It Wasn't The Swiss: Continuing Plunge In GOFO Means No Easing Of Worst Gold Shortage In Over A Decade - www.zerohedge.com

Submitted by Tyler Durden on 12/01/2014 10:43 -0500

Yesterday, when we commented on what was largely a pre-determined outcome of the Swiss gold referendum, we said that there still "is the question of what happens to the tension in the gold swap market: as noted last week, the 1 Month GOFO rate had tumbled to the most negative in over a decade. It was not clear if this collateral gold squeeze was the result of Swiss referendum overhang or due to other reasons. The market's reaction on Monday should answer those questions."

Well, a few hours ago we got the GOFO update for the "day after" and the answer is clear: it wasn't fear of the Swiss referendum after all because the 1 Month GOFO just crashed even deeper into negative territory with the entire curve through 6M now red, and with 12 month GOFO just 0.6 bps away from negative for the first time. At this rate, tomorrow's update will suggest that big institutions expect the gold swap shortage to persist through the end of 2015!

Also, judging by the gold reaction, which is about $50 from the overnight lows, someone else appears to have noticed that the rather shocking shortage of synthetic gold among institutions, which is finally seeping through into that whole "price discovery" process, where supply and demand actually matter.

|

| Zero Hedge |

Bottom line: whatever caused the record scramble for rehypothecated gold; it wasn't fears about the outcome of the Swiss referendum. Something else spooked the precious metal a month ago, and as seen on the chart above, things have only gotten progressively worse since then.

_____________________________

11/30 Goldeneconomizer - Dutch Get 24K Reward for MH17 Silence - www.lemetropolecafe.com

Dutch Get 24K Reward for MH17 Silence

by Goldeneconomizer

"The USA Government is withholding satellite and radar information .... The Ukrainian Government is withholding radar information and silencing the Spanish air traffic controller .. The Dutch Safety Board is withholding information (Cockpit Voice Recording, Black Box Flight data and initial accident observations... Cockpit riddled with 30mm machine gun rounds)..."

"If I was a betting man, I would say a Ukrainian Mig-29 deliberately shot down the Airliner. It has similar signature to Su-25 on radars. Russian Ministry of Defense shot themselves in the foot back in August.....by saying it might be an Su-25, which made their assessment easier to debunk. You don't send an Su-25 to perform a mission like that given it's speed and ceiling...you make sure with a Mig 29 or at least an Su-27."

So here's my latest analysis:

The MH370 was most likely shot down by cannon fire from a Ukraine Air Force Mig 29, as shown intercepting MH17 on publicly released Russian radar photos. Mig-29 has a similar radar signature to the SU-25. US recon satellites were directly over the area at the time and have still not released any photos. The wreckage photos show localized holes in the cockpit area from 30mm cannon, not the wider damage one would expect from a BUK impact.

The ground launched BUK (which likely missed the target) was used to camouflage the air-to-air shoot down and misdirect blame. MH17 was flying close to the upper "effective" limit of the BUK's range, depending on distance to target. This could also explain the mysterious descent from 33,000 ft. to 31,000 ft. just before it was shot down. Release of the Flight Voice Recorder would likely give evidence where this command to descend originated.

https://en.wikipedia.org/wiki/Buk_missile_system

The Ukrainian BUK systems were most likely equipped with either 9?38 or 9?38M1 missiles with a maximum range of 30,000 and 35,000 meters and maximum altitude of 20,000 meters and 22,000 meters. The USSR broke up in 1991. The next generation 9?38M2/9M317 were not introduced until 1998, and likely would not have been exported until much later. Ukraine was a perfect dumping ground for their outdated (but not outmoded) missile systems while deploying the latest technology only in Russia.

MH17 was shot down at an altitude of 10,000 meters. Keep in mind that the maximum lethal altitude of 20,000 meters would be attainable only at the ideal range, not the maximum range. Any further than the ideal range, the maximum lethal altitude would be less, possibly explaining the need for MH17 to descend.

Both Kiev and the separatists have the BUK system, but since the separatists have no aircraft, Kiev would have little reason to risk deploying their BUK system in separatist controlled East Ukraine, so suspicion would naturally fall on the separatists. Russia would have nothing to gain by shooting down a Malaysian passenger jet and a lot to lose if they were caught.

The Dutch are being paid in gold to keep their mouths shut. The Dutch Safety Board is sitting on the Cockpit Voice Recorder and Flight path Black box information in cooperation with Washington and Kiev (and silencing the Dutch Safety Board investigators) to prevent the truth from coming out.

Interestingly, the black boxes from the earlier flight MH117 were turned off in flight before it disappeared from radar, and were never recovered.

"Keeping the German repatriation story in mind, the Netherlands are basically giving the Federal Reserve the finger. Unlike Germany, it does not trust the Federal Reserve more than its own central bank and it prefers to 'sit' on the gold in Amsterdam rather than store it in a foreign nation. This is a huge policy shift which cannot be underestimated"

"So what was the main reason why the Netherlands brought the shiny precious metal back home? The central bank wants you to believe it's just an ordinary decision, but believe it or not, the only reason for this move was to restore the confidence of the public in the Central Bank. By publishing this statement, the Dutch Central Bank basically admits that holding gold increases the public trust in the central bank as an institution, and that's a statement which should not and cannot be underestimated as it basically means that only physical gold can be trusted and that the gold should be stored inside the country."

Here's where I disagree with the Zerohedge article above:

I don't believe the Netherlands were giving the Federal Reserve the finger. More like they were twisting its arm to return some of their gold in a secret deal that was not even announced until after completion. I'm surprised that they even announced the return of Dutch gold at all, except that the Dutch needed to provide a credible source for such a sizable increase in their central bank holdings. And this would also explain why the Dutch didn't request any of their gold back from Ottawa or London, since they had no leverage there.

The Dutch got 122 tonnes in secret and the Germans got only 5 tonnes after publicly requesting it? {After requesting the return only 300 of its 1500 tonnes "on deposit" with the Fed, the best they could manage to produce was a mere 5 tonnes of freshly smelted 1 kilo bars for the Germans. Purification by smelting destroys the "chemical signature" of the gold. So are we to believe that in the first year the Fed could not come close to the required pace of 43 tonnes per year (to accomplish the return of just 20% of the German gold over 7 years), but somehow still managed to deliver 122 tonnes in secret to the Dutch? Hmmm...}

And what became of the bars originally deposited with the Fed by the Germans?

The Germans don't have the leverage right now (as well as the fact that the Fed doesn't have any tonnage to spare) so the Germans are being strung along until it serves the Fed's purpose to return it (never). The Fed appears to be dangling the German gold as a carrot to prevent them from cooperating with the Russians. And now Merkel has even publicly canceled the request.

All these governments are aware that gold is a valuable, physically limited commodity while any fiat currency can be printed in unlimited quantities.

How Much Earmarked Gold Holds The Federal Reserve?

"From 1965 onwards the US' gold reserves continue to fall while the holdings of other central banks at the Fed were quite stable at around 12,000 tonnes. It is not coincidental that foreign gold holdings at the Fed should peak at 12,282 tonnes in August 1971; the month the US unilaterally cancelled the direct convertibility of the US dollar to gold. Thereafter foreign central banks holdings at the Fed fell to 7,200 tonnes by 2000, an average rate of 15 tonnes a month.

The period mid-1992 to mid-2001 saw a rapid decline in foreign gold holdings at the Fed, a reduction of just over 3,000 tonnes in 9 years."

"Focusing in more detail, the chart below of foreign central bank gold holdings at the Fed over the past fifteen years shows little activity except for 2007 and 2008, when just under 410 tonnes was withdrawn - big sellers during that period included Switzerland (250 tonnes) and France (227 tonnes) [Note that the French and Swiss did not part with any gold already in their own custody. They sold gold held at the Fed into the market, which they had little hope of getting back anyway]. It would seem that the remaining central banks holding around 6,000 tonnes are generally happy with the Fed's free custodial storage service. [Ha ha ha, they are all under the Fed's thumb, or the World Bank's, or IMF's. The smart ones like the Russians and Chinese have already taken possession of their own bullion.]

Of particular interest is the spate of recent withdrawals, which Koos Jansen has speculated are repatriations by Germany. Since June 2013, 75 tonnes have been withdrawn and if all are related to Germany, then they are on track with their plans to transfer 150 tonnes from New York to Frankfurt by 2015 and another 150 tonnes by 2020."

I don't believe that this tonnage went to Germany, but rather to the Netherlands in exchange for their silence on MH17. If you look at the chart, only a tiny amount was liquidated in June 2013, and the majority of the most recent 400+ tonnes was withdrawn from the Fed in 2014 with the largest withdrawals in September and October.

As recently as 2009, central banks were projected to sell some 4 million ounces of gold; instead, when the 2009 real numbers came in, they had purchased 15 million ounces.]

In 2010, Governments worldwide bought 77 tonnes of Gold. In 2011 it was 457 tonnes. And last year [2011] it was a whopping 535 tonnes. All told, they've accumulated 1,000 tonnes of Gold since 2Q09.

It has been over four months since the MH17 black boxes were delivered by the Malaysians to the Dutch for analysis on July 23, 2014. These could have been analyzed in 24 hours.

Facts withheld regarding the MH17 Malaysian airlines crash. Dutch Government Refuses to Release Black Box Recordings August 30, 2014

"Notable for its absence in the corporate media is any mention of the July 17 downing of Malaysian Airlines Flight MH17 over Ukrainian territory, killing all 298 people on board.

At that time, and without any evidence, all U.S. and NATO officials immediately blamed Russia and the Ukrainian rebels in eastern Ukraine for shooting down the Boeing 777. They used this charge to whip the European Union into imposing sanctions on the Russian economy.

On Aug. 11, the Dutch Safety Board announced that a preliminary report would be published in a week with the first factual finding of the ongoing investigation into the flight that departed from Amsterdam and crashed in Ukraine. The Netherlands was given custody of the flight data recorder, or black box recordings, from the crash [on July 23].

As of Aug. 25, [and through November 30, 2014] the Dutch government has refused to release the recordings. (RIA Novosti, Aug. 25) This, of course, immediately raises suspicions that the Kiev junta forces were responsible for the crash.

Questions had already been raised of why the Kiev forces would have placed numerous BUK anti-aircraft batteries in the area when the rebels have no planes, why the Malaysian flight was diverted hundreds of miles by Kiev ground control over the battle zone, and why Kiev air traffic control data and radar data of the flight have still not been made public.

Did the Ukrainian military shoot down the passenger plane simply to create a provocation that could be turned against the rebels in east Ukraine and Russia?"

Michael Bociurkiw, head of the OSCE group of monitors confirmed in late July in a CBC TV interview (which has not been suppressed) the presence of machine gun holes in the fuselage (pointing to a military aircraft rather than a missile). The byline of the CBC report was "OSCE monitor Michael Bociurkiw mentions bullet holes in #MH17, not able to find any missile so far."

The Kiev Regime's Official Report on the Downing of MH370

It is worth noting that one week after Michael Bociukiw's statement, the Kiev regime released its official report (August 7) on the downing of MH17 drafted by Ukraine's intelligence bureau, The Security Service of Ukraine (SBU). This report, which borders on the absurd, has barely been acknowledged by the mainstream media.

According to the SBU report entitled Terrorists and Militants planned cynical terrorist attack at Aeroflot civil aircraft, the Donetsk militia (with the support of Moscow) was aiming at a Russian Aeroflot passenger plane and shot down the Malaysian MH17 airliner by mistake. That's the official Ukraine government story, which has not been reported by the MSM, nor mentioned "officially" by Western governments.

goldeneconomizer@gmail.com

_____________________________

EXCHANGE WAREHOUSE SILVER STOCKS: Large Declines Across The Globe - srsroccoreport.com

by SRSrocco on November 26, 2014

After experiencing a small build of inventory over the past few months, silver warehouse stocks at the Shanghai Futures Exchange are now back on the decline. Matter-a-fact, Shanghai Future Exchange (SHFE) silver stocks fell 11 metric tons today, nearly 10% in just one day.

Silver warehouse stocks at the SHFE bottomed in September at 81 metric tons (mt), and then slowly increased to a peak in November..... this can be seen in the chart below:

|

| SRSRocco Report |

By the end of October, silver warehouse inventories at the SHFE increased to 120 mt and then peaked on November 11th at 138 mt. In just the past two weeks, 20 mt were removed from the exchange. The chart below shows the weekly change of silver inventory at the SHFE over the past two months:

|

| SRSRocco Report |

(NOTE: There is no Oct 3rd inventory figure as the Chinese markets were closed due to the weeklong holiday)

On October 10th, the SHFE had 95 mt of silver on hand. Inventories increased slowly over the next five weeks until there was a significant one-day build of 14 mt on November 11th, reaching a high of 138 mt. Then in the past two weeks there were several small withdrawals until today.

As I mentioned before, there was a large 11 mt withdrawal today bringing the total down to 108 mt. While this is higher than the all-time low of 81 mt in September, it seems as if the overall trend has now reversed leading to a continued decline of silver inventory at the SHFE.

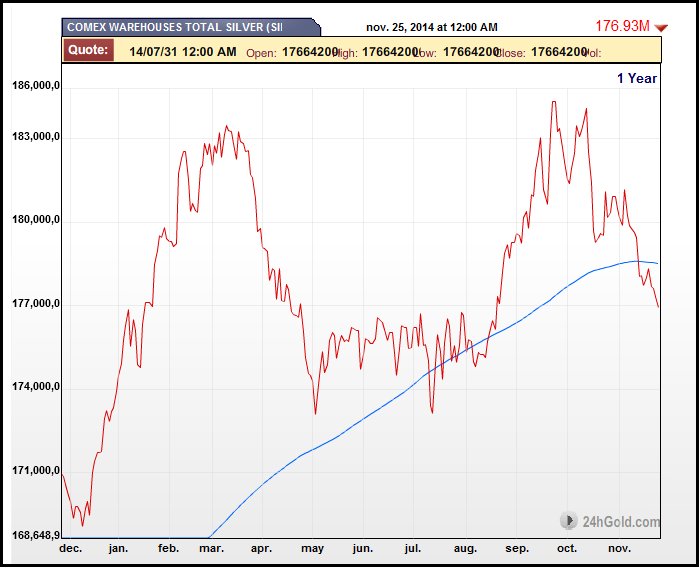

If we compare the first chart showing the 2013 & 2014 Shanghai Silver Stocks to the 1-year COMEX silver inventories, there are some interesting relationships. You will notice that silver inventories increased from the beginning of the year in 2014 on both exchanges.

|

| SRSRocco Report |

The COMEX silver warehouse stocks increased from approximately 170 million oz in January 2014 to 183 million in March. The SHFE experienced a build during the same time rising from 425 mt at the end of 2013 to a high of 575 mt in February 2014.

Furthermore, warehouse stocks on both exchanges declined into the summer. The COMEX bottomed earlier in August at 175 million oz, while the SHFE continued to experience a drawdown until it hit a low of 81 mt in September. Then both exchanges saw their silver warehouse stocks increase over the next few months. However, the COMEX peaked in the middle of October, while the SHFE did so a month later on Nov 11th.

We must remember, the Shanghai Futures Exchange is more of a physical delivery system while the COMEX is more of a paper price setting (RIGGING) mechanism. This is probably why the SHFE has experienced a 95% reduction of its silver inventory since its peak of 1,143 mt March 2013... RIGHT BEFORE THE HUGE TAKEDOWN IN THE PRICE OF SILVER.

Important Implications In the Silver Market

In my prior article titled, BREAKING: Significant Drawdown Of U.K. Silver Inventories Due To Record Indian Demand, it was reported by GFMS, one of the official sources on the silver market, that massive Indian demand caused a serious decline in U.K. silver inventories:

Meanwhile demand for silver bars and coins has soared in recent weeks as bargain hunting retail investors returned to the silver market after a disappointing first half of the year. Nowhere is this more evident than in India where imports of silver are up by 14% year-on-year for the January to October period and set for an annual record. With imports in the first ten months totaling a massive 169 Moz many vaults in the UK, traditionally the largest supplier to India, have seen significant drawdowns, leading to more supply flowing from China and Russia.

Basically, GFMS stated that the "massive" Indian silver demand caused a large draw-down of U.K. silver inventories this year forcing India to acquire silver from Russia and China. I would imagine the decline of Shanghai silver stocks after the peak of 575 mt in February of this year was due in a large part from Indian demand.

So what does this all mean? Huge demand for silver started after the April 2013 paper price smash resulting in a 95% reduction of warehouse stocks at the Shanghai Futures Exchange. Also, this continued into 2014 as the U.K. (known as the global hub for physical silver delivery), experienced a drawdown of silver inventories as well.

While the COMEX has seen a decline over the past month or so, overall silver inventory is higher than it was at the beginning of 2014. Which also proves that the COMEX is more of a paper price setting exchange than either the LBMA or SHFE.

It will be interesting to see how developments play out over the next several months and into the first quarter of 2015. If the U.K. and SHFE silver inventories have already been drawdown significantly... where is supply going to come from if we see continued strong demand or how about a LARGE PLAYERS requesting actual delivery from the COMEX.

The continued drawdown of silver inventories in China and the U.K. may have something to do with the SET-UP in this chart. This chart was put together by Bo Polny of Gold2020Forecast.com, who I spoke on the phone yesterday on some of the details.

I do not follow Technical Analysis as it's become worthless in a rigged market, however professional traders still use it as a tool for setting up positions in the market. According to Bo, the Silver Chart represents the Mother of a Descending Triangles. Normally a descending triangle that is forming a bottom results in a huge reversal and SPIKE HIGHER.

|

| SRSRocco Report |

You will also notice in the chart the MASSIVE increase in trading volume. At first it was assumed that all the volume (on netdania.com) was 5,000 oz contracts, but this is not the case. The SHFE has 15 kilogram silver contracts and the SGE - Shanghai Gold Exchange has 1 kilogram silver contracts. The SHFE is approximately 482 troy ounces and the SGE is 32 troy ounces. So, the 1 trillion ounce silver trading volume is much less, but still OFF THE CHARTS prior to 2011.

Furthermore, trading volume on the SHFE has now surpassed the COMEX. This part of the reason why overall trading volume has increased nearly exponentially since 2011. As we can see from the chart, trading volume during the $49 silver price peak and decline in 2011 did not increase all that much... basically it was a flat line until the middle of 2012.

While it's impossible to figure the actual silver trading volume in ounces (due to the different sized contracts around the world), we can plainly see PAPER TRADING has picked up substantially during the TAKEDOWNS in early 2013 and Oct-Nov 2014.

Lastly... yeah I get it. We are all wondering why the price of silver continues to decline if inventories are falling in the major silver delivery markets such as China and the U.K. Unfortunately, we don't really understand what is taking place in the silver market as the majority of trading takes place in the opaque OTC- Over-the-counter derivatives market.

That being said, at some point in time the world will wake up to the fact that the U.S. Dollar and highly inflated Stocks and Bonds are not stores of wealth, but rather a massive leveraged paper Ponzi scheme. Ironically, this public realization will probably occur right at the same time when the silver inventories at these exchanges are nearly depleted.

Got silver?

***

BREAKING: Significant Drawdown Of U.K. Silver Inventories Due To Record Indian Demand - srsroccoreport.com

by SRSrocco on November 24, 2014

There was a huge development reported in the silver market last week and how did the precious metal community respond? They basically ignored it. Go figure. So, I will try again to get the word out by presenting it in a different fashion.

Indian silver demand was so strong this year, that it produced a significant drawdown of U.K. silver inventories. Matter-a-fact, India had to access silver from China and Russia because available supplies from the U.K. were not sufficient.

According to GFMS Silver Interim Report released on Nov 18th:

Meanwhile demand for silver bars and coins has soared in recent weeks as bargain hunting retail investors returned to the silver market after a disappointing first half of the year. Nowhere is this more evident than in India where imports of silver are up by 14% year-on-year for the January to October period and set for an annual record. With imports in the first ten months totaling a massive 169 Moz many vaults in the UK, traditionally the largest supplier to India, have seen significant drawdowns, leading to more supply flowing from China and Russia.

As you can see from GFMS statement, they even included the word "Massive" to describe the demand coming from India. I emailed Andrew Leyland, GFMS silver analyst and author of the report, to see if he could put some figures behind the declining U.K. silver inventories. He was nice enough to respond today by stating the following:

The LBMA itself doesn't hold any silver stocks, but its member companies do. These stocks may be unallocated or allocated (often allocated to ETF holdings) and GFMS survey these stock levels once a year ahead of the silver survey in May.

What we've heard so far in 2014 has been anecdotal, that there have been large drawdowns in the UK of unallocated material. This has been backed up by trade data that has seen India increasingly buying from China and Russia while the UK (as the traditional lead supplier to India) has lost market share. While we can't quantify the drawdown or stock level at this point we thought it worth mentioning the trend. In addition, for the silver survey, we'll be trying to survey how much material from European bullion stocks is allocated. Silver ETFs holdings have been robust, in comparison to gold, and this could effectively limit available inventory to the silver market moving forward.

Unfortunately, Mr. Leyland could not provide any actual figures, but to state that there have been "LARGE DRAWDOWNS" from U.K. silver inventories is a big issue for the silver market. As stated, U.K. was India's "traditional lead supplier" of silver. Why the big change? Why did India need to resort to acquiring silver metal from China and Russia if the low paper price signifies a SURPLUS???

Another interesting item Mr. Leyland stated in the response was that this U.K. silver metal was from "unallocated material." Furthermore, he commented, "Silver ETF holdings have been robust, which could effectively limit silver inventory to the silver market moving forward."

Continue reading on SRSRocco Report.

_____________________________

Dramatic Increase In Gold Flows Into China - seekingalpha.com

Nov. 26, 2014 12:58 PM ET

Summary

- China is importing gold bullion equivalent to 80% of the world's production.

- Western depositories are seeing declines as gold flows to eastern vaults.

- Today's new owners of gold are not concerned by gold's lack of yield.

For over two thousand years, China practiced what came to be known as the "tributary system," reflecting the view that it alone was the center of the civilized world. All who wished to do business with the Chinese were considered tributary states. Rulers and travelers from other lands had to follow certain procedures, including gift giving, in order to associate or do business with them.

When Japan ignored this policy, it brought about two invasion attempts by the Mongols under Kublai Khan.

Now, that line of thinking has morphed into something quite interesting, which may one of these days come to be known as "The Great Gold and Silver Migration," the transfer of massive amounts of true wealth - precious metals - from West to East.

Streams of Gold Flowing East, Emptying Western Vaults

In nature, a tributary is a smaller stream flowing into and feeding a larger stream or river. Around the globe, several "tributary trends" are coming together in order to feed the Chinese (and Indian) precious metals' demand river, with major supply-side implications in the near to intermediate future.

The Chinese gold accumulation "river" has feeder supply streams from a variety of sources swelling its in-country gold tonnage. Quite a bit is imported legally through Hong Kong. Until this year, this statistical source was a reasonably accurate representation of publicly accounted for gold coming into China.

However, Beijing and Shanghai are now ports of entry for a considerable volume of bullion, so annual import totals have become much more difficult to quantify.

For 2013, several sources have estimated total Chinese gold imports at 2,000 to 2,200 tons. If this was indeed the case, then it would be the equivalent of over 80% of global gold production for the year!

In an official Chinese Press Release about the China Gold Yearbook 2014, the Chinese Gold Congress (CGC) in Beijing stated that gold demand in 2013 was 2,199 tonnes, and 2014's numbers continue apace.

China encourages its citizens to buy gold - jewelry, numismatic coins, or bullion. Another tactic - though extremely difficult to quantify - is the effort by Chinese business and government entities to purchase gold and silver properties for their future production capabilities.

Over the last few years, Bolivia, Argentina and Chile (also copper deposits) have seen considerable activity of this nature. Not long ago, China approached Barrick Gold (NYSE:ABX) about a partnership in its cost over-run plagued Pascua Lama project, a massive gold-silver property that straddles the Argentine-Chilean border.

Will Leased Gold from Central Bank Vaults Ever Be Returned?

In an interview with King World News, Dr. Keith Barron, the man who made one of the largest gold deposit discoveries of the last 25 years, had this to say:

I believe that most of the Western world's gold, which is supposed to be in central bank vaults, has been leased out. Much of it is now in private hands in India, and what remains continues going east to China and other Asian vaults. So most of the Western gold has vanished from the vaults, and it's now just a book entry.

One thing both precious metals' bears and bulls agree upon is that for uncertain times, holding gold and silver can make a lot of sense. The saying that "silver can feed your family and gold will save your life" has the ring of truth - fully borne out by history.

But the larger rationale for holding precious metals is even better - when times are good and people have more disposable income, as literally hundreds of millions of Chinese and Indians are in the process of achieving right now - the buy-and-hold demand for precious metals looks destined to rise in a big way and continue doing so in the foreseeable future.

Below is a chart showing electricity production in India. This core measure of economic activity demonstrates a well-entrenched trend showing no signs of abating. Add the surprising election win earlier this year by reputed free-market advocate Narendra Modi as India's new Prime Minister, and you have the ingredients for stronger economic growth, concomitant with continued robust domestic demand for gold and silver.

In closing, let me leave you with two more considered perspectives as to why gold and silver are destined to move much higher over time - the first, a position statement from Sprott Asset Management:

In closing, let me leave you with two more considered perspectives as to why gold and silver are destined to move much higher over time - the first, a position statement from Sprott Asset Management:

We are gold investors because we have made a specific and calculated bet against paper money. Simply put, we are betting against paper money as a store of value. We believe its supply will continue to increase. We do not believe that the world's major governments have any stake left in protecting it... Gold bull markets are unique in that buying becomes driven by both fear and greed. Gold is quickly moving into the hands of those who are unwilling to gamble on fiat currencies or bonds as a store a value. The new owners of gold are unconcerned with its lack of yield but instead are focused on its historic ability to preserve wealth and its unquestionable value.

Second is this quote from Frank Giustra, one of Canada's wealthiest and most successful businessmen. Though by his own admission, he has been a bit early in calling for a resumption of the upward move in the metals, he still maintains that "All the reasons gold went from $250 to $1,900 are still intact. In fact, they've been amplified tenfold."

Buy the physical gold and silver you anticipate wanting to acquire in the future... Now!

_____________________________

Abenomics Is Dead And Self-Preservation Has Started - sproutmoney.com

November 19, 2014

|

| Sprout Money |

Japan's Prime Minister Shinzo Abe has had an extremely busy past few weeks. After increasing the sales tax rate earlier this year which caused the GDP to contract by more than 7%, the Bank of Japan announced earlier this month it would step up its game and print money like never before. In a previous column we explained that Japan would print new money at twice the rate the USA was printing cash at the height of its quantitative easing program.

Even though Abe's economic policy (called Abenomics) seemed to be working in the first phase of the implementation, the progress has stalled and Japan is now back in a recession again. This could be a huge indication that Abenomics is quite dead. In an attempt to resuscitate the policy, the huge money printing program has started and Abe has announced he would postpone a planned increase in the sales tax to 10% by 18 months years as the effect of another increase might have been devastating for the country's economy. It was already quite weird for someone who wanted to increase the consumption pattern of the Japanese population to increase a sales tax (which obviously reduces the demand for goods) to get the country's financial situation back in order.

Surprisingly enough, even though Japan's economy is now officially in recession again Abe has called for new elections within the month. With Abenomics failing and the domestic economy tumbling back into recession, the central bank printing money like crazy leading to a severe depreciation of the Japanese Yen and an unpopular move to increase the sales tax from 5% to 8%, one would definitely not expect a democratic leader to ask the citizens of Japan to vote for him once again.

|

| Sprout Money |

But Abe has effectively called for elections, which will be held on December 14th, which is in less than four weeks from now, now that's an electoral 'Blitzkrieg'! It's also quite easy to understand why the sales tax hike has been postponed as the prime minister needs to make himself popular with his citizens. But more than anything else, the elections were called to take the left side of the political landscape by surprise. As elections are a complete surprise for everyone, the left-wing parties haven't organized and harmonized their opposition against Abe yet. On top of that, with such a short time frame before the elections it's extremely unlikely the left side will actually be able to organize themselves and take up the glove Abe has dropped.

By adding this element of surprise, Abe just wants to secure another term in office despite his failing economic policy. As he's a real politician, Shinzo Abe is still upbeat about Abenomics stating 'it's working' but he seems to forget that even though the unemployment rate decreased and the company's revenues increased, there still isn't a noticeable increase in consumption and salaries. Realizing one out of three promises isn't really what you'd call 'passing' the test. It's also a very wise decision to ask the Japanese population for a vote of confidence before the newly-printed money will be felt by the man in the street through an increasing inflation rate.

|

| Sprout Money |

The 'Abenomics -balloon' is slowly deflating and Abe seems to want to secure his personal future before Japan's economic situation deteriorates even further. The Japanese Yen has already lost 15% of its value in the past six months and with a failing economy and huge quantitative easing program we are expecting a further depreciation of the Yen. Meanwhile, the gold price in JPY has increased by almost 10% in the same six months, despite a 7.5% drop in the price of gold (expressed in USD). This once again emphasizes every decent investment portfolio should contain some gold and silver to protect yourself against sudden changes in the economic policy. Our thesis seems to be confirmed as our research has indicated the total amount held in a physical gold ETF issued by Mitsubishi UFJ - "Fruit of Gold" - has increased exponentially since Abenomics went in full force, as can be seen on the following chart.

|

| Sprout Money |

The amount of gold is expressed in grams. So whereas this ETF had roughly 1 million grams of gold in 2010 (32,150 ounces), this increased exponentially and almost eightfolded in just a few years time. The vertical red line is the moment the Bank of Japan started behaving irrational and you can clearly see the interest to hold physical gold has increased since then. The smart Japanese have mobilized their money and invested it in physical gold to safeguard and protect their purchasing power. And they are right to do so!