Chris Powell: The crucial questions financial journalism won't ask and central banks won't answer - www.gata.org

Submitted by cpowell on Thu, 2014-10-23 20:26.

For many years this conference has bravely invited GATA Chairman Bill Murphy and me to speak here about the evidence of manipulation of the gold market, particularly manipulation undertaken directly or indirectly by central banks, and every year there has been new documentation to report. This documentation has been compiled at GATA's Internet site, GATA.org, whose home page you can see here --

http://www.gata.org

-- with the "Documentation" section noted at the top left, along with a section called "The Basics," which summarizes the documentation as well as the purposes and history of central bank policy of suppressing the price of gold, gold being a currency that competes with government currencies.

The last two months have brought confirmation that, as we long have suspected, GATA has outlined only a small part of the surreptitious market manipulation being undertaken by central banks -- that this manipulation is actually comprehensive, that it covers nearly every major market in the world.

This confirmation is largely the work of Eric Scott Hunsader, founder of the market data and research company Nanex in Winnetka, Illinois, who publicized, through the Zero Hedge Internet site, documents recently filed with the U.S. government, two of them with the Commodity Futures Trading Commission and one with the Securities and Exchange Commission.

The first document is a letter to the CFTC, dated January 29 this year, from CME Group, the operator of the major futures exchanges in the United States, and signed by CME Group's managing director and chief regulatory counsel, Christopher Bowen:

http://www.gata.org/files/CMEGlobexCentralBankIncentiveProgram.pdf

The letter notifies the CFTC of changes to CME Group's discount trading program for central banks. That is, the letter reveals that central banks are getting discounts for trading all futures on CME Group's exchanges, including the New York Commodity Exchange, the major mechanism for "price discovery" in the monetary metals.

The CME Group letter argues that letting central banks trade in futures is beneficial because it adds "liquidity" to the markets. But of course "liquidity" here might as well mean the ocean. Anyone trading against the ocean will drown.

The second document is another letter from CME Group's Bowen to the CFTC, dated August 28 this year, disclosing that CME Group is enacting rules against certain trading practices that are considered abusive and unfair, specifically "spoofing" and "quote stuffing," the abrupt placing and withdrawal of huge volumes of phony orders to mislead traders about prices:

http://www.gata.org/files/CMEGroupManipulativePractices-08-28-2014.pdf

The letter's implication is that such manipulative trading practices have been common on CME Group exchanges.

The third document is the CME Group's annual report to the Securities and Exchange Commission, its 10-k report:

http://www.gata.org/files/CMEGroup-10K-03-03-2014.pdf

CME Group's 10-k report reveals on Page 9: "Our customer base includes professional traders, financial institutions, institutional and individual investors, major corporations, manufacturers, producers, governments, and central banks."

That central banks and governments are trading both surreptitiously and comprehensively in U.S. futures markets is a transformative development. Since central banks can create and deploy infinite money, this trading means that there are probably no markets anymore in anything, mainly just government interventions. It means that democratic capitalism has been quietly overthrown by a totalitarian coup and that the world has lost the great engine of its economic and democratic progress, free markets -- without even being aware of the loss.

And yet what has been disclosed by these documents filed by the CME Group is only what was asserted 14 years ago in an essay written by the British economist Peter Warburton, an essay he titled "The Debasement of World Currency: It Is Inflation But Not As We Know It":

http://www.gata.org/node/8303

* * *

"What we see at present," Warburton wrote, "is a battle between the central banks and the collapse of the financial system fought on two fronts.

"On one front, the central banks preside over the creation of additional liquidity for the financial system in order to hold back the tide of debt defaults that would otherwise occur.

"On the other, they incite investment banks and other willing parties to bet against a rise in the prices of gold, oil, base metals, soft commodities, or anything else that might be deemed an indicator of inherent value. Their objective is to deprive the independent observer of any reliable benchmark against which to measure the eroding value not only of the U.S. dollar but of all fiat currencies.

"Equally, they seek to deny the investor the opportunity to hedge against the fragility of the financial system by switching into a freely traded market for non-financial assets.

"The central banks have found the battle on the second front much easier to fight than the first. Last November [November 2000] I estimated the size of the gross stock of global debt instruments at $90 trillion as of mid-2000. How much capital would it take to control the combined gold, oil, and commodity markets? Probably no more than $200 billion, using derivatives.

"Moreover, it is not necessary for the central banks to fight the battle themselves, although central bank gold sales and gold leasing have certainly contributed to the cause. Most of the world's large investment banks have overtraded their capital so flagrantly that if the central banks were to lose the fight on the first front, the stock of the investment banks would be worthless.

"Because their fate is intertwined with that of the central banks, investment banks are willing participants in the battle against rising gold, oil, and commodity prices."

* * *

That is, as the saying goes, the futures markets are not manipulated; the futures markets are the manipulation.

As Warburton noted, if a commodity has a futures market, the price of that commodity likely is being manipulated, and probably suppressed, by surreptitious trading by central banks and their agents. As a result most market prices now are probably mere illusions, holograms created in large part in the trading rooms of central banks, like the trading room at the Federal Reserve Bank of New York.

But overwhelming as the power to create and deploy infinite money surreptitiously through central banks is, it is not the decisive power of governments. No, the decisive power of governments is the power to stifle or intimidate news organizations. For if people are ever informed that a market is rigged, they won't participate in it and the rigging will lose its usefulness.

For 15 years GATA has done a fair job documenting the manipulation of markets by central banks and their agents. But publicizing that manipulation has been part of GATA's work as well, and in that respect we have not succeeded much. We can get on television in Asia and Russia but we strain for the occasional citation by Western news organizations.

We have sent the recent CME Group documents to most major financial news organizations and to many financial letter writers, and as far as we can determine, not one has posed any question about them to the authorities or written or broadcast anything about them.

As with GATA's other documentation, no one disputes these documents either. They simply cannot be acknowledged. They give the game away.

Maybe that will change on Saturday, when this conference will have the remarkable opportunity of questioning Alan Greenspan, who was chairman of the Federal Reserve for more than 17 years, from August 1987 to January 2006. If Greenspan is in a mood to be candid, we may learn a lot without having to interrogate him as a prosecutor would. If Greenspan is not in a mood to be candid, extracting anything useful from him will be tedious, requiring his interrogators to be very specific and to brandish documentation.

Of course I suspect that Greenspan may not care to be candid. So let me suggest a few very specific and detailed questions for him.

Question 1: Mr. Greenspan, in your testimony to Congress in July 1998, in which you urged Congress not to legislate regulation of derivatives --

http://www.federalreserve.gov/boarddocs/testimony/1998/19980724.htm

-- you said: "Nor can private counterparties restrict supplies of gold, another commodity whose derivatives are often traded over-the-counter, where central banks stand ready to lease gold in increasing quantities should the price rise."

Did you mean that gold lending by central banks was intended to suppress or control gold's price -- that Congress didn't have to worry about someone cornering the gold market because central banks already had it cornered? With their many years of selling, lending, and swapping of gold, have central banks been underwriting the bullion banking business because it is a mechanism by which governments control the gold price?

Question 2: Mr. Greenspan, in recent years right down to the present, have central banks or governments been trading in the gold market and related markets? Are they trading in the gold and related markets now? If so, what has been and is the objective of that trading? Is it to make money, to obtain more gold, or to control gold's price?

Question 3: Mr. Greenspan, did central banks and governments trade in the gold market and related markets when you were chairman of the Federal Reserve? How about any agency of the U.S. government -- not just the Fed but the Treasury Department or any other agency? If there was such trading, what was its objective? Was it to control the gold price because gold is a currency competing or potentially competing with government currencies?

Question 4: Mr. Greenspan, when you were chairman of the Fed you were also, by virtue of that office, a member of the Board of Directors of the Bank for International Settlements. The annual report of the BIS --

http://www.gata.org/node/12717

-- says the BIS "transacts foreign exchange and gold on behalf of its customers, thereby providing access to a large liquidity base in the context of, for example, regular rebalancing of reserve portfolios or major changes in reserve currency allocations. The foreign exchange services of the bank encompass spot transactions in major currencies and Special Drawing Rights as well as swaps, outright forwards, options, and dual currency deposits. In addition, the bank provides gold services such as buying and selling, sight accounts, fixed-term deposits, earmarked accounts, upgrading and refining, and location exchanges."

Additionally, in a presentation to potential central bank members at BIS headquarters in Basel, Switzerland, in June 2008, the BIS advertised, as being among its services to its members, secret interventions in the gold and currency markets:

http://www.gata.org/node/11012

Further, in a speech to a BIS conference in Basel in June 2005, the head of the bank's monetary and economic department, William R. White, said that a primary purpose of international central bank cooperation is "the provision of international credits and joint efforts to influence asset prices -- especially gold and foreign exchange -- in circumstances where this might be thought useful":

http://www.gata.org/node/4279

So: While you were chairman of the Federal Reserve and a member of the BIS board, did the BIS operate in the gold market on behalf of any of its members to influence the gold price, and, if so, exactly how and for what purposes? Were such operations in the gold market public and announced or were they kept secret? If they were kept secret, why?

Question 5: Mr. Greenspan, by virtue of your chairmanship of the Fed, you were also a member of the Board of Governors of the International Monetary Fund. In March 1999, while you were a member of the IMF board, the IMF staff presented the IMF board with a secret report that has been posted on the Internet site of the Gold Anti-Trust Action Committee:

http://www.gata.org/node/12016

The secret IMF staff report said central banks objected to the staff's proposal to require them to make a forthright public accounting of their gold swaps and lending. Such a public accounting would have required central banks to distinguish gold in central bank vaults from gold that had been swapped or loaned by central banks. The secret IMF staff report said central banks objected to such a forthright accounting of their gold reserves out of "a desire to preserve the confidentiality of foreign exchange market intervention for a period, in order to enhance its effectiveness."

While you were Fed chairman and a member of the IMF board, did the IMF intervene secretly in the gold and foreign exchange markets, and, if so, on whose behalf and for what purposes? Did the Fed, U.S. Treasury Department, U.S. State Department, or any other U.S. government agency advocate or concur with any such intervention? Why was such intervention kept secret?

Question 6: Mr. Greenspan, in a letter to the Gold Anti-Trust Action Committee in September 2009 --

http://www.gata.org/files/GATAFedResponse-09-17-2009.pdf

-- Fed Governor Kevin M. Warsh wrote that the Fed has secret gold swap arrangements with foreign banks. Did the Fed have such arrangements during your chairmanship? If so, with whom were these arrangements undertaken and what were their purposes? And why must these arrangements be kept secret?

Question 7: Mr. Greenspan, during your tenure as Fed chairman, how many markets were the Fed and other U.S. government agencies trading in, directly or through intermediaries? Was such trading by U.S. government agencies for their own accounts or for the accounts of other governments and central banks, or both? And which markets were involved and what was the objective of such trading?

Question 8: Mr. Greenspan, do the Fed or other U.S. government agencies have any connection to the huge interest rate derivative positions that, according to the U.S. comptroller of the currency, are held by JPMorganChase, a primary dealer in U.S. government securities? Are these positions really U.S. government positions or the positions of other governments or central banks, undertaken to defeat market forces on interest rates?

* * *

Of course these questions might be useful for interviewing not just Alan Greenspan but any current or former central banker -- if the world ever gets any financial news organizations willing to put critical questions to central banks.

Instead, of course, while surreptitious central bank intervention in the markets is setting the value of all capital, labor, goods, and services in the world, the first rule of financial journalism is that central banks are never to be questioned about anything important.

In any case GATA aims to continue its work on behalf of free and transparent markets and limited and accountable government. We're a nonprofit educational and civil rights organization recognized as federally tax-exempt by the U.S. Internal Revenue Service, so financial contributions to GATA are federally tax-deductible. We're also close to broke, so we would be especially grateful for any support from you now. Donations can be made through our Internet site, GATA.org.

Thanks for your kind attention.

___________________________

Why Gold Is Undervalued - www.peakprosperity.com

And poised to re-price upwards from here

by Alasdair Macleod

Wednesday, October 22, 2014, 12:31 PM

Gold has been in a bear market for three years. Technical analysts are asking themselves whether they should call an end to this slump on the basis of the "triple-bottom" recently made at $1180/oz, or if they should be wary of a coming downside break beneath that level. The purpose of this article is to look at the drivers of the gold price and explain why today's market value is badly reflective of gold's true worth.

First, I think a reminder would be timely. Those who seek to trade gold are at substantial disadvantage:

- they line themselves up against too-big-to-fail banks which have the implicit backing of the taxpayer to bail them out of their trading positions;

- furthermore markets have become so manipulated and dangerous that gold should be considered as insurance against systemic risk instead of a punt.

Because the majority of market investors don't fully grasp these risks, when the current global financial bubbles eventually burst, there will only be a tiny minority who end up possessing gold -- by which I mean physical gold held outside the fiat money system.

Technical Analysis & Gold

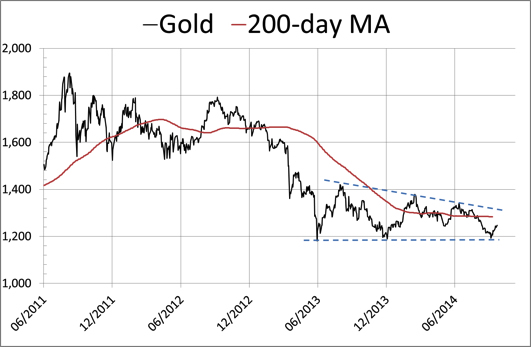

Using charts has the theoretical advantage of taking the emotion out of trading. So long as there is no significant change in the purchasing power of the currency against which it is traded, prices in the past have relevance to the future, because recent price experience sets an expectation in the human mind. The chart below shows the gold price since the peak in September 2011.

|

| Peak Prosperity |

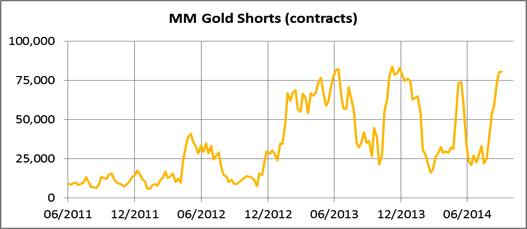

The chart shows a potential triple-bottom pattern formed over fifteen months, at just over $1180/oz. We know that the three bottoms were all at quarter-ends, strongly suggestive of price manipulation to enhance bullion bank profits and their traders' bonuses. In each case, computer-driven traders had near-record short positions evident in this second chart, of Managed Money shorts on Comex:

|

| Peak Prosperity |

This confirms that $1180/oz appears to be the point of maximum bearishness, in which case our triple-bottom pattern should hold.

However, this pattern is rare and should not be the first conclusion we jump to. The definitive work on Dow Theory (Technical Analysis of Stock Trends - Edwards & Magee) describes an unconfirmed triple bottom as "treacherous". But the characteristics we're seeing in this current formation, with the third low on low volume and the subsequent rise on improving volume, are encouraging. Confirmation of the pattern according to Edwards & Magee requires the gold price to move above $1375, a level worth noting. Once confirmed, a triple-bottom "almost always produces an advance of distinctly worth-while proportions."

The danger of course is non-confirmation. One can imagine a price rally to say, $1300, unwinding the shorts, at which point subsequent bears might then mount a successful challenge on $1180.

Additionally, since Edwards& Magee published their work, computers have allowed us to define trends by moving averages, and a commonly accepted indicator is the 200-day MA, which stands at about $1280. If that level is broken and the gold price stays above it long enough to cause the MA to rise, that should trigger computer-driven buying. So any price over $1300 will likely confirm the bullish case, yet it would be a mistake today to be unreservedly bullish on technical grounds alone until this price level is exceeded.

Valuing Gold

None of this reins in the truly subjective nature of tomorrow's prices. Instead, we should turn to relative valuations to get a sense of whether gold should be bought today or not.

To do this, we need to compare the quantity of gold with the quantity of fiat currency. While we have reasonable estimates of the total amount of above-ground gold stocks over the last few centuries, we really don't know how much the central banks actually hold, on the basis their figures are for "gold and gold receivables (i.e. leased, loaned or swapped and not in their physical ownership). Equally, the task of assessing the true total amount of the world's fiat currency and how that has grown over time is too great to be a practical proposition.

Instead, I have devised a simple and practical approach, by comparing the increase in the world's above-ground gold stocks with a measure of the increase in the quantity of USD fiat currency.

I've devised a metric called the "fiat money quantity" (FMQ) which reverses the process by which fiat money was originally created. Our forebears' gold was taken in by commercial banks, which would issue currency notes and record deposits in gold substitutes (dollars payable in our forebears' gold). When the Fed was created, the Fed took in the same gold from member banks and issued its notes and recorded reserves against that gold in its balance sheet. So FMQ is the total of cash, accessible deposits in the commercial banks and bank reserves held at the Fed, adjusted by temporary factors that affect those reserves such as Repos and Reverse Repos. More details on how FMQ is calculated can be found here.

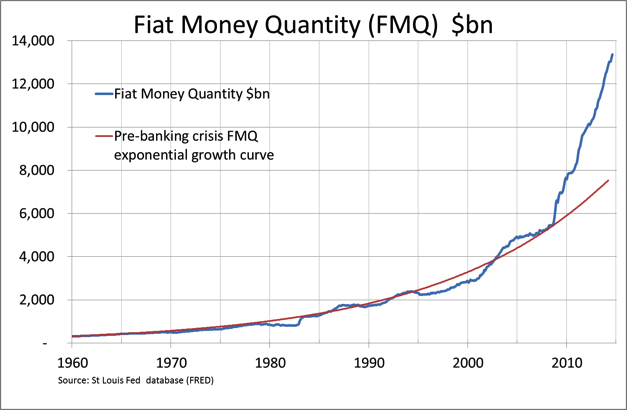

The chart below shows how FMQ has grown since 1959. It shows a steady rate of exponential growth prior to the Lehman crisis, after which it has increased alarmingly:

|

| Peak Prosperity |

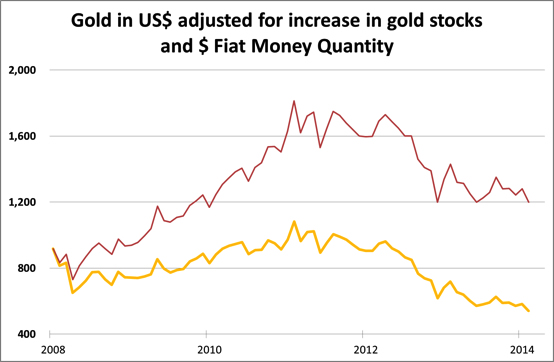

One glance tells us that USD fiat currency is in monetary hyperinflation, which is not reflected in official price inflation statistics (but that's another story). Our objective is to try to get a feel for whether gold is cheap or dear, and the next chart shows how the gold price has progressed from the month before the Lehman crisis (nominal gold price in red, FMQ-adjusted price in yellow):

|

| Peak Prosperity |

The message could not be made more clear: compared with fiat dollars, in real terms gold has fallen in price since the Lehman crisis despite the increase in its nominal price. With gold at $1200 recently, it has actually fallen by 41% in real terms from July 2008.

So to summarize, before the Lehman crisis, investors' appreciation of systemic risk was relatively low. After the crisis, there were concerns that we faced a deflationary price contraction, so the nominal price of gold dropped (from $918 to $651). When it became clear the Fed would successfully inflate the financial system out of immediate trouble, gold rose to its high-point in September 2011 -- but on an FMQ-adjusted basis the high was considerably less, reflecting the sharp increase in the quantity of new fiat money being issued: gold only rose about 20% from July 2008 on this basis. While there was undoubtedly some froth in the gold price at this point that needed correcting, given the circumstances the price level was otherwise reasonable. The subsequent bear market in gold since has taken it to an extreme undervaluation today.

Gold is not alone in having a market value divorced from reality. A bankrupt government such as Greece has had no problem borrowing 10-year money recently at only 6.5%, though this anomaly is beginning to correct. Other insolvent nations, such as Spain and Italy were recently able to borrow 10-year money as low as 2% and 2.2% respectively, though their bond yields have also subsequently risen slightly.

Think about this for a moment: the US dollar is the reserve currency and its government bond yields are the benchmark for global fiat money risk-free return. Governments with a demonstrably (much) worse borrowing record have been able to issue bonds at what amounted to a yield backwardation -- significantly lower than the US 10-year Treasury bond. This has never happened before, so far as I'm aware.

Key market valuations are totally screwed up in a world of 0% interest rates and manipulated markets. If gold was alone in its extreme undervaluation, without a counterbalancing overvaluation in fiat-currency bond markets, something would probably be wrong with our analysis. The fact that this is not the case offers confirmation that gold is mis-priced and incorrectly valued in markets that have become divorced from reality.

Defining the Gold Market

It is common knowledge that dealings in paper gold are greater than that in physical bullion. Paper gold includes the following categories:

- Unallocated gold accounts held with bullion banks.

- Sight accounts held with central banks on behalf of other central banks.

- Over-the-counter derivatives and options

- Forwards on the London market (deferred settlement never intended to settle)

- Regulated futures markets (Comex, Tocom etc.)

- Gold ETFs not backed by physical gold.

The total of these markets, for which there is no estimate, is simply enormous (by contrast GoldMoney estimates above-ground stocks of physical bullion total some 162,500 tonnes today, increasing at about 2,800 tonnes per annum.)

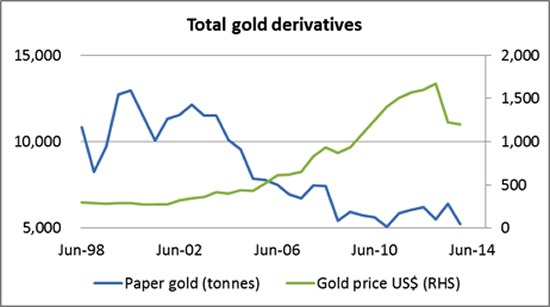

But we can get an idea of the overall interest in paper gold from numbers released by the Bank for International Settlements covering off-market derivatives, plus outstanding Comex interest. This is shown in the next chart:

|

| Peak Prosperity |

The last data-point was end-2013, when gold coincidentally sank to $1180 for the second time. A significant portion of these derivatives can be expected to be hedges against bullion-bank liabilities such as unallocated accounts and perhaps positions in regulated futures, so they are a fair reflection of changes in outstanding paper interest. It is clear that over the course of the last thirteen years, in terms of tonnes equivalent, total gold derivatives have declined significantly. Some of this decline has been due to the increase in the gold price so the currency value of these derivatives would not have fallen so much; but from the peak in 2011 from which the gold price has fallen by nearly 40% in USD terms, outstanding paper gold has certainly accelerated gold's decline.

This tells us that, given that their hedge positions are historically low, bullion banks have reduced their outstanding liabilities to customers with unallocated accounts, which would be consistent with the late stages of a bear market. Ironically, the unwinding of unallocated accounts has been hastened by the withdrawal of bullion from the London market redeployed to satisfy Asian demand, because ultimately physical bullion is the basis for the whole market. It is obvious that if the trend outlook for gold improves, given that the decline in outstanding derivatives has not led to reducing leverage on the physical market, liquidity could rapidly become a serious issue.

Meanwhile, physical gold goes from West to East.

Asian Demand

Physical gold features in the family pension fund for the average Asian. We are all familiar with this being the case for Indians, but it is also true for most other countries on the continent. The reason is simple: no Asian government has been able to suppress the ordinary citizen's interest in gold as a store of wealth, and generally currency issuance has been badly abused by Asian governments. For example, in Turkey accumulating inflation from the 1980s led to six noughts being lopped of the lira in 2004. In India, since the 1960s the rupee price of gold has gone from INR160 to about INR76,000 per ounce today.

The history of Asian demand goes back to the oil crisis in the 1970s, when the Middle East suddenly became immensely wealthy from the rise in the price of oil. Naturally, they invested a portion of their new-found wealth in gold. The pace of gold acquisition by Arabs slowed in the early 1990s, because a new western-educated Arab generation began to manage the region's financial resources, and these youngsters were doubtless discouraged by gold's prolonged bear market. Instead they turned to equity markets and infrastructure investment. Then in 1990 India repealed the Gold Control Act.

This legislation banned Indians from owning gold in bar and coin form, which gave added impetus to smuggling and jewellery manufacturing. Its repeal was part of a process of economic liberation in the wake of a financial crisis, which led to market-friendly economic reform. Since then, recorded private sector imports grew from a few hundred tonnes to as much as 1,000 tonnes annually before the Reserve Bank of India reintroduced import controls last year. Predictably the effect has been to restrict officially imported gold and increase smuggling.

Turkey is the gateway to Iran and the Moslem world to the east beyond the Caspian Sea. Gold has been actively used as money by this region since time immemorial. According to the Borsa Istanbul, Turkey has imported 3,060 tonnes of gold since 1995. Some of this has gone to Iran and to the east of Turkey, but equally the rest of the region will have had other sources over the decades. Lastly, South-East Asia is populated with a Chinese diaspora, and since its industrialization in the 1990s this region has also been stockpiling significant quantities of bullion. But the big story is China itself, which we investigate in detail in Part 2 of this report

Summary (Part 1)

When the gold price is being smashed in western capital markets, it's easy to forget that Asia is quietly buying up not only all or most of its own mine and scrap supply, but significant quantities of the above-ground stocks held in western vaults as well. It's a process that dates back to the birth of the petro-dollar in the 1970s and has continued ever since. The three big ownership centers are the Middle East, India and China -- the latter two having in recent years enjoyed high rates of economic expansion, with increasingly wealthy middle-classes with a high propensity to save.

We cannot know in truth how much of the world's above-ground stocks of gold are in the hands of these three centers. But they are only part of the Asian story, with Turkey and its sphere of influence plus the whole of South-East Asia, whose people also regard gold as a prime savings medium. All we can say is that it is likely that significantly more than half the world's gold is in Asian hands. Importantly, over the last ten years the pace of Asian accumulation has increased, draining the west of its physical liquidity. And in this respect perhaps the most important indicator is the decline in outstanding OTC derivatives shown in the last of the charts above.

So not only do we have evidence that the price is based on western paper markets with declining liquidity, but by comparing above-ground stocks with the Fiat Money Quantity of the world's reserve fiat currency, we can see that gold is extremely undervalued at a time of high, possibly escalating systemic and currency risk.

In Part 2:The Case For Owning Physical Gold Now we delve more deeply into the flows of bullion to Asia which will soon create supply shortages in the West, as well as detail the growing systemic and currency risk factors that few asset besides physical gold can offer protection against.

Executive Summary

- Why China & Russia are placing the highest priority on increasing their gold reserves

- The Asian SCO's agenda for re-defining trans-Asian money

- The looming crisis in paper currencies

- The 6 key reasons to amass paper gold today

If you have not yet read Part 1: Why Gold Is Undervalued available free to all readers, please click here to read it first.

Part 1 summarized gold's technical position, the market position, made a value judgment against fiat dollars, described and quantified the paper market, and noted the long-term shifts of bullion into Asia. There are three big subjects left to deal with: the dynamics at the hear of the West-to-East flow of physical bullion, the scope for an accelerated deterioration in the purchasing-power of paper currencies, and the financial cold war between the advanced western economies and the Asian Shanghai Cooperation Organization (SCO.

Understanding The Flow Of Gold Into China & Russia

China

China's appetite for gold has only become obvious in recent years. In reality, we do not know how much gold China has imported. We only know that for whatever reason she appears to be importing significantly larger quantities than publicly admitted. It is worth bearing in mind that this started long before the Shanghai Gold Exchange was established in 2002; the original regulations delegated total control of gold and silver to the Peoples Bank (the central bank - PBOC) in June 1983. Given at that time the west was selling gold down to the $250 level, China has most probably been secretly stockpiling gold for the last thirty years.

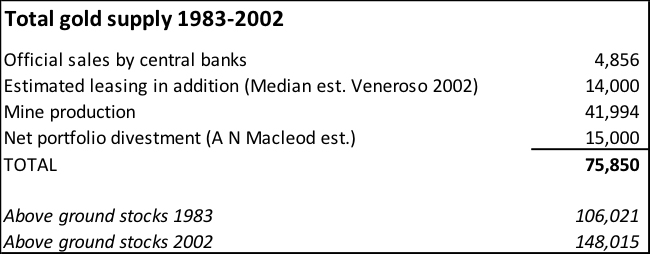

The 1983 regulations appear to have been introduced to take advantage of freely-available supply. Between 1983 and 2002 there was significant leasing activity by European and other central banks as well as outright sales in addition to mine output. Furthermore, the bear market from 1980-2000 led to considerable divestment of privately owned gold vaulted in Switzerland. The following table summarizes the estimated effect.

|

| Peak Prosperity |

Approximately half the above-ground stocks in 2002 appears to have changed hands since 1983. The principal buyers were the Middle East until the mid-1990s and India after the Gold Control Act was rescinded. No one has suspected China of acquiring meaningful quantities of gold during this period, but the timing of the 1983 regulations suggests otherwise. India's demand between 1990 and 2002 was only 5,426 tonnes, with perhaps 2,000 tonnes smuggled in the seven years previously, leaving 68,424 tonnes unaccounted for. And while Middle Eastern oil exporters were certainly buying in quantity it is unlikely they would have taken more than 35,000-40,000 tonnes, which leaves 28,000-33,000 tonnes unaccounted for. Conversion of bullion into jewellery for the European and North American markets could have absorbed 5,000 tonnes at most, but equally there were other sources of supply such as Russia, which was forced to sell all her gold (507 tonnes) during the financial crisis in 1998, and potentially some net selling as a result of the Tiger economies' crisis at about the same time.

There is only one logical conclusion: China passed regulations in 1983 to acquire gold bullion. This being the case, before 2002 she could easily have secretly acquired over 20,000 tonnes. And this explains why she was then happy to let her own citizens in on the act...