11/17 Ivan Lo - The Equedia Letter - Forget Ebola, Worry About the Coconut Virus - www.lemetropolecafe.com

Forget Ebola, Worry About the Coconut Virus

Ivan Lo

Dear Readers,

A week ago, I was at a birthday party for a rocker who had just turned 50.

His daughter, my girlfriend's best friend, had placed notes on the tables showing the cost of things when he was born (1964) and the cost of things today.

I couldn't help but snicker at what I saw: The drastic difference between the average cost of goods, services, and housing and the average annual salary.

Since the notes were a novelty item, I didn't know if the prices shown on the notes represented "nominal" or "real" prices. So I asked.

No one knew the answer. As a matter of fact, most people couldn't tell me what the differences between nominal and real prices were.

I explained.

Nominal prices are the actual sticker price of something, not adjusted for inflation; in other words, a dollar is worth a dollar no matter how you look at it.

Real prices are the prices after it has been adjusted to account for inflation; in other words, what one-dollar can actually buy.

That seems simple enough.

But as we discussed the differences further, I soon found out that most didn't understand the modern concept of inflation.

Sure, they knew inflation meant rising prices.

But they all believed, as they were always taught in school, that inflation was the result of increased aggregate demand that lead to rising prices.

And if they told me that 50 years ago, I would have said they were mostly correct.

But that's 50 years ago.

Do you remember the prices of goods from when you were a kid?

Brainwash 101

In our modern society, inflation is now being used in place of devaluation.

That's because the dollar is now backed by nothing more than promises - as it has been since the end of the Bretton Woods System, somewhat backed by gold (see "How the Government Borrows Money").

And since the Fed is now the biggest holder of U.S. debt (see Biggest Buyers of Garbage), it also means the dollar is now primarily backed by the Fed's accounts which have never been publicly audited.

I want to go back to a Letter I wrote last year on inflation, "Inflation vs. Deflation: A Growing Currency War."

(The Fed) want(s) you to believe that we absolutely need inflation because the opposite - deflation - is a terrible thing. They want you to believe deflation represents a lack of economic growth.

But historically, deflation under normal circumstances has never been the cause of poor growth - as a matter of fact, it was quite the opposite.

Deflation occurred in the U.S. during most of the 19th century (the most important exception was during the Civil War).

But this deflation was caused by technological progress that created significant economic growth.

This was also a period before the establishment of the US Federal Reserve System's role in active management of monetary matters.

So "they" may tell you that deflation is a very bad thing.

But what deflation really means is a lack of growth in "their" banking system.

The Fed is a bank. Its growth - like all banks - relies on lending.

If people stop borrowing, banks wouldn't make money.

The more they lend, the bigger they become.

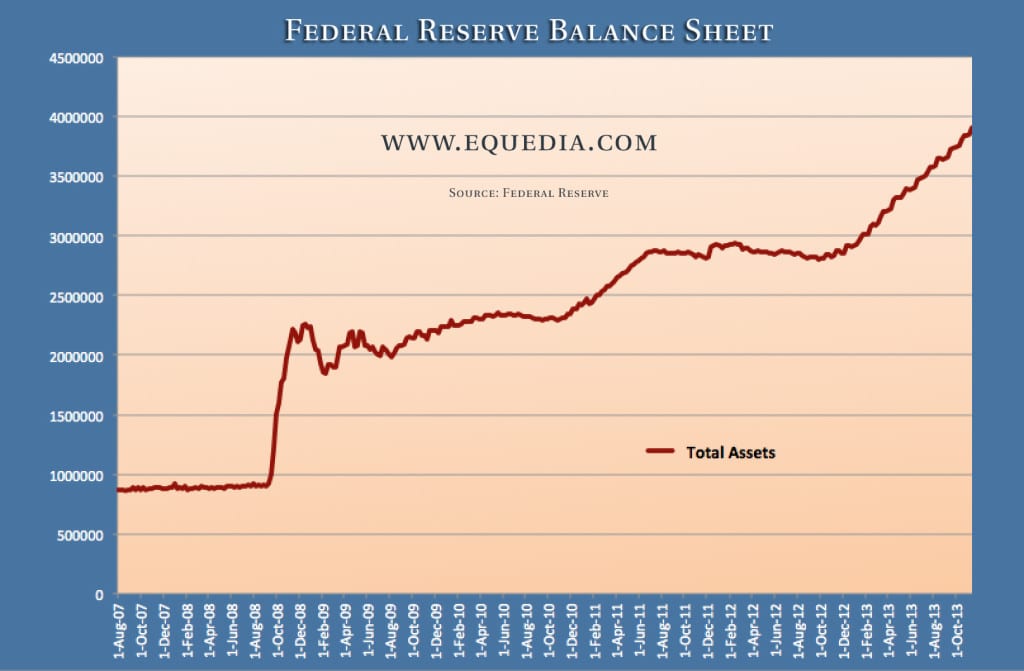

And the Fed has lent more money since 2007 than it ever has in its history.

Here's a look:

|

| Equedia.com |

Starting to get the picture?

What Inflation Means for the Fed

The Fed's policy is to prevent inflation from falling too low.

What that really means is that their policy is to prevent the cost of living from...well...staying the same.

Inflation is good for those who are heavily indebted, but punishes those who have been financially responsible.

The scary part is that people have fallen for the "we need inflation" mentality because they have been so heavily brainwashed by the media that inflation is a great thing and deflation is really bad.

Inflation vs. Deflation

Inflation means prices for goods and services are rising, which means you have to pay more for something.

Deflation means the opposite, which means you pay less.

The less we pay, the less likely we need to borrow to pay for the things we buy.

We're all bargain hunters. If we could buy a new iPad for $500 instead of $1000, we would.

So why then would we want inflation? Why would we want to pay more for something, when we can pay less?

Why wouldn't we want deflation instead?

Deflation: Good or Bad?

If our society never fell into this debt crisis, we would want deflation.

But since our world has fallen for the idea of cheap money via the central bank system, deflation can be scary.

Deflation increases the real value of debt.

In other words, deflation makes it harder to pay back money that you have borrowed.

Let's use housing as a simple example.

If housing prices drop by 10% (deflation), a homeowner with a large mortgage could see the real value of his debt rise by 10% because he now owes 10% more than what his home is worth (assuming he borrowed all the money for his house to keep the math simple.)

Since deflation means lower prices, which can eventually lead to wage declines, that same homeowner would now have a higher ratio of monthly mortgage payments to wage income.

Deflation would mean higher loan-to-value ratios for homeowners, leading to increased mortgage defaults (which we saw in 2007) and ultimately a crash in the banking system.

Banks need people to borrow to keep their system alive and they have done a great job of making everyone pay more for everything as a result.

The more expensive things get, the more we have to borrow - and that's good for the banks.

Housing prices haven't gone up because the real estate market is hot; they've gone up because credit has been cheap.

The next time you're buying a condo in Vancouver for $1 million, or a condo in Toronto for $750k, don't thank a great real estate market for that - thank the central banks.

Deflation: The Bigger Picture

Deflation causes a country's debt-to-GDP ratio to rise.

As prices fall GDP is lowered, which then leads to a country's inability to service its debt - the same debt accumulated as a result of easy money.

In other words, if deflation occurs, many countries could default...or print more money to prevent that from happening - which is exactly what the US is doing.

The central bankers' blueprint is very simple: If they can make you believe that inflation is low, then they can print as much money as they want, further entangling the world in a central bank credit system."

What do you think of inflation now?

What Inflation Really Means Today

Ludwig von Mises, one of the most notable economists and social philosophers of the twentieth century, defined inflation as the following:

"Inflation, as this term was always used everywhere and especially in this country, means increasing the quantity of money and bank notes in circulation and the quantity of bank deposits subject to check.

But people today use the term 'inflation' to refer to the phenomenon that is an inevitable consequence of inflation, that is the tendency of all prices and wage rates to rise. The result of this deplorable confusion is that there is no term left to signify the cause of this rise in prices and wages.

There is no longer any word available to signify the phenomenon that has been, up to now, called inflation."

Well said.

In simpler words, the term inflation is now widely used simultaneously to describe two very different things: True Price Inflation and Monetary Inflation.

The Truth About Your Money

True Price Inflation is caused by an increase in aggregate demand forcing the price of goods and services to go up. It is what most of us have been taught in Economics 101.

For example, let's say you're on an island and there are 1,000 coconuts available (a fixed supply), the price of a coconut will depend on how many people want one. If 5,000 people wanted one, the seller can raise prices so that the richest 1000 are the only ones that can afford to buy one. When demand is higher than supply, prices go higher.

However, monetary inflation - often mistaken for true price inflation - is not the result of aggregate demand, but a decline in the value of a currency.

Let's again use coconuts as an example.

You start on an island with a limited supply of 1,000 coconuts. So when people trade these coconuts for other things, the price is fairly constant.

Over time, you save up 20 coconuts, which you can trade for a new hut.

Then, one day, a ship hits some rocks by your island, and its cargo of coconuts washes ashore.

Suddenly, 5,000 coconuts are lying on the beach, and everyone scatters to grab some.

Because the coconut supply has increased, your coconuts can no longer be traded for a new hut because every one has more coconuts.

This scenario shows that monetary inflation is not the result of an increase in aggregate demand, but a decrease in the demand of a currency. In the above case, coconuts are the currency.

As I mentioned earlier, in our modern society, inflation is being substituted for another word: devaluation.

Now think of the coconut scenario in the context of our own current financial system, substituting coconuts for dollars.

Every time you save enough coconuts to buy a new hut, the Fed drops another boat of coconuts onto your island.

All of a sudden the coconuts you saved can no longer buy you what they once did before the Fed's drop.

If you want to buy that hut you have been saving for now, you'll now have to borrow more coconuts.

The Coconut Virus

The Fed has dropped an unprecedented amount of coconuts onto our island.

But that's not the worst part.

Along with these coconuts, the Fed has also dropped a coconut virus that spreads to all other coconuts.

We'll call this virus negative zero real interest rates.

This virus causes coconuts to spoil over time.

So if you save your coconuts, they will eventually become worthless.

But that's not all.

The Fed will continue dropping these coconuts to make sure you use them before they spoil.

Get the picture?

Back to Real Life

We can't control how fast these coconuts drop, and we can't control where they end up.

Let's also assume there are those who started with more coconuts and used their riches to build a coconut collector, so that every time coconuts were dropped, they would gather the most coconuts.

We'll call these guys the richest 0.0001%, or bankers - whichever you prefer.

If we made a living on the island selling lemonade, it would take a long time before the dropped coconuts affected our earnings because we can't control where, when, and how the dropped coconuts will be spent, nor who will spend them.

Since the richest 0.0001% can only drink so much lemonade and they collected the most dropped coconuts, it will take even more time for those dropped coconuts to affect our earnings.

This means it will take a long time before we can increase wages for our island employees, if at all.

So what's the result of all of these dropped coconuts in our real world scenario?

Here's a look at the rising average cost of goods against wages in US dollars, in nominal terms.

|

| Le Metropole Cafe |

In the last 50 years, the price of oil has gone up 32x; housing 18x; pack of gum 20x; subway ride 16x; and movie night for two 15x.

The average annual and minimum wage increase? Eight times.

Welcome to modern slavery.

Enjoy saving your coconuts.

To read the full article, please subscribe to Le Metropole Cafe.com.

__________________________

Russell - Stock Market Crash, Gold & Eventual Hyperinflation - kingworldnews.com

November 18, 2014

With historic events taking place around the globe, the Godfather of newsletter writers, 90-year old Richard Russell, covered everything from a stock market collapse, to gold, hyperinflation, and massive numbers of homeless people in New York. The 60-year market veteran also included a fantastic chart to go along with his outstanding commentary.

"On the news that Japan is back in recession, the Central Bank of Japan countered the news with a massive explosion in quantitative easing. On this news, Japan's yen semi-crashed.

The stock market in the US continues with its bullish progression, a sell signal, little downward follow-through, and then either the Dow or the Transports goes to a new high. Today, with 50 minutes to the close, the Dow is well on its way to recording a new record high."

Russell also included this quick note from Dennis Gartman:

Continue reading on King World News.

***

David Stockman On Monetary Breakdown & Skyrocketing Gold - kingworldnews.com

November 15, 2014

Today David Stockman warned King World News that the global monetary breakdown is going to intensify and this will lead to a skyrocketing gold price. KWN takes Stockman's warnings very seriously because he is the man former President Reagan called on in 1981, during that crisis, to become Director of the Office of Management and Budget and help save the United States from collapse. Below is what Stockman, author of the website contracorner, had to say in his powerful interview.

Eric King: "David, you're thoughts on the gold market as there is all of this massive money printing all over the world. It really is unprecedented."

Stockman: "Yes. It's leading to a breakdown of the monetary system, not to the classic hyperinflation, which causes a flight to gold in the initial instance....

Continue reading on King World News.

__________________________

Koos Jansen: Who's Feeding China's Gold Hunger? - www.caseyresearch.com

By Ed Steer

November 18, 2014

The Wrap

Just reading the highlights of the precious metal-related stories in today's column, it's easy to see that the demand for gold has become ferocious. Silver demand is even greater, as India imported almost a record amount in October---and China, in the Bloomberg story mentioned above, says they want to increase solar panel production by a factor of ten next year.

Then there's the 40+ million silver eagles sold [mostly to JPMorgan] this year---and add to that the counterintuitive amount of silver heading into SLV---along with the manic in/out silver activity at the COMEX-approved depositories for the last number of years. I'm sure that when the Royal Canadian Mint reports 3rd quarter results later this month, they will show record sales in silver maple leafs as well.

This Swiss gold repatriation looms large---as the vote on that is less than two weeks now. And not to be forgotten in all of this is the story above that mentions that the ECB may buy gold to boost inflation.

Sooner or later---and sooner rather than later, I would think---something has got to give.

Continue reading on Casey Research.

__________________________

Ukraine Admits Its Gold Is Gone: "There Is Almost No Gold Left In The Central Bank Vault" - www.zerohedge.com

Submitted by Tyler Durden on 11/18/2014 19:47 -0500

... we reported of a strange incident that took place just after the Ukraine presidential coup, namely that according to at least one source, "in a mysterious operation under the cover of night, Ukraine's gold reserves were promptly loaded onboard an unmarked plane, which subsequently took the gold to the US."

Needless to say there was no official confirmation of any of this taking place, and in fact our report, in which we mused if the "price of Ukraine's liberation" was the handover of its gold to the Fed at a time when Germany was actively seeking to repatriate its own physical gold located at the bedrock of the NY Fed, led to the usual mainstream media mockery.

Until now.

In an interview on Ukraine TV, none other than the head of the Ukraine Central Bank made the stunning admission that "in the vaults of the central bank there is almost no gold left. There is a small amount of gold bullion left, but it's just 1% of the gold reserves."

Continue reading on Zero Hedge.com.

***

Japan's Last Stand - Portent Of Keynesian Collapse- www.zerohedge.com

Submitted by Tyler Durden on 11/18/2014 - 12:12 - 0500

"Just when did Central Bankers become world media superstars and when do we get to put them back in their box?" Strutting the world stage, flitting from press conference to rubber chicken dinner, dispensing what passes for wisdom and prognosis as if the court astrologers have toppled the mighty Nebuchadnezzar and now rule in his place. Whatever happened to discreetly overseeing the balance of payments and facelessly staunching the worst panics only when absolutely necessary?

This is clearly Japan's last stand and there is no real exit strategy except to explicitly default on its debt. But an economic collapse and a sovereign debt default on the world's third largest economy will contain massive economic ramifications on a global scale.

Continue reading on Zero Hedge.com.

***

Eric Sprott: Global Gold Demand Is Overwhelming Supply - www.zerohedge.com

Submitted by Tyler Durden on 11/16/2014 21:23 -0500

Submitted by Adam Taggart via Peak Prosperity,

Precious metals have had an especially tough go of it over the past month. Both gold and silver are back in price territory last seen in 2010.

Eric Sprott returns to the program to discuss the facts as we know them in this market, and what's likely to happen from here. Specifically, he explains the tremendous imbalance currently seen between global supply and demand for precious metals. In his view, prices will have to correct upwards - prodigiously - to bring the two back in alignment:

We see almost 60 tons a week being delivered on the Shanghai Gold Exchange. Well, you start annualizing 60 tons a week you're talking 3,000 tons a year now. We saw 94 tons of gold go into India in September. We saw the Russian Central Bank buy 37 tons of gold in September. I mean I could come up with numbers that might suggest that we've got 400 tons a week of demand. And we only got 230 tons a week of mine supply. And I've only gotten to three data points. I haven't even gone to the rest of the world.

We've now created a situation unfortunately in the market where between high frequency trading and algorithms and interference by the planers they can make things happen that looks like everything is OK. And it's the "OK" part where I think we can really relate to gold not being allowed to go up. Because that's the canary in the coal mine. If gold was above $2,000 we'd all be wondering: What the hell is going on here? And so they haven't allowed it to happen.

But by suppressing the price - and one of the great things about a price of $1,100/oz is that you can buy a lot of gold at $1,100 versus $1,900 - you can buy almost 50%-60% more gold than you could three years ago with the same amount of money. And you can buy 3x the silver. With the same amount of money!

Continue reading on Zero Hedge.com.

__________________________

At Least 50% Of Your Portfolio Should Be In Gold: NYT Besteller Robert Ringer - www.kitco.com

Nov 17, 2014

Guest(s): Robert Ringer Publisher, RobertRinger.com

Why should investors hold at least 50% gold in their portfolio? Kitco News speaks with American icon and New York bestselling author Robert Ringer to find out. "First of all, I'm not in the investment business, I don't give investment advice but I've said for a good 35 years...buy gold, buy as much as you could possibly buy because gold is money," he told Daniela Cambone. "Don't measure the price of gold by dollars, measure the value of dollars by ...

Continue reading on Kitco.com.