stronger quarter following the weather disruptions [of the first quarter], but what is telling is that we are now observing stronger demand trends for Class B and C space in many markets, indicating tenant demand is spreading beyond the highest quality product. Although high-quality space still dominates leasing activity, the Class B and C segment of the market accounted for 40 percent of the absorption this quarter, a major shift from the 25 percent averaged earlier in the recovery."

-- Scott Reid

Click here to read the full story.

|

|

InterFace Conference Group: Seniors Housing Southeast

When: August 20-21, 2014

Where: The Westin Buckhead

3391 Peachtree Road NE

Atlanta, GA 30326

|

InterFace Conference Group: California Commercial Real Estate Trends

When: September 22-23, 2014

Where: The Omni Los Angeles Hotel at California Plaza

251 South Olive Street

Los Angeles, CA 90012

|

InterFace Conference Group: Texas Commercial Real Estate Trends

When: October 1-2, 2014

Where: Intercontinental Dallas Hotel

15201 Dallas Parkway

Addison, TX 75001

|

Have an event that you would to share with our readers? Send an email with the details to Southeast Real Estate Business editor John Nelson at jnelson@francemediainc.com.

|

|

France Media Inc. 3500 Piedmont Rd., Atlanta, GA, 30305 Phone: 404-832-8262 Fax: 404-832-8260 E-mail Website |

|

|

|

|

|

Copyright © 2014 France Media, Inc. All Rights Reserved.

Copyright © 2014 France Publications, Inc., d/b/a France Media, Inc. All rights reserved. The opinions and statements made by authors, contributors and advertisers to Southeast Real Estate Business are not necessarily those of the editors and publishers. To unsubscribe, please click on the links at the bottom of this email.

|

|

|

|