|

|

|

|

|

|

Irvine Co. Acquires 60-Story

Chicago Office Building for $850M

|

| | 300 North LaSalle is located in downtown Chicago. (Photo courtesy of Wikimedia Commons) |

|

CHICAGO -- The Irvine Company has completed its acquisition of 300 North LaSalle, a 60-story office property overlooking the Chicago River in downtown Chicago, for $850 million.

The Newport Beach, Calif.-based investment firm purchased the 1.3 million-square-foot building from KBS Real Estate Investment Trust II. Officials with KBS REIT II told GlobeSt.com that the purchase price of 300 North LaSalle was the most ever paid for a Chicago office building. The sale was the third-largest office building transaction in the United States so far this year, according to CoStar.

"300 North LaSalle offers a central business district location with all the excitement of River North, Chicago's innovation center and a destination for dining, shopping, culture and metropolitan living," said Doug Holte, president of Irvine Company Office Properties.

"The Irvine Company will continue to be geographically focused on its core California real estate markets, however the acquisition of 300 North LaSalle represents a unique opportunity to invest in an iconic national building that shares many of the same community amenities we embrace in California," Holte continues.

Jamie Fink, senior managing director of HFF's Chicago office, oversaw the competitive bidding process. 300 North LaSalle is fully leased to tenants that include Groupon, Razorfish and Google's Motorola Mobility.

|

|

Broadstone Net Lease REIT Invests $52.1M in Two Industrial Facilities

|

ELGIN, ILL., AND SHAKOPEE, MINN. -- Broadstone Net Lease (BNL) has invested a total of $52.1 million in two industrial facilities in the Midwest. The private real estate investment trust (REIT) managed by Broadstone Real Estate purchased a Siemens industrial facility in Elgin and a newly constructed Shutterfly production facility in Shakopee.

The 170,000-square-foot Siemens facility was offered to Broadstone on a proprietary basis after last October's $36.3 million sale-leaseback of another Siemens facility in Hoffman Estates, Illinois. The Elgin transaction carries an initial lease length of 10.5 years, with annual rent increases of more than 2 percent.

In late 2013, BNL entered into a forward commitment to acquire the 217,622-square-foot Shutterfly facility. Ryan Cos. built the property. Shutterfly and BNL have executed a new 10-year lease with annual rent increases of 2 percent. The lease also carries three 5-year renewal options. Shutterfly provides a range of personalized photo-based products and services.

|

|

|

|

Capital One Originates $31.8M

in Loans for Skilled Nursing Facilities

|

CHICAGO, MARION AND ITASCA, ILL. -- Capital One Specialty Healthcare Real Estate, part of Capital One Bank's Commercial Real Estate Group, has provided $31.8 million in HUD 232/223(f) loans for a portfolio of skilled nursing facilities in Illinois.

A loan of $8.8 million will be used to acquire a 125-bed property in Marion built in 1966 and renovated in 2011. Loans of $17.9 million and $5.1 million will be used to refinance a 228-bed facility constructed in 1996 in Chicago and a 144-bed facility built in 1975 with an addition in 1983 in Itasca.

The fixed-rate loan for the Marion facility has a 30-year term. Those for the Chicago and Itasca facilities have terms of 35 years. Joshua Rosen, who leads the company's agency healthcare efforts from the company's Chicago office, originated the loan.

The undisclosed borrower has closed several deals with Capital One Multifamily Finance during the past year and has extensive long-term care and real estate management experience.

|

|

ARA Brokers $24.2M Sale

of Apartment Property in Fort Wayne

|

| | Oak Crossing Apartments consists of one-, two- and three-bedroom apartments. |

FORT WAYNE, IND. -- Atlanta-based ARA has brokered the $24.2 million sale of Oak Crossing Apartments, a 222-unit, Class A apartment community located in Fort Wayne. Steadfast Income REIT Inc., an Orange County, California-based public non-listed REIT, purchased the property. Completed in 2013, Oak Crossing consists of one-, two- and three-bedroom apartments.

The property is currently 94 percent occupied with average market rents of $996. The apartment community is located within a mile of the newly built Parkview Regional Medical Center. Todd Stofflet and Steve Kemmerling of ARA's Chicago office represented the seller, Dupont & Tonkel Partners LLC, which developed and built the property.

|

|

Grandbridge Originates $17M Loan

for Historic Property in Columbus

|

| | This 190,949-square-foot historic building includes offices and event spaces. |

COLUMBUS, OHIO -- Grandbridge Real Estate Capital has originated a $17 million first mortgage loan for the Smith Bros' Hardware Building in Columbus. The 190,949-square-foot historic building includes offices and event spaces.

The historic building and its iconic rooftop water tower have been a distinct feature on the Columbus skyline since it was constructed in 1929 as a home for the Smith Bros' Hardware Co.

Craig Kegg of Grandbridge Real Estate Capital originated the refinance loan with a fixed interest rate through Goldman Sachs & Co. Mary Zofko of Grandbridge's Columbus office assisted in the transaction.

|

|

|

|

Lubert-Adler, Farbman Group Acquire 154,000 SF Office Building

|

| | This Class A office building is located at 1007 Church St. |

EVANSTON, ILL. -- In a joint venture, Lubert-Adler and The Farbman Group have acquired a 154,000-square-foot, Class A office building in Evanston, a suburb of Chicago, for an undisclosed sales price. The property is located at 1007 Church St.

The building, previously owned by a tenant-in-common group, had been taken over by a special servicer when the joint venture acquired its outstanding debt in February 2014. The property is located near Northwestern University and adjacent to a transit station. The building includes 351 parking spaces, two rooftop decks and an outdoor patio. The joint venture plans to improve the building, currently at 52 percent occupancy, and then lease the remaining vacancy.

Lubert-Adler, which invests on behalf of leading national university endowments and state retirement systems, owns five other Chicagoland properties with The Farbman Group: 79 W. Monroe St., 209 W. Jackson Blvd., and 205 W. Randolph St., all in the Loop area, plus the Atrium Building in Naperville and 25 Northwest Point in Elk Grove Village.

|

|

Boulder Group Arranges Sale of ALCO Property in Southern Illinois

|

| | The ALCO property is located at 17774 Mercantile Drive in Nashville, approximately 43 miles east of Belleville. |

NASHVILLE, ILL. -- The Boulder Group has arranged the $910,000 sale of a single-tenant, triple-net-leased ALCO property in Nashville, approximately 43 miles east of Belleville. The 4.2-acre property is located at 17774 Mercantile Drive near Illinois Route 127, a roadway that connects to I-64. I-64 has direct access to St. Louis, which is approximately 50 miles northwest of the property.

The retail chain is headquartered in Coppell, Texas and operates 217 stores in 23 states primarily in the Midwest. ALCO has approximately six years remaining on its 20-year lease, which expires Jan. 27, 2020. Randy Blankstein and Jimmy Goodman of The Boulder Group represented the seller, a Midwest-based real estate partnership. A West Coast investor purchased the property in a 1031 tax-deferred exchange.

|

|

M&M Arranges $3M Sale of 251,599 SF Retail Property in Toledo, Ohio

|

| | The 251,599-square-foot retail property is located at 5860 Lewis Ave. |

TOLEDO, OHIO -- Marcus & Millichap has arranged the $3 million sale of a 251,599-square-foot retail property in Toledo. Alexis Park Shopping Center is located at 5860 Lewis Ave. The property represented a value-add opportunity for an investor as the shopping center had a below market occupancy level. Erin Patton, Scott Wiles and Craig Fuller of Marcus & Millichap represented the seller, a partnership. The Marcus & Millichap team also represented the buyer, a limited liability company.

|

|

Hilliker Corp. Arranges Sale

of 20,000 SF Retail Property in St. Louis

|

| | This 20,000-square-foot retail property located at 11555 Gravois Road, formerly served as Johnny's Market, a family owned and operated grocery store that closed in 2012. |

ST. LOUIS -- Hilliker Corp. has arranged the sale of a more than 20,000-square-foot retail property in St. Louis. The property, located at 11555 Gravois Road, formerly served as Johnny's Market, a family owned and operated grocery store that closed its doors in 2012 after 68 years in business.

K2 Commercial Group, a St. Louis-based real estate and retail developer, purchased the property for an undisclosed price. The new owner plans to redevelop the 2.5-acre property. Will Aschinger of Hilliker Corp. represented the seller, Jon-Del Investments LLC. K2 Commercial Group represented itself in the transaction.

|

|

|

|

Demand for U.S. Office Space Grows

in Second Quarter

|

| | Click on the image above to view a larger photo. |

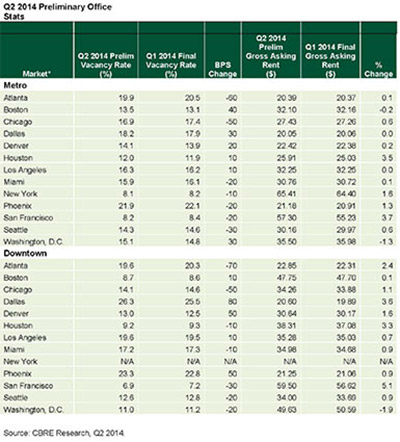

Demand for office space nationwide accelerated in the second quarter of 2014, according to research reports by several commercial real estate services firms that track data throughout the United States.

CBRE Group Inc. found that office vacancy rates declined in seven out of 13 major metro office markets during the second quarter of the year. The firm also reported that average asking rents increased during this period.

In its quarterly report, CBRE found that Atlanta led in vacancy declines, with a vacancy rate drop of 60 basis points (bps) during the quarter. Chicago posted a fall of 50 bps in its office vacancy rate, and Seattle's rate dropped 30 bps due to the expansion in its office stock of high-tech occupiers. Increases in bps occurred in Boston (40 bps), Dallas and Washington, D.C. (both 30 bps).

Vacancy rates in markets such as San Francisco and Houston are now near pre-recession levels. San Francisco saw a 3.7 percent increase in its average asking rents, and Houston experienced a 3.5 percent increase. Boston and Washington, D.C., saw decreases in average asking rents - 0.2 percent and 1.3 percent, respectively.

Click here to read more of Scott Reid's story.

|

|

|

|

Young Real Estate Professionals of Chicago

15th Annual Summer Bash

When: 5:30 p.m. Thursday, August 28

Where: Blackfinn, 65 W. Kinzie St., Chicago

|

|

6th Annual InterFace Healthcare Real Estate

When: Tuesday, September 4

Where: Dallas

|

|

Have an event that you would like to share with our readers? Send an e-mail with the details to

|

|

|

|

CONTACT US

| Danielle Everson, Associate Editor

Heartland Real Estate Business

France Media, Inc.

404-832-8262

404-832-8260

|

|

|

|

|

|

|

|

Copyright © 2014 France Publications, Inc., d/b/a France Media, Inc. All rights reserved. The opinions and statements made by authors, contributors and advertisers to Heartland Real Estate Business are not necessarily those of the editors and publishers. To unsubscribe, please click on the links at the bottom of this email.

|

|

|