|

Free* CE's For IIAN Members!

May 18 - Ogallala

May 19 - Kearney

May 20 - Norfolk

May 21 -MahoneyPark

Up To 6 CEUs

(approval pending)

Equipment Breakdown

Commercial & Homeowners

Identity Theft Plus

Data Compromise Insurance

Fred Knoll, Instructor

Hartford Steam Boiler

Register Today!

(*$1 per credit hour NDOI

processing fee)

| |

|

|

Mark Your Calendar!

108th Annual Convention

October 13-15, 2015

Embassy Suites

LaVista, NE

Trade Fair - 50+ Exhibitors

Up To 20 CEUs*

New E&O Loss Control Seminar - 6 Ethics CEUs*

(*approval pending)

Learning Tracks for CSR's, Applied Users,

Producers & Managers

Mardi Gras

Awards Dinner &

Celebration

19th Annual Jacupke Memorial Golf Tournament

October 13, 2015

Course To Be Announced - Omaha

$$$ For IIAN Foundation Scholarships

| |

|

Welcome New Big "I" Members!

| | |

These independent insurance agencies recently joined

IIAN & IIABA!

Kearney

Brian Blakely Insurance --

Brian Blakely

Nebraska City

Bremer Agency, Inc. --

Vic Johns

Papillion

Olson Insurance, Inc. --

Keith Olson

Tekamah

Welte Insurance --

Shari Widener

|

| |

Thanks to the Big "I" Industry

"Diamond Level"

Partner for April

Their support enables IIAN to present affordable, high-quality member programs.

|

|

Thanks To IIAN's 2015Industry Partners!

Realizing the value that the Big "I" brings to Nebraska's independent agents, many give generously - without their collective support we could not offer affordable, high-quality programs.

Thanks to all of

| |

Don't see your company's name on the list?

Click here to discover the benefits of being an IIAN Industry Partner

|

|

Technology Corner

How To Select The Best Agency Management System - Free Five-Day Course

Automation guru Steve Anderson - known to many IIAN members - has a great free tool for agencies thinking about investing in a new agency management system.

If your agency is thinking about getting an agency management system for the first time or replacing the one you have, his free email course is worth checking out! There are 30 different products from 28 different vendors to choose from.

Steve has created a free email course that details the five critical steps an agency must take to make sure you pick the very best system for your organization.

| |

Did you know that DocuSign is used by 11 of the top 15 insurance carriers? DocuSign is the global standard for eSignatureŽ and more than 40 million people around the world have DocuSigned. That's why the Big 'I' has endorsed DocuSign as the official electronic signature platform for our members.

Discount For Big "I" Members

Click here for more information and to see how it works!

|

Join Our List

|

|

|

| Nebraska Big "I" Members Go To Washington |

IIABA Legislative Conference Focuses On State Regulation, ACA Fixes & Crop Insurance Program

|

| |

IIAN VP Mike Jones, David City (center) makes his point to Congressman Brad Ashford (left) as IIAN Sec-Treas Krae Dutoit, Grand Island listens in.

|

On April 22 and 23, 13 IIAN members and staff joined 1,000 agents from across the country at the Big "I" National Legislative Conference in Washington D.C. Led by IIAN President Phil Winkelmann and National Director Mark Lisko, IIAN's representatives held a series of meetings with Nebraska's Congressional delegation to lobby on behalf of agents -- meeting personally with Senators Deb Fischer and Ben Sasse, and Representatives Adrian Smith, Brad Ashford, and Jeff Fortenberry.

The major points of our discussion were: preserving state insurance regulation, fixes to the Affordable Care Act, and the importance of agents in

the Federal Crop Insurance program.

Attendees heard from Congressional leaders such as U.S. House Majority Whip Steve Scalise (R-LA), as well as top insurance company CEO's.

Read all about it.

|

| |

Coach Riley with Todd Anderson, York, who represents IIAN on the IIABA Crop Insurance Task Force.

|

UNL Head Football Coach Mike Riley made an unexpected appearance at the traditional Nebraska Breakfast on April 22. Riley spoke to about 60 Nebraskans who attended, including IIAN leaders.

IIAN's Legislative/PAC committee, chaired by Bob Hoppe, was recognized for achieving Nebraska's 2014 InsurPac fundraising goal - helping InsurPac raise over $1 Million last year.

Included in the IIAN contingent were winners of Big "I" Young Agent and Grassroots conference scholarships: Vincent Christensen, St. Paul; Matthew Gerken,Omaha; and Lori Ruzicka, Omaha. Other members attending were John Deardorff and Tom Greco, along with IIAN CEO Carol McClelland and Marketing Director Jeremiah Gudding.

See more photos.

|

| Big "I" Supports House Bill To Repeal "Cadillac" Tax |

Legislation Would Repeal ACA Provision That Hurts Middle Class Americans

IIABA has announced support for the "Middle Class Health Benefits Tax Repeal Act," introduced by Rep. Joe Courtney (D-Connecticut). The legislation would repeal the excise - or so-called "Cadillac"- tax, a provision in the Affordable Care Act (ACA) that will impose a 40% tax on health benefits that exceed an established annual cost starting in 2018.

"The Big 'I' supports the 'Middle Class Health Benefits Tax Repeal Act' and other legislative efforts to repeal or delay the "Cadillac" tax in the Affordable Care Act which, without further action, will have a huge negative impact on middle income Americans," says Charles Symington, Big "I" senior vice president of external and government affairs. In 2018, health plans exceeding $10,200 a year in value for individuals or $27,500 a year for families will be subject to this 40% tax. The levels are indexed for inflation but over time this tax will impact more and more individuals because Congress tied the threshold to a slow measure of inflation that will not keep up with the rising cost of health care.

"The excise or "Cadillac" tax will potentially cause an increase in health insurance costs for both employers and employees while also causing many employees to see a significant decrease in the quality of their health insurance coverage as employers are forced to reduce benefits to avoid this tax increase," says Wyatt Stewart, Big "I" director of federal government affairs. "

Last week, IIAN members urged Nebraska's Senators and Congressmen to support the bill, on Hill visits during the IIABA Legislative Conference in Washington, D.C.

|

| Top 5 Flood Insurance Issues To Watch This Year | |

Brace Clients For New Flood Policy Surcharge

A number of changes that took effect April 1 will impact the overall cost of many flood policies in the U.S. As FEMA continues to implement portions of the Homeowners Flood Insurance Affordability Act of 2014 (HFIAA), here's what to keep an eye on when serving your flood insurance clients. Read more about Top 5 issues - including mandatory surcharges up to $250 per policy.

|

| Best Practices Guide To Serving Today's Customer | |

The Customer Service Experience combines information and hands-on guidance to help your agency clearly define customer service goals and focus your efforts toward achieving them. In addition, it will serve as a long-term guide in adjusting and enhancing your customer service focus as inevitable changes occur in the marketplace. This guide is releasing one new section per month and also has related resources to each section available on the website.

|

| Study Reveals Stability & Growth In P/C Insurance Market | |

Independent Agents Continue To Dominate Commercial Lines, Rival Competitors In Personal Lines

The Independent Insurance Agents & Brokers of America has released the results of the 2015 Market Share Study (based on 2013 data) which revealed that independent insurance agents ("IAs") continue to dominate commercial lines, while rivaling direct response writers and captive carriers in personal lines business.

This is the 19th year the Big "I" has contracted with A.M. Best Company to receive year[end industry market share and company expense data. Selected findings from the report:

- IAs still control a majority of the entire p-c market, writing nearly 57% of all premiums.

- IAs write nearly 35% of all personal lines premiums.

- IAs still dominate commercial insurance sales, writing nearly 80% of a market that has grown by more than $35 billion over the last three years.

- IAs grew market share in 23 states and the District of Columbia. In many states, they dominate both personal and commercial lines. That suggests IAs in other states have an opportunity to add share in more lines if they put a renewed focus on it.

Download the study - read about Nebraska market.

|

| Agent M&A's Drive Growth |

A recent report by Deloitte entitled "2015 Insurance M&A Outlook: Continuing Acceleration" reports that serial acquisitions have been the core driver of agency and brokerage growth for years. The consolidation is creating bigger, larger-scale organizations that are progressively growing in their ability to influence carriers, negotiate commissions and manage the customer relationship. Interest from private equity firms will continue to drive greater deal activity because of modest capital requirements, steady cash flow and strong return on equity.

|

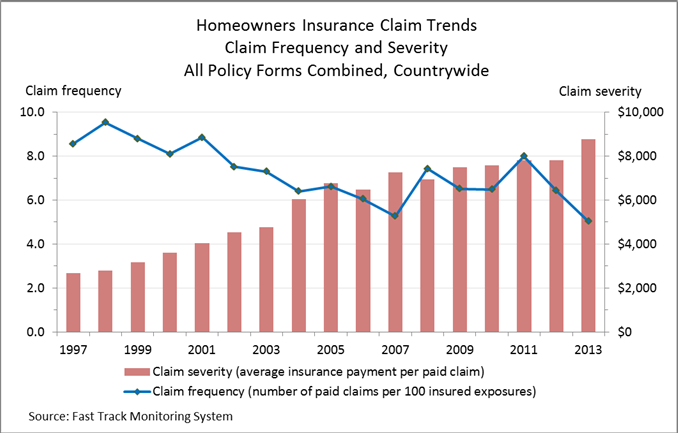

| Homeowners' Claims Costs Jump |

The severity of U.S. homeowners' insurance claims has increased at more than three times the rate of inflation over the past 17 years. A recently released Insurance Research Council (IRC) report, "Trends in Homeownes Insurance Claims, 2015 Edition," details the trends.

- The average claim payment increased at twice the rate of inflation.

- Claim frequency was more volatile than severity, especially in relation to catastrophes.

- The rise in claim severity more than offset a 2.5% decline in claims frequency.

IRC cautions that it will be difficult for insurers to continue responding to the rapid increase in severity and extreme volatility. The countrywide report looked at insured homes, apartment, and condominiums between 1997 and 2013.

|

| Federal Court Rules States Can Regulate Navigators |

On April 10, the U.S. Court of Appeals for the 8th Circuit issued a much-anticipated ruling connected to the Affordable Care Act (ACA) that affirms the broad authority of states to license and regulate health insurance exchange navigators, certified application counselors and other assisters. The ruling overturned a lower court order and was a victory for proponents of state insurance regulation.

St. Louis Effort for AIDS v. Huff arose when a number of self-described consumer organizations challenged a Missouri law that created a state-level regulatory framework for insurance navigators and exchange-related assisters. Missouri and many other states (including Nebraska) enacted similar navigator and assister-specific statutes following the passage of the ACA to fill the regulatory void that might otherwise exist and to make clear that these entities are subject to the jurisdiction of state officials. The plaintiffs argued that the ACA largely preempted the Missouri law.

In January 2014, the federal district court that first considered the lawsuit issued a preliminary injunction that prevented the state from implementing the law. The judge suggested that jurisdictions with federal exchanges have no authority to license or oversee navigators and similar assisters and went so far as to say that "any attempt by Missouri to regulate the conduct of those working on behalf of the [federal health insurance exchange] is preempted." Some consumer groups and others argued the order threatened the existence of similar statutes in other states, and the independent agent community and other supporters of state insurance regulation welcomed the state's decision to appeal the troubling decision.

|

|

|

|

|