There's Still Time:

Enter Mortgage-Free Monday Drawing

In honor of National Homeownership Month this June, TSAHC will be paying a month's mortgage for five new homeowners. TSAHC will conduct a drawing on Monday, June 29, 2015 to select the five winners. Each winner will receive one month's mortgage payment paid by TSAHC.

The raffle is open to all home buyers closing on a loan using TSAHC's down payment assistance and/or Mortgage Credit Certificate programs between April 1, 2015 and June 26, 2015. Learn more about Mortgage-Free Monday.

|

|

June is Homeownership Month - Help Us Celebrate

In 2002, President George W. Bush officially proclaimed June as National Homeownership Month. It is observed to raise awareness about the vital role homeownership plays in improving lives, creating jobs and economic opportunities, and strengthening America's neighborhoods. In addition to Mortgage-Free Monday , TSAHC will recognize National Homeownership Month by sharing stories from people who have used our programs to buy a home in our On the House Blog. We are also introducing the domain www.readytobuyatexashome.com to help prospective home buyers find information on TSAHC's down payment and Mortgage Credit Certificate programs. TSAHC maintains www.texasfinancialtoolbox.com, an easy way to find organizations who provide home buyer and financial education.

We hope you will help us celebrate National Homeownership Month by sharing our stories and resources.

|

Texas Community Bank Commits

$500,000 to TSAHC

We are excited to announce that Texas Community Bank has committed $500,000 as an Equity Equivalent Investment to support TSAHC's Affordable Communities of Texas (ACT) program .

Texas Community Bank (TCB) is a locally owned and operated, community-oriented financial institution that serves not only its primary home of Laredo, but also San Antonio, Somerset and the border towns of Brownsville, McAllen and Del Rio. TSAHC's ACT program is a statewide land banking/land trust initiative. TSAHC will use TCB's investment to acquire and rehabilitate vacant and foreclosed properties in TCB's service areas. The properties will provide affordable housing to low and moderate income families. Thank you Texas Community Bank for supporting the ACT program and TSAHC's mission. Learn more about why you should consider investing in TSAHC. |

|

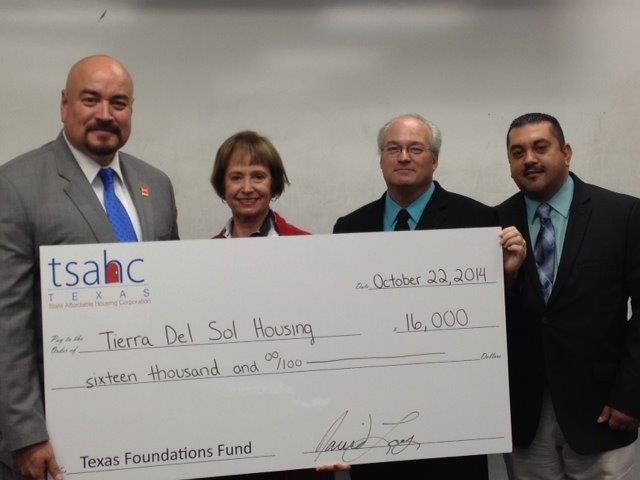

2015 Texas Foundations Fund

Applications Due June 5, 2015

We are now accepting applications for the 2015 Texas Foundations Fund awards cycle. Through the Texas Foundations Fund, TSAHC partners with non-profit organizations and rural government entities to provide housing stability to very low-income households. Read the article below for an inspirational success story of the Texas Foundations Fund program.

TSAHC selects partners through a competitive application process and provides awards from $15,000 to $50,000 to support partners' supportive housing services and critical home repair programs. Since 2008, TSAHC has awarded nearly $1.9 million through the Texas Foundations Fund.

Guidelines and Application

Organizations interested in submitting an application should complete the following steps:

3. If you pass the eligibility quiz, click here to access the online application. Applications must be submitted online no later than 5:00 p.m. on Friday, June 5, 2015. Questions?Learn more about the Texas Foundations Fund.

|

|

Texas Foundations Fund Success Story

TSAHC awarded the Salvation Army of Tyler a Texas Foundations Fund grant during the 2014 awards cycle. The organization used the grant to get people back on their feet, including an individual named Crystal. This is her story.

Crystal enrolled in the Tyler Salvation Army's Emergency Solutions supportive housing program in 2014. She had no I.D., no high-school education, and no job. Furthermore, her teeth had decayed due to an extreme vitamin deficiency and past drug abuse, and she was afraid to smile.

With a grant from the Texas Foundations Fund, the Tyler Salvation Army was able to provide Crystal with a case manager who helped her put together a plan to get her life back on track. Crystal obtained an I.D. and immediately enrolled in her first G.E.D. class. The Tyler Salvation Army also arranged for her to see an oral surgeon, who provided her with a complete set of dentures. With her new smile and her new-found confidence, a week later Crystal found a job.

And Crystal's story gets even better. She has earned her G.E.D., enrolled in classes to become a Certified Nursing Assistant and has even qualified for grants to pay for school. Thanks to the guidance and positive reinforcement she received from her case manager, in just four months Crystal has overcome the physical and psychological barriers that were weighing her down and completely transformed her life.

The Tyler Salvation Army is very proud of Crystal and so grateful for TSAHC's Texas Foundations Fund program, which provided them with the means to assist her.

|

|

Discounted Home Available for

Eligible Veteran in Austin

TSAHC is looking for eligible veterans interested in purchasing a discounted home. As part of TSAHC's Affordable Communities of Texas-Veterans Housing Initiative (ACT-VET) program, these properties are available at a discounted rate of 25% off the listing price to disabled and/or low-to-moderate income veterans.

A home is currently on the market in Austin at 4609 Dudmar Dr., and we encourage local veterans services providers, Realtors®, and housing organizations in the Austin area to advertise this property to veterans who may qualify.

|

Learn more about the ACT-VET program.

|

The below piece is an excerpt from On The House, a weekly blog TSAHC launched in 2014 on affordable housing topics. We invite you to drop by On The House every Friday as we share information on important housing issues, provide an inside look into our programs, and share other valuable resources. Click here to sign up to receive the blog every Friday.

Getting a Hand Up on the Down Payment Challenge

One of the most daunting obstacles to becoming a homeowner is saving for the down payment. It's not easy, and it may require significant lifestyle changes. As Michael Corbett of Trulia bluntly stated in a Washington Post article "you're not going to earn a down payment by [cutting out] Starbucks." While this may be true, it doesn't have to mean drastic changes are in order. One of the most daunting obstacles to becoming a homeowner is saving for the down payment. It's not easy, and it may require significant lifestyle changes. As Michael Corbett of Trulia bluntly stated in a Washington Post article "you're not going to earn a down payment by [cutting out] Starbucks." While this may be true, it doesn't have to mean drastic changes are in order.

How much do you need?

Down payment requirements can start as low as 3.5% of the purchase price for FHA loans, but potential home owners may consider saving up to 20% for better loan terms. Either way, a down payment is immediate equity in a house and a step towards long term wealth building.

Is assistance available?

TSAHC offers two down payment assistance programs to help low and moderate-income home buyers purchase a home or refinance an existing loan. The assistance is a grant for up to 5% of the home purchase price and does not need to be repaid. First-time home buyers can also use TSAHC's Mortgage Credit Certificate Program to save money each year over the life of the loan. We encourage you to see if you qualify for our programs as well as checking out the Texas Financial Toolbox or Bank of America's Down Payment Resource Center to research other forms of assistance.

Put together a savings plan.

Unfortunately, many Americans are struggling with stagnant wages and rising costs of living. A recent The Simple Dollar article points out that Americans in 1975 saved 15% of their income. That number dipped to 4.7% at the end of 2014. At the same time, household income in 2013 was 8.7% lower than in 1999 when adjusted for inflation. And back then, your money went further. Now, it takes $140 to buy the same amount of goods and services that cost $100 in 1999.

This means Americans have to save more and consider other ways to earn income. The earlier referenced Washington Post article offers ways to do both. Consider saving money by:

- eliminating small luxuries,

- downsizing your living space to reduce rent,

- living off one person's income in a household,

- selling your car or eliminating a car payment by buying an inexpensive one with cash, or

- explore additional income opportunities like doing freelance work or turning a hobby or craft into a second paycheck.

Finally, your money should make money in a safe and low-risk interest earning account. NerdWallet has a list of good options.

Keep in mind that a home purchase is one of the most important decisions you will make. Saving for the down payment may take longer than you like, but the reward of owning your home is worth the effort.

|

|