|

|

|

HFF Secures $97M Construction Loan For Two Boston Seaport District Hotels |

| | The 330-room Aloft Hotel is one of two hotels to be built adjacent to the Boston Convention and Exhibition Center in Boston's Seaport District. |

BOSTON -- HFF (NYSE: HF) has secured a $97 million construction loan for the development of a 330-room Aloft Hotel and a 180-room Element Hotel adjacent to the Boston Convention and Exhibition Center in Boston's Seaport District.

"The development of the Aloft and Element hotels will add more than 500 hotel rooms to the immediate area," says Anthony Cutone, HFF managing director, "providing a degree of relief to the undersupplied Boston hotel market and allowing the Boston Exhibition and Convention Center to more effectively compete for convention business."

HFF worked on behalf of a venture between Ares Management LLC and CV Properties LLC to place the 42-month construction loan with RBS Citizens and Santander Bank N.A.

Cutone and senior real estate analyst Alan Suzuki led HFF's debt placement team. Kevin Boyle, Chris Robie and John Fahy led Citizens' team. George Brockman, director of commercial real estate, and Pete Olivier, senior commercial real estate banker, led Santander's team.

The two hotels will be situated on a 3.1-acre site at 371-401 D Street in Boston's Seaport District, leased from the Massachusetts Convention Center Authority. The Aloft Hotel will be a 13-story hotel with 325 guestrooms and five one-bedroom suites. Hotel amenities will include a gourmet eatery, fitness center, pool, outdoor entertainment area and 12,000 square feet of function space.

The Element Hotel will be designed for longer-stay travelers and will feature 180 guestrooms with fully equipped kitchens and flexible workspace. The six-story hotel will have studio suites, one-bedroom suites, standard king rooms and eight conference suites. Element Hotel amenities will include a pool and fitness center, a bike sharing program and meeting space.

Aloft and Element are two brands of Starwood Hotels & Resorts Worldwide Inc., a hotel and leisure company with nearly 1,200 properties in 100 countries. The company has 181,400 employees at its owned and managed properties. HFF is a provider of commercial real estate and capital markets services to the U.S. commercial real estate industry that operates out of 22 offices nationwide.

The stock price of HFF Inc. closed at $36.46 per share on Wednesday, June 25, up from $16.95 per share on June 25, 2013.

-- Scott Reid

|

|

|

|

Cushman & Wakefield Arranges $48.2M In Capital For LCB Senior Living

|

| The Residence at Valley Farm will bring 80 units and 83 beds

in senior living options to Ashland, Mass. |

| |

EASTON AND ASHLAND, MASS. -- Cushman & Wakefield's Senior Housing Capital Markets group has arranged $48.2 million in senior construction financing and joint venture capital for the construction and development of two senior housing projects for LCB Senior Living. Situated approximately 30 miles south of Boston in Easton, The Residence at Five Corners will be an 84-unit, 90-bed senior living facility. Located in Ashland, The Residence at Valley Farm will be an 80-unit, 83-bed senior housing facility. Situated on Pond Road, the three-story, 72,000-square-foot building is located in a heavily trafficked retail corridor.

Both projects will offer independent and assisted living, as well as memory care units. PNC Bank provided construction financing for the Easton project, while M&T Bank provided the construction financing for the Ashland project. An institutional investor provided the joint venture equity on both projects. Construction on both projects is slated to begin in June, with the properties opening in late summer/early fall 2015.

|

|

Leasing To Begin At 500 Sterling Place In Brooklyn's ProCro Neighborhood

| |

| 500 Sterling Place will bring 77 apartment units

to Brooklyn's ProCro neighborhood when it opens in July. |

NEW YORK CITY -- Adam America Real Estate, in partnership with Horizon Group, will begin leasing 500 Sterling Place, a 77-unit multifamily property in Brooklyn's ProCro neighborhood, in late June. The seven-story apartment building offers studio, one- and two-bedroom units with premium kitchens, countertops and appliances. Building amenities include a rooftop deck with misting wall, outdoor movie projection capabilities, game and lounging areas and barbecuing stations. Additionally, the amenity package includes a fully equipped window gym, parking, part-time doorman, package room, bicycle storage and a live-in superintendent. Rents range from $1,995 to $3,100, and move-in is slated for July 1.

|

|

Long Island Industrial Completes Renovation For Consumers Kitchens & Baths

| | |

HOLBROOK, N.Y. -- Long Island Industrial has completed a renovation project for Consumers Kitchens & Baths' headquarters in Holbrook. The upgrade is part of the company's $35 million capital improvement program, which is aimed at modernizing its portfolio of properties across Nassau and Suffolk counties. Completed by Long Island, N.Y.-based Hunt Construction Services, the renovation included the demolition of the outdated exterior and the installation of a new energy-efficient Exterior Insulation Finish System façade, as well as new electrical circuits, crown molding and window accents. As part of its capital improvements program, Long Island Industrial will invest an average of $7 million per year over a projected five-year period into its Long Island portfolio, which includes 23 buildings totaling 2 million square feet in Suffolk County and 13 buildings totaling 1.5 million square feet in Nassau County.

|

|

|

|

Meridian Capital Arranges $100M Loan For 110 Fifth Avenue in NYC

|

| | The 176,000-square-foot property is occupied by H&M, Town Residential, Joe Fresh and Wellcare. |

NEW YORK CITY -- Meridian Capital Group has arranged a $100 million mortgage for the refinancing of 110 Fifth Avenue in New York. Constructed in 1888, the 11-story, 176,000-square-foot office and retail building is occupied by H&M, Town Residential, Joe Fresh and Wellcare. The seven-year loan, which was provided by a regional balance sheet lender, features a 4.125 percent fixed interest rate and two years of interest-only payments. Avi Weinstock and Chaim Tessler of Meridian's New York headquarters negotiated the loan for the borrower, Samson Management.

|

|

HKS Capital Brokers $66M Permanent Financing For Multifamily Property | |

ELMSFORD, N.Y. -- HKS Capital Partners has brokered $66 million in permanent financing for Ridgeview Apartments in Elmsford. Located at 32 Nob Hill Drive, the 416-unit property is owned by Ridgeview Partners LLC, which is led by Stephen Reitano. The seven-year loan, provided by Cantor Commercial Real Estate, features a three-year interest-only period. Ayush Kapahi of HKS brokered the transaction. The owners purchased the property in 2010 for $58 million, assuming $50 million in debt, and this mortgage allows the owners to take out equity on the property.

|

HREC Brokers 225-Room Sheraton Sale In Mahwah, New Jersey

|  | |

MAHWAH, N.J. -- HREC Investment Advisors has brokered the sale of a Sheraton in Mahwah. Located in the Crossroads Corporate Center, the 225-room hotel is on the border of New York and New Jersey. Ketan Patel, Geoff Davis and Scott Stephens of HREC represented the seller in the transaction.

|

|

Meridian Capital Group Arranges $10.5M Financing For Mixed-Use Property  |

|

| |

The mixed-use building features 18 apartment units and 1,200 square feet of retail space.

|

NEW YORK CITY -- Meridian Capital Group has arranged $10.5 million in permanent financing to refinance a mixed-use property in Manhattan's Lower East Side neighborhood. Located at 139 Essex St., the five-story property features 18 apartments and 1,200 square feet of retail space. The property was purchased by the sponsor 14 months ago and has undergone significant renovation and was at 100 percent occupancy at the time of financing. The seven-year loan, provided by a regional balance sheet lender, features a 4.07 percent fixed rate and two years of interest-only payments. Judah Hammer and David Bollag of Meridian's New York City office negotiated the transaction.

|

|

Rittenhouse Realty Advisors Sells Phoenixville Apartment Complex

| |

Maison Ridge Apartments features six two-bedroom units and

10 one-bedroom units in Phoenixville, Pa.

|

PHOENIXVILLE, PA. -- Rittenhouse Realty Advisors (RRA) has brokered the sale of Maison Ridge Apartments in Phoenixville. The 16-unit property features six two-bedroom/one-bathroom units and 10 one-bedroom/one-bathroom units. Historically, the property has remained at least 95 percent occupied. The property offers off-street parking, on-site laundry facilities and individual storage units. Steve Miceli and Corey Lonberger of RRA arranged the transaction. The seller was a long-term owner who held the property for more than 20 years. The buyers were undisclosed principal partners.

| |

|

|

Marcus & Millichap Arranges Eight-Unit Multifamily Building Sale In Brooklyn

| |

| 147 Leonard Street sold for

$2.3 million in Brooklyn. |

NEW YORK CITY -- Marcus & Millichap has brokered the sale of 147 Leonard St. in Brooklyn. The eight-unit apartment building sold for $2.3 million, or approximately $411 per square foot. James Saros, Michael Salvatico and Shaun Riney of Marcus & Millichap's Brooklyn office represented the seller, a private investor, and the buyer, a private investor, in the transaction.

|

|

Eastern Consolidated Arranges

$5.25M Staten Island Retail Center Sale

| |

The retail center is leased by Avo, Papa John's Pizza, Payless Uniforms and CKO Kickboxing in Staten Island, N.Y.

|

NEW YORK CITY -- Eastern Consolidated has arranged the sale of a retail center located at 1257-1267 Forest Ave. in Staten Island for $5.25 million at $200 per square foot with an 8 percent cap rate. The two-story, 25,860-square-foot property features 12 fully leased retail spaces and a 41-car parking lot. Current tenants include Avon, Papa John's Pizza, Payless Uniforms and CKO Kickboxing. Adelaide Polsinelli and Carlos Olson of Eastern Consolidated represented the seller in the transaction.

| |

|

|

|

|

Architecture Billings Index Posts Positive May Score Across U.S.

By John Nelson

|

| | Kermit Baker |

|

WASHINGTON, D.C. -- Following a negative posting in both March and April, the Architecture Billings Index (ABI) posted a score of 52.6, a three-point jump from April's 49.6 score. The score reflects an increase in design activity, with any score above 50 indicating an increase in billings.

A barometer of future non-residential construction activity, the ABI reflects the roughly nine- to 12-month lead time between architecture billings and construction spending. The index is produced by The American Institute of Architects (AIA) Economics & Market Research Group. The score is tabulated based on a monthly survey sent to a panel of AIA member-owned architecture firms.

"Volatility continues to be the watchword in the design and construction markets, with firms in some regions of the country reporting strong growth, while others are indicating continued weakness," says Kermit Baker, AIA's chief economist. "However, overall, it appears that activity has recovered from the winter slump, and design professions should see more positive than negative numbers in the coming months."

The South region posted the highest three-month average ABI score (58.1) nationally, followed by the Midwest (51.3), Northeast (47.6) and West (46.9).

Among property types, multifamily posted the highest three-month ABI score (58.2), followed by office/industrial (53.6), mixed-use (50.4) and institutional (47.3). The regional and property sector scores are calculated as three-month moving averages, but the national index is reported as a monthly score.

The AIA has also added a new indicator measuring the trends in new design contracts at architecture firms that signals the direction of future architecture billings. The score for design contracts in May was 52.5. Like the national ABI, the design contracts score is a monthly number.

|

|

New CBRE, Maastricht University Study Lists Top 10 Green U.S. Cities

|

| |

Nils Kok

Maastricht University

|

|

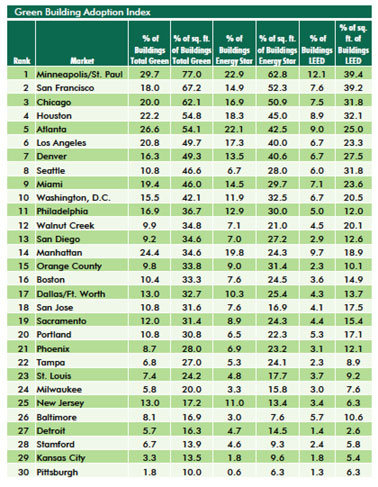

LOS ANGELES -- The 2014 Green Building Adoption Index, a joint project between CBRE Group Inc. (NYSE: CBG) and Maastricht University, has named Minneapolis as the greenest city in the nation, with 77 percent of the city's commercial real estate certified as green. The term green is in reference to buildings that are either certified by the EPA's Energy Star rating or the U.S. Green Building Council's LEED program.

|

Top 10 Green Cities

| | 1. Minneapolis (77 percent) | | 2. San Francisco (67.2 percent) | | 3. Chicago (62.1 percent) | | 4. Houston (54.8 percent) | | 5. Atlanta (54.1 percent) | | 6. Los Angeles (49.7 percent) | | 7. Denver (49.3 percent) | | 8. Seattle (46.6 percent) | | 9. Miami (46 percent) | | 10. Washington, D.C. (42.4 percent) |

The study also emphasizes the dramatic increase in the number of green commercial real estate properties in the United States since 2005. During that time frame, the amount of Energy Star-labeled buildings has increased 600 percent, and the proportion of buildings that are LEED certified has jumped up 1,000 percent. LEED-certified space now totals 19.4 percent of the total building stock in the 30 office markets reviewed in the study when measured by floor area. The study is the first project in CBRE's Real Green Research Challenge (RGRC), the company's $1 million initiative for research and innovation in sustainability. CBRE launched the RGRC in September 2012.

|

Click here to view a larger version. |

| |

Dave Pogue

CBRE

|

"We have all seen the rapid growth in the number of green-certified buildings in the markets in which we work. However, we were quite surprised to see how large the numbers actually are. Green is absolutely the new norm," says Dave Pogue, global director of corporate responsibility for CBRE. "We wanted to do something in the built environment to help advance the discussion of sustainability. With the RGRC, we have the opportunity to affect the entire real estate industry and have a lasting effect on the way real estate is built, occupied and financed, and in doing so be a force for positive environmental change."

Dr. Nils Kok of Maastrict University of the Netherlands leads the Green Adoption Index and works in close collaboration with CBRE and the USGBC. The study reviews more than 34,000 buildings -- totaling more than 3.5 billion square feet -- in the central business districts (CBDs) of the top 30 U.S. markets, in terms of square footage. "This is the first study to quantify the relevance of green building practices in the commercial real estate market," says Dr. Kok, associate professor in finance and real estate at Maastricht University. "While we all know examples of LEED-certified buildings, the results presented here are facts based on robust methodology, not anecdotal evidence. The evidence shows that green has become mainstream in all major U.S. cities." -- Staff reports |

|

|

|

Certified Buyer Representative Course

| |

Overview: Sponsored by REBNY, the two-day course is for real estate professionals looking to obtain CBR certification or continuing education credits.

When: August 12-13, 9 a.m. to 5:30 p.m.

Where: REBNY Mendik Education Center, 570 Lexington Ave. (Lower Level), NYC

|

Certified Negotiation Expert Course

| |

Overview: Sponsored by REBNY, the two-day course is for real estate professionals looking to obtain CNE certification or continuing education credits.

When: September 29-30, 9 a.m. to 5:30 p.m.

Where: REBNY Mendik Education Center, 570 Lexington Ave. (Lower Level), NYC

|

|

|

Contact us

Matt Valley, Editorial Director Northeast Real Estate Business France Media, Inc. 404-832-8262 404-832-8260 northeast@francemediainc.com www.rebusinessonline.com |

|

|