When Does "Investment" Become "Speculation"?

I have previously written several Updates distinguishing "speculation" from "investment." I bring this up again as I believe it is critical at this time that investors understand what has been occurring in the stock market over the past 3 years.

As defined by Benjamin Graham and David Dodd in Security Analysis, "An investment operation is one which, upon thorough analysis, promises safety of principal and a satisfactory return. Operations not meeting these requirements are speculative."

It is important to note that "promises safety of principal" does not mean an absolute guarantee of principal, but instead investing in such a manner, and in such securities, that upon thorough analysis under normal or reasonable conditions the securities are worth the price paid and should therefore provide some assurance of safety.

Investment becomes speculation (or gambling) when the security(ies), based upon fundamental measures (e.g., price/earnings ratio, Tobin's Q, dividend ratio, etc.), becomes notably overvalued, such as when the Shiller PE ratio reaches a level at least 15% above its historic mean, which is 16.5 for the S&P 500. At this point it should be expected that any future gains will at some point be taken away. As we have experienced since the financial crisis, the point where unsustainable gains achieved are subsequently purged can be delayed for a lengthy period of time. But don't be confused by the amount of time passed, the excess gains will be ultimately erased; they always have.

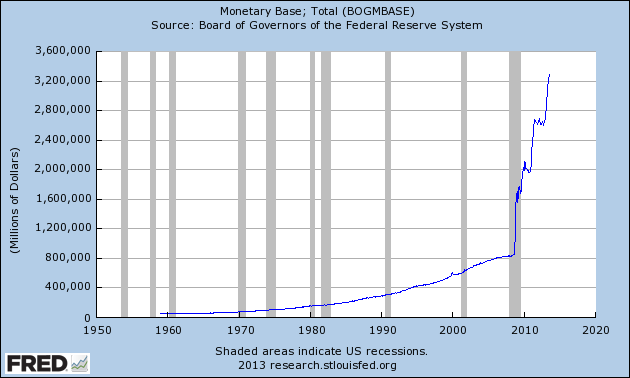

Economist and financial advisor Lance Roberts with Streettalk Advisors frequently compares the stock market to a rubber band. At reasonable value, the rubber band is dangling loose; however, as it becomes overvalued it stretches upward. In our present case the rubber band is being pulled by the full weight of the four most powerful men on the planet: Ben Bernanke, Chairman of the Federal Reserve Bank (the Fed); Mario Draghi, President of the European Central Bank (ECB); Haruhiko Kuroda, Governor of the Bank of Japan (BOJ); and Zhou Xiaochuan, Governor of the People's Bank of China (PBoC). Together these four unelected men have managed to see to it that multiple trillions of dollars (or dollar equivalent) of monetary base have been created out of thin air since the end of the financial crisis. See the following chart for the U.S. monetary base:

The printing of these trillions has not solved our economic problems as our GDP growth remains mired below 2% both year-to-date as well as for the prior decade. Our employment situation has not improved as the employment-to-population ratio remains below that prior to the recession. And as written about previously, what little job growth that has occurred is primarily of a part-time nature, not the type of jobs that will increase demand and help grow our economy.

The Federal Reserve Bank of San Francisco's Economic Letter of August 12, titled "How Stimulatory Are Large-Scale Asset Purchases?", discusses the impact of QE2, derived through simulation, and compares these findings to other research. The findings were that "QE2 added about 0.13 percentage point to real GDP growth in late 2010 and 0.03 percentage point to inflation."

They go on to say, "The 0.13 percentage point median impact on real GDP growth fades after two years." You have to wonder why several years and several trillion dollars later, seeing nominal impact on GDP and unemployment, the Fed hasn't admitted the failure of this approach. But the lack of GDP growth from these programs isn't the real concern now, the real concern is the next impending financial crisis due to the massive amounts of debt - funded, unfunded and monetized - that exist globally today, and the stock market bubble it has created.

Back to our example, with the weight of central banks pulling the rubber band higher based solely on the fantasy that they are solving our problems, we are nearing the point when they won't be able to pull anymore. At some moment the market will awaken to the fact that a crisis is brewing and the Fed can't do anything to prevent it. When that happens, the rubber band will snap back and in accordance with the theory of reversion to the mean should eventually pull the rubber band (the stock market) below the mean. If the rubber band is eventually pulled low enough - to a point of undervaluation - then we would expect a snap back in the upward direction.

When markets move so radically merely upon the words of one man (out of four), then that should be a major red flag that the markets are not looking at earnings growth or other fundamentals, but merely speculating that some amount of increase in the monetary base will solve our problems...but it won't. This is a delay tactic and like a snowball rolling down hill it will gather steam with each new QE program. The longer we wait, the worse the consequences will be.

From a fundamental standpoint, over the past 18 months S&P 500 net earnings per share have grown about 3% on an average annualized basis. However, of this amount almost 1% is attributable to corporate stock buybacks reducing the number of shares outstanding, and thus giving the impression that earnings grew more than they really did. Additionally, the forward guidance of many companies has turned negative. Therefore, with real net earnings growth at or below 2% and negative forward guidance, how can you justify growth in the S&P 500 of 20% annualized over the past 18 months? You can't.

Economist John Hussman included the following historic quote in a prior Weekly Market Comment. I found this to be quite prophetic:

"In the ruin of all collapsed booms is to be found the work of men who bought property at prices they knew perfectly well were fictitious, but who were willing to pay such prices simply because they knew that some still greater fool could be depended on to take the property off their hands and leave them with a profit."

- Chicago Tribune, April 1890

The S&P 500 Index closed last week at 1,633, down about 2% for the week. The yield on the 10 year Treasury note ended the week down at 2.75%. Oil prices closed up at $108 per barrel and the national average price of gasoline according to AAA rose to $3.59 per gallon.