Powers That Be Have Frozen Money For Swiss Gold Initiative - kingworldnews.com

October 30, 2014

Today a 42-year market veteran told King World News that the powers that be have frozen the money intended for the Swiss Gold Initiative. This is a stunning event. Below is what Egon von Greyerz, who is founder of Matterhorn Asset Management out of Switzerland, had to say in this extraordinary interview.

Greyerz: "Eric, there was a time when central bankers were independent and free thinking individuals. But now they are all part of the system. They are more investment bankers than central bankers. Alan Greenspan wrote in 1966, 'In the absence of a gold standard there is no way to prevent savings from confiscation through inflation.'....

"Before joining the Fed, Alan Greenspan was totally in favor of owning gold. But by 1987 he was busy at the Fed. Later he was manipulating markets and printing money as U.S. debt levels skyrocketed. But today Greenspan is free from constraints, so he is once again saying that gold is a good place to be because it's not possible for the Fed to end its easy money policies.

And if we look at Switzerland, before 1999 Switzerland kept 40 percent gold in the Swiss National Bank's balance sheet. This was a requirement. But the central planners snuck something into the Constitution that changed that requirement and the amount of gold plunged from 40 percent in 1999, down to 19 percent in 2009. But then Switzerland really started printing money and so now there is only 7 percent gold in the Swiss National Bank's balance sheet, which is one of the lowest of all the European countries.

As you know, Eric, I have been involved in the Swiss Gold Initiative. The Swiss National Bank is opposing this initiative. They have admitted that it stops their ability to manipulate markets. The campaign is going well. The public has generously donated because of KWN and other sites. But that came to a stop two days ago when PayPal closed the account for donations and they froze the funds that were in that account without any warning.

So unfortunately the campaign cannot receive some of those donations, which were just frozen. PayPal will not even answer the questions we are asking them, but I assume the money will be returned to the donors. Clearly the powers that be did not want the campaign to receive this money. We will keep on fighting for this campaign because gold will always have an advantage over worthless printed pieces of paper that governments and central banks create at will in order to manipulate markets."

Greyerz added: "But coming back to the Fed, Eric, they will never be able to permanently stop QE. It's not that QE is a solution, it's just that if they stop it rates will go up and there will be no chance to refinance the massive U.S. debt load or the Fed's own balance sheet. The system cannot survive with higher rates.

So I believe there will continue to be some type of ongoing secret QE done through foreign central banks or some type of Plunge Protection Team. But eventually the system will require massive worldwide money printing. This is because the problems from the 2008 collapse are still present in the system.

But regardless, the public will continue to suffer with high unemployment, high personal debt loads, and falling real wages. 90 percent of Americans are poorer today than they were in 1987. 58 percent of the population is now earning below $28,000. We also just saw a 19-year low in mortgage applications, which shows that the problem in the real economy is massive.

But we will also see more QE in Japan, where there are huge problems. And China's property market is now in a real bubble. This will affect China's banking and shadow banking system. French unemployment is also at a record high now, and Germany's Business Confidence is at a 6-month low.

If you look at the stress tests in Europe, 25 banks failed. But the stress test was devised in such a way that most banks passed. Virtually all of them would have failed a normal stress test. But even the banks, which did not pass the test, won't have to take measures to pass at a later stage. The bad debt in Europe is now over $1 trillion euros. This will eventually mean even more massive money printing in Europe.

So people need to be patient and focus on the fundamentals as the Western central planners push the gold and silver prices around one last time in their game of psychological warfare against hard asset investors. Before this is over, Eric, the people invested in gold and silver will see the prices of the only true money the world has ever seen skyrocket."

____________________

Understanding Gold's Massive Impact on Fed Maneuvering - moneymorning.com

By PETER KRAUTH, Resource Specialist, Money Morning October 30, 2014

Just about everyone knows Alan Greenspan. As central bankers go, he may just be the most famous ever. Even today, 1 in 6 Americans still think he's the current chair of the Federal Reserve.

As Fed chief from 1987 until 2006, Greenspan oversaw the latter part of the greatest stock bull in history.

For that, some called him "The Maestro."

From other quarters, the names are far less flattering. Many blame him for inflating massive stock and real estate bubbles, resulting in financial devastation across the economy.

Well, these days Greenspan is acting rather schizophrenic. In fact, you won't believe what he's saying now, unless you understand where he's coming from.

Given the havoc its wreaking on market stability (while ostensibly doing the opposite), it's absolutely critical to look back at Greenspan's handiwork to try to make sense of today's Federal Reserve maneuvering...

Greenspan Was Molded Decades Before Heading the Fed

Greenspan has been an economic adviser to two presidents and a director at several corporations, including JP Morgan & Co., as well as a director of the Council on Foreign Relations.

But his ideas about economics and money change dramatically depending on when you ask him, or where he works.

Back in the early 1950s Greenspan became a member of Ayn Rand's inner circle. His essay "Gold and Economic Freedom" was published in Rand's newsletter The Objectivist in 1966 and in her book, Capitalism: The Unknown Ideal in 1967. He even read Atlas Shrugged while it was being written.

In case you're confused, yes... it's the same Alan Greenspan.

In the "Gold and Economic Freedom" essay, he wrote: "... gold and economic freedom are inseparable, that the gold standard is an instrument of laissez-faire and that each implies and requires the other."

He went on to say: "In the absence of the gold standard, there is no way to protect savings from confiscation through inflation. There is no safe store of value."

Does this sound like a guy who would be in charge of the world's most powerful central bank?

Remember, the raison d'Ítre of central banks, and of course central bankers, is to promote and defend a system of fiat money creation and debt. Gold is neither of those. Actually it's the complete opposite. It's the anti-fiat money and anti-credit.

It's not perfect, but it's still the best money that fiat money can buy.

Greenspan knows it. He's always known it.

Now, no longer obliged to toe the Fed's line, he's again free to say what he really thinks.

Which has him back to extolling the virtues of gold, a topic he was outspoken on before selling out to the dark side of central banking...

Recycling a Tired Stance

"The Maestro" recently shared his thoughts through an op-ed piece in Foreign Affairs magazine, published by the Council on Foreign Relations.

That's the same publication that brought us the "brilliant" article we recently discussed in Money Morning, suggesting the Fed should print and give cash directly to citizens.

In Greenspan's piece, "Golden Rule: Why Beijing Is Buying," he suggests:

If China were to convert a relatively modest part of its $4 trillion foreign exchange reserves into gold, the country's currency could take on unexpected strength in today's international financial system. It would be a gamble, of course, for China to use part of its reserves to buy enough gold bullion to displace the United States from its position as the world's largest holder of monetary gold. (As of spring 2014, U.S. holdings amounted to $328 billion.) But the penalty for being wrong, in terms of lost interest and the cost of storage, would be modest.

Greenspan is even on the pro-gold standard bandwagon:

The broader issue - a return to the gold standard in any form - is nowhere on anybody's horizon... For more than two millennia, gold has had virtually unquestioned acceptance as payment. It has never required the credit guarantee of a third party. No questions are raised when gold or direct claims to gold are offered in payment of an obligation... If the dollar or any other fiat currency were universally acceptable at all times, central banks would see no need to hold any gold. The fact that they do indicates that such currencies are not a universal substitute.

Here's a guy who's as connected as one gets in the realm of central banking, and yet he's extolling the virtues of gold as money, suggesting a return to a gold standard. Heck, he even thinks China ought to beef up its gold reserves, enough to overtake the U.S. as the largest owner of gold.

Why? Because he realizes that's what it would take to partially back China's currency, the renminbi, with gold, or at least challenge the dollar's status as world reserve currency. He also appreciates that it's a strategy that would be impossible to implement without sufficient gold.

In fairness, as Fed chief, Greenspan did display some affinity towards the precious metal.

In fact, he even followed his own system of a "virtual gold standard" for years, a principle he eventually abandoned the moment it became inconvenient...

The "Virtual Gold Standard" Was Quietly Cultivated

Greenspan recounts how, back in the 1990s at a G-10 governors' meeting, the discussion was all about the European counterparts itching to sell off their gold.

They knew their simultaneous dumping risked depressing the gold price. So they set up the first Central Bank Gold Agreement in 1999, whereby 15 European central banks agreed to limit sales to 400 metric tons annually over the next 5 years. Curiously, Greenspan points out that Washington abstained.

Clearly he was the savviest of the bunch, knowing that gold is the ultimate form of payment, something a central bank should never sell unless it's absolutely necessary.

Understanding the positive effects of gold as money, Greenspan devised his own method to reap the benefits.

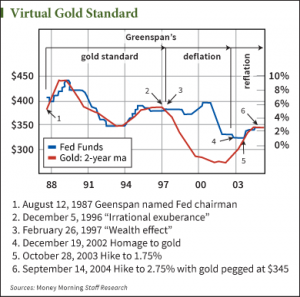

While heading the Federal Reserve, Greenspan appears to have imposed a "virtual gold standard," at least according to Donald Luskin of Trend Macrolytics.

Gold, it seemed, acted as the barometer. As its rising price signaled inflation, Greenspan would raise the funds rate. As gold's price fell, he would inject liquidity by lowering the funds rate.

But in 1997, that relationship was severed.

The Maestro dropped his "virtual gold standard," and raised rates as gold prices fell, and vice versa.

That fueled the blow-off phase of the dot-com bubble and its inevitable crash. Greenspan then drastically cut rates again, inflating the housing bubble.

By 2006 Greenspan had exited, leaving the reins to Bernanke. The housing bubble soon popped, and we all know how that ended. On Ben's watch, the funds rate was slashed and has flat-lined near zero for the past five years running.

Smell any bubbles? Poor Janet.

Back to Alan...

Let's follow the Maestro's original advice. The fact remains that Greenspan knows sound money, and he recognizes the deleterious side effects of fiat money.

In testimony before the U.S. Banking Committee in 1999, Greenspan said, "Gold still represents the ultimate form of payment in the world." Later, when Maryland Senator Sarbanes asked him if he endorsed a return to the gold standard he replied: "I've been recommending that for years, there is nothing new about that."

Yet it's intriguing that for all the ambiguous talk Greenspan spewed out during his tenure, his thoughts on gold seem to be clear as crystal.

Greenspan summed it up best when addressing the Council on Foreign Relations back in 2010: "Fiat money has no place to go but gold... It signals problems with respect to currency markets. Central banks should pay attention to it."

Indeed they should. Indeed we all should. If you're ever going to follow any the Maestro's advice, follow that bit and ignore the rest.

It's just Fedspeak.

____________________

Jim's Mailbox - www.jsmineset.com

Posted October 30th, 2014 at 10:14 AM (CST) by Jim Sinclair

Jim,

Strap on your seat belts: The Federal Reserve ended its controversial quantitative-easing (QE) program at its meeting today.

It also plans to keep interest rates at record lows for a "considerable time," and that environment will continue to support gold prices.

However, today's biggest news came not from Fed Chairwoman Janet Yellen but one of her predecessors, none other than Alan Greenspan. In a speech at the Council on Foreign Relations, "The Maestro" said he fears potential "turmoil" in the economy as the Fed halts QE. "I don't think it's possible" for a smooth exit, he said, implying that rampant inflation and bursting asset bubbles could result. QE has failed to jump-start the real economy, he said.

"QE has been most effective in inflating asset prices, and both the markets and economy are addicted to the stimulus," said Peter Boockvar of the Lindsey Group. History indeed shows that since 2009, the stock market has lost its gains each time the Fed has previously ended QE. With the global economy rapidly slowing, and with no correction of 10% or more in the S&P 500 in three years, stocks are overdue for a fall.

And the real danger here is that once the stock market corrects - or any number of risks from Ebola to a eurozone debt implosion cause a wider crisis - the Fed will succumb to pressure and launch a new round of QE. That's when things could start to spiral out of control.

Where should investors turn? "Greenspan said gold is a good place to put money these days given its value as a currency outside of the policies conducted by governments," The Wall Street Journal reported.

CIGA Art M.

***

In The News Today - www.jsmineset.com

Posted October 30th, 2014 at 6:43 PM (CST) by Jim Sinclair

Greenspan: Price of Gold Will Rise

Axel Merk, Merk Investments

October 29, 2014

Any doubts about why I own gold as an investment were dispelled last Saturday when I met the maestro himself: former Fed Chair Alan Greenspan. It's not because Greenspan said he thinks the price of gold will rise - I don't need his investment advice; it's that he shed light on how the Fed works in ways no other former Fed Chair has ever dared to articulate. All investors should pay attention to this. Let me explain. The setting: Greenspan participated on a panel at the New Orleans Investment Conference last Saturday. Below I provide a couple of his quotes and expand on what are the potential implications for investors.

Greenspan: "The Gold standard is not possible in a welfare state."

The U.S. provides more welfare benefits nowadays than a decade ago, or back when a gold standard was in place. Greenspan did not explicitly say that the U.S. is a welfare state. However, it's my interpretation that the sort of government he described was building up liabilities - "entitlements" - that can be very expensive. Similar challenges can arise when a lot of money is spent on other programs, such as military expenditures. It boils down to the problem that a government in debt has an incentive to debase the value of its debt through currency devaluation or otherwise. As such, it should not be shocking to learn that a gold standard is not compatible with such a world. But during the course of Greenspan's comments, it became obvious that there was a much more profound implication.

Who finances social programs?

Marc Faber, who was also on the panel, expressed his view, and displeasure, that the Fed has been financing social programs. The comment earned Faber applause from the audience, but Greenspan shrugged off the criticism, saying: "you have it backwards." Greenspan argued that it's the fiscal side that's to blame. The Fed merely reacts. Doubling down on the notion, when asked how a 25-fold increase in the Consumer Price Index or a 60-fold increase in the price of gold since the inception of the Fed can be considered a success, he said the Fed does what Congress requires of it. He lamented that Fed policies are dictated by culture rather than economics. So doesn't this jeopardize the Fed's independence? Independence of a central bank is important, for example, so that there isn't reckless financing of government deficits. Greenspan: "I never said the central bank is independent!" I could not believe my ears. I have had off the record conversations with Fed officials that have made me realize that they don't touch upon certain subjects in public debate - not because they are wrong - but because they would push the debate in a direction that would make it more difficult to conduct future policy. But I have never, ever, heard a Fed Chair be so blunt. The maestro says the Fed merely does what it is mandated to do, merely playing along. If something doesn't go right, it's not the Fed's fault. That credit bubble? Well, that was due to Fannie and Freddie (the government sponsored entities) disobeying some basic principles, not the Fed.

And what about QE? He made the following comments on the subject:

Greenspan: "The Fed's balance sheet is a pile of tinder, but it hasn't been lit ... inflation will eventually have to rise."

But fear not because he assured us:

Greenspan: "They (FOMC members) are very smart."

Trouble is, if no one has noticed, central bankers are always the smart ones. But being smart has not stopped them from making bad decisions in the past. Central bankers in the Weimar Republic were the smartest of their time. The Reichsbank members thought printing money to finance a war was 'exogenous' to the economy and wouldn't be inflationary. Luckily we have learned from our mistakes and are so much smarter these days. Except, of course, as Greenspan points out it's the politics that ultimately dictate what's going to happen, not the intelligence of central bankers. And even if some concede central bankers may have above average IQs, not everyone is quite so sanguine about politicians.

Now if they are so smart, the following question were warranted and asked:

More...

U.S. Mint Gold Coin Sales Near 60,000 Ounces In October - Swiss Gold Initiative Leading To Increase In Demand?

29 October 2014

By Mark O'Byrne

The U.S. Mint has sold nearly 60,000 ounces of American Eagle gold coins so far in October due to increased global demand from store of wealth buyers as economic and geopolitical uncertainty increased.

With only three business days left until the end of October, the U.S. Mint has sold 59,500 American Eagle bullion one ounce gold coins. On a year-on-year basis, U.S. gold coin sales in October are up 21% from 48,500 ounces in October 2013.

U.S. Mint Silver Eagle, 2014 (1 Ounce)

Store of wealth silver bullion buyers continue to stack silver at a steady clip. They bought 4.12 million ounces of American Silver Eagle coins so far this month, versus 4.14 million ounces in September.

This means that nearly 68 times more silver in ounce terms was bought than gold. Silver buyers continue to see silver as severely depressed with silver below $20/oz and the gold silver ratio at 71 or $1,228/oz divided by $17.24/oz.

More...

____________________

Greenspan: "The Price of Gold Will Rise-Measurably" - www.caseyresearch.com

By Ed Steer

October 30, 2014

The Wrap

When small men begin to cast big shadows, it means that the sun is about to set. -- Lin Yutang

Well, I'm sad to say that the Wednesday trading session turned out exactly as I expected it would, although I was hoping beyond hope that it might be different this time---but it wasn't.

But what should not be lost in this is the continuing engineered price declines in both gold and silver---and after 'da boyz' and their algorithms got through with both metals yesterday, there's only 20 or so dollars to go to get back to the October 6 low in gold.

But, as Ted Butler always points out, it's not the price, rather it's the number of long gold contracts that JPMorgan et al can get the Managed Money traders to puke up---and how deeply they can guide these same technical funds onto the short side of the gold market. So how 'low' the price goes, will be a direction function of that process.

Here are the 6-month charts for both gold and silver.

|

| Casey Research |

|

| Casey Research |

Ted says that with silver, the Managed Money is all 'locked and loaded' with a record short position. It's possible they may have added to their short position yesterday, but there's no way of knowing, because Wednesday's price action occurred a day after the cut-off for tomorrow's Commitment of Traders Report. So we'll have to wait until the COT Report on November 7, which is a lifetime away at the moment.

And as I type this paragraph, the London open is about 50 minutes away. I note that the two tiny rally attempts that occurred in gold---one shortly after trading began in New York yesterday evening---and the one that came shortly after 9 a.m. Hong Kong time, were both sold down. But the real sell-off began around 1 p.m. Hong Kong time as the HFT boyz leaned on the price---and gold is now at a new low for this move down, and it probably won't be the low of the day. Gold volume is already north of 32,000 contracts, which is very heavy for this time of morning---and 99 percent of it is in the current front month, which is December, so it's not normal trading volume.

Silver's tiny rally attempt in morning trading in the Far East on their Thursday met with the same fate as gold---and 'da boyz' really put the boots to the price shortly before 2 p.m. Hong Kong time. The silver price is now knocking on the door of its old low set back on Friday, October 3. Gold volume is just north of 12,000 contracts at the moment, which is also pretty big for this time of day.

After trading flat for most of the Far East session, platinum also met the same fate starting shortly before 1 p.m. Hong Kong time. Palladium got hit shortly after trading began at 6 p.m. in New York last night---and has been allowed to trade flat since then.

The dollar index has been in rally mode almost since the open yesterday evening---and at the moment it's up 25 basis points. But if you believe that these engineered price declines are a result of the 'strength' in the dollar index, do I have a bridge for you! However, that's what the so-called experts will use as a reason for the decline in all precious metals.

I'd like to think that this is the last swing for the fences by JPMorgan et al, but it's just not possible to tell at the moment. I think some comfort should be drawn from Greenspan's use of the world "measurable" because it confirms that there is an end game, which, as I've said many times over the years, will certainly result in a re-pricing of not just the precious metals, but all commodities in general. The only thing we don't know is the timing. But looking at the current set-up in the Comex futures market, never have the stars been so favorably aligned---and that was Ted's opinion in his mid-week commentary yesterday, which was headlined "Resolution is Dead Ahead".

So we wait some more.

Continue reading on Casey Research.com.

____________________

Santelli Slams The Fed As "Weak-Data"-Dependent; Lacy Hunt Warns "We're Not On The Right Path"- www.zerohedge.com

Submitted by Tyler Durden on 10/29/2014 18:43 -0400

Confirming Rick Santelli's perspective on the unending 'easiness' of the Fed, Hoisington Investment Management's Lacy Hunt states unequivocally that "The Fed will not raise rates in 2015," and warns that the US economy and monetary policy "are not on the right path," in this excellent brief interview. Santelli slams the Fed's asymmetric policy, coining a new phrase that Yellen is only "weak-data"-dependent and Hunt confirms that "by its past policy errors, the Fed has put itself out of business," enabling massive build ups of debt, warning that "debt is an increase in current spending in lieu of future spending," and confirms the truth that rather than deleveraging, "the world is significantly more leveraged now than in 2008."

Continue reading on Zero Hedge.com.

***

Putting The Fallacy Of QE Into Perspective - www.zerohedge.com

Submitted by Tyler Durden on 10/29/2014 18:11 -0400

"Remember, the Fed has injected into the market nearly 4 Trillion dollars. That's $4,000,000,000,000.00.

"In just 3 years the Federal Reserve has pushed into the financial markets via the QE programs the equivalent in dollar amounts to have purchased 510 B-2 Stealth Bombers, 72 Nimitz Class Air Craft Carriers, 120 Ohio Class Submarines. and still have Two TRILLION or so left in my pocket left to spend."

As far as what we have to show for all this spending at the end of QE this month? Who knows, but I do know - we didn't even get a lousy T-shirt.

Continue reading on Zero Hedge.com.

***

Alan Greenspan: QE Failed To Help The Economy, The Unwind Will Be Painful, "Buy Gold"- www.zerohedge.com

Submitted by Tyler Durden on 10/29/2014 23:42 -0400

"Effective demand is dead in the water" and the effort to boost it via bond buying "has not worked."

"I don't think it's possible" for the Fed to end its easy-money policies in a trouble-free manner. ...

"Gold is a good place to put money these days given its value as a currency outside of the policies conducted by governments."

Continue reading on Zero Hedge.com.

***

Fireworks Fly As Peter Schiff Warns "An Economy That Lives By QE, Dies By QE" - www.zerohedge.com

Submitted by Tyler Durden on 10/29/2014 22:15 -0400

Ahead of tomorrow's decision by the FOMC, Peter Schiff ventured on to CNBC to discuss the economy, the fed, and gold... among other things. Schiff rightly fears that while the Fed may well stop QE3 tomorrow, QE4 will not be too long behind it as he notes, rather eloquently, that "an economy that lives by QE, will die by QE" as the Fed's total lack of willingness to allow stocks to fall (see Bullard 2 weeks ago) or a 'cleansing' recession leaves the nation's economy in far worse shape than it was before the Fed's intervention. Schiff calmly replies to the anchor's questions (as she proclaims "I am not on the side of the Fed but..."), gently explains his view on gold when challenged about his 'wrongness', but when a guest starts hounding him for being dangerous to CNBC viewers' wealth... Schiff (rightly) loses it - must watch!

Continue reading on Zero Hedge.com.