Are Market Analysts "Betting on the Come"?

The eternal optimism of many stock market analysts never ceases to amaze me. My faith in analysts was shattered with the breaking of the technology bubble beginning in 2000. Just prior to the bottom falling out of the dot com bubble, analysts persisted in touting "buy" recommendations on stocks with three digit price/earnings (P/E) ratios and stratospheric "target prices". After the bubble burst, and these stock prices plummeted as much as 80% or more, with no fundamental change other than valuation; then, these same analysts began to issue "sell" recommendations. The "target prices" morphed into "sell" recommendations after losing nearly 80%.

Well, the optimism continues today and is evident with even a cursory review of S&P 500 earnings expectations. One way the analysts justify exorbitant stock prices is by maintaining the illusion of a future surge in earnings. We can examine earnings results and analysts' expectations by looking at data on the S&P website.

In quarter 1 ending March 31, 2015, net earnings fell 12.3% compared to earnings for first quarter 2014. Quarter 2 plunged a whopping 15.6% compared to prior year. After much revision, the hope for quarter 3 is that net earnings will only drop 2.6% (we shall soon see). And, never fear, the hopium returns in full-force in quarter 4 as projections are for -get ready for this - a 25.9% increase in net earnings.

Let's see if sales or revenues are trending toward that enthusiastic result. In quarter 1 sales fell 2.4%. Quarter 2 sales dropped 3.8%. No estimates are available for Q3 or Q4 2015 on Standard and Poor's website. With the data available, it doesn't appear "sales" are going to do the trick. Maybe the economy is going to recover so rapidly by the fourth quarter earnings will soar.

We have seen that global GDP is falling as countries push forward with more economic juice derived from printed money, aka quantitative easing (QE). The economic impact from this QE activity has not been sufficient to push global growth higher. In the U.S., GDP growth for the first two quarters continued range-bound near 2%. And, according to the Atlanta Fed's GDPNow model, estimated growth for Q3 is currently 1.5%. As you can see in the graph below prepared by Doug Short of Advisor Perspectives, we remain at or below levels seen at the start of many recessions.

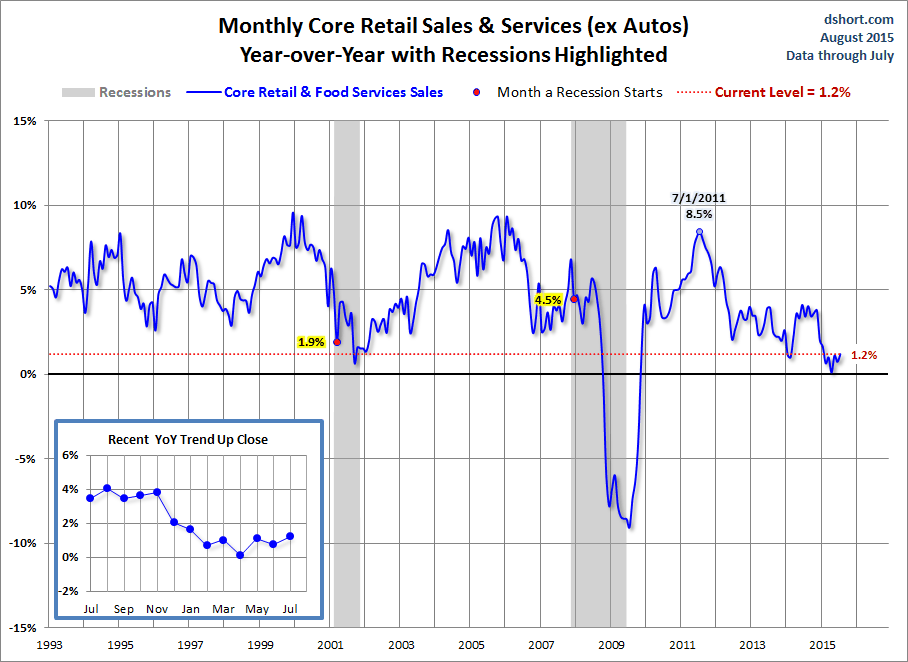

Maybe analysts expect production of goods to pick-up significantly from here. Unfortunately, the Institute for Supply Management's (ISM) manufacturing index at 51.1 is barely above the 50 level which is the demarcation between expansion and contraction. And, consumer sales, excluding the current bubble in new car sales (loans), shows we are below the point that designated the start of the prior two recessions (graph also per Doug Short):

Combining the above with the fact that China's economy and imports (of our goods) have decreased, makes one wonder what will drive the expected 25.9% surge in fourth quarter net earnings. I guess if corporations executed a series of the most profound stock buybacks in history, earnings reported on a "per share" basis might come close to expectations. Realistically, I don't think that is possible. So let the earnings adjustments begin. As earnings are adjusted downward, it becomes even more apparent how overvalued the stock market is, despite the slight correction incurred recently.

In order for the market to approach historical standards of mean valuation, another 40% drop would be required. Many in the media feel we have recently experienced a "crash". In reality we have barely scratched the surface of a normal correction. To justify current market levels, we would need many more quarters of the hoped-for 25% growth currently built into eternally optimistic analysts' expectations. It seems analysts continue "betting on the come"...memories of 2000 abound. Expect the revisions posthaste.

The S&P 500 Index closed at 1,921, down 3.4%. The yield on the 10 year Treasury note fell to 2.13%. Oil prices rose to $46 per barrel and the national average price of gasoline according to AAA fell to 2.40 per gallon.