HFF Closes Sale of 1.2M SF

Fountain Place Tower in Dallas

|

| Fountain Plaza is located at 1445 Ross Avenue in downtown Dallas, Texas.

|

| |

DALLAS, TEXAS -- HFF has closed on the sale of Fountain Place, a 1.2 million-square-foot office tower in Dallas. The company marketed the tower on behalf of the seller, J.P. Morgan Asset Management. Goddard Investment Group bought the property for an undisclosed amount.

Fountain Place is located at 1445 Ross Ave. near Klyde Warren Park and the Dallas Arts District. The 58-story tower was designed by architect I.M. Pei and features a dancing water garden called "The Fountain Plaza."

It is one of three LEED-certified Class A buildings in downtown Dallas. The tower is 88 percent leased to tenants including Tenet Healthcare, Hunton & Williams and Wells Fargo Bank.

HFF says the tower is the most recognizable building in the Dallas skyline.

|

|

|

|

m

Brasfield & Gorrie Completes $120M Hospital in New Braunfels

| |

NEW BRAUNFELS, TEXAS -- Brasfield & Gorrie has completed the $120 million Resolute Health hospital in New Braunfels. The hospital spans 364,000 square feet in four stories, including 22 emergency exam rooms, trauma rooms, operating rooms, intensive care units and neonatal care rooms. Construction started in June 2012. The hospital sits on a 56-acre campus that also will include community centers, green spaces, retail shops, restaurants, a fitness center and day spa.

|

|

M&M Brokers Sale of 7,000 SF

Net-Leased Family Dollar in Amarillo

|

| A 7,000-square-foot Family Dollar in Amarillo has been sold. The store is less than one mile from the Amarillo City Zoo.

|

|

AMARILLO, TEXAS -- Marcus & Millichap has sold a 7,000-square-foot net-leased Family Dollar located Amarillo. Terms of the sale were not released.

Jason Vitorino and Jared Aubrey of Marcus & Millichap's Dallas office marketed the property on behalf of the seller, a private investor. An outside broker represented the out-of-state buyer in the transaction. Before completing the all-cash transaction, Vitorino and Aubrey worked out agreements with the broker on deferred maintenance issues concerning the parking lot, HVAC and roof. During the due diligence period, Family Dollar announced the closing of 370 locations.

Family Dollar is located at 3460 River Road in Amarillo, less than one mile from the Amarillo City Zoo. The tenant has occupied the space since 1998. At the time of listing, five years remained on the double-net lease.

|

|

|

|

m

Kroger Planned For Burleson Commons

|

| Kroger will join Premiere Cinemas as an anchor at

Burleson Commons shopping center.

|

|

BURLESON, TEXAS -- Kroger has purchased 13.4 acres at the Burleson Common Shopping Center at Highway 174 and FM 731. The grocer plans to build a 114,000-square-foot store, joining Premiere Cinemas as the anchor tenant at Burleson Commons. Other tenants in the area include Target, The Home Depot, Office Depot and CVS/pharmacy. Cullinan Properties and Burleson Commons LP sold the site to Kroger.

|

|

m

Greystone Funds $9M Refi of Houston

Affordable Housing Communities

|

| | Greystone funded the mortgage for Countryside Village, a 182-unit Section 8 property in Houston, as well as one other affordable housing property. |

|

HOUSTON -- Greystone has provided $9 million in HUD financing for two multifamily housing properties in the Houston area. Lexington Square, an 80-unit Section 8 property in Angleton, was refinanced with 30-year HUD loans. Countryside Village, a 182-unit Section 8 property in Humble, was refinanced with 35-year HUD loans. John Williams, a senior mortgage originator for Greystone, originated the loans. National Community Renaissance owns the two properties.

|

|

m

Peloton, Pennybacker Sell Adjacent Office Buildings in Houston

|

| 2950 S. Gessner was one of the adjacent office buildings that Peloton and Pennybacker Capital sold.

|

|

HOUSTON -- Peloton Capital Partners and Pennybacker Capital have sold a recently renovated two-building office property in Houston's Westchase district. InSite Realty Partners purchased the buildings for an undisclosed amount. The properties total 121,700 square feet and are 80 percent occupied. Todd Casper and Mike Hassler with CBRE's capital markets team arranged the sale. ITT Educational Service Inc. anchors the development, located at 2950 and 3030 S. Gessner near the Westpark Tollway and U.S. Highway 59.

|

|

m

Marcus & Millichap Arranges Sale Multifamily Sale in Dallas

|

| Marcus & Millichap has arranged the sale of Holly Park Apartments in Dallas, representing both buyer and seller.

|

|

DALLAS -- Marcus & Millichap has brokered the sale of Holly Park, a 160-unit apartment property located at 9710 Military Parkway in Dallas. The property features one- and two-bedroom units located in 10 two-story buildings. Rentable square footage is 120,128 square feet, with an average unit size of 751 square feet. Community amenities include two on-site laundry facilities, a playground area, on-site maintenance and a courtyard. John Barker with Marcus & Millichap's Fort Worth office represented the seller, a partnership, and the buyer, a limited liability company, in the transaction.

|

|

Hendricks-Berkadia Brokers Sale

of Manor Palms in Austin

| |

AUSTIN, TEXAS -- Hendricks-Berkadia has brokered the sale of Manor Palms, an apartment complex located at 6103 Manor Road in Austin. Forrest Bass and George Deuillet III of Hendricks-Berkadia's Austin office negotiated the sale. The property was 100 percent occupied at the time of sale.

The seller is Yes We Can LLC of Los Angeles. The buyer is REMM Legacy Properties LLC of Hacienda Heights, California. The company recently sold its apartment holdings in Southern California and is reinvesting in the Austin market.

Built in 1973, the 124-unit property features one- and two-bedroom floorplans on 4.3 acres. Amenities include a swimming pool, two laundry facilities, gazebos, barbecues and perimeter fencing. Each unit has air conditioning, kitchens, disposals, pantries, ceiling fans, tile flooring, walk-in closets and balconies/patios.

The apartments are close to Highways 183 and 290 and Interstate 35. Manor Palms is less than two miles from Morris Williams Golf Course and five-and-a-half miles from downtown Austin.

|

|

|

|

m

CBRE Arranges Sale of Austin Industrial Complex

|

| Mississippi-based EastGroup Properties has bought Centerpoint @ Colorado Crossing in Austin.

|

|

AUSTIN, TEXAS -- EastGroup Properties has purchased Centerpoint @ Colorado Crossing, a 265,099-square-foot, four-building industrial complex in Austin, for an undisclosed price.

The Mississippi-based company has acquired a fully leased complex with tenants including OriGen Biomedical, Hisco and OnRamp Access. The four buildings, built in 2009, have an average of 24 percent office and 76 percent light industrial space.

Centerpoint @ Colorado Crossing is located on Burleson Road in East Austin, with close access to State Highway 71, US Highway 183, Interstate 35 and State Highway 130. CBRE's marketing team included Jack Fraker, Todd Mills, Josh McArtor, Greg Marberry, Hunter Mills, Jonathan Bryan and Heather McClain Venegoni. The seller is an undisclosed, Boston-based pension fund.

|

|

The Retail Connection, Long Wharf Acquire Woodpark Plaza in Houston

| |

THE WOODLANDS, TEXAS -- The Retail Connection and Long Wharf Real Estate have purchased Woodpark Plaza, a 143,850-square-foot shopping center at the northwest corner of Interstate 45 and Briar Rock Road.

Located in The Woodlands, the seller is a joint venture between Eagle Equity and DNC Capital Partners. Jo-Ann Stores, Ashley Furniture and Golfsmith are the anchor tenants of Woodpark Plaza.

The shopping center is 100 percent occupied, with tenants including SAS Shoes, HoneyBaked Ham, The Rustic Mile and Fitness Unlimited. It was originally constructed for Builder's Square, which later became The Home Depot.

|

|

|

Demand for U.S. Office Space Grows in Second Quarter

| |

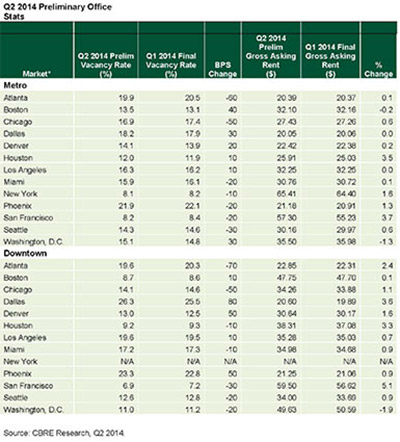

Demand for office space nationwide accelerated in the second quarter of 2014, according to research reports by several commercial real estate services firms that track data throughout the United States.

CBRE Group Inc. found that office vacancy rates declined in seven out of 13 major metro office markets during the second quarter of the year. The firm also reported that average asking rents increased during this period.

In its quarterly report, CBRE found that Atlanta led in vacancy declines, with a vacancy rate drop of 60 basis points (bps) during the quarter. Chicago posted a fall of 50 bps in its office vacancy rate, and Seattle's rate dropped 30 bps due to the expansion in its office stock of high-tech occupiers. Increases in bps occurred in Boston (40 bps), Dallas and Washington, D.C. (both 30 bps).

| | Click on the above chart to view a larger version. |

Vacancy rates in markets such as San Francisco and Houston are now near pre-recession levels. San Francisco saw a 3.7 percent increase in its average asking rents, and Houston experienced a 3.5 percent increase. Boston and Washington, D.C., saw decreases in average asking rents -- 0.2 percent and 1.3 percent, respectively.

Kevin Thorpe, chief economist of Cassidy Turley, says this growth was expected but his firm's findings pointed to stronger underlying trends.

"The office sector was due for a stronger quarter following the weather disruptions [of the first quarter], but what is telling is that we are now observing stronger demand trends for Class B and C space in many markets, indicating tenant demand is spreading beyond the highest quality product. Although high-quality space still dominates leasing activity, the Class B and C segment of the market accounted for 40 percent of the absorption this quarter, a major shift from the 25 percent averaged earlier in the recovery."

-- Scott Reid

Click here to read the full article.

|

|

CCIM Houston Chapter

Luncheon

| |

11:30 a.m., Thursday, July 10

Maggiano's

2019 Post Oak Blvd., Houston

Click here for more info. |

CREW Dallas

Strategic Leadership Communications Certificate

| |

8:30 a.m.,Tuesday, July 22

SMU James M. Collins Executive Education Center

Dallas

Click here for more info. |

3rd Annual

InterFace Multifamily Texas

| |

Wednesday, September 3

Dallas

Click here for more info. |

6th Annual

InterFace Healthcare Real Estate

| |

Thursday, September 4

Dallas

Click here for more info. |

| Have an event that you would like to share with our

readers? Send an email with the details to texas@francemediainc.com

|

|

Contact Us |

Texas Real Estate Business

France Media, Inc.

404-832-8262

404-832-8260

texas@francemediainc.com www.REBusinessOnline.com |

|