|

|

Strategic Hotels & Resorts Closes

$120M Loan for Four Seasons in D.C.

|

| | Courtyard section of Four Seasons Washington, D.C. |

WASHINGTON, D.C. -- Strategic Hotels & Resorts Inc. has closed a $120 million limited recourse loan that is secured by the Four Seasons Washington, D.C. The new loan replaces the previous $130 million financing that was encumbering the property. Deutsche Bank Securities Inc. originated the five-year loan, which features a three-year initial term with two one-year extension options available to Strategic Hotels & Resorts.

|

|

AWH Partners Buys Former Hotel Melia

in Midtown Atlanta for Conversion

|

| | The former Hotel Melia in Midtown Atlanta is undergoing a conversion to a Crowne Plaza and Staybridge Suites hotels, which both will occupy the building. |

ATLANTA -- AWH Partners LLC has purchased the former Hotel Melia, a 501-room hotel in Atlanta's Midtown neighborhood, in an all-cash transaction. AWH will reposition the property into a dual-branded hotel, with both brands belonging to InterContinental Hotels Group (IHG). After the renovation is complete, the new property will include 360 Crowne Plaza rooms and 102 Staybridge Suites rooms. The dual hotel is scheduled to open in January 2016.

Spire Hospitality will operate the two hotels under a franchise agreement with IHG. Upon completion, the 25-story property will feature 31,000 square feet of meeting space, three restaurants and two lobbies.

|

|

Build-to-Suit Industrial Facility in the Pipeline for Coastal Sunbelt Produce

|

| | Coastal Sunbelt Produce's new build-to-suit facility will be located at 9001 Whiskey Bottom Road in Laurel, Md. |

LAUREL, MD. -- Preston Scheffenacker Properties Inc. has plans to develop a new 244,500-square-foot industrial facility in Laurel. The new property, located at 9001 Whiskey Bottom Road, will be a build-to-suit facility for Coastal Sunbelt Produce, a produce distributor with a staff of 300 and annual revenue near $300 million. The property will include 196,500 square feet of refrigeration space, 38-foot clear heights and 48,000 square feet of office space on two floors.

Cambridge will serve as the development manager and lease representative for the new facility. Coastal Sunbelt Produce signed a 15-year lease at the build-to-suit.

|

|

Grandbridge Arranges $53M Refinancing

of Charlotte Industrial Portfolio

|

| | Beacon Partners has refinanced its 13-property industrial portfolio in the greater Charlotte area. |

CHARLOTTE, N.C. -- Grandbridge Real Estate Capital has arranged a $53 million loan to refinance a 13-asset industrial portfolio located in the Charlotte MSA. The portfolio totals more than 1.7 million square feet. Chris Caison of Grandbridge arranged the loan with a fixed interest rate through an unnamed life insurance company on behalf of the owner, Charlotte-based Beacon Partners. Beacon Partners leases and manages more than 9 million square feet of office and industrial space in the Carolinas. C.J. Webb of Grandbridge assisted in the deal.

|

Skanska to Expand Deerfield Beach Hospital for $47M

|

| | Broward Health North's $47 million expansion will include a revamped emergency department. |

DEERFIELD BEACH, FLA. -- Skanska USA has signed a $47 million contract to renovate and expand the Broward Health North Campus in Deerfield Beach. The project will include a 34,444-square-foot emergency department with trauma bays, operating rooms, more than 50 new examination rooms and a new 22,604-square-foot energy plant. Skanska will begin construction on the project in August, and the entire project is slated for a summer 2016 completion.

|

Finmarc Management Buys Two Office Properties in Alexandria for $31.5M

|

| | Waterfront Center I and II in Alexandria total more than 150,000 square feet and are cumulatively 69 percent leased. |

ALEXANDRIA, VA. -- Finmarc Management Inc. has purchased Waterfront Center I and II in Alexandria from Gates Hudson for $31.5 million. The two office buildings total more than 150,000 square feet and are cumulatively 69 percent leased. Waterfront Center I, located at 801 N. Fairfax St., was delivered in 1971, and Waterfront Center II, located at 209 Madison St., was delivered in 1987. With the transaction, Finmarc Management has acquired or disposed of more than $427 million worth of properties in the last 24 months.

|

Capstone Arranges $14.8M Sale

of Asheville Apartment Community

|

| | Kenilworth Inn Apartments in Asheville's Biltmore Village was fully occupied at the time of the sale. |

ASHEVILLE, N.C. -- Capstone Apartment Partners has brokered the $14.8 million sale of the historic Kenilworth Inn Apartments in the Biltmore Village in Asheville. The 93-unit multifamily community was fully occupied at the time of the sale. The apartment community, originally built in 1892 and renovated in 2003, is listed on the National Register of Historic Places. Austin Green and Alex McDermott of Capstone Apartment Partners' Charlotte office represented the seller, Kenilworth Apartments LLC, in the transaction. Saratoga Capital LLC was the buyer.

|

HFF Arranges $11.2M Sale, $8.6M Loan

of Metro Atlanta Shopping Center

|

| | Lilburn Corners is 92.4 percent leased to tenants such as Publix, H&R Block, The UPS Store, Snap Fitness and Marco's Pizza. |

LILBURN, GA. -- HFF has closed the sale of and arranged acquisition financing for Lilburn Corners, a 105,161-square-foot Publix-anchored shopping center at 375 Rockbridge Road N.W. in Lilburn, a northeastern suburb of Atlanta. The asset is 92.4 percent leased to tenants such as H&R Block, The UPS Store, Snap Fitness and Marco's Pizza. BDB Realty LLC purchased the asset from Philips Edison & Co. for $11.2 million. Jim Hamilton and Richard Reid of HFF represented the seller in the transaction.

HFF also arranged $8.6 million in acquisition financing on behalf of the buyer. Chip Sykes of HFF arranged the 10-year loan with a fixed interest rate through Jefferies LoanCore.

|

|

Axiometrics: U.S. Apartment Market

has Strongest Quarter Since 2000

|

| | Source: Axiometrics |

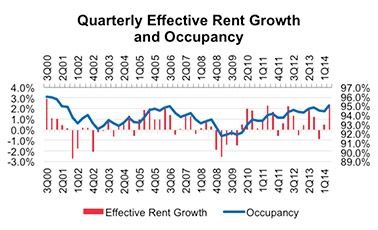

DALLAS -- The second quarter of 2014 has emerged as the strongest quarter for the U.S. apartment market since the third quarter of 2000, according to early release figures from Axiometrics, an apartment data and research firm.

Effective rent growth was 2.4 percent on a quarterly basis nationwide in April-June 2014, the highest quarter-to-quarter rate since the 2.9 percent of July-September 2000. Occupancy in the second quarter of 2014 was 95 percent, the strongest since the first quarter of 2001 (95.6 percent).

Both rent growth and occupancy exceeded Axiometrics' expectations.

"The year started slowly for the apartment market, perhaps due to weather, but it experienced a major reacceleration during the second quarter," says Jay Denton, vice president of research at Axiometrics, referring to the major winter storms and cold temperatures during the early part of the year. "Effective rent growth was soft in January and February, but the period from March through May was the one of the strongest three-month stretches we've seen in the 19 years we've been tracking apartments."

Another reason for the strong apartment performance is the falling homeownership rate, Denton added. U.S. Census Bureau statistics show that the homeownership rate in the first quarter of 2014 was 64.8 percent, the lowest in 19 years -- since the second quarter of 1995, when the rate was 64.7 percent.

"Demographics, along with the increasing choice to rent rather than own, continue to play in the favor of apartments," says Denton.

Additionally, occupancy was up 60 basis points from the first quarter's 94.4 percent, ending a two-quarter streak of decline.

|

|

ICSC Next Generation Atlanta: Game Night

When: July 8, 2014

Where: The Painted Pin

737 Miami Circle N.E.

Atlanta, GA 30324

|

InterFace Conference Group: Seniors Housing Southeast

When: August 20-21, 2014

Where: The Westin Buckhead

3391 Peachtree Road NE

Atlanta, GA 30326

|

InterFace Conference Group: California Commercial Real Estate Trends

When: September 22-23, 2014

Where: The Omni Los Angeles Hotel at California Plaza

251 South Olive Street

Los Angeles, CA 90012

|

InterFace Conference Group: Texas Commercial Real Estate Trends

When: October 1-2, 2014

Where: Intercontinental Dallas Hotel

15201 Dallas Parkway

Addison, TX 75001

|

Have an event that you would to share with our readers? Send an email with the details to Southeast Real Estate Business editor John Nelson at jnelson@francemediainc.com.

|

|

France Media Inc. 3500 Piedmont Rd., Atlanta, GA, 30305 Phone: 404-832-8262 Fax: 404-832-8260 E-mail Website |

|

|

|

|

|

Copyright © 2014 France Media, Inc. All Rights Reserved.

Copyright © 2014 France Publications, Inc., d/b/a France Media, Inc. All rights reserved. The opinions and statements made by authors, contributors and advertisers to Southeast Real Estate Business are not necessarily those of the editors and publishers. To unsubscribe, please click on the links at the bottom of this email.

|

|

|

|