|

|

|

Gramercy Buys Garrison's Interest

in $395 Million Office Portfolio

|

| | Gordon DuGan, CEO, Gramercy Property Trust |

|

NEW YORK -- Gramercy Property Trust Inc. (NYSE: GPT) has agreed to buy Garrison Investment Group's 50 percent interest in a joint venture that owns a portfolio of 67 properties totaling approximately 3.1 million square feet across the United States for $92.2 million in cash. The properties are 96 percent leased to Bank of America. Gramercy currently owns the remaining 50 percent interest of the joint venture.

The purchase and sales agreement values the joint venture's assets at $395 million. At closing, New York-based Gramercy plans to repay the existing $200 million loan encumbering the portfolio with proceeds from a new unsecured credit facility. The acquisition is expected to close sometime during the second quarter.

Additionally, Gramercy has also signed a commitment letter with J.P. Morgan Securities LLC and Merrill Lynch; Pierce, Fenner & Smith; J.P. Morgan Chase Bank; and Bank of America for a $400 million senior unsecured credit facility, which will consist of a $200 million senior revolving credit facility and an up to $200 million senior term loan.

To read Scott Reid's full report, click here.

|

|

|

|

|

Village Green Breaks Ground

on 213-Unit Apartment Community

|

| | Morrow Park City Apartments will bring 213 apartment units to Pittsburgh's Bloomfield neighborhood. |

| |

PITTSBURGH, PA. -- Village Green has broken ground on Morrow Park City Apartments in Pittsburgh's Bloomfield neighborhood. The $40 million development will feature 213 apartment units, a hotel-style lobby with a two-sided movie screen, Zen garden, courtyard, indoor/outdoor pool, 24-hour fitness center, business conference center, heated, underground parking and a club room with a bar, fireplace and gourmet kitchen. The apartment community is slated to open in summer 2015.

Morrow Park City Apartments represents the first of multiple developments planned by Village Green in Pittsburgh. "This was an exciting challenge for us, the architect, the local community and the city to jointly create a truly innovative place for demanding renters while blending well into the historic neighborhood they enjoy," says Jonathan Holtzman, CEO of Farmington Hills, Mich.-based Village Green.

|

|

79-Suite Home2 Suites by Hilton Opens in Erie, Pennsylvania

|

| |

Chase Hotel Group owns the 79-suite Home2 Suites in Erie, Pa.

|

| |

ERIE, PA. -- Hilton Worldwide has opened its 32nd Home2 Suites by Hilton. Located near interstates 90 and 79 in Erie, the four-story, 79-suite hotel features an Oasis lobby area, Home2 MKT, Spin2 Cycle and complimentary continental breakfast. Additionally, the hotel features an indoor pool and gas grills for guests' use. Chase Hotel Group owns the property.

|

|

|

|

|

Meridian Capital Arranges $18 Million Loan for NYC Office Property

|

| The 12-story, 95,500-square-foot office building is located at

114 West 26th Street in New York. |

| |

NEW YORK CITY -- Meridian Capital Group has arranged an $18 million mortgage for the refinancing of an office building in New York. The 12-story, 95,500-square-foot office property is located at 114 West 26th Street at the intersection of the NoMad, Flatiron and Chelsea neighborhoods. The property offers 88,000 square feet of office space and 7,500 square feet of retail space. The seven-year loan provided by a regional balance sheet lender features a 4.25 percent fixed rate and a flexible prepayment penalty. David Zlotnick of Meridian Capital Group negotiated the transaction.

|

|

|

Brookwood Sells One Alewife Center for $21.6 Million in Cambridge

| |

CAMBRIDGE, MASS. -- Brookwood Financial Partners has completed the disposition of One Alewife Center, which is located at the intersection of Routes 2 and 16 in Cambridge. James Campbell Company LLC purchased the four-story, 89,875-square-foot office building for $21.6 million. Brookwood originally acquired the office building in June 2012 and since then increased the property's occupancy from 53 to 91 percent. The Boston office of Colony Realty Partners advised the buyer, while Robert Griffith, Edward Maher and Matt Pullen of Cushman & Wakefield represented the seller in the transaction.

|

|

Houlihan-Parnes Arranges $13.1 Million in Financing for Office Building |

| |

Located at 4 West Red Oak Lane, the 135,000-square-foot office building is occupied by 21 tenants.

|

| |

WHITE PLAINS, N.Y. -- Houlihan-Parnes Realtors has placed a $13.1 million first mortgage on a property located at 4 West Red Oak Lane in White Plains. The property features a 135,000-square-foot office building, which is occupied by 21 tenants. GHP Office Realty, the office building division of Houlihan-Parnes Realtors, manages and leases the building. Provided by a local bank, the loan has a 4 percent interest rate for a 5-year term on a 30-year amortization schedule. Additionally, the loan features a renewal option and flexible pre-pay schedule. Elizabeth Smith of Goldberg Weprin Finkel Goldstein LLP represented the borrower in the transaction.

|

|

LCB Senior Receives $19.6 Million Acquisition Loan for Seniors Housing  | |

READING, MASS. -- Cushman & Wakefield Senior Housing Capital Markets has arranged $19.6 million in senior financing and joint venture equity capital for LCB Senior Living's acquisition of a seniors housing property in Reading. M&T Bank provided $13.5 million in acquisition financing, and Virtus Real Estate Capital provided the joint venture equity. LCB plans to rebrand the newly acquired property as The Residence at Pearl Street. The 86-unit assisted living community is situated in a former school building that was converted into seniors housing in 1997 by the previous owner. LCB plans to convert the first-floor units into memory care units and continue to rehabilitate the property. Richard Swartz, Jay Wagner, Aaron Rosenzweig and Stuart Kim of Cushman & Wakefield arranged the financing on behalf of LCB Senior Living.

|

|

Bussel Brokers Sale of 33,484 SF Industrial Facility in Fairfield

|

| |

Smart-MNLS LLC acquired 25 Dwight Place for $2.6 million

in Fairfield, N.J.

|

| |

FAIRFIELD, N.J. -- Bussel Realty Corp. (BRC) has brokered the sale of an industrial flex facility located at 25 Dwight Place in Fairfield. Smart-MNLS LLC purchased the 33,484-square-foot property for $2.6 million from Ented Associates. Situated on 2.2 acres of land, the property features 4,000 square feet of office space, 20-foot ceiling heights, a loading dock and drive-in, 1,600 amps of power and parking for 90 cars. James Hodgkins of BRC represented the buyer in the transaction.

|

|

358,000 SF Industrial Building Sells

for $3.5 Million in Lehigh Valley | |

EAST TEXAS, PA. -- Smooth-On Inc. has acquired 5700 Lower Macungie Road in East Texas for $3.5 million. Located in the Lehigh Valley region, the 358,000-square-foot property features 10 interconnected industrial and flex buildings with ceilings ranging from 16 to 22 feet. Additionally, the 31-acre property site offers more than 740 parking spaces. Smooth-On plans to expand and relocate from its current location in Easton, Pa. Mike Adams of NAI Summit represented the buyer in the transaction. The seller, Day-Timer, a division of ACCO Brands, was represented by the Cushman & Wakefield team of Gerry Blinebury, Patrick McBride, Adam Campbell, Leah Balerno, Marie Connell, Lou Hall and Daniel Wilkins.

|

|

Gebroe-Hammer Completes Three Multifamily Sales Totaling $5.8 Million |

| |

The 18-unit Gold Haven Commons sold for $1.65 million

in Irvington, N.J.

|

| |

ELIZABETH AND IRVINGTON, N.J. -- Gebroe-Hammer Associates has completed three multifamily sales totaling $5.76 million and 86 units in Northern New Jersey. In Elizabeth, Stephen Tragash and Steven Follman of Gebroe-Hammer arranged the sale of 1009-1015 East Jersey Street, a 34-unit apartment property. The low-rise, garden-style property sold for $2.2 million. Also in Elizabeth, David Oropeza and Tragash brokered the $1.9 million sale of 409-421 Jefferson Avenue. A private equity fund sold the 34-unit property, which was built in 1971. In Irvington, Joseph Brecher and David Jarvis of Gebroe-Hammer arranged the sale of Gold Haven Commons, an 18-unit condominium apartment property located at 512-516 Union Ave. Featuring one-bedroom and three-bedroom units, the property sold for $1.65 million.

|

|

Binswanger Brokers 20,479 SF Office Lease in Bala Cynwyd  | |

BALA CYNWYD, PA. -- Philadelphia-based Binswanger has brokered a 20,479-square-foot lease at 401 City Ave. in Bala Cynwyd. LF Driscoll Co LLC will occupy the space at the 400,000-square-foot Class A office building. Nick Sannelli and Josh Haber of Binswanger represented the tenant in the long-term lease.

|

|

|

|

Bach: April Jobs Report Will Benefit

Commercial Real Estate Leasing Market

|

| | Robert Bach |

|

By Matt Valley

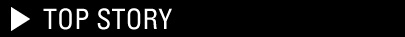

WASHINGTON, D.C. -- The U.S. economy appears to be gaining traction, boosting the outlook for the commercial property leasing market in the coming quarters, says Robert Bach, director of research for the Americas at real estate brokerage firm Newmark Grubb Knight Frank.

Emerging from their winter hibernation, employers added 288,000 net new payroll jobs in April, according to the Bureau of Labor Statistics (BLS), easily beating economists' expectations of 220,000 jobs. The severe cold and heavy snow blamed for the meager U.S. GDP growth of 0.1 percent in the first quarter of 2014 is now a distant memory.

The BLS also revised the February and March data higher by a combined 36,000 jobs, putting the labor market within reach of a new peak that would erase all recessionary job losses, according to Bach. That new peak could occur as early as the next payroll employment report due to be released by the Bureau of Labor Statistics in early June.

The job gains in April were widespread. Among the highlights:

- The three primary office-using sectors -- information, finance, and professional and business services -- added a combined 78,000 jobs, beating the six-month average of 52,700. "If the labor market can sustain this level of performance during the next few months, the increased hiring will begin to show up in office absorption data," says Bach.

- Sectors related to demand for industrial space -- manufacturing, transportation and warehousing and wholesale trade -- added 39,000 jobs, indicating strong occupier demand for warehouses and distribution centers in particular.

- Leisure and hospitality added 28,000 jobs in April, signaling continued strong performance in the lodging industry.

- Retailers added 34,500 jobs, building on March's rebound from the weather-related losses earlier in the year.

- Construction added 32,000 jobs, including 4,100 in construction of nonresidential buildings and 4,000 in nonresidential specialty trade contractors, a leading indicator of new commercial properties coming on line.

- Education and health services added 40,000 jobs, including 18,700 in healthcare, with gains spread across all subsectors (including physician offices, hospitals and residential care facilities), a sign that providers are expanding to serve newly insured customers.

- Government added 15,000 jobs, mostly in local government education.

Average hourly earnings and average hours worked for all employees were unchanged in March, "a disappointing footnote to an otherwise upbeat report," says Bach.

The unemployment rate, which is calculated from a different survey, dropped from 6.7 percent in March to 6.3 percent in April, the lowest level in five-and-a-half years.

"Unfortunately, the drop is partly due to the exit of 806,000 workers from the labor force, which pushed the labor force participation rate down to 62.8 percent, tying a 36-year low," explains Bach. "A robust labor market normally would attract new entrants, increasing the participation rate."

|

|

|

|

Real Estate Opportunity & Private Funding Investing Forum

| |

Overview: The 15th annual U.S. Real Estate Opportunity & Private Fund Investing Forum.

When: June 12-13; 11:00am - 6:00pm

Where: Marriott Marquis, 1535 Broadway, NYC

|

|

|

Contact us

Matt Valley, Editorial Director Northeast Real Estate Business France Media, Inc. 404-832-8262 404-832-8260 northeast@francemediainc.com www.rebusinessonline.com |

|

|